Think of a Dubai offshore company as your business's financial passport. It’s a powerful tool that lets you operate on the world stage, manage your assets, and protect your wealth from a secure, tax-neutral home base. These companies are specifically built for international trade and holding assets, not for doing business inside the UAE itself.

Unlocking Global Operations With a Dubai Offshore Company

Imagine a specialized instrument designed purely for international business. Unlike a mainland or free zone company, an offshore entity doesn't require a physical office in Dubai or engage in local trade. It's set up as a non-resident company in a top-tier jurisdiction like the Jebel Ali Free Zone (JAFZA) or Ras Al Khaimah International Corporate Centre (RAK ICC), specifically to manage your activities across the globe.

This structure gives entrepreneurs and investors a strategic base in a reputable, secure, and financially efficient environment. The main goal isn't to sell products or services in Dubai; it's to hold assets, protect intellectual property, or run international trading operations while taking advantage of the UAE’s strong legal system and pro-business climate. It creates a clean, clear line between your global business and the local UAE market.

Core Characteristics of an Offshore Company

So, what makes a Dubai offshore company so attractive? It all comes down to a few key features that make it stand out from other business structures, offering maximum flexibility and security for international investors.

To give you a clearer picture, here’s a breakdown of what you can expect:

Key Features of a Dubai Offshore Company

| Feature | Description |

|---|---|

| Complete Foreign Ownership | You have 100% control over your business. No need for a local partner or sponsor. |

| Strict Confidentiality | Shareholder and director details are kept private and are not part of any public record. |

| Tax Neutrality | Your international profits are not subject to corporate tax in the UAE, keeping your operations lean. |

| Asset Protection | The company acts as a legal shield, safeguarding your personal and business assets from liabilities. |

These features are specifically designed to give you peace of mind and operational freedom when managing your international affairs.

Strategic Advantages for International Entrepreneurs

One of the biggest draws is 100% foreign ownership. While recent reforms now allow this for many mainland companies, offshore entities were the original pioneers of this model in the UAE. They remain distinct because their purpose is different. An offshore company can't operate within the UAE's domestic market or provide local services—its real power is in handling international trade, managing assets, and protecting intellectual property.

The setup is also incredibly efficient. A mainland company might take one to two weeks to incorporate and comes with significant costs for office space. An offshore company, on the other hand, can be up and running in just a few days with minimal administrative hassle. For more insights on setting up in the UAE, you can find helpful information on ceoworld.biz.

Choosing Between RAK ICC and JAFZA Offshore

Picking the right jurisdiction for your offshore company in Dubai is the first big strategic move you’ll make. This isn't just about filling out forms; it's about selecting the right tool for the job you need to do. The UAE has two main jurisdictions for offshore entities, and really getting to grips with what makes each one tick will ensure your company is set up perfectly for your business goals.

The two players in this space are the Ras Al Khaimah International Corporate Centre (RAK ICC) and the Jebel Ali Free Zone Authority Offshore (JAFZA Offshore). I like to think of them as two different instruments in a toolkit. RAK ICC is the flexible, cost-effective multi-tool, while JAFZA is the specialized, premium instrument built for specific, high-value tasks.

Which one you go with will fundamentally shape how you manage your assets, handle international trade, and structure your investments down the line.

RAK ICC: The Versatile and Cost-Effective Choice

RAK ICC is known across the board for its flexibility and how efficiently it operates, making it a fantastic choice for a wide range of international business activities. It has become the go-to for entrepreneurs and corporations who need a straightforward, modern, and affordable offshore solution.

Think of it as the perfect framework for things like:

- Holding International Investments: If your main goal is to set up a holding company to manage a portfolio of global assets, RAK ICC provides a clean, secure structure.

- Managing Intellectual Property: For a software company or a creative agency, RAK ICC is a solid vehicle to hold patents, trademarks, and copyrights, keeping those valuable assets protected in a tax-neutral home.

