So, you're thinking about starting a business in the UAE. It really boils down to a few key decisions: picking your location (Mainland or a Free Zone), nailing down your business activity, and getting the right trade licence. With a bit of expert help, you can go from initial approval to having your visa stamped in just a few weeks.

Why Launch Your Business in the UAE

Setting up a business here isn't just about finding an office space; it’s about plugging into an ecosystem designed for growth. The UAE acts as a strategic gateway, a perfect launchpad connecting Eastern and Western markets. This isn't just a marketing line—it's backed by incredible infrastructure, a remarkably stable political climate, and a government that genuinely wants businesses to succeed.

It's no coincidence that the UAE is seen as a top business destination. For the fourth year in a row, it was ranked number one globally in the Global Entrepreneurship Monitor (GEM) report. That kind of consistent recognition shows a deep commitment to creating a place where new ideas and investments can flourish.

Your Pathways to Success

Your first big decision is a fundamental one: Mainland or a Free Zone? They each serve very different purposes, and your choice will shape how you operate.

- Mainland Company Formation: This is the way to go if you want to trade directly within the UAE market or work with government bodies. We are specialists in Mainland Company Formation in Dubai, Sharjah & Abu Dhabi.

- Free Zone Company Formation: If your focus is on international trade, a Free Zone is usually the better fit. You get benefits like 100% foreign ownership and some very attractive tax advantages. As specialists in Freezone Company Formation across the UAE, we can help you find the one that aligns with your business goals.

On top of that, the tax environment is a huge draw for international founders. Being able to reinvest your profits back into the business without a heavy tax burden is a game-changer for growth. As an international entrepreneur, you can enjoy significant UAE tax benefits.

Navigating the legal side of things is where having an expert in your corner really pays off. We handle the paperwork and make sure you're compliant, turning what could be a headache into a straightforward process.

Comprehensive Support for Your Venture

Getting your trade licence is just one piece of the puzzle. It's a whole series of interconnected steps, and that’s where professional guidance makes all the difference. We also help secure your long-term future here, as specialists in the Golden Visa on Property and standard Investor Visas to give you and your family stability.

Our Corporate PRO Services and Attestation Services take care of all the administrative heavy lifting, from clearing documents to dealing with various government departments. Plus, with our 24/7 support service, we're always here when you need us. We pride ourselves on providing cost-effective business setup solutions tailored to your needs.

Once the legal groundwork is laid, your focus will naturally shift to building your brand. A great starting point is learning how to build a business website to establish your online presence.

Choosing Your Jurisdiction: Mainland vs Free Zone

When you decide to set up a business in the UAE, your very first—and most important—decision is where to establish it. This choice is about far more than a physical address; it dictates your ownership structure, who you can do business with, and the entire operational framework for years to come.

Think of it this way: are you building a global e-commerce brand from the UAE? If your customers are international and your priorities are cost efficiency and total control, a Free Zone is almost certainly your best bet. A setup in a place like Ras Al Khaimah (RAKEZ) or Dubai CommerCity gives you 100% foreign ownership, zero customs duties on imports, and a much simpler registration process.

But what if you're a management consultant looking to win contracts with local Emirati companies or even government departments in Dubai? For that, you absolutely need a Mainland license from the Department of Economy and Tourism (DET). It’s the only way to get unrestricted access to the entire UAE market and bid on those lucrative government tenders, which are closed off to nearly all Free Zone companies.

Understanding the Core Differences

At its heart, the difference boils down to market access. A Mainland company is fully integrated into the UAE’s onshore economy, giving you the freedom to operate anywhere across all seven emirates. A Free Zone company, on the other hand, is technically in an offshore jurisdiction designed for international trade or business within that specific zone. If you want to sell directly to the Mainland market from a Free Zone, you’ll typically need to go through a local distributor.

This single distinction has a massive impact on your day-to-day operations. A retail shop in the Dubai Mall needs a Mainland license. A software firm serving clients in Europe and North America can operate brilliantly from a tech-focused hub like Dubai Internet City. Part of our job is to dig into your business plan and make sure you choose the path that actually matches your goals. We break down this process in more detail in our guide to company formation in the UAE.

