If you've legally set up a company in Dubai, whether on the mainland or in a free zone, opening a corporate bank account isn't just a good idea—it's a mandatory next step. This account is more than just a place to hold your money; it’s the financial engine for your entire operation. It keeps your personal and business finances separate and builds your company's credibility in the UAE’s fast-paced market.

Decoding Dubai's Corporate Banking Scene

Getting a business bank account in Dubai isn't a simple box-ticking exercise like it might be elsewhere. It's a major milestone, and you need to understand the local banking landscape to navigate it successfully. UAE banks take their due diligence seriously, largely because of the country's strict commitment to global anti-money laundering (AML) and Know Your Customer (KYC) regulations.

This means every single application is put under the microscope. For you, the entrepreneur, this just means you need to be thoroughly prepared. The type of business you have—be it a mainland LLC or a free zone entity—will directly shape the kind of paperwork and information you'll need to hand over.

Why Due diligence is So Strict

At the end of the day, banks in Dubai are looking for real, sustainable businesses with a clear plan and a genuine presence in the UAE. They need assurance that you’re building a legitimate enterprise, not just a paper company. This is precisely why a solid business plan and proof of a physical office are so critical to your application. To see just how sophisticated this process has become, it's interesting to note how banks are now using tools like AI in financial risk assessment to vet potential clients.

This whole process is a crucial piece of the much larger puzzle of setting up your company. For a complete picture, it’s worth reading our comprehensive guide on how to start a business in the UAE.

The Key Players in UAE Banking

Dubai’s banking sector has something for everyone, from large corporations to brand-new startups. The main players fall into a few categories:

- Large Conventional Banks: Think global and local powerhouses like Emirates NBD and FAB. They're a great fit for established companies managing high transaction volumes.

- SME-Focused Banks: Banks like Mashreq and RAKBANK have built their reputation on catering to startups and SMEs, often with more approachable requirements.

- Digital Banks: A new wave of digital-first banks is shaking things up, offering slick, tech-focused solutions that appeal to modern businesses.

There's no denying the sector is booming. The Central Bank of the UAE reported that corporate deposits hit around AED 1,046 billion in early 2025. That’s a huge leap from AED 606 billion just a few years back, which really speaks to the health of the business ecosystem here. This vibrant environment makes choosing the right banking partner one of the most important decisions you'll make.

Your Essential Document Checklist for Approval

When it comes to opening a business bank account in Dubai, preparation isn't just important—it's everything. Banks here work under incredibly strict compliance rules. Any missing or incorrect document can send your application right back to square one, leading to frustrating and expensive delays.

Think of it like building a case for your business. You aren’t just handing over papers; you're proving your company is legitimate, showing its structure, and demonstrating the credibility of everyone involved. A complete, organised file tells the bank you're a serious professional.

So many entrepreneurs underestimate this part of the process and pay the price later. By getting every single document in order upfront, you’ll not only make a great first impression but also seriously speed up the whole approval timeline.

Core Company Documents The Bank Will Scrutinise

This first batch of documents is the legal backbone of your business. They are completely non-negotiable and prove your company is properly registered and allowed to operate in the UAE. Without these, a bank won't even look at your application.

- Valid Trade Licence: This is your company's proof of life. It must be current and clearly list all your business activities. The bank will check these activities against your business plan to make sure everything lines up.

- Certificate of Registration: Issued by your licensing authority (like the Department of Economy and Tourism for mainland or a free zone authority), this certificate officially confirms your company's legal existence.

- Memorandum of Association (MOA) and Articles of Association (AOA): These are critical. They spell out your company's ownership structure, shareholding details, and internal rules. The bank needs a complete, stamped copy to understand who owns and controls the business.

These foundational papers are just the starting point. From here, the bank's compliance team will turn its attention to the people behind the company.

Personal Documentation for All Shareholders

Next up, the bank will do its due diligence on every single shareholder and signatory. Their goal is to verify the identity and residency status of all key individuals, which is a core part of the UAE's strict KYC (Know Your Customer) regulations.

For each shareholder, partner, and authorised signatory, you'll need to have these ready:

- Passport Copy: A crystal-clear, high-quality copy of every individual's passport is mandatory. Make sure it's valid for at least another six months.

- UAE Residence Visa Page Copy: For any partner living in the UAE, a copy of their residence visa is required. This is a key factor for banks as it proves their legal status in the country.

- Emirates ID Copy: You'll need a copy of both the front and back of the Emirates ID for all UAE-resident shareholders.