- Facilitating Global Trade: Businesses that deal in cross-border trade can use a RAK ICC company to centralize all their invoicing and transactions, which really simplifies international commerce.

The real appeal of RAK ICC is its lean operational requirements and lower setup costs. This makes it a very accessible way to structure global operations without getting bogged down by a heavy administrative burden.

An offshore company in Dubai, whether it's in RAK ICC or JAFZA, comes with a major financial advantage. These entities benefit from zero corporate income tax and no withholding tax on dividends or interest, which directly boosts profitability for international entrepreneurs.

JAFZA Offshore: The Premium Real Estate Investment Tool

While RAK ICC offers broad-stroke versatility, JAFZA Offshore has carved out a very specific and prestigious niche for itself. It is widely seen as the gold standard for one particular purpose: owning real estate in Dubai. If your investment strategy involves buying property within Dubai, a JAFZA offshore company isn't just an option—it's often the most effective and recommended way to do it.

That’s because JAFZA is the only offshore jurisdiction that is explicitly approved by the Dubai Land Department for property ownership. This unique status gives real estate investors a level of security and legal clarity that you just can't get anywhere else. For a closer look at its specific advantages, you can explore more about JAFZA offshore company formation.

For example, an international investor looking to purchase several commercial properties in Dubai would almost certainly choose JAFZA. It allows them to create a holding structure that not only protects their assets but also makes succession planning much simpler. The solid reputation and robust regulatory framework of JAFZA add an extra layer of confidence, especially for high-value deals.

On average, setting up an offshore company in Dubai will cost you somewhere between AED 12,500 to AED 20,000 annually. That’s significantly lower than a mainland setup when you factor in office and visa expenses. One major hurdle for both jurisdictions, however, can be opening a bank account. UAE banks have very strict compliance rules and will require transparent ownership details and clear proof of where your funds came from to fight financial crime.

Unlocking the Financial Benefits of a Dubai Offshore Company

Let's be honest, the main reason international entrepreneurs look into an offshore company in Dubai comes down to the powerful financial perks. This setup is specifically designed to boost your profitability and protect your assets by drawing a clear line between your global business activities and any local tax rules. Think of it as a secure financial container for your international operations.

At its heart, a Dubai offshore company provides incredible tax neutrality. If your business earns all its money from outside the UAE, this structure is a huge advantage. It allows you to legally and effectively minimize your tax bill, making sure the profits from your international deals, investments, or intellectual property stay right where they belong—in your company.

This is more important than ever. With the UAE introducing a 9% corporate tax on mainland companies' onshore income in 2023, the distinction has become crystal clear. Offshore companies whose income is purely international are not subject to this tax, making them a cornerstone of any smart tax planning strategy. You can dive deeper into the differences between UAE company structures at kinzaad.ae.

Drastically Reduced Operational Costs

Beyond the major tax benefits, the savings on day-to-day operational costs can be a real game-changer. Unlike a mainland or free zone company, an offshore entity has no requirement for a physical office or any local staff.

This simple rule knocks out two of the biggest recurring expenses for any business:

- No Office Rental: You aren't required to lease a physical office, which can save you anywhere from AED 5,000 to over AED 100,000 a year, depending on the location and size.

- No Employee Visas: Since you don't have a local presence or employees in the UAE, you completely avoid the costs of sponsoring visas, which usually run between AED 3,000 to AED 7,000 for each visa.

These savings go directly to your bottom line. That's capital you can reinvest into growing your business instead of just keeping the lights on.

A Cost Comparison for an International E-Commerce Business

To put this into perspective, let's look at the numbers. Here’s a quick comparison of the estimated yearly costs for an international e-commerce business that generates all its revenue outside the UAE.

| Expense Category | Offshore Company | Mainland/Free Zone Company |

|---|---|---|

| Corporate Tax | 0% (on foreign-sourced income) | 9% (on profits over AED 375,000) |

| Annual Licence Fees | AED 12,500 – AED 20,000 | AED 20,000 – AED 50,000+ |

| Office Rental | AED 0 | AED 25,000 (minimum estimate) |

| Employee Visa Costs | AED 0 | AED 6,000 (for two employees) |

| Total Estimated Annual Cost | AED 12,500 – AED 20,000 | AED 51,000+ plus corporate tax |

As the table shows, the difference is huge. The offshore structure gives you a lean, efficient way to manage international business, making it the perfect choice for anyone focused on global trade, holding assets, or managing wealth.