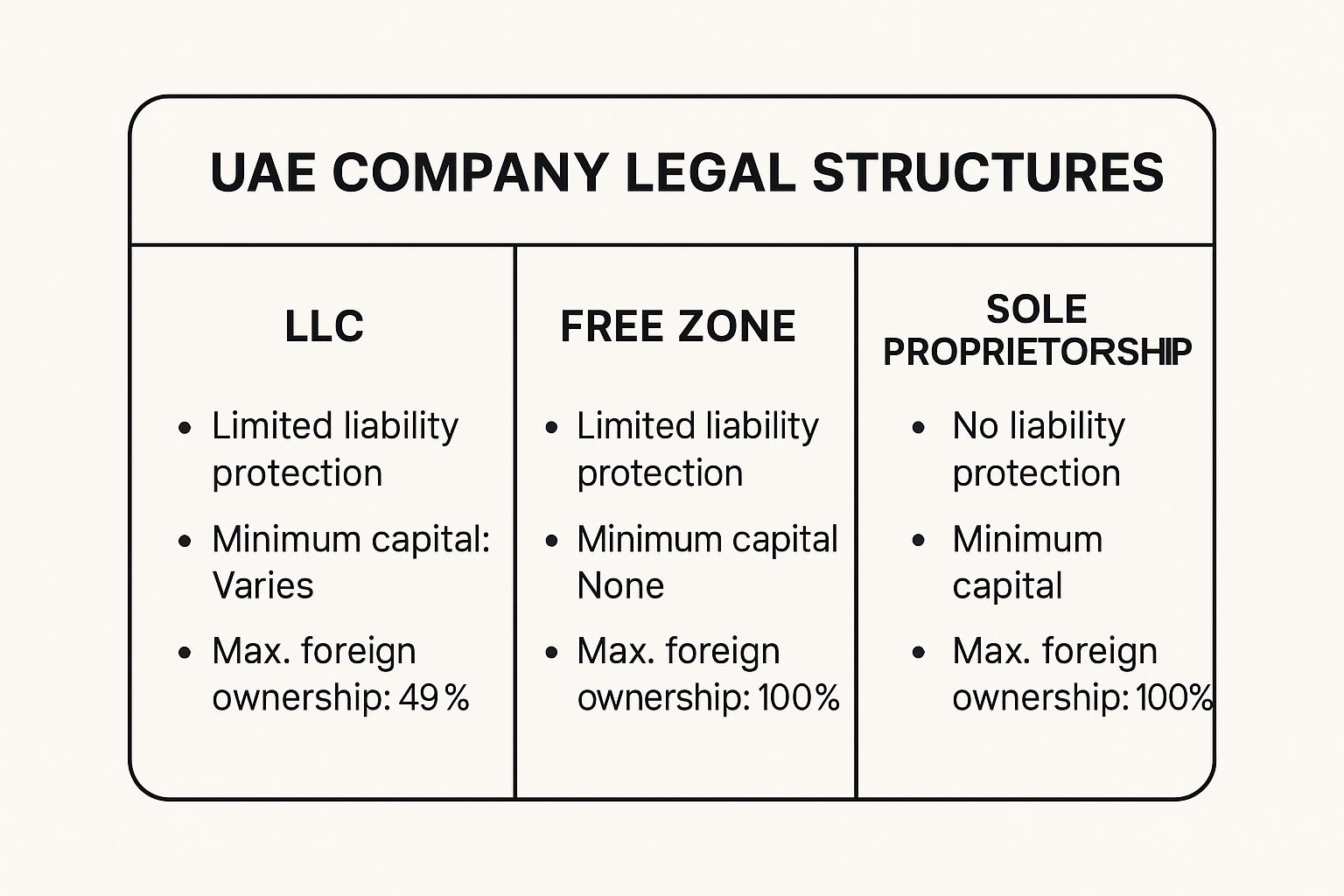

The image below gives a quick visual breakdown of the key legal and financial differences.