If you have shareholders who aren't UAE residents, the requirements can be a bit different. They might need to provide extra proof of address from back home and maybe even a reference letter from their personal bank. It’s also worth remembering that the visa status of your shareholders impacts more than just banking; you can learn more about the requirements for an investor visa in the UAE.

Key Takeaway: Banks look much more favourably on companies with resident partners. Having at least one signatory with a valid UAE residence visa and Emirates ID dramatically strengthens your application and boosts your chances of a quick approval.

Supporting Documents That Build Your Case

Finally, you’ll need a set of supporting documents that give the bank the full story of your business operations and financial health. These items help compliance officers get a handle on your business model, where you operate from, and your company's viability.

Be ready to present the following:

- A Detailed Business Plan: This needs to outline your business activities, who you sell to, your revenue projections, and key suppliers or clients.

- Proof of Business Address: This is usually your Ejari (tenancy contract) for your office space or a recent utility bill, like one from DEWA.

- Shareholder Résumés (CVs): A brief CV for each shareholder gives the bank a sense of their professional background and industry experience.

- Board Resolution: This is a formal, signed document from the board of directors that gives official permission to open the business bank account in Dubai and names who is authorised to sign on its behalf.

Finding the Right Bank for Your Business

Choosing a bank in Dubai isn’t just about finding a place to park your company’s cash. Think of it as selecting a long-term financial partner, one that genuinely understands where your business is headed.

The right choice for a massive trading corporation handling huge transaction volumes is almost never the best fit for a nimble tech startup or a boutique consultancy. The real trick is to match your company's specific needs—your industry, your transaction volume, your international ambitions—with the institution best equipped to handle them.

You’ll find everything from global banking giants to agile, SME-focused banks offering a much more personal touch. Each has its own culture, its own set of rules, and its own strengths. Taking the time to properly compare them is one of the most important decisions you'll make when setting up your business here.

Traditional Banking Giants

For well-established mainland companies or large-scale enterprises, the titans of UAE banking like Emirates NBD and First Abu Dhabi Bank (FAB) are often the go-to. They are built to handle complex financial operations, from high-volume trades to sophisticated international financing.

Their sheer size and global networks provide a deep sense of security and a massive product portfolio. These banks are ideal if your business requires:

- Advanced Trade Finance: Things like letters of credit and bank guarantees are standard services.

- Multi-Currency Accounts: They offer robust platforms for managing funds in different currencies, a must-have for any import/export business.

- Dedicated Relationship Managers: Larger clients usually get a dedicated manager who acts as a single point of contact to smooth out complex requests.

But there’s a catch. The barrier to entry can be quite high. They often demand a substantial minimum balance and their application process can feel a bit bureaucratic and slow. Their prime focus tends to be on established businesses with a solid track record.

SME-Focused and Challenger Banks

Thankfully, a number of banks have recognised the massive potential of the UAE's thriving startup and small business scene. Banks like RAKBANK and Mashreq have earned a strong reputation for being more accessible and in-tune with the needs of small and medium-sized enterprises.

These institutions usually offer a much more straightforward account opening process and tend to be more flexible with their requirements. For instance, in 2025, Emirates NBD offers accounts with minimum balances anywhere from AED 0 up to AED 3.5 million, catering to everyone. But for a new tech startup, Mashreq's NeoBiz platform, with its AED 25,000 minimum balance and fully online opening, is a game-changer.

RAKBANK is another favourite for startups and businesses wanting to keep costs low, offering accounts with no minimum balance for a monthly fee of around AED 99. You can explore more about UAE business bank account options on proservicesindubai.com.

Real-World Insight: We often see new mainland and free zone companies get up and running much faster with these SME-focused banks. Their quicker turnaround times and lower minimum balance requirements remove major hurdles, letting entrepreneurs focus on what really matters: building their business.

Specialised Banking Options

Beyond the usual suspects, Dubai’s financial sector offers specialised services that might be the perfect match for your company's ethics or operating style.

A prominent example is Islamic Banking. Institutions like Dubai Islamic Bank (DIB) and Abu Dhabi Islamic Bank (ADIB) operate under Sharia principles. This means they avoid interest-based transactions and instead use profit-sharing models. For businesses that need ethical or Sharia-compliant financing, these banks are the clear choice.

Another growing trend is the rise of Digital-First Banks. These players are all about a seamless online and mobile experience—perfect for tech-savvy founders who want to manage their finances on the move. Some, like Mashreq's NeoBiz, are the digital arms of larger banks, giving you the best of both worlds: modern innovation backed by the stability of a traditional institution.

