Securing a business license in the UAE is the very first, non-negotiable step to getting your venture off the ground. Think of it as the official green light from the government, your permission slip to operate legally. This one document is the key that unlocks everything else, from opening a corporate bank account and hiring staff to actually doing business with clients.

Your First Step in the UAE Business World

The idea of starting a business in the United Arab Emirates is thrilling, brimming with potential. But before you can jump into operations, you have to get the right business license. It's truly the passport for your company; without it, you can't legally trade, rent an office, or even get visas for your team. It is the cornerstone of your entire enterprise here.

This license is much more than a piece of paper—it’s a testament to your company's legitimacy and commitment to following local laws. Getting and renewing a valid trade license is a mandatory legal requirement for every business. It's fundamental for day-to-day operations, including things you might take for granted like visa processing, leasing an office, and handling financial transactions. You can find more details about what it takes when scaling a business in Dubai to see just how critical it is.

Core Jurisdictions: Mainland, Free Zone, and Offshore

One of the first big decisions you'll face is choosing where to set up your business—your jurisdiction. This choice will define who you can do business with, what your ownership structure looks like, and how you can operate. The UAE offers three main options, each tailored for different business goals.

Getting a handle on these jurisdictions is crucial because it helps align your business structure with your long-term ambitions.

- Mainland: This is your ticket to trade directly with the local UAE market, with no restrictions. It's the perfect setup for businesses that need a physical presence across the Emirates, like a retail shop, a local consulting firm, or a restaurant.

- Free Zone: Think of these as special economic zones with powerful incentives, like 100% foreign ownership and zero corporate tax. They are ideal for companies focused on international trade or those operating in specific industries like tech, media, or commodities.

- Offshore: An offshore company is a bit different. It’s a legal entity registered in the UAE, but it isn’t allowed to do business within the country. Its main purpose is for things like international asset management, holding property, and managing investments.

Choosing the right jurisdiction is the most strategic decision you will make. It directly influences your company's ability to trade, its ownership structure, and its tax obligations, setting the entire foundation for your future success in the region.

To give you a clearer picture, I've put together a quick comparison table. This should help you start thinking about which path makes the most sense for your new venture.

UAE Business Jurisdictions at a Glance

| Feature | Mainland | Free Zone | Offshore |

|---|---|---|---|

| Ownership | Up to 100% foreign ownership | 100% foreign ownership | 100% foreign ownership |

| Market Access | Unrestricted access to the entire UAE market | Can trade internationally and within its designated Free Zone | Cannot trade within the UAE market |

| Office Space | Physical office space is often mandatory | Offers flexible options including virtual offices | No physical office requirement in the UAE |

| Visa Eligibility | High eligibility for employee and investor visas | Visa eligibility based on office size and business type | No visa eligibility |

As you can see, each option has distinct advantages. Your final decision will really depend on the nature of your business and your strategic goals. A local service provider needs Mainland access, while an international trading company might thrive in a Free Zone.

Choosing Your Jurisdiction: Mainland vs. Free Zone

One of the very first, and most critical, decisions you'll face when setting up your business in the UAE is where to register it. This isn't just about a physical address; it's a choice between two distinct operating environments: Mainland and Free Zone.

Getting this right from day one is essential. Your choice will directly impact who you can trade with, your ownership structure, and the regulations you'll need to follow for years to come.

Think of it this way: a Mainland company is like opening a high-street shop with its doors wide open to the entire country. You have total freedom to trade with any customer or business across all seven emirates, without restriction. This is the go-to option if your business plan involves serving the local UAE market, bidding on government projects, or setting up a physical spot like a restaurant or clinic.

On the other hand, a Free Zone company is more like a specialised global trade hub. It comes packed with incredible perks like 100% foreign ownership and major tax advantages, but its ability to trade directly within the UAE mainland is limited. Companies here are usually focused on international trade, making free zones perfect for import/export businesses, global consulting firms, and tech startups targeting a worldwide audience.

The Mainland Advantage: Unrestricted Market Access

When you choose a Mainland business license in Dubai, Sharjah, or Abu Dhabi, you're registering your company directly with that emirate's Department of Economic Development (DED). This is your ticket to operate anywhere in the UAE, completely unhindered.