As you can see, both Free Zone entities and Mainland LLCs provide robust liability protection and now typically offer 100% foreign ownership. The Sole Proprietorship is simpler but leaves the owner personally liable for business debts—a critical distinction.

To help you see the contrasts more clearly, here's a quick comparison of the most important factors.

Mainland vs Free Zone: Key Differences at a Glance

| Feature | Mainland Company | Free Zone Company |

|---|---|---|

| Market Access | Unrestricted access to the entire UAE market | Primarily for international business or within the specific Free Zone |

| Ownership | 100% foreign ownership now available for most activities | 100% foreign ownership has always been standard |

| Office Requirement | A physical office with an Ejari (lease) is mandatory | Flexible options, including virtual offices and flexi-desks |

| Visa Eligibility | Generally more flexible; scales with office size | Usually tied to a package, with a set number of visas |

| Government Tenders | Can bid on government and semi-government contracts | Ineligible for most government contracts |

| Customs Duty | 5% customs duty on imported goods | 0% customs duty within the Free Zone |

This table provides a snapshot, but the right choice for you will depend on the specifics of your business plan.

Key Factors to Consider for Your Decision

Making the right call means looking beyond today and thinking about where your company will be in five or even ten years.

-

Business Activities: What will you actually be doing? If you're opening a law firm or a medical clinic, you'll almost certainly need a Mainland license to serve the local community. But for activities like media production or logistics, specialised hubs like Dubai Media City or Jebel Ali Free Zone (JAFZA) are designed for your needs.

-

Ownership and Control: While the UAE now permits 100% foreign ownership for most Mainland activities, a few strategic sectors still have specific rules. Free Zones, in contrast, have always offered this as a core benefit, giving international founders complete autonomy from day one.

-

Office Space Requirements: Do you need a physical office, a warehouse, or just a flexible desk to get started? Mainland setups in Dubai and Abu Dhabi require a registered physical lease (Ejari). Free Zones are known for offering a huge range of cost-effective options, from virtual offices that get you a visa to massive industrial plots.

-

Visa Quotas: How many people do you need to bring on board? For Mainland companies, visa eligibility often scales with the size of your office. In Free Zones, you typically get a set number of visas with your licence package, though you can usually apply for more if needed.

Your choice of jurisdiction is the foundation of your entire business setup. A mismatch between your business model and your license type can create operational hurdles and unnecessary costs down the line. It's crucial to get this right from the very beginning.

Ultimately, choosing between Mainland and a Free Zone is a strategic decision that will shape your company's future. Our specialists in Mainland company formation in Dubai, Sharjah & Abu Dhabi and across the UAE's many Free Zones provide clear, practical guidance. We make sure your business is built on the right foundation, tailored precisely to your needs and ready for success.

Navigating Company Registration and Licensing

Alright, you’ve picked your jurisdiction. Now for the part that turns your big idea into a real, legal business. This is where the paperwork trail begins, but trust me, it’s a lot more straightforward when you know the path. The journey from reserving a trade name to holding your final trade licence is a series of logical, sequential steps.

Think of it like building a house. First, you secure the plot of land—that’s your trade name and initial approval. Then you lay the foundation with all the legal documents. Only then can you finally get the keys, which in this case, is your trade licence. Getting each step right is crucial to avoid headaches and costly delays later on.

This is exactly where our Corporate PRO Services come in. We’re the ones who handle the back-and-forth with government departments, making sure every form is filled out correctly and every submission hits its deadline. This hands-on approach sidesteps the common pitfalls that can easily stall a new business launch.

Securing Your Business Identity

The first real move is choosing and reserving your company’s trade name. This isn't just about clever branding; the name has to play by UAE rules. It can't be offensive, have any religious or political undertones, or be a carbon copy of an existing company’s name.

Once your name gets the green light, you’ll apply for an Initial Approval Certificate. This is the government's official nod, confirming they have no objections to your business and giving you the go-ahead to proceed with the formal registration.

