Picture a ‘financial passport’ for your business—that’s probably the best way to think about a Dubai offshore company. It's a legal business entity registered right here in the UAE, typically in a well-known jurisdiction like JAFZA or RAK ICC, but it’s built exclusively for international business, operating entirely outside the UAE’s borders.

Understanding the Dubai Offshore Company

A Dubai offshore company is a strategic tool for entrepreneurs and businesses with global ambitions. Unlike mainland or free zone companies that are set up to interact with the local UAE market, an offshore entity is legally fenced off to only conduct business internationally. This structure isn't for getting a UAE residence visa or for trading locally; it's a powerful vehicle for your global operations.

Let's use an analogy. Think of your business as a ship. A mainland company is like a vessel docked in a UAE port, busy loading and unloading goods for the local market. A free zone company is a ship in a special economic port, trading both in the UAE (with some rules) and internationally.

But a Dubai offshore company? That’s an ocean liner sailing purely in international waters. It's registered in the UAE for the stability and credibility that brings, but it never actually comes ashore to do business.

Key Distinctions and Purpose

The main reason for setting up this kind of company is to build a secure, tax-efficient base for your global activities. It acts as its own legal personality, totally separate from its owners, which is a massive advantage for asset protection and smart corporate structuring.

Here’s what these companies are really designed for:

- International Trading and Invoicing: Manage your global sales and contracts from a neutral, tax-friendly jurisdiction.

- Asset Protection: Keep high-value assets like property, investments, or intellectual property safe from potential liabilities.

- Holding Company: Own shares in other companies around the world, making it easier to centralise dividends and simplify your ownership structure.

- Enhanced Confidentiality: Protect the identities of shareholders and directors from being listed on public registers, giving you a high degree of privacy.

This unique setup is exactly why the UAE's offshore sector is booming. In fact, projections show it's on track to become a major contributor to the economy, expected to create nearly 83,000 skilled jobs and have an economic impact of $7 billion (around AED 25.7 billion) by 2030.

The best way to understand a Dubai offshore company isn't by where it's registered, but by where it operates—everywhere except the UAE itself. It gives you a globally respected corporate identity without getting tangled in local market regulations.

For entrepreneurs and investors, this structure offers a fantastic mix of global credibility, operational freedom, and financial efficiency. For a deeper dive into the setup process, have a look at a comprehensive guide to offshore company formation in Dubai.

Quick Look: Dubai Offshore vs Other UAE Structures

It's easy to get the different UAE company types mixed up. Offshore, Mainland, Free Zone—they all serve very different purposes. This table breaks down the main differences at a glance.

| Feature | Offshore Company | Mainland Company | Free Zone Company |

|---|---|---|---|

| Business Scope | Strictly international business, outside the UAE | Can trade anywhere in the UAE and internationally | Can trade within its free zone and internationally |

| Ownership | 100% foreign ownership permitted | 100% foreign ownership now available for most activities | 100% foreign ownership permitted |

| Office Space | Not required; registered agent address is sufficient | Mandatory physical office space in the UAE | Mandatory physical office space or flexi-desk within the free zone |

| Visas | No eligibility for UAE residence visas | Can apply for multiple employee and investor visas | Can apply for employee and investor visas (quota based on office size) |

| Confidentiality | High; shareholder details are not public | Lower; details are on public commercial registers | Varies by free zone, but generally higher than mainland |

| Best For | Holding assets, international trade, IP protection | Direct local UAE market access, retail, services | International trade, specific industry clusters, re-exporting |

Ultimately, the right choice depends entirely on what you want your business to do. An offshore company is an incredibly powerful tool, but only when used for its intended international purpose.

Choosing Your Jurisdiction: JAFZA vs. RAK ICC

Picking the right jurisdiction for your UAE offshore company is probably the most important decision you'll make in this entire process. It’s not just about ticking boxes on a features list; it's about matching the jurisdiction’s core strengths with what you actually want to achieve long-term.

In the UAE, the offshore world really revolves around two main players: the Jebel Ali Free Zone Authority (JAFZA) and the Ras Al Khaimah International Corporate Centre (RAK ICC). While both provide solid platforms for international business, they are built for very different purposes. Your choice will come down to your primary goal, whether that's protecting your assets, managing global trade, or investing in Dubai property.