This direct market access is the single biggest reason entrepreneurs opt for a Mainland setup. You can open offices or branches wherever you see an opportunity, compete for lucrative government tenders, and sell directly to the local population. For many businesses—especially in retail, professional services, and construction—this isn't just a nice-to-have; it's a must.

What's more, recent government reforms have made Mainland setups even more appealing. Most business activities now allow for 100% foreign ownership, getting rid of the old requirement for a local Emirati sponsor. This has been a game-changer, opening up the vibrant local economy to international investors like never before.

A Mainland license is your key to the entire UAE domestic market. It provides the ultimate flexibility for growth, expansion, and direct engagement with local customers and government entities, making it the premier choice for businesses focused on national operations.

The Power of Free Zones: A Global Business Hub

The UAE is home to over 45 specialised Free Zones, each one a self-contained ecosystem designed to boost specific industries like technology, media, finance, and logistics. These zones are governed by their own independent authorities and roll out the red carpet for foreign investors with a suite of attractive benefits.

The biggest draws of a Free Zone company formation are clear:

- 100% Foreign Ownership: You maintain complete control of your business without needing a local partner.

- Tax Exemptions: Most Free Zones offer exemptions from both corporate and personal income taxes.

- Repatriation of Profits: You can send 100% of your capital and profits back to your home country, no questions asked.

- Streamlined Setup: The registration process is generally faster and involves less paperwork than a Mainland setup.

These advantages make Free Zones incredibly popular. To give you an idea, the Dubai International Financial Centre (DIFC) saw a huge 25% year-on-year jump in licensed companies in 2023, as reported by the Dubai Financial Services Authority (DFSA).

While Free Zone companies can't trade directly on the Mainland, they can appoint a local distributor or agent to get their products to market. This structure works perfectly for businesses that don't need a direct physical presence across the UAE. For a deeper look at the specific zones and what they offer, our guide on Dubai free zone company formation is a great place to start.

Making the Right Choice for Your Business

So, how do you decide? It all boils down to your business model and your vision for the future. Start by asking yourself a few key questions:

- Who are my main customers? If they are inside the UAE, a Mainland license is probably your best bet. If they're international, a Free Zone has some serious perks.

- What does my business actually do? Retail shops, restaurants, and local service providers thrive on the Mainland. E-commerce, global trade, and media production are a natural fit for Free Zones.

- Do I need a physical office or multiple branches across the Emirates? Mainland gives you the freedom to set up anywhere. In a Free Zone, you're generally required to operate within that zone's boundaries.

- What's my budget? Costs can differ quite a bit. Free Zones often seem cheaper upfront with their flexible office solutions, but for certain business types, a Mainland license is a better long-term investment.

By thinking through these points, you can align your jurisdiction with your strategy, ensuring your business license in UAE is the perfect foundation for success.

Decoding the Types of UAE Business Licenses

Once you've zeroed in on your ideal jurisdiction—whether it's the sprawling Mainland or a niche Free Zone—the next big step is picking the right business license in UAE. This is more than just paperwork; your license is the legal foundation of your company, spelling out exactly what you're allowed to do. Getting this right from the start means you'll operate legally and sidestep any expensive headaches later on.

Think of it like choosing the right tool for a job. You wouldn't bring a hammer to fix a leaky pipe, and you certainly wouldn't use a manufacturing license to run a marketing agency. The UAE government neatly categorises licenses based on business activities to keep things clear and regulated for everyone involved.

This organised approach is a big reason why the UAE's business environment is so strong. As of 2025, there are over 1.5 million active trade licenses across the emirates, a number that really speaks to the country's diverse and booming economy. You can dive deeper into the data on the UAE's global business standing to see just how much the landscape is growing.

The Commercial License for Traders

First up is the Commercial License. This is probably the most common one you'll come across and it’s built for any business that buys and sells goods. It’s a wide umbrella, covering everything from general trading and import/export to your local retail shop. If your business is all about moving physical products, this is your license.

- Who needs it? E-commerce businesses, retail stores, real estate agencies, and general trading companies.

- Example: Imagine you're launching an online store selling electronics to customers in the UAE and beyond. You'd need a Commercial License. This permit is your green light to legally import products, hold stock, and sell your goods both online and in a physical shop.