Comparing Top Business Bank Accounts in Dubai

To help you get a clearer picture, it’s useful to see how some of the top banks stack up against each other. This table breaks down a few popular options based on what they typically ask for and who they're best suited for.

| Bank Name | Typical Minimum Balance | Best For | Key Features & Notes |

|---|---|---|---|

| Emirates NBD | Varies (AED 50,000 – AED 3.5M+) | Established Mainland Companies | Extensive branch network, strong trade finance, and comprehensive corporate services. |

| Mashreq Bank | AED 25,000+ (NeoBiz) | Tech Startups & Modern SMEs | Excellent digital platform (NeoBiz) with a fast, often fully online, application process. |

| RAKBANK | Can be as low as AED 0 | Startups & Low-Turnover Businesses | Known for low fees, no minimum balance options, and a business-friendly approach. |

| Dubai Islamic Bank | AED 25,000+ | Sharia-Compliant Businesses | Offers a full suite of Islamic banking products, from financing to everyday accounts. |

Ultimately, the goal is to find a bank that doesn't just hold your money, but actively supports your business's growth in the long run. Take the time to evaluate these options carefully based on your specific operational needs.

So, you've got your documents in a neat little pile and you've picked your bank. What now? Now the real fun begins. Getting your business bank account in Dubai up and running isn't a one-and-done deal; it's a multi-stage journey. Knowing what's coming will save you a lot of headaches and help you set realistic expectations.

Think of the initial application as your opening move. Whether you submit it online or walk into a branch, this is your first formal contact. Get this wrong, and you're already behind. A single missing document can, and almost certainly will, stall the entire process before it's even started.

