Setting up an offshore company in Dubai is a smart play for international entrepreneurs. It's all about asset protection, tax optimisation, and running a global business from a stable, reputable hub. An offshore entity is different from a mainland or free zone company because it’s specifically designed to operate outside the UAE. Think of it as a powerful tool for holding international assets and managing global trade, all with total confidentiality.

What a Dubai Offshore Company Really Means for You

Let's clear the air on what an "offshore company" actually is. People often have the wrong idea. A Dubai offshore company is a completely legitimate and highly effective legal structure. Its purpose isn't to do business inside the UAE. Instead, it’s a non-resident company, legally registered here but doing all its business internationally.

It’s best to see it as a central hub for your global operations. You can handle international invoicing, hold shares in other companies, own intellectual property, or even buy real estate in certain designated freehold areas of Dubai. You get all these benefits while being backed by the UAE's solid political and economic environment.

The Key Distinctions You Must Understand

It's really important to know the difference between the three main company types in the UAE. Picking the wrong one can be an expensive mistake, so let's break down where an offshore setup fits in.

- Mainland Company: This is what you need if you want to trade directly within the local UAE market and work with government bodies. It gives you the most freedom inside the country but usually has more complex setup rules.

- Free Zone Company: This is perfect for businesses in a specific industry. A free zone company allows for 100% foreign ownership and gets tax exemptions. You can trade globally and within your free zone, but there are limits on dealing with the UAE mainland.

- Offshore Company: This is your non-resident option. It can't trade inside the UAE, rent a physical office (other than a registered address), or get visas for staff. Its real power is in its international reach and the privacy it offers.

An offshore company is fundamentally a strategic tool for international entrepreneurs. It’s built for asset protection, tax efficiency, and holding global investments, not for local Emirati commerce. Understanding this distinction is the first step toward leveraging its true potential.

Why International Entrepreneurs Choose This Path

The draw of setting up an offshore company in Dubai comes down to a few key advantages that global business owners are looking for. With established jurisdictions like the Jebel Ali Free Zone Authority (JAFZA) and Ras Al Khaimah International Corporate Centre (RAK ICC), you get a framework built for security and growth.

For instance, a tech entrepreneur with clients all over Europe and Asia could use a Dubai offshore company to manage contracts and centralise payments. This setup makes international banking easier and protects profits in a tax-neutral jurisdiction. In another scenario, an investor with a portfolio of international properties can put them all under one offshore holding company. This shields those assets from legal issues or liabilities in their home country. To really get it, it helps to see how it works as a foreign subsidiary and its part in global expansion.

The main reasons people go this route are pretty clear:

- Complete Foreign Ownership: You keep 100% ownership of your company. There's no need for a local Emirati partner.

- Tax Optimisation: You can take full advantage of the UAE's zero corporate and personal income tax policies on international profits.

- Asset Protection: It’s a great way to safeguard your global assets from legal fights, creditors, or economic problems in other countries.

- Enhanced Confidentiality: The names of company directors and shareholders are not on public record, which ensures a high level of privacy.

At the end of the day, an offshore company isn't just a piece of paper. It's a strategic foundation that lets you build a secure and efficient international business from one of the world's most respected financial centres.

Choosing Your Jurisdiction: JAFZA vs. RAK ICC

https://www.youtube.com/embed/OWnAPUbPZWo

Selecting the right jurisdiction is easily the most important decision you'll make when setting up an offshore company in Dubai. This isn't just about comparing fees; it's a strategic choice that dictates what you can legally do with your company, how it’s viewed by international banks, and your ongoing compliance duties.

In the UAE, the offshore landscape really boils down to two heavyweights: Ras Al Khaimah International Corporate Centre (RAK ICC) and Jebel Ali Free Zone Authority (JAFZA). They each serve very different, very specific purposes.

RAK ICC is often the go-to for its cost-effectiveness and quick setup, making it perfect for holding companies, intellectual property (IP) portfolios, or international consulting firms. On the other hand, JAFZA offers a unique and powerful advantage: the ability to own property in Dubai's freehold areas. This makes it the only real choice for real estate investment.