The Professional License for Service Providers

Next, we have the Professional License. This one is specifically for individuals and companies whose business is built on expertise and specialised services. It’s for the consultants, artisans, and professionals who trade in skill and knowledge, not physical items. It's the go-to option for service-based businesses in Dubai, Abu Dhabi, and Sharjah.

One of the major draws of this license, especially on the Mainland, is that it often allows for 100% foreign ownership—a perk that existed even before recent reforms made it more common. This makes it a really appealing choice for international consultants and service firms wanting to set up shop here.

- Who needs it? Marketing agencies, IT consultants, law firms, private tutors, and doctors' clinics.

- Example: A group of seasoned software engineers wanting to start their own IT consultancy would get a Professional License. This allows them to offer services like building custom software, advising on cybersecurity, and managing IT systems for other companies.

Choosing your license type is about more than just staying compliant—it’s about defining your business's identity. The activity you select dictates your legal structure, visa eligibility, and even the office space you require, making it a foundational decision for your company.

The Industrial License for Manufacturers

Finally, there’s the Industrial License, which is essential for any business involved in manufacturing, production, or industrial processing. If you're taking raw materials and turning them into finished goods, this is the license for you. Getting one means getting approvals not just from the economic department, but usually from other authorities like the Ministry of Economy and civil defence to meet safety and quality standards.

Setting up an industrial operation is a bit more involved. It requires a physical factory or workshop and you’ll have to follow strict environmental and zoning rules.

- Who needs it? Furniture makers, food processing plants, metal fabricators, and clothing manufacturers.

- Example: A company planning to open a facility to manufacture and assemble furniture would require an Industrial License. This permit would give them the authority to import raw wood, operate heavy machinery, and produce finished furniture for sale.

By getting a handle on these three core categories, you can correctly classify your business and secure the right business license in UAE. It’s the first step to building your venture on solid ground.

The Step-by-Step Business Licence Application Process

So, you’ve picked the perfect jurisdiction and the right licence type. What's next? Getting down to the application itself. While the exact steps might differ slightly between a Mainland setup in Dubai and a Free Zone in Sharjah, the core journey to getting your business licence in UAE follows a pretty clear path. Think of it as a roadmap with specific milestones you need to hit along the way.

Getting through these stages smoothly is all about careful preparation and paying close attention to the details. Each step builds on the last, so tackling them in the right order is key to avoiding delays and making sure you’ve ticked all the legal boxes.

Stage 1: Initial Approvals and Name Reservation

The first real step on the ground is choosing a trade name for your business. This isn't just about branding; your name has to follow the UAE's naming rules and get the nod from the relevant authority. That could be a Department of Economic Development (DED) for the Mainland or a specific Free Zone authority. The name needs to be unique and can't go against public morals.

At the same time, you'll apply for your Initial Approval. This is basically a preliminary thumbs-up from the authorities, signalling they have no objection to you setting up the business. It's a critical green light that lets you move forward with things like drafting legal documents and leasing an office.

Stage 2: Legal Documentation and Office Space

With your Initial Approval secured, it’s time to make your company's legal structure official. This means drafting and signing some key documents. For most companies, this involves creating a Memorandum of Association (MOA). If you have a local partner or agent, a Local Service Agent (LSA) agreement might also be needed.

The MOA is a foundational document that spells out:

- The business's goals and activities.

- Who the shareholders are and their share capital.

- The management structure of the company.

This document usually needs to be notarised by a public notary in the UAE. After that, you have to lock down a physical address for your business. For Mainland companies, this means leasing an office and registering the tenancy contract with Ejari. Free Zones are a bit more flexible, offering options like flexi-desks or even virtual offices that meet the requirement.

Stage 3: Final Submission and External Approvals

Once you've gathered all your paperwork—your signed MOA, tenancy contract, and passport copies for all shareholders—you're ready for the final submission. This whole package goes back to the same authority that gave you the Initial Approval. They'll do one last check to make sure everything is in order.

Now, for some business activities, you might also need approvals from specific government ministries or regulatory bodies. For instance:

- A medical clinic needs a green light from the Ministry of Health and Prevention (MOHAP).

- An engineering firm will need approval from the local municipality.

- A food trading business has to get permissions from the food safety department.