The real value of an offshore company lies in its simplicity and focus. By stripping away the need for physical infrastructure, it allows entrepreneurs to concentrate purely on their international financial strategy and asset protection.

On top of the tax savings, a Dubai offshore company makes global finance much smoother. For instance, it allows you to open specialized business accounts for international payments. This kind of financial flexibility is crucial for managing global transactions, getting paid by international clients, and paying overseas suppliers without the usual headaches of cross-border banking. An offshore company provides the perfect corporate backbone for these essential tools.

The Step-By-Step Incorporation Process Explained

Setting up an offshore company in Dubai might seem like a complex affair from the outside, but it's actually a very clear and structured process. Think of it less like navigating a maze and more like following a well-marked road map—especially when you have the right guide.

The entire procedure is designed for efficiency, making sure every legal and regulatory box is ticked without hitting unnecessary speed bumps. From your initial decision to getting that final certificate in hand, each step logically follows the last, creating a fully compliant offshore company ready for business.

Your Initial Preparations and Documentation

First things first, you need to get your house in order. This initial stage is all about gathering the right documents and information to kick things off smoothly. It’s a bit like preparing all your ingredients before you start cooking; having everything ready upfront saves you from scrambling later on.

You'll need to partner with a registered agent who will handle the application for you. They are your essential link to the authorities and will manage all the communication required to get your company registered.

Here’s a quick checklist of what you'll typically need to provide:

- Company Name Selection: You’ll have to come up with three unique names for your company, ranked by preference. The registry will then approve the first one available.

- Shareholder and Director Details: Clear, color copies of the passports for everyone involved are a must.

- Proof of Address: You'll need a recent utility bill or a bank statement (no older than three months) to confirm the home address of each shareholder and director.

- Brief Business Plan: A simple, concise summary explaining what your offshore company plans to do is also required.

Getting this paperwork right is the foundation of your whole application. Make sure everything is clear, current, and completely accurate to avoid any hitches.