While this is happening, you need to have a firm grip on your finances. The fees for registration and licensing are just the start, so mapping out your capital is essential. For many entrepreneurs, figuring out how to fund a startup is a parallel track that ensures they have the cash flow to cover these setup costs and hit the ground running.

Preparing Your Foundational Documents

With your initial approval in hand, it's time to build your company's legal framework. This means drafting and signing the core documents that define your business structure and how it will operate.

-

Memorandum of Association (MOA): This is a cornerstone legal document, especially for Mainland companies with partners. It details the company's purpose, share capital, ownership breakdown, and partner responsibilities. It must be notarised by a public notary here in the UAE.

-

Tenancy Contract (Ejari): If you're setting up a Mainland business in Dubai, Sharjah, or Abu Dhabi, you need a physical office space. You must provide a valid tenancy contract registered through Ejari, which is the official online portal for lease registrations. This serves as proof of your legitimate business address.

-

Additional Approvals: Depending on what your business actually does, you might need special permits from certain ministries. For example, a medical clinic needs approval from the Ministry of Health and Prevention (MOHAP), while a financial advisory would require clearance from the Securities and Commodities Authority (SCA).

This is where having an experienced team really pays off. Our specialists know the ins and outs of what's required for different business activities. We make sure all the necessary external approvals are sorted without delay, which is a very common place for newcomers to get stuck.

A Real-World Example: A Tech Startup in a Dubai Free Zone

Let's walk through a common scenario: launching a tech startup in a Dubai free zone like DMCC or DIFC. The process here is typically faster and more streamlined than a Mainland setup.

The founder starts by submitting an online application with three potential trade names and a business plan. Once a name is approved—often within 24 hours—they receive the initial approval. The free zone authority even provides a template for the MOA, which can be signed digitally.

Instead of leasing a full office, the startup opts for a flexi-desk package. This satisfies the requirement for a physical presence, allowing them to get a licence and one visa. After submitting passport copies and a few other personal documents, the entire process can be wrapped up. From application to getting the e-licence, it can take as little as five to seven working days. Our team excels in these fast-track Freezone Company Formation setups across the UAE.

Final Steps and Licence Issuance

Once every document has been submitted and all approvals are in, you'll receive a payment voucher for your trade licence fees. As soon as that's paid, your trade licence is officially issued.

This licence is your ticket to operate legally in the UAE. It’s what you’ll use to apply for your establishment card, open a corporate bank account, and start sponsoring visas for yourself, your family, and your team. With our guidance, what looks like a mountain of legal requirements becomes a clear, manageable checklist, getting you up and running in no time.

Securing Your Residency and Future in the UAE

https://www.youtube.com/embed/26jx2bXF4IU

Getting your trade licence is a fantastic moment, but for anyone moving to the UAE to run their new business, it’s really just the beginning. The licence makes your company legal, but it’s your residency visa that lets you actually live here. This is the step that truly plants your feet on the ground, allowing you and your family to transition from being just a business owner to a fully-fledged UAE resident.

This is where your entrepreneurial venture becomes a real lifestyle. It involves a clear set of procedures, including a medical fitness test and Emirates ID registration, which can seem a bit intimidating from the outside. But honestly, with a bit of guidance, it's a straightforward part of the setup. Our specialists navigate these steps every day and can make the whole thing feel effortless.

The Standard Path: The Investor Visa

For most people starting a new company, the most direct route to residency is the Investor Visa, which you might also hear called a Partner Visa. This visa is tied directly to the company you’ve just set up—your business essentially becomes your sponsor, giving you the legal right to live and work in the country.

It's usually valid for two to three years and is renewable, making it the go-to option for founders of both Mainland and Free Zone companies. The process generally follows these stages:

- Establishment Card: First, your company needs to be registered with the immigration authorities.

- Entry Permit: An initial permit is then issued so you can start the in-country visa stamping process.

- Medical Fitness Test: This is a mandatory health check for certain communicable diseases.

- Emirates ID Biometrics: You'll have your fingerprints and photo taken for your official residency card.