The Real Estate Investor Scenario

Let's say you're an international investor looking to buy a couple of apartments in Dubai Marina. Your main goal is to hold these assets securely and ensure a simple inheritance path for your family.

In this case, JAFZA isn't just the best option—it's your only option.

JAFZA is the sole offshore jurisdiction whose companies are permitted by the Dubai Land Department to own freehold property. That’s a critical distinction. Trying to use any other offshore structure will lead to a dead end. On top of that, JAFZA’s premium reputation makes real estate developers and government bodies comfortable, which helps smooth out the property acquisition process.

For anyone focused on Dubai real estate, the choice is clear-cut. You can explore more on the specific advantages of a JAFZA offshore company in our guide.

The Global Consultant and IP Holder Scenario

Now, picture a completely different situation. A global tech firm wants to hold its software patents and trademarks in a secure, tax-neutral entity. The company’s work is entirely international, with no physical assets or activities inside the UAE.

For this business, RAK ICC is the clear winner.

RAK ICC is well-known for being cost-effective and having very streamlined administrative processes. The initial setup fees and annual renewal costs are much lower than JAFZA's, which is great for holding intangible assets like IP. The compliance rules are also more straightforward, reducing the ongoing management headache.

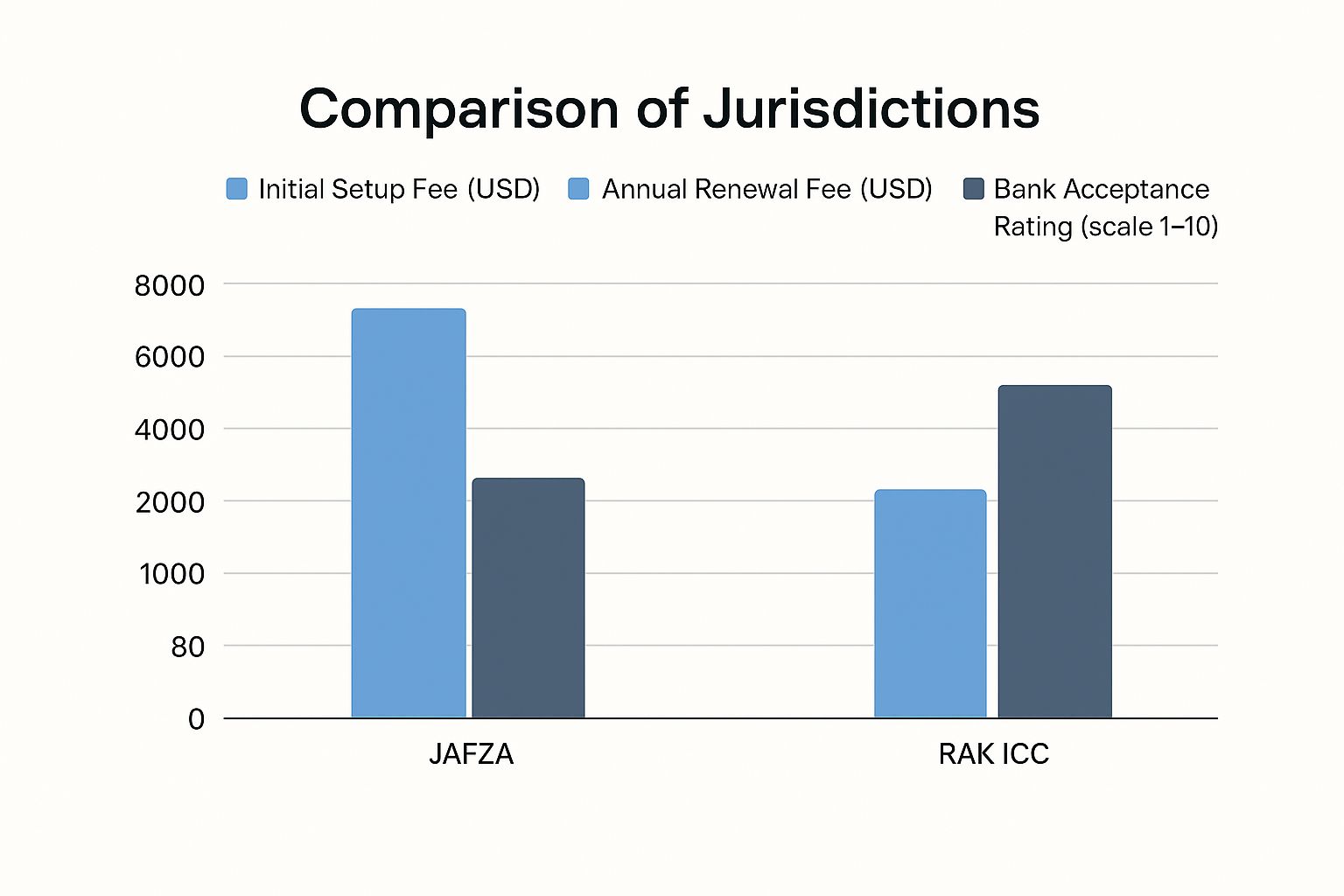

As you can see, the data highlights RAK ICC's cost advantage, while JAFZA scores slightly higher on bank acceptance ratings, thanks to its long-standing premium reputation.

Head-To-Head Comparison: JAFZA vs. RAK ICC

To make the right call, you need to see the differences side-by-side. It’s not just about the big features; the small details in their regulations and banking relationships can really affect your day-to-day operations.

Choosing your offshore jurisdiction is like picking the foundation for a house. JAFZA is a robust, premium foundation perfect for building significant local assets like real estate. RAK ICC provides a flexible, cost-effective foundation ideal for a global structure that doesn't need to be anchored in Dubai.

Let's break it down to help you decide.

JAFZA vs RAK ICC: A Feature Comparison

When you put the two jurisdictions head-to-head, their distinct strengths become immediately obvious. The table below cuts through the noise and focuses on what really matters for your business.

| Feature | JAFZA Offshore | RAK ICC |

|---|---|---|

| Primary Use Case | Owning freehold property in Dubai, prestigious holding company | International trade, asset protection, IP holding |