The JAFZA Advantage: Holding Dubai Real Estate

JAFZA has one massive, standout feature that sets it apart: it’s the only offshore jurisdiction in the UAE that lets a company own real estate in Dubai. For international investors wanting to hold property assets in a secure, tax-efficient structure, this is a total game-changer.

If your main plan is to buy and hold property in one of Dubai’s designated freehold areas, JAFZA isn’t just a good choice—it’s your only choice. This setup creates a clear separation between your personal wealth and your property assets, which adds a powerful layer of protection and makes things like succession planning much simpler.

Think of a JAFZA offshore company as a secure vault for your Dubai property investments. It provides a legal shield that’s perfect for high-net-worth individuals and families who want to manage their real estate portfolio privately and efficiently.

The RAK ICC Edge: Global Flexibility and Cost-Effectiveness

While JAFZA is the king of property holding, RAK ICC is celebrated for its flexibility, lower costs, and wide international recognition. For almost every other offshore use case—like international trade, consulting, or as a holding company for global assets—RAK ICC is usually the go-to option.

The setup process with RAK ICC is generally quicker and more affordable, and the annual renewal fees are lower. This makes it a great vehicle for entrepreneurs and SMEs who need to manage international operations without the higher overheads that come with JAFZA.

Here are the key areas where RAK ICC really shines:

- International Trading: Perfect for invoicing global clients and managing international contracts from a tax-neutral home base.

- Consulting Services: A great way to offer professional services to clients outside the UAE with a credible, globally recognised corporate name.

- Holding Company: Ideal for owning shares in other companies around the world, centralising dividend income, and simplifying your corporate group structure.

- Intellectual Property: Use it to hold patents, trademarks, and copyrights, keeping them safe from the risks of your day-to-day operational businesses.