Knowing exactly what documents you need is the secret to a smooth application. For a complete breakdown of what's required, take a look at our detailed guide on the UAE Investor Visa requirements.

Elevating Your Status: The Golden Visa

While the Investor Visa is an excellent and reliable option, the UAE also offers something for those looking for more permanence: the Golden Visa. This is a special programme aimed at attracting top-tier talent, visionary entrepreneurs, and major investors with a 10-year renewable residency visa. It provides incredible stability for you and your family, completely independent of your company sponsorship.

The Golden Visa is more than just a long-term visa; it’s a clear signal from the UAE government that it values and supports long-term investors and innovators. It offers a unique peace of mind that lets you focus completely on building your business and your life here.

Our team are specialists in Golden Visa on Property and Investor Visa applications, and we know exactly how to position our clients' profiles to give them the best possible chance of success. This premium visa category has a few different routes available to entrepreneurs.

Pathways to the Golden Visa

Qualifying for the Golden Visa is often more achievable than people think. For international entrepreneurs, the most common routes are:

-

Golden Visa for Investors: This is for individuals who make a significant financial investment in the UAE. This could be through a deposit in a local bank, an investment in an existing business, or the establishment of a new company with a certain capital.

-

Golden Visa on Property: A very popular choice. If you own property in the UAE with a value of AED 2 million or more, you become eligible to apply. It’s a great way for entrepreneurs to invest in the country's booming real estate market while securing their long-term future here.

Figuring out the best path really comes down to your personal and financial situation. Our expertise is in looking at your profile and recommending the most direct and efficient strategy. With our 24/7 support service, we're here to guide you through everything, from getting your documents attested to celebrating the final approval.

Opening a Corporate Bank Account

You’ve got your trade licence and residency visa in hand. It feels like the biggest hurdles are behind you, but there's one more crucial piece of the puzzle: the corporate bank account.

For many entrepreneurs setting up in the UAE, this part of the process can be an unexpected and frustrating bottleneck. Local banks are known for their rigorous due diligence, but if you go in prepared, you can navigate it smoothly.

At the end of the day, banks need to see a real, tangible business. It's not enough to just have the paperwork; you need to paint a clear picture of a legitimate operation with genuine substance.

Assembling a Bulletproof Application Package

A meticulously prepared application can be the difference between a quick approval and months of back-and-forth. The goal is to prove your company is more than just a name on a licence.

Think of it as building a case for your business. Here’s what you absolutely must include:

- A Solid Business Plan: Don’t just throw something together. Your plan needs to clearly define your business model, who you're selling to, realistic revenue forecasts, and how you'll get there.

- Proof of 'Business Substance': This is a big one. You need to show you have a physical presence and are ready to operate. Your office tenancy contract (Ejari), utility bills, or even early-stage contracts with suppliers or clients are perfect for this.

- Founder's Background: A professional CV or a detailed profile for each shareholder helps the bank see the expertise and credibility driving the company.

- Source of Funds Declaration: Be ready to clearly document where your start-up capital is coming from. Transparency is non-negotiable here.

Trying to shortcut this step is the single biggest reason applications get delayed or flat-out rejected. We help our clients get ahead of the bank’s questions by compiling a package that leaves no room for doubt.

Choosing the Right Bank for Your Business

You'll find a mix of local UAE banks and international players, and there’s no single "best" option. It really comes down to what your business needs.

Local banks often have a better feel for the regional market and can sometimes be more flexible with new start-ups and SMEs. On the other hand, an international bank might be a better fit if your business relies heavily on global trade and complex cross-border transactions.

A common mistake I see is people getting discouraged after one rejection. Every bank has its own internal policies and risk tolerance. A 'no' from one doesn't mean you won't get a 'yes' from another.

The banking world here is also evolving quickly. For a deeper look into these changes, it's worth reading up on digital innovation in the UAE banking sector.

Taking Full Advantage of the UAE Tax System

With your corporate account active, you can finally unlock the full financial benefits of operating in the UAE. The environment is deliberately designed to help international businesses succeed, and for start-ups, the advantages are immense.