| Property Ownership | Yes, can own freehold property within approved Dubai areas | No, cannot directly own real estate in Dubai |

| Reputation & Prestige | Considered the premium, most established offshore authority in Dubai | Globally recognised and respected, known for efficiency and value |

| Initial Setup Cost | Higher, reflecting its premium status and unique benefits | More cost-effective, offering excellent value for global businesses |

| Annual Renewal Fees | Generally higher than RAK ICC | Lower, making it economical for long-term holding structures |

| Banking Perception | Excellent reputation with UAE and international banks | Strong and widely accepted, with a straightforward account opening process |

| Administrative Burden | Slightly more stringent compliance and reporting requirements | Simplified and streamlined annual compliance and administration |

Ultimately, the right choice comes down to your business model. If your plans involve Dubai real estate, the conversation starts and ends with JAFZA. For almost every other international business activity—from global consulting and e-commerce to asset protection and IP management—RAK ICC offers a compelling, efficient, and budget-friendly solution for setting up an offshore company in Dubai.

Navigating the Incorporation Process

Alright, you’ve picked your jurisdiction. Now comes the part that can feel a bit daunting: the actual incorporation. This phase of setting up an offshore company in Dubai is really just a logical sequence of steps. With some good preparation and the right guidance, you can get through it smoothly and sidestep the common mistakes that lead to frustrating delays.

Think of this process less as a bureaucratic headache and more as building a solid, compliant foundation for your business. It's all designed to verify who you are, what your business plans to do, and make sure everything is above board with UAE and international regulations.

Assembling Your Essential Documentation

The first real task is to get your paperwork in order. The authorities need these documents to perform their due diligence and confirm the identities of everyone involved, from shareholders to directors. Trust me, being organised here is non-negotiable and will dramatically speed things up.

Every document has a purpose, whether it's proving who you are or confirming where you live. Most delays I see are because of simple things: a missing document, an expired passport copy, or paperwork that isn't properly certified.

Here’s a quick rundown of the core documents you'll almost certainly need:

- Certified Passport Copies: These need to be clear, valid, and usually certified by a notary public or lawyer. It’s the main proof of identity for every shareholder and director.