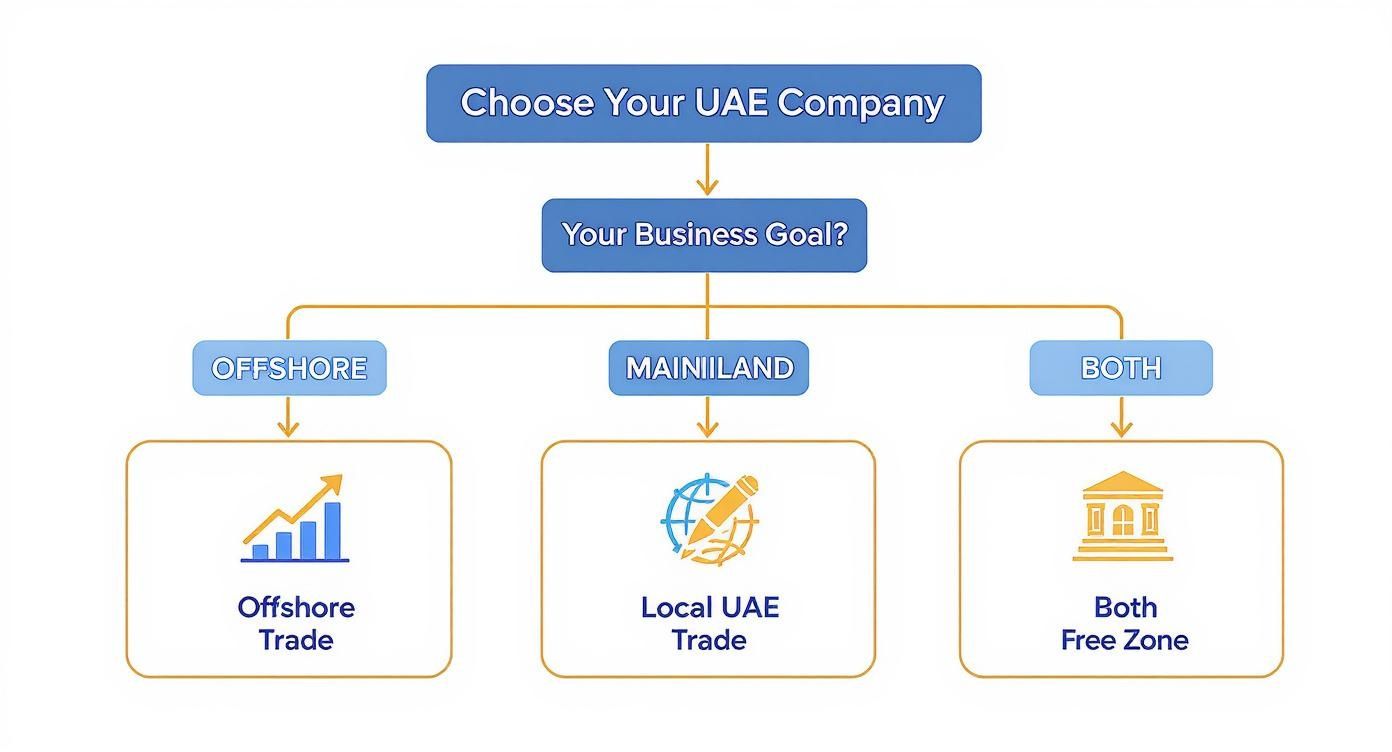

Deciding on the right company structure is crucial for your success. This flowchart can help you visualise whether an offshore, mainland, or free zone company is the best fit for your business ambitions.

As the infographic shows, if your business is focused on global trade and holding assets without any local operations in the UAE, an offshore company is the clear path forward.

To make the comparison clearer, let's break down the key differences between the two main jurisdictions side-by-side.

JAFZA vs RAK ICC Head-to-Head Comparison

| Attribute | JAFZA Offshore | RAK ICC |

|---|---|---|

| Primary Use Case | Holding Dubai real estate | Global trade, asset holding, IP protection |

| Property Ownership | Yes, can own property in Dubai | No, cannot own property in the UAE |

| Setup Cost | Higher | Lower |

| Annual Renewal Fees | Higher | Lower |

| Reputation | Excellent, well-established (part of Dubai) | Strong, modern, and internationally recognised |

| Setup Process | More documentation-intensive | Streamlined and faster |

| Shareholder Meetings | Can be held anywhere globally | Can be held anywhere globally |

| Redomiciliation | Possible to move company into JAFZA | Possible to move company in or out of RAK ICC |

| Bank Account Opening | Straightforward with UAE banks | Straightforward with UAE and international banks |

| Ideal For | Property investors, HNWIs with Dubai assets | Traders, consultants, global entrepreneurs, SMEs |

Ultimately, the choice comes down to what you need the company to do. Are you anchoring your investment in Dubai's property market, or are you building a flexible vehicle for global commerce? The answer to that question will point you directly to the right jurisdiction.

As specialists in all types of UAE company formations, from mainland and free zone to offshore setups, we can offer advice that’s tailored to your specific situation. Whether you're aiming to secure a Golden Visa on Property through a compliant company structure or just looking for a cost-effective business setup solution, our expertise will ensure you make the right choice. With our 24/7 support, we're always here to guide you through this critical decision.

The Strategic Advantages of Going Offshore in the UAE

Global entrepreneurs are consistently drawn to the UAE for their offshore needs, but what makes this structure so compelling? The decision to set up a Dubai offshore company is about much more than just a simple registration; it's a strategic move that unlocks a powerful set of benefits built for international business and serious asset protection.

This kind of setup gives you a secure and credible corporate identity, backed by the UAE's stellar international reputation. It allows entrepreneurs to operate across the globe with confidence, tapping into the stability and reliability that comes with a UAE-registered entity.

Complete Control with 100 Percent Foreign Ownership

One of the biggest attractions of a Dubai offshore company is the guarantee of 100% foreign ownership. Unlike many other corporate structures around the world, you won’t be required to find a local partner or sponsor. This gives you absolute, undisputed control over your business operations, your assets, and your strategic direction.

Having this complete ownership means your company's future is entirely in your hands. You can make executive decisions, manage how shares are distributed, and steer your business’s growth without any outside influence—total freedom for the international entrepreneur.