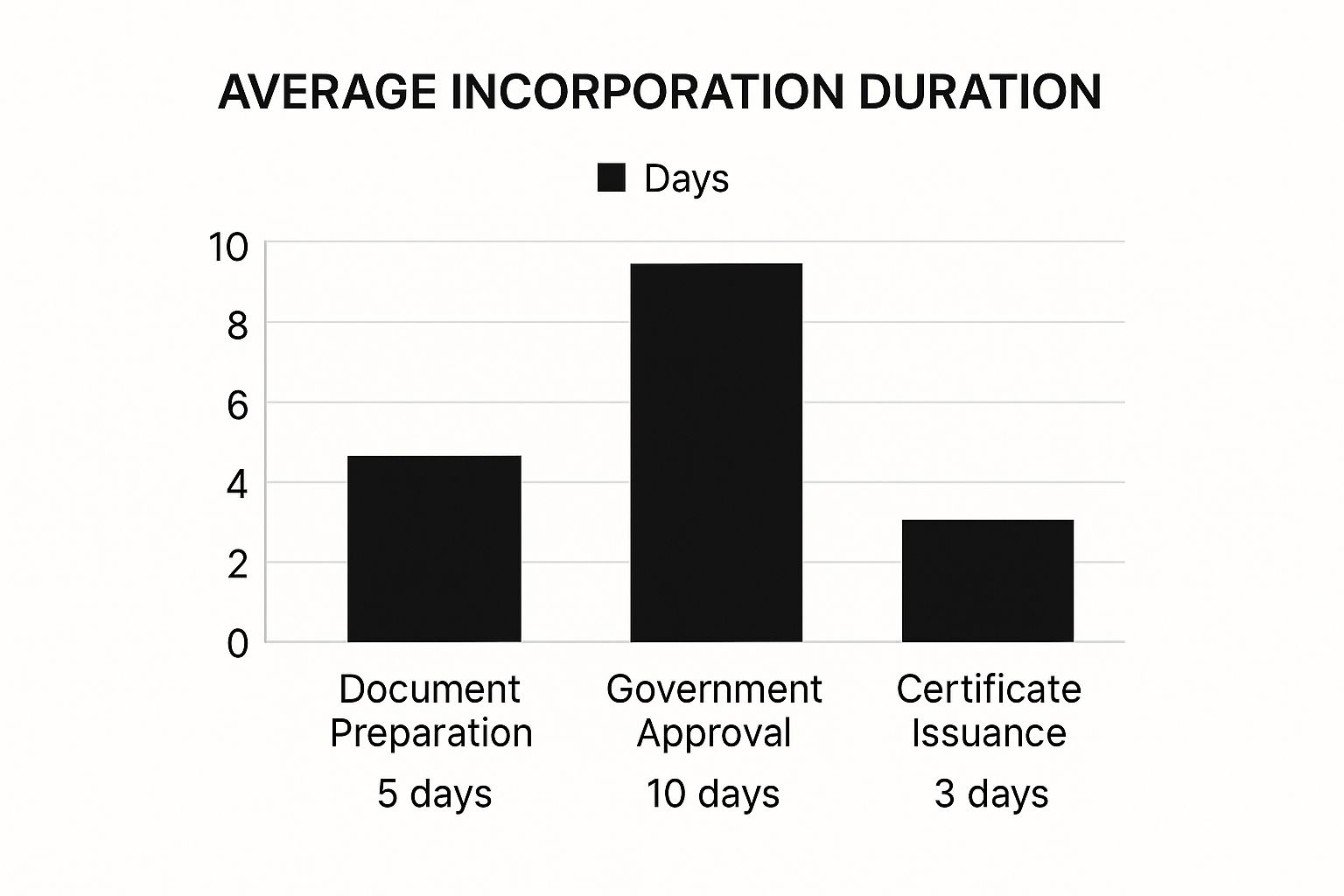

The infographic below breaks down the average time you can expect for each major step of the incorporation process.

As you can see, the government approval stage takes the longest. This is exactly why preparing your documents perfectly from the start is so important—it's the best way to prevent delays.

Navigating the Approval and Registration Stages

Once your registered agent submits the documents, your application officially enters the review stage with the offshore authority, like RAK ICC or JAFZA. This is where they perform their due diligence, checking all the information you provided and making sure your proposed company ticks all the regulatory boxes.

Throughout this period, your registered agent is your go-between, fielding any questions the registry might have. This is where their expertise really shines, as they can quickly sort out minor issues that could otherwise bring your application to a halt.

The role of the registered agent isn't just about paperwork; it's a legal requirement. They serve as your official point of contact with the authorities and ensure your company stays compliant with local laws long after it's formed.

After a successful review, the registry gives the green light and issues the final incorporation documents. This is the official paperwork that brings your company into legal existence.

The final items you’ll receive are:

- Issuance of Certificate of Incorporation: This is the official birth certificate of your company, proving it's legally registered.

- Memorandum and Articles of Association (MOA/AOA): These are the rulebooks for your company, detailing its structure, purpose, and how it will be run.

- Share Certificates: This is the official proof of ownership distributed to each shareholder.

With these documents in your possession, your offshore company is officially good to go. For most business owners, the next step is opening a corporate bank account to start managing international finances. For a closer look at that process, you can learn more about how to open an offshore company and bank account in our detailed guide.

Offshore vs Free Zone vs Mainland Company Comparison

Choosing the right company structure in the UAE can feel like standing at a crossroads. It's a critical decision, but it doesn't have to be complicated. Let's break it down with a simple analogy.