Under the current corporate tax rules, any start-up earning less than AED 3 million in revenue can qualify for a 0% tax rate. This is part of the Small Business Relief scheme, which runs until the end of 2026. This is a game-changer, as it lets you plough every dirham of profit back into growing your business.

This tax structure is a massive competitive advantage. Once your bank account is operational, you can manage your finances, get paid by clients, and build your company on a rock-solid financial footing in one of the world's most attractive tax environments.

Common Questions on Setting Up a Business in the UAE

When you're looking at how to start a business in the UAE, a lot of questions pop up. It’s completely normal. To give you some clarity, we've put together answers to the questions we hear most often from entrepreneurs who are exactly where you are right now.

What’s the Real Cost to Start a Business Here?

This is always the first question, and the honest answer is: it depends. The final figure is a mix of your chosen jurisdiction, the specific activity your business will undertake, and how many visas you'll need.

For a lean start, a basic Free Zone package can get you in the door for around AED 15,000. It's a fantastic, cost-effective way to get started. On the other end of the spectrum, a Mainland company formation in Dubai, complete with a physical office and visas for your team, will naturally command a higher initial investment.

The most important thing is to get a detailed cost breakdown from the very beginning. This isn't just about budgeting; it's about avoiding nasty surprises later on. You should see every single fee, from the licence to the visas, laid out clearly.

If you want a precise number for your specific business idea, just WhatsApp us for a free consultation. We’ll map out all the costs involved so you can plan with confidence.

Can I Get a UAE Residence Visa Without Leasing an Office?

Yes, you absolutely can. This has become a game-changer for so many modern entrepreneurs. A lot of Free Zones now offer "flexi-desk" or virtual office packages that are designed for this exact purpose. They give you a legitimate business presence that satisfies the legal requirements for visa eligibility, but without the overhead of a dedicated physical office.

This setup is perfect for:

- Consultants, coaches, and freelancers

- Digital nomads and lean tech startups

- Entrepreneurs managing their UAE venture from abroad

It's worth remembering, though, that some professional activities and all Mainland licences still demand a physical office space with a registered tenancy contract (known as an Ejari). Our team can look at your business model and find the most economical path that ticks both your operational and visa boxes.

How Long Does the Whole Setup Process Actually Take?

The timeline can be surprisingly quick or take a bit of patience, really ranging from a few days to a few weeks. A straightforward Freezone company formation is usually the fastest route—we've seen some get registered in less than a week.

Mainland setups, however, are a bit more involved and generally take between two and four weeks. This is simply because more government departments need to give their approval. Once your licence is issued, you'll need to factor in another two to four weeks for the visa processing and getting your corporate bank account up and running.

This is where having an experienced Corporate PRO Services team makes a massive difference. We know how to prepare and submit your paperwork to avoid the common administrative hiccups that can easily derail your launch timeline.

Do I Still Need a Local Partner for a Mainland Business?

This is a big one, and it's a holdover from the old rules. The great news is that for the vast majority of business activities, 100% foreign ownership is now standard on the UAE Mainland. You no longer need an Emirati sponsor to hold a 51% share in your company.

The main exception to this rule is for businesses with a professional services licence—think consultancies, law firms, or auditing companies. These structures require what’s called a Local Service Agent (LSA).

An LSA is an Emirati national or a fully Emirati-owned company that acts as your formal representative for government paperwork. But here’s the crucial part: an LSA has zero ownership of your business, no say in how you run it, and no claim on your profits. They are simply paid an annual fixed fee for their service. We handle this entire arrangement, making sure your professional licence is set up correctly right from the start.

Ready to turn your business idea into a UAE reality? The team at PRO Deskk is here to guide you through every single step, from picking the right jurisdiction to getting your visa and opening a bank account. We specialise in cost-effective, straightforward solutions with 24/7 support.

📞 Call Us Now: +971-54-4710034

💬 WhatsApp Us Today for a Free Consultation at https://prodesk.ae