When you hear "Dubai," you might think of gleaming skyscrapers and bustling local markets. But for savvy international entrepreneurs, Dubai represents something more: a strategic gateway for global business. Setting up an offshore company here is a powerful move, allowing you to register a non-resident entity in a respected jurisdiction like RAK ICC or JAFZA to run your international operations.

This kind of setup offers some incredible advantages, including 100% foreign ownership, complete confidentiality, and zero corporate tax on profits your business earns outside the UAE.

Unlocking Global Potential with a Dubai Offshore Company

It’s crucial to understand that a Dubai offshore company is a different beast from a mainland or free zone business. Think of it as a legal vehicle designed exclusively for business conducted outside the UAE's borders. It’s essentially a global headquarters for your assets and international trade, legally based in a stable and reputable jurisdiction.

The main draw? Efficiency and privacy. These companies are often used as holding structures to own assets, real estate, or intellectual property across the globe. They're also perfect for handling international invoicing and consulting work without getting tangled in local UAE regulations.

Core Strategic Advantages for Entrepreneurs

Deciding to go offshore isn't just about paperwork; it's driven by clear financial and operational perks that extend far beyond a simple registration certificate.

Here’s what you stand to gain:

- Complete Asset Protection: An offshore company acts as a legal shield. It separates your personal liabilities from your business assets, protecting them from potential legal issues or financial instability in other countries.

- Absolute Confidentiality: Unlike many onshore registries, the details of shareholders and directors are kept private. This ensures a high degree of privacy, which is a major concern for many business owners.

- Tax Optimisation: This is a big one. Offshore companies benefit from a 0% corporate tax rate on international profits, making them an incredibly efficient way to manage global revenue and reinvest capital back into your business.

- 100% Foreign Ownership: You keep full control. There's no need for a local partner or sponsor, which is a fundamental advantage for any international entrepreneur.

Financial Planning and Long-Term Value

Establishing an offshore entity is a serious strategic step. It's wise to look at the numbers and calculate the potential return on investment based on tax savings and the value of protecting your assets.

An offshore company is more than just a legal entity; it's a foundational tool for structuring your global business, managing wealth effectively, and securing your financial future in a stable, pro-business environment.

By using well-regarded jurisdictions like the Ras Al Khaimah International Corporate Centre (RAK ICC) or the Jebel Ali Free Zone Authority (JAFZA), you're tapping into a world-class legal framework backed by the UAE's economic stability. It’s a calculated move that positions you for long-term international success.

Choosing the Right Offshore Jurisdiction for Your Business

Picking the right jurisdiction for your offshore company is probably the most critical decision you'll make right at the start. This isn't just about getting a certificate with a name on it; your choice will fundamentally define what your company can do, how much it will cost, and how it’s viewed on the international stage.

While there are a few options out there, three jurisdictions really stand out for entrepreneurs looking at Dubai: RAK ICC, JAFZA, and Ajman Offshore. Each has its own distinct flavour and is built for different kinds of businesses. Forget a simple list of features—let's look at how these legal setups match up with real-world business needs. Your goal is what matters most, whether you're a digital nomad sending invoices worldwide, an investor holding property, or a founder protecting your intellectual property.

RAK ICC: The Flexible and Cost-Effective Powerhouse

For a huge range of international entrepreneurs, the Ras Al Khaimah International Corporate Centre (RAK ICC) is the default choice, and it's easy to see why. It nails the balance between flexibility, a strong legal reputation, and affordability, making it a perfect fit for consulting firms, tech startups, and global holding companies.

Let's say you're a software developer with clients scattered across Europe and Asia. You just need a straightforward, legitimate way to handle international payments and keep your profits without getting tangled in complex local taxes. RAK ICC is tailor-made for this. It gives you a solid legal structure that international banks recognise, letting you operate seamlessly across borders.

The real strength of RAK ICC is how adaptable it is. It's built for the way modern businesses operate globally, where being nimble and keeping overheads low is the key to winning.

Its cost-effectiveness is another major plus. Setting up an offshore company in Dubai has become a massive trend for international investors because of the financial perks, especially in places like RAK ICC.

For example, getting a RAK ICC Offshore company set up can cost anywhere from AED 5,000 to AED 8,000, with annual renewals falling between AED 4,000 and AED 6,000. That makes it one of the most accessible options on the market. In contrast, a JAFZA Offshore setup will run you AED 10,000 to AED 15,000 upfront, with renewals between AED 7,000 and AED 10,000, while Ajman Offshore sits somewhere in the middle.