Unmatched Tax Efficiency for Global Profits

The UAE's tax environment is a cornerstone of its appeal for offshore setups. A Dubai offshore company is designed to be exceptionally tax-efficient, letting you legally and transparently maximise your global profits.

Here’s a quick look at the key tax benefits:

- Zero Corporate Tax: Any international profits you make are not subject to corporate tax in the UAE.

- Zero Personal Income Tax: As the owner, you won't be liable for personal income taxes on dividends or profits you take from the company.

- No Capital Gains Tax: Profits from selling assets or shares are not taxed.

This tax-neutral environment means more of your revenue can be ploughed back into the business, fuelling expansion and innovation. It’s a significant competitive edge in the global marketplace.

Building a Fortress for Your Assets

Asset protection is another core reason to set up a Dubai offshore company. It acts as a legal shield, creating a clear separation between your personal wealth and your business liabilities. This structure is an incredibly effective tool for safeguarding high-value assets from potential legal disputes, creditors, or financial turbulence.

Think of your offshore company as a secure vault. By placing assets like real estate, investment portfolios, intellectual property, or company shares inside it, you legally separate them from personal risk. If your other businesses face challenges, the assets held by the offshore entity stay protected.

This legal separation provides real peace of mind, ensuring your hard-earned wealth is preserved for the future. You can find more details about how these entities work in our comprehensive guide to offshore companies in the UAE.

Balancing Privacy with Global Compliance

Confidentiality is a critical benefit, but it's handled with a modern, responsible approach. The details of shareholders and directors in a Dubai offshore company aren't made public, which offers a high degree of privacy. This protects your personal information and business dealings from prying eyes.

However, this privacy is balanced with a firm commitment to global compliance standards. The UAE follows international regulations on anti-money laundering (AML) and know-your-customer (KYC) protocols. This ensures your company operates with integrity and is recognised as a legitimate entity by international banks and regulatory bodies.

Gaining Unmatched Global Credibility

Finally, having a Dubai offshore company lends immense credibility to your international operations. The UAE is a respected global financial hub known for its stable economy, strong banking system, and solid legal framework. Associating your business with this jurisdiction automatically enhances its reputation and trustworthiness in the eyes of clients, partners, and financial institutions worldwide. This global standing makes it much easier to open corporate bank accounts, secure contracts, and conduct business across borders.

How to Use Your Dubai Offshore Company

Knowing the strategic perks of a Dubai offshore company is one thing, but seeing it work in the real world is something else entirely. This is where theory gets real, turning into powerful tools that global entrepreneurs use every day to protect their assets, simplify how they run their business, and boost their bottom line.

Think of an offshore company as a specialised instrument. It’s not meant for trading here in the UAE. Instead, it’s fine-tuned for a whole range of international activities, from pulling together a global business empire to putting a shield around your personal wealth.

The International Holding Company

One of the most popular and effective ways to use a Dubai offshore company is as an International Holding Company.

Let's say you own shares in several different businesses across the globe—maybe a tech company in Asia, a factory in Europe, and a consulting firm in North America. Just managing that portfolio can get incredibly messy and tied up in administrative knots.

By setting up a Dubai offshore company as a central holding entity, you can move the ownership of all these separate businesses under a single, tax-neutral roof.

This structure brings some serious benefits:

- Centralised Dividends: Instead of profits trickling in from multiple places, all dividends flow into your one offshore company. This makes financial management a breeze and lets you reinvest your capital more strategically across your businesses.

- Streamlined Ownership: You get a clean, organised corporate structure. This makes it far easier to manage, sell, or pass on your business interests down the line.

- Enhanced Asset Protection: It adds a crucial layer of separation between the holding company and the businesses on the ground, protecting the parent entity from any liabilities that might pop up at the subsidiary level.

The Asset Protection Vehicle

Another key role for these companies is to act as a solid Asset Protection Vehicle. High-net-worth individuals and families often use this setup to legally safeguard valuable assets from future risks, like business liabilities, creditors, or legal battles. The assets are legally owned by the offshore company, not the individual, which creates a powerful protective barrier.