Think of a mainland company as your classic high-street shop. It's perfectly positioned to trade directly with customers and other businesses anywhere in the UAE. Next, a free zone company is like a specialized import-export hub at an international airport. It’s designed for global trade, operating within a specific economic zone with some limited pathways to the local market.

Then you have the offshore company in Dubai. This is your global headquarters—a strategic, non-resident entity designed purely for managing international finances and assets, completely separate from the local economy. Grasping these fundamental differences is the first step to aligning your business setup with your actual goals.

Market Access and Operational Scope

The biggest dividing line between these three setups is simple: where can you legally do business? This one factor often makes the decision for you.

A mainland company gives you a golden ticket to the entire UAE market. You can sell to local consumers, partner with any other mainland business, and even bid on lucrative government contracts without any restrictions.

On the other hand, a free zone company operates within its designated zone and internationally. While it's become easier for free zone entities to do some business on the mainland, it usually requires special permits or working with a local agent. For a deeper dive, our guide on Dubai free zone company formation has all the details.

An offshore company has the clearest boundary of them all. It is legally prohibited from conducting any business within the UAE. Its entire purpose is international—perfect for global trade, managing investments, and holding assets.

Ownership, Visas, and Physical Presence

Your need for foreign ownership, residency visas, and a physical office also plays a huge role in this decision. While 100% foreign ownership is now possible across all three structures for most activities, their approach to visas and office space couldn't be more different.

- Mainland Companies: These setups can apply for an unlimited number of employee visas, but this is tied directly to leasing sufficient office space. A physical office is mandatory.

- Free Zone Companies: Visa eligibility here is typically linked to the size of your office or flexi-desk package within the free zone. You still need a physical presence, but it can be a more flexible arrangement.

- Offshore Companies: This is the leanest option. It requires no physical office in the UAE and, crucially, is not eligible for any residence visas. It's a true non-resident entity.

The decision often boils down to one question: Do you need a physical base and visas in the UAE? If the answer is no, an offshore company is an incredibly efficient and cost-effective choice.

To make things even clearer, let's put it all in a table. This side-by-side view really helps highlight the unique purpose of each structure.

Company Structure Comparison UAE

| Criteria | Offshore Company | Free Zone Company | Mainland Company |

|---|---|---|---|

| Primary Business Focus | International trade, asset holding, and investments. | International trade with some local market access. | Direct trade within the UAE local market. |

| Market Access | No access to the UAE market. | Limited access to the mainland, operates within its zone. | Full, unrestricted access to the entire UAE market. |

| Ownership Structure | 100% foreign ownership is standard. | 100% foreign ownership is the primary model. | 100% foreign ownership is available for most activities. |

| Visa Eligibility | Not eligible for any UAE residence visas. | Eligible for visas, number depends on office size. | Eligible for visas, tied to office space requirements. |

| Office Requirement | No physical office is required. | A physical office or flexi-desk is mandatory. | A physical office lease is mandatory. |

| Taxation | 0% corporate tax on foreign-sourced income. | 0% corporate tax for most, 9% for some local business. | 9% corporate tax on profits above AED 375,000. |

Ultimately, there's no single "best" option. The right choice depends entirely on what you want to achieve. By defining your target market, operational needs, and long-term vision, the ideal path forward will become obvious.

How Expert Guidance Makes for a Smooth Setup

Setting up an offshore company in Dubai isn't a weekend DIY project; it's a strategic move that demands precision. While the process itself is designed to be straightforward, the small details in local regulations and paperwork can lead to expensive delays if you don't get them right. This is exactly why partnering with a specialist is your biggest advantage—it turns a potentially tangled process into a simple, seamless experience.

With an expert on your side, every single step is handled with care, from getting your documents in order to securing the final approvals. They know the legal landscape inside and out, making sure you stay fully compliant while freeing you up to focus on your actual business strategy. Think of them as your single point of contact, managing the entire setup so you don't have to.