Even with the UAE's new corporate tax, offshore companies can still enjoy a 0% tax rate on their operations as long as they are conducted entirely outside the UAE—a huge advantage compared to the standard 9% for onshore businesses.

JAFZA: The Prestige Jurisdiction for Asset Holding

The Jebel Ali Free Zone Authority (JAFZA) is the original and arguably the most prestigious offshore jurisdiction in the UAE. That name carries a lot of weight around the world, which can be a huge advantage when you're dealing with major financial institutions or high-value partners.

But the real standout feature for a JAFZA offshore company is its unique permission to own real estate in certain approved developments in Dubai. This makes it the undisputed champion for real estate investors.

Picture this: You're an international investor looking to buy and manage a portfolio of properties in Dubai. A JAFZA offshore entity lets you do this under a corporate umbrella, giving you both asset protection and a straightforward succession plan. It’s an incredibly powerful tool for managing significant property assets.

Ajman Offshore: The Balanced and Efficient Alternative

While RAK ICC and JAFZA usually get all the attention, Ajman Offshore is a solid, well-rounded alternative that shouldn't be overlooked. It offers a very direct and efficient setup process, making it a dependable choice for entrepreneurs who need a reliable offshore structure without the specific prestige of JAFZA or the broad flexibility of RAK ICC.

Ajman Offshore is a great fit for general trading activities or as a holding company for international assets. You get all the core benefits—confidentiality, tax efficiency, and full foreign ownership—wrapped up in a streamlined package. For a business owner who just needs to get a reliable offshore entity up and running quickly, Ajman is a practical and effective solution.

Ultimately, the key is to match the jurisdiction's strengths to your long-term business goals. That's how you ensure your offshore company does exactly what you need it to from day one.

Navigating the Documentation and Application Maze

So, you’ve picked your jurisdiction. Now comes the part that often feels like wading through treacle: the paperwork. This is where a lot of entrepreneurs get bogged down, but honestly, it’s a lot more straightforward than it looks once you have a clear plan.

It’s not just about ticking boxes on a form. It's about getting every single detail right from the start. A tiny mistake—a name that doesn’t match a passport or a document that isn’t properly attested—can bring the whole process to a screeching halt. This is where being meticulous (or having someone meticulous on your side) really pays off.

Your Essential Document Checklist

Before your application can even be considered, you'll need to pull together a core set of documents. The offshore registrar needs these to perform their due diligence and verify who is behind the new company.

Here’s what you’ll almost always be asked for:

- Certified Passport Copies: For every shareholder and director involved. These need to be clear, valid, and often stamped by a notary public or a lawyer.

- Proof of Residential Address: A recent utility bill or bank statement usually does the trick. The key is that it must be no older than three months and clearly show your name and current address.

- A Detailed Business Profile or CV: This gives the authorities a snapshot of your professional background. It’s all about establishing your credibility as a business owner.

- Bank Reference Letter: A simple letter from your bank confirming you have a good-standing relationship with them. This is a standard part of the ‘Know Your Customer’ (KYC) checks.

- Proposed Company Name: You'll need to list three names in order of preference. The registrar will check them for availability and to make sure they fit the local naming rules.

Getting this foundational paperwork correct and up-to-date from day one is the single best thing you can do to avoid frustrating delays.

Understanding the Key Players in Your Setup

A few different parties will be involved in getting your offshore company off the ground. Knowing who does what makes the whole thing feel less mysterious.

- You (The Applicant): Your job is to provide all the correct information and documents. You’re the one making the final calls on the company structure, who the shareholders are, and what the business will do.

- The Registered Agent: This is your mandatory partner on the ground in the UAE. A licensed firm like PRO Deskk acts as your official representative, handling the application, communicating with the registrar, and making sure you stay compliant. You literally can't set up an offshore company without one.

- The Registrar: This is the government body for your chosen jurisdiction (like RAK ICC or JAFZA). They review applications, grant approvals, and issue the all-important certificate of incorporation.

Working with a skilled registered agent is not just a legal requirement; it’s your strategic advantage. They act as the bridge between you and the registrar, translating complex legal requirements into simple, actionable steps and flagging potential issues before they become problems.