- Proof of Residential Address: This is typically a recent utility bill or bank statement, usually no older than three months. It must clearly show your name and current address.

- A Detailed Business Plan: While you might not need a massive document for a simple holding company, a clear, brief outline of your business activities is crucial. It gives the authorities and banks a clear picture of what you're doing.

- Bank Reference Letter: Some jurisdictions might ask for a letter from your personal bank just to confirm you have a good-standing relationship. It's another layer of credibility for your application.

As you get into the thick of it, don't underestimate the importance of thorough due diligence. A proper review ensures you're making smart, informed decisions. You can get a good feel for what's involved with an essential due diligence checklist template.

Defining Your Company Structure and Name

Once your personal documents are sorted, it’s time to give your company its official identity. This means choosing a name that follows the rules, defining its activities, and appointing the key people. These details form the backbone of your company's legal documents.

Picking a company name isn't just a creative task; it's governed by strict rules. The name can't be too similar to an existing company, and you can’t use words that are restricted or suggest a link to the government. It also has to end with a legal suffix like “Limited” or “Ltd.”

You also need to be precise when defining your business activities. You’ll have to clearly state what the company will do—whether that's international trading, holding investments, owning intellectual property, or providing consulting services. Vague descriptions are a common reason for applications being kicked back.

Your registered agent is your most valuable ally during incorporation. They are not just paper-pushers; they are your strategic advisors. Leveraging their expertise is the single most effective way to ensure your application is accurate, complete, and processed without unnecessary delays.

The roles of directors and shareholders also need to be clearly laid out. A director manages the company's day-to-day operations, while a shareholder owns it. For many small offshore setups, it's perfectly fine for the same person to be both.

The Critical Role of Your Registered Agent

This is a big one. Perhaps the single most important factor for a smooth incorporation is your registered agent. In the UAE, you can’t just set up an offshore company by yourself; you have to go through an approved registered agent. They are the official go-between for you and the offshore authority.

Their job is much more than just submitting forms. A good agent will:

- Review Your Documents: They'll pre-screen all your paperwork to catch any errors or missing information before it even gets to the registrar.

- Guide Name Selection: They check if your chosen company name is available and compliant, saving you a lot of back-and-forth.

- Prepare Legal Forms: They draft the key documents like the Memorandum and Articles of Association, making sure your company’s structure is correctly recorded.

- Handle All Communications: They manage all correspondence with the authority, fielding questions and providing any extra details needed.

By working with seasoned specialists, you turn a potentially confusing process into a predictable, well-managed project. Whether it’s for Mainland, Freezone, Investor Visas, or Corporate PRO Services, having an expert on your side means every detail is handled correctly, letting you focus on your actual business.

A Transparent Look at Offshore Setup Costs

Getting your budget right is the foundation of any successful business, but it's absolutely critical when you're setting up an offshore company in Dubai. It's easy to get fixated on the initial registration fee, but the real cost is a mix of upfront payments, annual renewals, and a few expenses people often forget about. A clear financial picture from day one is the best way to avoid nasty surprises down the road.

One of the biggest financial advantages of an offshore entity is what you don't have to pay for. Unlike a Mainland or Freezone company, there’s no requirement for a physical office or employee visas. This immediately cuts out two of the largest recurring expenses, making it a seriously cost-effective business setup solution for anyone focused on international trade or asset holding.

Breaking Down the Initial Investment

Your main upfront cost is the incorporation package. This is what you pay to get the company officially registered and covers government fees, the issuance of key legal documents like the Certificate of Incorporation, and the first year’s registered agent and office fees. Think of it as the one-time price to get your company legally off the ground.

But that’s not always the full story. Depending on your specific situation, a few other one-time costs might pop up.

- Document Attestation: Your personal documents, like passport copies and proof of address, need to be properly certified. If these are from outside the UAE, they’ll have to go through a multi-step attestation process, and each step has its own fee.

- Bank Account Opening Assistance: While you can go it alone, getting professional help to open a corporate bank account can be a lifesaver. This usually comes with a separate fee for preparing the application and liaising with the bank to make sure everything goes smoothly.