These external approvals are non-negotiable for specialised industries. If you don't get them, your application will grind to a halt. This is where working with a corporate PRO service can be a huge help, as they already know the people and the precise requirements. Our in-depth guide on how to start a business in the UAE dives deeper into handling these regulatory hurdles.

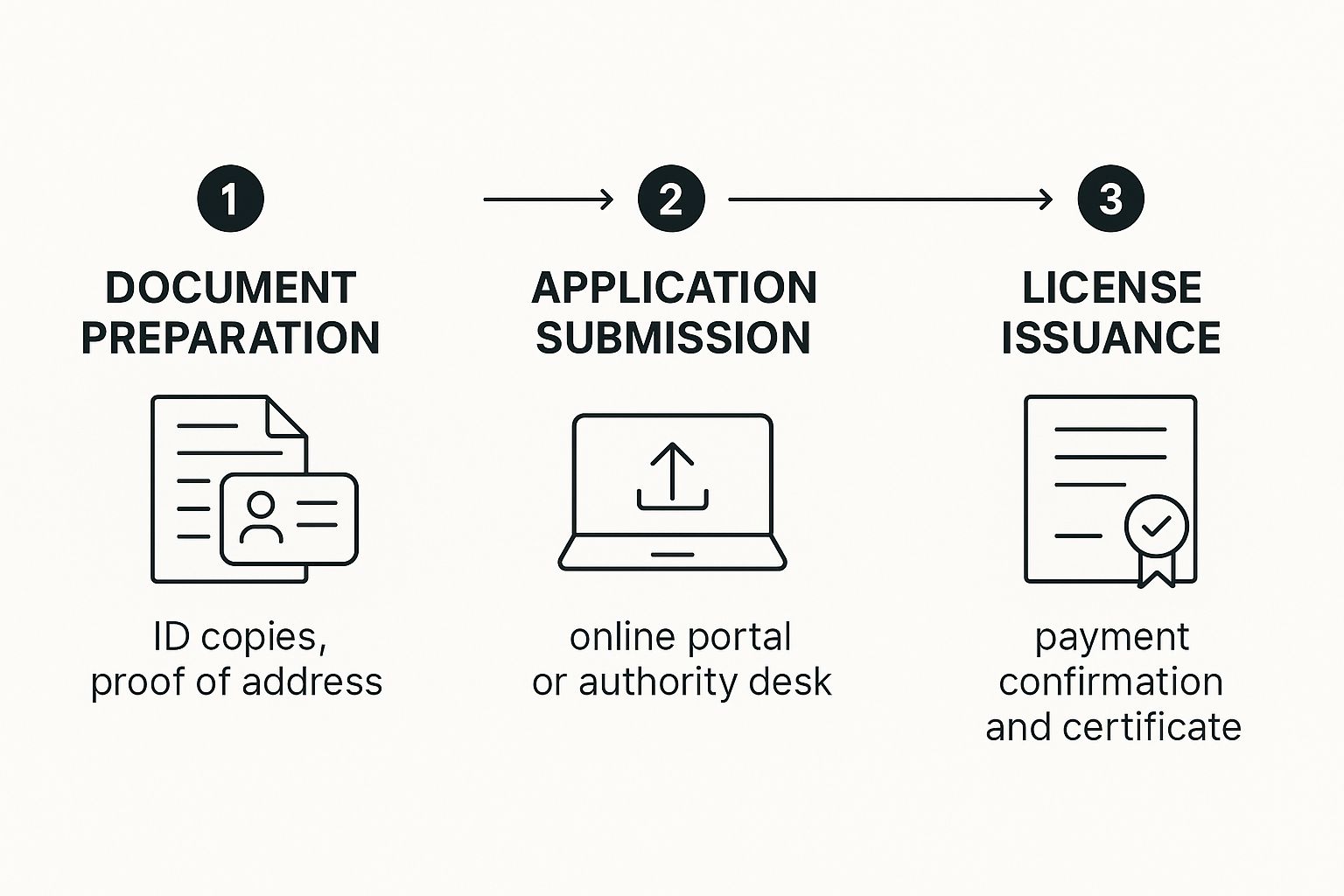

This infographic breaks down the main application workflow into three simple stages.