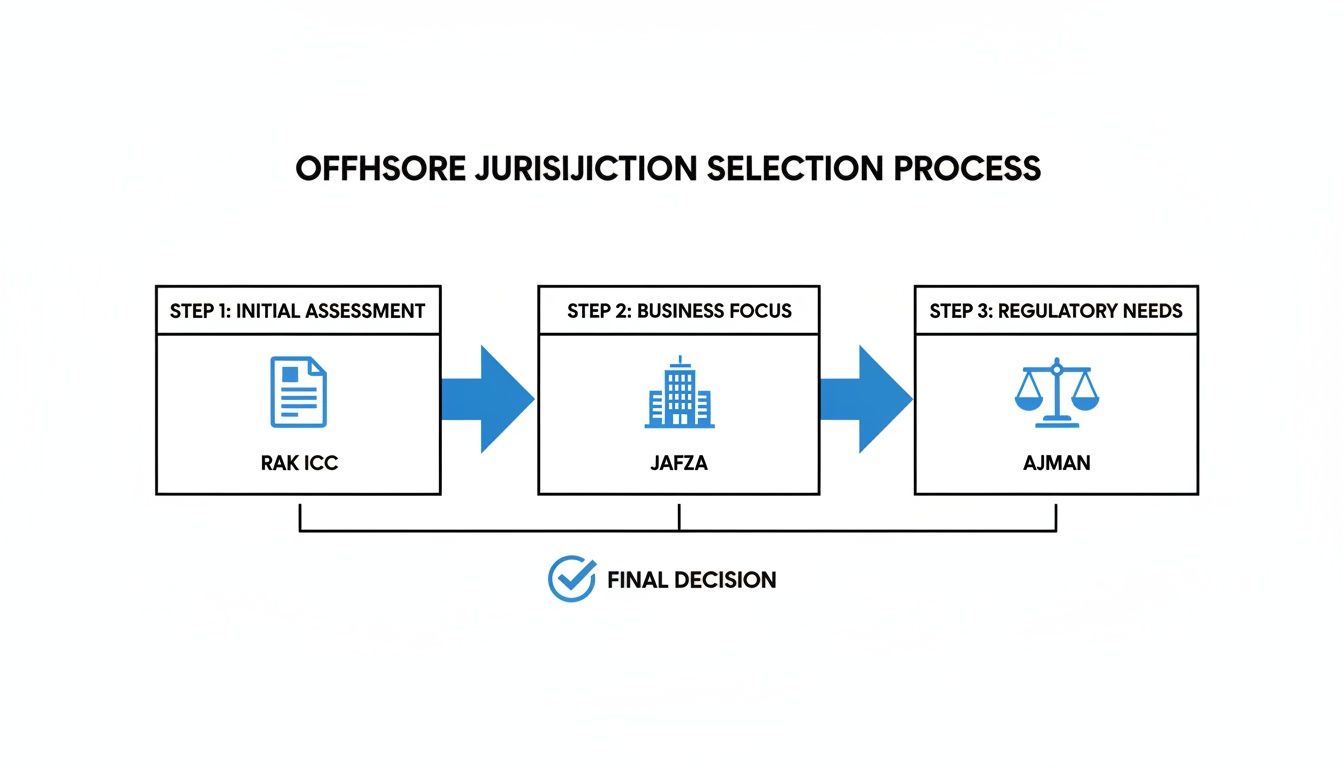

This flowchart illustrates the high-level decision process for selecting the right jurisdiction for your offshore company setup.

The visual shows how different jurisdictions cater to specific needs, whether you're focused on asset holding with RAK ICC or international trade through JAFZA.

The Application Timeline From Submission to Approval

While things can vary, the application process generally follows a clear path. Knowing the typical timeline helps you manage your expectations and plan ahead.

-

Stage 1: Name Reservation and Initial Approval (1-2 working days)

Once your proposed company names are submitted, your agent gets your preferred choice reserved. The authorities run a quick security and compliance check at this point. -

Stage 2: Document Submission and Verification (2-3 working days)

Your full set of documents is formally submitted. The registrar goes through everything with a fine-tooth comb to ensure it all meets legal standards. This is where having properly attested documents is absolutely vital. -

Stage 3: Final Approval and Incorporation (1-2 working days)

After a successful review, you get the final green light. Your company is officially incorporated, and you’ll receive your certificate of incorporation, memorandum of association, and share certificates.