- Corporate PRO Services: For more complex offshore structures that need specific government paperwork, using Corporate PRO Services and Attestation Services can make a huge difference. It's an added cost, but it saves a lot of headaches.

These are the details that are easy to overlook but are essential for a realistic budget. For a deeper dive into how different business structures stack up, check out our comprehensive breakdown of the cost of setting up a business in Dubai in our detailed guide.

Comparing Offshore Costs to Mainland and Freezone Setups

To really see the financial logic behind an offshore company, it helps to put the numbers side-by-side. The offshore model is built for lean, international operations, and its cost structure shows it.

For international entrepreneurs, the offshore model provides access to UAE tax benefits without the significant overheads of a physical presence. It’s a financially efficient structure built for global reach, not local operations.

Typically, you can expect the all-in cost for an offshore incorporation to fall between AED 12,500 and AED 20,000. That figure doesn't involve office rent or visas because you don't need them.

Now, compare that to a Mainland company, which can run anywhere from AED 15,000 to over AED 50,000 before you even factor in office and visa costs. Free Zone setups have the widest range, with licence fees from AED 5,750 to AED 50,000, plus annual office rent that can easily climb towards AED 100,000.

Planning for Annual Renewal Fees

Your financial planning doesn't stop once the company is formed. Every year, you’ll need to pay a renewal fee to keep your company in good legal standing. It’s significantly lower than the initial setup cost, but it's non-negotiable if you want to keep your company active.

This annual fee generally covers two things:

- Government Licence Renewal: This is the fee paid to the authority (either JAFZA or RAK ICC) to keep your company's registration active for another year.

- Registered Agent and Office Fees: By law, your company must have a registered agent and address in the UAE. This fee covers that service.

Missing the renewal deadline is a bad idea. It can lead to penalties, a loss of good standing, and eventually, the authorities could strike your company from the register. That could have serious knock-on effects, like getting your corporate bank account frozen. Budgeting for this expense is a simple but crucial step to protect your assets. With our 24/7 support service, we make sure you’re always reminded and supported through this critical annual process.

Life After Incorporation: Banking and Compliance

Successfully registering your offshore company is a huge milestone, but it's really just the beginning of the journey, not the end. The real work starts now, and it boils down to two critical areas that will make or break your company’s long-term success: securing a corporate bank account and keeping up with strict annual compliance.

These are the post-incorporation steps where many entrepreneurs trip up, so let's walk through them carefully.

A common mistake is assuming that once the company is registered, opening a bank account is a simple formality. That couldn't be further from the truth in the UAE. Banks here perform incredibly thorough due diligence, especially for non-resident offshore entities, to combat money laundering and stay aligned with global regulations.

Getting this right is non-negotiable. Your corporate bank account is the operational lifeblood of your business, allowing you to manage international transactions, receive payments, and build a solid financial reputation.

Navigating the Corporate Bank Account Maze

Opening a bank account for a Dubai offshore company is a detailed process that demands meticulous preparation. Banks are under immense pressure to follow global Anti-Money Laundering (AML) and Know Your Customer (KYC) rules. This means they will scrutinise every detail of your business and its ownership structure.

You’ll need to put together a comprehensive file that proves your legitimacy—and it goes way beyond just showing them your new company documents. Banks want to understand the source of your funds, the exact nature of your business activities, and who the Ultimate Beneficial Owners (UBOs) are.

To boost your chances of a successful application, you should have these ready:

- A Solid Business Profile: A clear, concise document explaining your business model, target markets, and expected transaction patterns.

- UBO Declarations: Full transparency on every individual who ultimately owns or controls the company. Trying to hide this is a major red flag.

- Proof of Experience: Your personal CV and professional background to show you have the expertise to run the business you've described.

- Supporting Invoices or Contracts: If you can, provide draft contracts or initial invoices to prove that legitimate business is ready to begin.

Ultimately, the bank's decision comes down to its internal risk assessment. A well-prepared application that presents a clear, low-risk business model is far more likely to get the green light. If you need expert guidance on this, our guide to opening an offshore company and bank account offers more in-depth advice.