As you can see, the process is logical, moving from preparation and paperwork to the final submission and issuance. It really shows why a structured approach is so important.

Stage 4: Licence Issuance

Once all your documents have been verified and any external approvals are in the bag, the authority will send you a payment voucher for your licence fees. As soon as you've paid, your business licence in UAE will be issued, usually within a few business days.

With that trade licence in your hands, you are officially a legally registered company in the UAE. You can finally get on with opening a corporate bank account, processing visas for yourself and your team, and getting your business up and running.

To give you a head start, we've put together a checklist of the most common documents you'll need for the application. Getting these organised early will make the whole process a lot smoother.

Document Checklist for UAE Business Licence Application

| Document | Mainland Requirement | Free Zone Requirement |

|---|---|---|

| Passport Copies | Required for all shareholders and managers. | Required for all shareholders and managers. |

| Visa Copies | Required for resident shareholders/managers. | Required for resident shareholders/managers. |

| Trade Name Options | 3-5 name options for reservation. | 3-5 name options for reservation. |

| Initial Approval Form | A completed application form is needed. | A completed application form is needed. |

| MOA/LSA | Notarised Memorandum of Association is mandatory. | MOA or similar incorporation documents required. |

| Tenancy Contract (Ejari) | A registered physical office lease is essential. | Varies; physical office, flexi-desk, or virtual office. |

| External Approvals | Required for certain regulated activities. | Required for certain regulated activities. |

Having these documents ready to go before you even start the formal application will save you a ton of time and potential headaches down the line.

Understanding the Costs and Timelines

When you’re launching a new business, getting a firm grip on your budget and timeline is everything. Securing your business license in UAE is no different; you need a clear financial roadmap to manage your funds and set the right expectations for the journey.

The total investment can swing quite a bit. It’s a bit like buying a car—a standard saloon has a very different price tag than a top-of-the-line SUV. In the same way, your license cost will hinge on your jurisdiction (Mainland vs. Free Zone), how complex your business activity is, and which emirate you’re setting up in, whether it’s Dubai, Sharjah, or Abu Dhabi.

Breaking Down the Key Costs

A few core fees make up the final bill for your business license. While the exact figures will change depending on your setup, you should definitely plan for these key items to avoid any nasty surprises down the road.

- Trade Name Reservation: This is the fee you pay to lock in your unique business name with the relevant economic department.

- Initial Approval: A charge for the authorities to give your application the once-over and issue a preliminary no-objection certificate.

- License Issuance Fee: This is the main government fee for the license itself and often makes up the biggest chunk of the cost.

- Office Rent: Mainland setups almost always require a physical office with an Ejari (tenancy contract). Free Zones, on the other hand, offer more flexible and budget-friendly options like virtual desks.

- Corporate PRO Services: These are the fees for a professional government liaison who handles all the paperwork, attestations, and submissions. It saves a ton of time and helps you sidestep common errors.

The final cost of a UAE business license is not a single figure but a sum of multiple components. A cost-effective business setup solution involves carefully selecting the right jurisdiction and license type to align with your budget and operational needs, ensuring you only pay for what is essential for your growth.

Realistic Timelines for Your Setup

Just as costs vary, so do timelines. How quickly you get your license in hand really depends on the jurisdiction and the type of business you’re running.

A straightforward Free Zone company formation can be incredibly fast, often wrapped up in just a few business days. This speed is a massive plus for entrepreneurs who are keen to get the ball rolling.

In contrast, a Mainland company, especially if it involves specialised activities that need extra approvals from different ministries, could take several weeks. The key to keeping things moving is to have all your documents prepared perfectly and respond to any questions from the authorities right away. For a more detailed financial breakdown, you can explore the typical cost of starting a business in Dubai in our comprehensive guide.

Managing Expectations for a Smooth Launch

At the end of the day, a successful launch comes down to being prepared and knowing what to expect. By understanding the potential costs and realistic timelines right from the start, you can get your finances in order and set a practical launch date.

The most reliable way to navigate this process is by partnering with specialists who can give you a tailored, cost-effective quote based on your specific needs—whether that’s in Mainland Dubai, Sharjah, a Free Zone, or Abu Dhabi. This turns a potentially complex journey into a clear, manageable project, setting you up for success in the UAE.