It's More Than Just Incorporation

The best setup partners don't just register your company and disappear. They offer a complete suite of services built to support your business as it grows here in the UAE.

✅ Specialists in Mainland Company Formation in Dubai, Sharjah & Abu Dhabi

✅ Specialists in Freezone Company Formation across the UAE

✅ Specialists in Golden Visa on Property and Investor Visa

✅ Specialists in Corporate PRO Services and Attestation Services

✅ 24/7 Support Service – Always here when you need us

✅ Cost-Effective Business Setup Solutions tailored to your needs

✅ Enjoy UAE Tax Benefits for International Entrepreneurs

Navigating the complexities of company setup can be streamlined with expert help; explore how professional company formation services can ensure a smooth and compliant process for your business.

Ultimately, the right partner isn’t just selling a service; they’re providing peace of mind. With 24/7 support, you have a team on standby whenever you need them. They deliver cost-effective business setup solutions built around your specific goals, so you can take full advantage of the UAE’s tax benefits for international entrepreneurs without getting bogged down in administrative headaches.

Ready to make your launch seamless? Let us handle the complexities.

📞 Call Us Now: +971-54-4710034

💬 WhatsApp Us Today for a Free Consultation

Frequently Asked Questions

Thinking about setting up an offshore company in Dubai? It's a smart move for many international investors, but it's natural to have questions about how things work on the ground. Let's clear up some of the most common queries people have about operations and compliance.

Getting these details right from the start is key to a smooth, successful setup. A little bit of knowledge about banking, annual requirements, and what you can (and can't) do will help you make a fully informed decision.

Can an Offshore Company Open a Bank Account in Dubai?

Yes, it absolutely can. A UAE-registered offshore company is entitled to open a corporate bank account right here in Dubai. But be prepared—it's not a simple walk-in process. UAE banks follow very strict due diligence and Know Your Customer (KYC) rules to prevent financial crime.

You’ll need to have your paperwork in order. This typically includes:

- Passport copies and proof of address for all shareholders and directors.

- A solid business plan that clearly explains your company's activities.

- Details about your source of funds and the kinds of transactions you expect.

Honestly, having a professional firm guide you through the application can make a world of difference. They know exactly how to package your file to meet the bank's compliance standards, which can seriously speed things up and boost your chances of approval.

What Are the Annual Compliance Requirements?

One of the big draws of an offshore company is its straightforward annual upkeep. Compared to mainland businesses that often face extensive auditing requirements, an offshore entity has minimal but mandatory compliance tasks.

Your main responsibility is the annual renewal of your registration with either RAK ICC or JAFZA. This is handled through your registered agent; you just pay the renewal fee, and they take care of the official submission. While formal audits aren't usually required, it's always a good practice to maintain proper financial records. Your bank will definitely want to see them from time to time.

What Business Activities Are Permitted for an Offshore Company?

This is a crucial point to understand. An offshore company is built for international business—it cannot trade directly within the UAE. Think of it as a global business vehicle that’s based in the UAE but operates everywhere else.

The scope of permitted activities is quite broad, as long as they happen outside the country. Common uses include:

- International Trading: Perfect for managing cross-border sales and invoicing clients worldwide.

- Asset Holding: You can use it to own shares in other companies, intellectual property, or even real estate (specifically in Dubai through a JAFZA company).

- Consulting Services: A great structure for providing professional advice to clients located outside the UAE.

- Wealth Management: Many people use it as a holding company for investments and personal assets.

The golden rule is simple: all business must be conducted internationally. There should be no direct engagement with the local UAE economy.

Partnering with PRO Deskk ensures you have expert guidance through every stage of your business journey, from initial setup to ongoing compliance. We specialise in Mainland, Freezone, and Offshore company formation, as well as Golden Visa services and corporate PRO support. Enjoy the benefits of a UAE presence with our cost-effective, tailored solutions and 24/7 support.

📞 Call Us Now: +971-54-4710034

💬 WhatsApp Us Today for a Free Consultation at https://prodesk.ae