A Dubai offshore company is like a secure vault for your most valuable possessions. By placing assets inside, you separate them from personal or other business-related risks, ensuring they're preserved for your family or future generations.

So, what kind of assets are we talking about?

- Real Estate Portfolios: Owning international properties through an offshore company simplifies both management and succession planning.

- Intellectual Property: Things like patents, trademarks, and copyrights can be held by the offshore entity. It can then license their use to other companies, keeping these valuable assets safe from business risks.

- Investment Portfolios: Stocks, bonds, and other financial instruments can be managed within this secure and confidential structure.

The Global Trading and Consulting Hub

For any business that operates across borders, a Dubai offshore company is the perfect base for Global Trading and Consulting. If you're providing services or selling goods to international clients, this structure lets you centralise all your invoicing and contracts in one tax-efficient spot.

Take a freelance software developer with clients in Europe, the USA, and Australia. They could use a RAK ICC offshore company to send out all their invoices and receive payments. This completely avoids the headache of trying to figure out different tax rules in each client's country.

Better yet, the profits can accumulate in a jurisdiction with 0% corporate tax. This strategy is a game-changer for international consultants, e-commerce businesses, and global traders who need a credible and efficient corporate home for their worldwide operations.

Your Step-by-Step Formation and Banking Guide

Setting up a Dubai offshore company might seem daunting, but when you break it down, it's actually a very clear and manageable process. Think of it as a journey with a few key milestones. This guide will walk you through the essential path, from making those initial big decisions to the crucial step of opening your corporate bank account.

Everything starts with strategy. The first move is always a consultation to really nail down what you want to achieve. Are you looking for solid asset protection, a vehicle for international trade, or a way to hold shares in other businesses? Your answer here will point you towards the right jurisdiction—almost always a choice between JAFZA and RAK ICC.

Preparing Your Documentation

Once your strategy is set, it's time to gather your paperwork. Getting this part right from the beginning is key to avoiding any frustrating delays down the line. Your registered agent will give you a specific checklist, but you can expect to need these core documents:

- Passport Copies: Clear, valid copies for every single shareholder and director.

- Proof of Residential Address: A recent utility bill or bank statement (usually dated within the last three months) for each shareholder.

- A Brief Business Plan: This doesn't have to be a novel—just a straightforward outline of your planned international business activities.

- Shareholder Résumé (CV): A quick summary of each shareholder's professional background.

After you've picked a company name, it's helpful to understand the general process of registering business names as you move forward. With all your documents in hand, your agent will submit the application to the offshore authority. This is where having an expert in your corner really pays off; they make sure every form is filled out correctly and is fully compliant, which can seriously speed up the approval.

Once approved, you'll receive the official documents—the certificate of incorporation and the memorandum and articles of association—that bring your company legally into existence.

Securing Your Corporate Bank Account

This is often seen as the trickiest part of the whole setup, but with the right preparation, it’s completely doable. Banks in the UAE have a strong reputation and follow strict international compliance rules, which means they perform very thorough due diligence on every application.

The secret to a successful bank account application is simple: you have to demonstrate legitimacy and substance. Banks need to see a clear, lawful reason for your business, transparent ownership, and a solid plan for your international activities.

To get the green light, you'll need to provide clear documentation proving the economic substance of your Dubai offshore company. Banks will want to review your business plan, get details on your clients, and see evidence of your professional history. As specialists, we guide clients through this process all the time, making sure they tick every box. You can get more details in our guide on how to open an offshore company and bank account.

Partner with Experts for a Seamless Offshore Setup

Setting up a Dubai offshore company isn't just a simple registration. It’s a maze of critical decisions, from picking the right jurisdiction to making sure you’re fully compliant and, crucially, getting a corporate bank account approved. Getting it right requires a deep understanding of the local landscape.

This is where having the right partner can make or break your launch. A smooth start versus months of frustrating delays often comes down to the expertise of the team guiding you.

At PRO Deskk, we live and breathe this stuff. We've walked countless international entrepreneurs through this exact process. We know your goals aren’t off-the-shelf, so we don't offer cookie-cutter solutions. Instead, we provide practical, cost-effective business setup solutions that are built around what you actually need to achieve.