Why Choose Us for Your UAE Business Setup?

Getting your business license in UAE is a massive achievement, but it's really the starting line, not the finish. To truly succeed in the UAE's fast-paced market, you need a reliable partner to navigate the journey. We are that partner. Our expertise is built on helping entrepreneurs like you launch and grow their ventures with confidence.

Our Specialised Services

- ✅ Mainland Company Formation: We are specialists in setting up your business in Dubai, Sharjah & Abu Dhabi, giving you unrestricted access to the local market.

- ✅ Freezone Company Formation: Our team navigates the complexities of over 45 free zones across the UAE to find the perfect fit for your international business.

- ✅ Visa Solutions: We are experts in securing the Golden Visa on Property and the Investor Visa, providing a stable foundation for you and your family.

- ✅ Corporate PRO and Attestation: We handle all government liaisons, from Corporate PRO Services to essential Attestation Services, ensuring full compliance.

The PRO Deskk Advantage

- ✅ 24/7 Support Service: We are always here when you need us, providing round-the-clock assistance to answer your questions and resolve issues promptly.

- ✅ Cost-Effective Solutions: We deliver tailored Business Setup Solutions designed to fit your specific needs and budget, with no hidden fees.

- ✅ Maximize Tax Benefits: We help international entrepreneurs leverage the UAE's favourable financial environment so you can enjoy UAE Tax Benefits and grow your capital.

By leaning on our specialised, cost-effective support, you can hand off the administrative headaches. This frees you up to pour your energy where it truly counts—growing your business and seizing every opportunity the market offers. You can explore some proven strategies for small business growth to build momentum from day one.

Frequently Asked Questions

Thinking about getting a business license in the UAE can bring up a lot of questions, especially if you’re doing this for the first time. We’ve answered some of the most common queries below to give you a bit more clarity and help you move forward.

Can I Get a UAE Business License Without a Physical Office?

Yes, in many cases you can, especially if you set up in a Free Zone. Most free zones offer affordable flexi-desk or virtual office solutions. These packages tick the box for having a registered business address and are a great starting point for consultants and startups.

For most Mainland companies, though, a physical office with a registered tenancy contract (known as an Ejari) is usually a must. There are some exceptions for certain professional activities, so it’s always best to check the specific rules for the jurisdiction and business activity you’ve chosen.

How Long Does It Take to Get a Business License in the UAE?

The timeline really depends on your specific setup. A straightforward Free Zone company can be set up surprisingly fast—often in just a few working days, assuming all your paperwork is in order.

A Mainland company, on the other hand, can take a bit longer, usually somewhere between two to four weeks. If your business needs special approvals from government bodies like the Ministry of Health or the local municipality, the process can take longer. The biggest factors are how prepared your documents are, how complex your business is, and where you decide to set up.

The speed of your license issuance is directly tied to preparation. Having every document correctly prepared and anticipating the need for external approvals is the fastest way to streamline the process, whether in a Mainland or Free Zone jurisdiction.

Do I Need a Local Sponsor for My Business in the UAE?

This is a big one. For almost all business activities on the Mainland, the old requirement for a local Emirati sponsor is no longer in place. 100% foreign ownership is now the standard for most commercial and professional licenses, which has been a major game-changer for international entrepreneurs.

A few strategic or highly regulated sectors might still require a local partner, but they are the exception. In contrast, one of the main draws of setting up in any UAE Free Zone is that 100% foreign ownership is guaranteed, so you’ll never need a local sponsor there.

What Is the Difference Between a Trade Name and a Legal Name?

Think of it this way: your trade name is what your customers know you as—for example, "Creative Digital Solutions." It's your brand.

Your legal name is the official name registered with the government, and it has to include a suffix that shows its legal structure, like "Creative Digital Solutions FZ-LLC." Before you can use a trade name, it has to be approved by the relevant economic department to make sure it’s unique and doesn't conflict with any existing businesses.

Figuring out these details is a lot easier with an expert by your side. Our team is here to provide cost-effective, practical solutions and 24/7 support to make sure your business setup goes smoothly.

📞 Call Us Now: +971-54-4710034

💬 WhatsApp Us Today for a Free Consultation: https://prodesk.ae