All in, the entire process—from handing over your documents to getting that incorporation certificate—can be done in as little as 3-5 working days if everything is in order.

This speed is a direct response to the massive interest in Dubai offshore setups, which is fueled by strong business confidence and smart regulations. According to the Dubai Business Survey, confidence in the services sector is at a high of 123 points. You can dig into the data yourself in the official Dubai DET report. This positive vibe makes navigating the setup process well worth the effort for any global entrepreneur.

Securing Your Corporate Bank Account

Getting your offshore company incorporated is a huge step, but honestly, it’s only half the job done. Without a corporate bank account, your new company is just a name on a piece of paper. It can't send invoices, get paid, or manage finances. Many entrepreneurs find this is actually the toughest part of the entire offshore setup.

Why is it so tricky? UAE banks are serious about compliance. They adhere to strict international regulations for anti-money laundering (AML) and counter-terrorism financing (CTF). Because of this, applications from offshore companies are put under a microscope.

Banks will run your application through rigorous Enhanced Due Diligence (EDD) and Know Your Customer (KYC) checks. They need to be 100% clear on who you are, what your business does, and where the money is coming from. This scrutiny is ramped up significantly for any offshore structure.

The Non-Negotiable Document Checklist

Don’t even think about walking into a bank unprepared. It’s the fastest way to get your application rejected on the spot. You need to build a solid case for your business’s legitimacy with a file that’s complete, professional, and answers questions before they are even asked.

While specific requirements might differ a little from bank to bank, this is the core package you’ll always need:

- Corporate Documents: Your original Certificate of Incorporation, Memorandum and Articles of Association (MOA), and Share Certificates. Make sure these are the originals or certified true copies.

- Shareholder and Director Information: Get certified passport copies for everyone involved, along with recent UAE entry stamps (if applicable) and proof of address, like a utility bill that’s less than three months old.

- A Comprehensive Business Profile: This is your chance to tell your story. It must clearly detail your business activities, who your customers are, your expected annual turnover, and the type of transactions you’ll be making. The more specific, the better.

- Proof of Source of Funds and Wealth: Banks have to verify where your initial capital came from. This could be personal bank statements, proof of a property sale, or audited financials from another business you own.

Think of it this way: banks are looking for a clear, logical, and transparent story. Any gaps, fuzzy details, or missing documents raise immediate red flags that can lead to long delays or a flat-out "no." Getting this right from the start is non-negotiable.

Navigating Common Roadblocks and Compliance Hurdles

Even with perfect paperwork, you can still hit a few bumps in the road. UAE banks are laser-focused on economic substance. They need to see that your offshore company has a real business purpose and isn't just a "paper company" set up to avoid taxes.

On top of that, international compliance rules are a minefield. The bank will assess your entire business model to make sure it doesn’t pose a reputational risk. This is where having a professional on your side, someone with existing relationships with local banks, becomes invaluable. They can often pre-vet your application, flagging potential issues before it’s even submitted. Our complete guide offers more insights on how to open an offshore company and bank account successfully.

The Power of Professional Guidance

Trying to open a corporate bank account for an offshore entity by yourself is a bit of a gamble. The process is full of nuances, and the rules are constantly changing. As you look at your financial toolkit, it’s also wise to consider specialised payment solutions for businesses that can work alongside your bank account for more flexible international transactions.

Working with a firm that specialises in company formation and banking support dramatically boosts your chances of success. An experienced consultant knows exactly what each bank is looking for and can position your application in the best possible light. They handle everything from preparing the documents to communicating with the bank's compliance team, turning a daunting challenge into a smooth, manageable process to get your business up and running.

Managing Your Annual Compliance Obligations

Getting your offshore company incorporated is a huge milestone, but it’s really just the starting line. Now, the real work begins: keeping your company in good legal standing year after year. To avoid any unwelcome penalties, you need to stay on top of your annual compliance obligations.

These aren’t just administrative hoops to jump through; they're essential for maintaining the legal status and integrity of your business. If you let these slip, you could be looking at hefty fines, disruptions to your operations, or even getting your company struck off the register entirely.

Think of it like regular maintenance for a car. It’s a predictable set of tasks that, when you get into a rhythm, become a simple annual routine that keeps your business engine running smoothly.

The Core Annual Requirements

Every single year, there are a handful of non-negotiable tasks you have to complete. This is true whether your company is registered with RAK ICC or JAFZA.