Our experience covers the full spectrum of UAE business structures. We are:

✅ Specialists in Mainland Company Formation in Dubai, Sharjah & Abu Dhabi

✅ Specialists in Freezone Company Formation across the UAE

✅ Specialists in Golden Visa on Property and Investor Visa

✅ Specialists in Corporate PRO Services and Attestation Services

We're More Than Just Your Setup Agent

Getting your company registered is just the beginning. We see ourselves as your long-term support system, here to help you succeed in the region for years to come.

Here’s what sets us apart:

✅ 24/7 Support Service – Always here when you need us

✅ Cost-Effective Business Setup Solutions tailored to your needs

✅ Enjoy UAE Tax Benefits for International Entrepreneurs

Choosing a partner for your offshore setup is about more than just paperwork. It’s about building a foundation for your global business strategy with a team that understands the nuances of UAE law and international finance.

Let us put our experience to work for you. By working with seasoned business setup consultants in Dubai, you can sidestep the common mistakes and keep your focus where it belongs—on growing your business.

We’re here to make sure you can enjoy the full UAE tax benefits for international entrepreneurs.

📞 Call Us Now: +971-54-4710034

💬 WhatsApp Us Today for a Free Consultation

Frequently Asked Questions

Setting up an international business structure always brings up a few questions. To help clear up any final uncertainties, here are some straightforward answers to the most common queries we get about Dubai offshore companies.

Can My Offshore Company Do Business Inside The UAE?

In short, no. A Dubai offshore company is built specifically for international activities and is legally not allowed to trade directly within the UAE mainland or its free zones. This is one of the core distinctions between an offshore setup and a mainland or free zone company.

However, there's a clever workaround. Your offshore company can hold shares in other UAE-based companies that operate locally. For example, your RAK ICC or JAFZA entity could be the legal owner of a Dubai mainland LLC, giving you a smart way to structure your local investments while keeping your offshore operations strictly separate and international.

What Are The Yearly Renewal Requirements?

Keeping your offshore company in good standing is simpler than you might think. The annual compliance is far less demanding than for other company types in the UAE, making it quite easy to manage.

Essentially, your yearly obligations boil down to a few key things:

- Registered Agent Fees: You need to maintain a registered agent, and their professional fees are paid annually.

- Registered Office Fees: The official address your agent provides also has an annual renewal fee.

- Proper Record-Keeping: You’re required to maintain accurate accounting records for your business activities.

A formal audit isn't always mandatory, but it can depend on the jurisdiction (JAFZA has different rules than RAK ICC) and what your company does. We can give you tailored advice on the exact requirements for your specific setup.

How Hard Is It To Open A Corporate Bank Account?

Opening a corporate bank account is a crucial step, and while it's not a walk in the park, it's a very manageable process with the right guidance. UAE banks have a strong global reputation and follow strict international due diligence and Know Your Customer (KYC) rules, so they will scrutinise your application carefully.

The secret to a successful application is proving your business is legitimate and has substance. You'll need a well-prepared file with a clear business plan, verifiable proof of your source of funds, and a solid explanation of your international activities.

We've helped countless clients navigate this process. Our experience means we know exactly what banks are looking for and can help you prepare a comprehensive application that ticks all their boxes, ensuring a smooth and successful outcome.

Does An Offshore Company Grant Me A UAE Residence Visa?

No, a Dubai offshore company does not provide a route to a UAE residence visa. Since it's designed as a non-resident entity for international business, it can't sponsor visas for its owners or employees. Its purpose is purely corporate and financial.

If getting a UAE residency visa is a key objective for you, we can point you to much better options. Setting up a free zone company, for instance, is an excellent alternative that offers 100% foreign ownership and makes you eligible for investor and employee visas. As specialists in Golden Visa on Property and Investor Visa services, we can help you find the perfect structure that aligns with both your business ambitions and personal goals.

At PRO Deskk, we take the complexity out of setting up your business, whether it's an offshore structure, a free zone company, or a mainland firm. Our team delivers cost-effective, tailored solutions backed by 24/7 support so you can focus on your global growth. To learn more and get started, explore our services at https://prodesk.ae.