Staying Compliant Year After Year

Your obligations don't stop once the bank account is active. Maintaining your offshore company's good standing is an ongoing responsibility that requires attention every single year. Ignoring these duties can lead to hefty fines, loss of legal standing, and even your bank account being frozen.

The core of your annual compliance is renewing your company registration. This is a non-negotiable requirement to keep your entity legally active. It involves paying the government renewal fees along with the fees for your mandatory registered agent and office address.

Think of annual compliance as the essential maintenance for your corporate vehicle. Just like a car needs an annual service to run smoothly, your offshore company needs its renewals and proper records to operate legally and protect your assets.

Beyond the renewal, there's the critical matter of financial records. While a formal audit might not be required for all offshore companies, you are legally obligated to maintain accurate and up-to-date accounting records that properly explain all the company's transactions.

This isn't just a box-ticking exercise. If any questions ever come up from your bank or the authorities, having organised financial records is your best defence and proof of legitimate operations. With our 24/7 support service, we make sure you never miss these critical deadlines, keeping your company compliant and your business running without a hitch.

Ready to Start Your Dubai Business? Let Us Handle the Paperwork

Trying to figure out the rules for setting up a company in a new country can be a real headache. The good news? You don't have to go it alone. When you’re setting up an offshore company in Dubai, getting the right advice from the start is absolutely key to making sure everything is done correctly and without any delays.

Our team has been through this process countless times. We know the ins and outs of company formations across the UAE and we can help you pinpoint the exact structure that makes sense for your business.

More Than Just a Registration Service

✅ Specialists in Mainland Company Formation in Dubai, Sharjah & Abu Dhabi

✅ Specialists in Freezone Company Formation across the UAE

✅ Specialists in Golden Visa on Property and Investor Visa

✅ Specialists in Corporate PRO Services and Attestation Services

✅ 24/7 Support Service – Always here when you need us

✅ Cost-Effective Business Setup Solutions tailored to your needs

✅ Enjoy UAE Tax Benefits for International Entrepreneurs

📞 Call Us Now: +971-54-4710034

💬 WhatsApp Us Today for a Free Consultation

Your Top Questions Answered

When you're looking at setting up an offshore company in Dubai, it's only natural for questions to pop up. To give you some final clarity, let's go through the most common queries we hear from entrepreneurs just like you.

Can My Offshore Company Do Business Inside the UAE?

This is a really important distinction to grasp. The short and simple answer is no.

A Dubai offshore company is legally a non-resident entity. It's designed from the ground up to handle business internationally, completely separate from the UAE's local market. If you need to conduct any commercial activities within the UAE itself, you'll have to set up a Mainland or Free Zone company. The offshore structure is purely for global trade, holding assets, or international consulting.

Is a Physical Office in Dubai Mandatory?

Nope, and this is one of its biggest perks. An offshore company has no requirement for a physical office space.

By law, all you need is a registered agent and a registered address. This is provided by the corporate services firm handling your incorporation, like us. This is a massive advantage, completely removing the significant costs tied to renting commercial property—a major expense you'd face with Mainland and Free Zone companies.

One of the smartest financial benefits of the offshore model is the lack of a physical presence requirement. It’s a structure built for international entrepreneurs who need a legal UAE base without the heavy overhead of local operations.

Do I Have to Live in the UAE?

You absolutely do not need to be a resident of the UAE to own or manage a Dubai offshore company. Shareholders and directors can be based anywhere on the globe, giving international business owners complete freedom.

It's crucial to remember, though, that an offshore company doesn't grant you or your employees residency visas. If getting UAE residency is part of your plan, you'd need to look into other avenues, like the Golden Visa on Property or an Investor Visa through a Freezone or Mainland company.

At PRO Deskk, we specialise in walking international entrepreneurs through every single step of their UAE business journey. Whether it's Mainland and Freezone formations, securing investor visas, or handling corporate PRO services, our experts are here to provide cost-effective solutions with 24/7 support. Let us take care of the complexities so you can focus on what you do best—growing your business. Find out more about our complete range of services at https://prodesk.ae.