These duties are straightforward, but they are absolutely vital:

- Annual Renewal Fees: This is the most basic one. You must pay an annual renewal fee to the registrar. It’s what keeps your company's licence active. Pay late, and you’ll get hit with penalties; ignore it for too long, and your company could be dissolved.

- Registered Agent and Office: It's mandatory to have a registered agent and a registered office address in the UAE at all times. Your agent, a firm like PRO Deskk, is your official point of contact, handling formal correspondence and making sure you don’t miss any regulatory deadlines.

- Proper Financial Records: Even if you don't need to submit fully audited financials, you are legally required to keep accurate and up-to-date financial records. These documents need to clearly show all your company’s transactions and its overall financial position.

Demystifying Major Compliance Regulations

Beyond those basics, a couple of key regulations often trip up new offshore company owners: UAE Corporate Tax and Economic Substance Regulations (ESR). Getting this right is critical.

A huge misconception is that a 0% tax rate on foreign income means you can just ignore the tax system. That’s a costly mistake. Even if your offshore company owes no tax, you are still required to register with the Federal Tax Authority (FTA). The UAE authorities need a record of every corporate entity operating under their jurisdiction, regardless of tax liability. Our detailed guide explains exactly how to register for Corporate Tax in the UAE and the steps involved.

Staying compliant isn't about avoiding tax; it's about transparency. The UAE's framework requires all entities to be on the official record, ensuring a regulated and credible business environment for everyone.

You also need to be aware of Economic Substance Regulations (ESR). These rules were put in place to ensure that companies have a genuine business purpose and aren't just "shell companies" set up purely for tax avoidance. You'll need to submit an ESR filing annually to declare your activities.

Finally, there’s the Ultimate Beneficial Ownership (UBO) declaration. This is another crucial piece of the puzzle, where you formally declare the individuals who ultimately own or control the company. It’s a global standard for financial transparency designed to combat illicit activities. Our corporate PRO services are built to handle these filings efficiently, so you meet every deadline without the stress.

Your Annual Compliance Checklist

To make sure nothing gets missed, it helps to have a clear checklist. Here’s a quick rundown of the key annual requirements that will keep your offshore company in good standing.

Annual Compliance Checklist for UAE Offshore Companies

| Compliance Task | Responsibility | Typical Deadline | Importance |

|---|---|---|---|

| Annual Renewal Fee Payment | Company Owner/Agent | Anniversary of Incorporation | Critical: Prevents license suspension and fines. |

| Corporate Tax Registration | Company Owner/Agent | As per FTA guidelines | Mandatory: Required even with 0% tax liability. |

| ESR Notification & Report | Company Owner/Agent | Annually | High: Demonstrates legitimate business purpose. |

| UBO Declaration | Company Owner/Agent | Annually/Upon Change | High: Ensures transparency and meets global standards. |

| Maintain Financial Records | Company Owner | Ongoing | Essential: Required for legal and banking purposes. |

Managing all this doesn't have to be a headache. By partnering with a specialist firm, you can hand off these responsibilities. With our 24/7 support and cost-effective solutions, we make sure your offshore company stays compliant year after year. That leaves you free to focus entirely on growing your international business.

Why Choose Us for Your Dubai Company Formation?

Navigating the complexities of setting up a business in the UAE requires expertise, reliability, and a deep understanding of the local landscape. Our dedicated team of specialists provides end-to-end support to ensure your venture is a success from day one.

✅ Specialists in Mainland Company Formation in Dubai, Sharjah & Abu Dhabi

✅ Specialists in Freezone Company Formation across the UAE

✅ Specialists in Golden Visa on Property and Investor Visa

✅ Specialists in Corporate PRO Services and Attestation Services

✅ 24/7 Support Service – Always here when you need us

✅ Cost-Effective Business Setup Solutions tailored to your needs

✅ Enjoy UAE Tax Benefits for International Entrepreneurs

We offer more than just registration; we provide a partnership built on trust and a commitment to your long-term growth.

📞 Call Us Now: +971-54-4710034

💬 WhatsApp Us Today for a Free Consultation

At PRO Deskk, we provide cost-effective and expert guidance for every aspect of your business journey, from mainland and free zone setups to securing Golden Visas.

📞 Call Us Now: +971-54-4710034

💬 WhatsApp Us Today for a Free Consultation at https://prodesk.ae