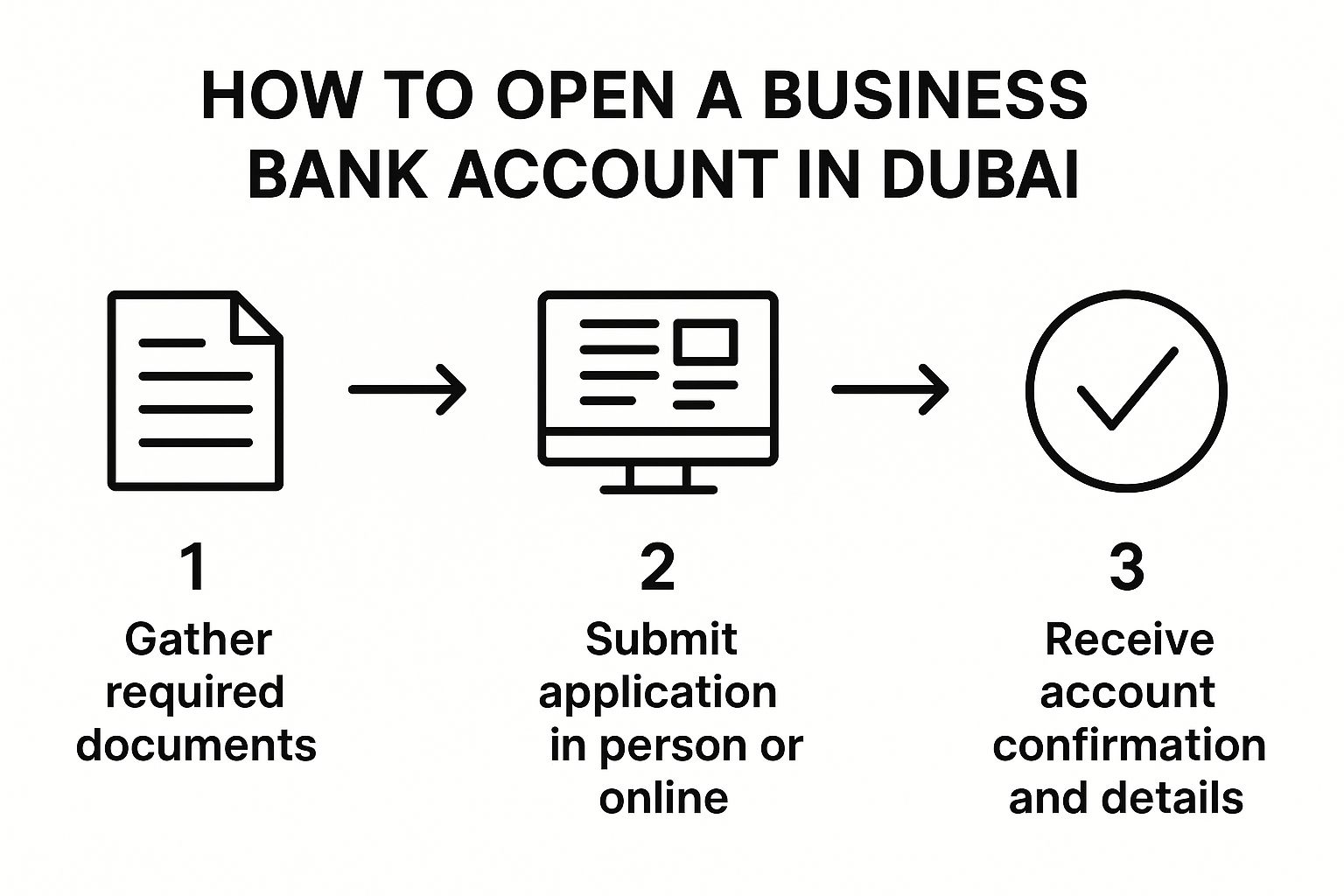

This infographic gives you a quick, visual breakdown of the main steps involved.

It lays out the path from gathering your paperwork and lodging the application to finally getting that all-important account activation notice.

The All-Important Face-to-Face Meeting

Don't be surprised when the bank asks for a meeting. Pretty much every bank in Dubai will want at least one account signatory to come in for a chat. This isn't just a box-ticking exercise; it's a fundamental part of their due diligence. The relationship manager wants to look you in the eye and get a genuine feel for your business.

You need to walk into that meeting ready to talk specifics. Be prepared to clearly and confidently cover:

- Your Business Model: What do you actually do? Ditch the corporate jargon. Explain your services or products in simple, direct terms.

- Your Funding: Where is the initial capital coming from? Be totally transparent, whether it's personal savings, money from investors, or a business loan. They've heard it all before, so just be straight with them.

- Your Financial Projections: They'll want to see realistic turnover estimates for your first year. Be ready to discuss who you'll be paying and who will be paying you. It helps them understand your transaction patterns.

This conversation is how the bank builds your company's risk profile. They're trying to see if you're running a legitimate, well-planned operation.

I always tell our clients to treat this meeting like a business pitch. You're not just opening an account; you're selling the bank on your company's credibility. Come prepared, be professional, and be transparent. Those are your best tools.

Surviving the Compliance Deep-Dive

Once the meeting is over, your application file lands on the desk of the compliance department. This is the most crucial, and often the most frustratingly long, part of the whole process. This is where the bank does its real homework, fulfilling its strict KYC (Know Your Customer) and AML (Anti-Money Laundering) duties.

The compliance team will go through every single piece of paper with a fine-tooth comb. They'll verify your trade licence, run background checks on shareholders, and assess the risk associated with your industry. It's totally normal for them to come back with more questions.

For example, if you're in a field they consider higher risk, like general trading, brace yourself for extra scrutiny. They might ask to see invoices from suppliers or even letters of intent from potential customers to back up your business plan. Your best strategy? Respond quickly and thoroughly.

This stage can take anywhere from a week to over a month. It really depends on the bank's internal workload and how complex your company structure is. Patience is a virtue here, but having a professional firm following up can make sure your application doesn't get lost in the shuffle.

The Final Stretch: Activation and Onboarding

Getting that email saying your account has been approved is a huge relief. The bank will send over your shiny new IBAN (International Bank Account Number) and other account details. This is the green light—you've officially passed their checks.

But hold on, you're not quite at the finish line. The last bit is getting the account fully active. This usually involves:

- Funding the Account: You'll need to make an initial deposit, which is often the minimum balance required to formally activate everything.

- Getting Your Tools: The bank will courier you a welcome kit. This typically has your corporate chequebook, debit card, and the little security token you'll need for online banking.

- Setting Up Online Access: The final step is registering for their online portal. This is where you'll manage transfers, check balances, and handle all your day-to-day payments.

Once that's all done, your business bank account in Dubai is live and ready for action. You can start sending out invoices with your new details and managing your finances like a pro. From start to finish, you should realistically budget for four to eight weeks. Make sure you factor that timeline into your overall business setup plan.

Insider Tips for a Faster Bank Approval

Getting a business bank account approved in Dubai can feel like a waiting game, but I've seen firsthand what works and what doesn't. There are absolutely ways to speed things up.

The most successful applications all have a few things in common: they're crystal clear, professional, and don't leave any room for doubt. Remember, banks are naturally cautious. Your job is to show them your company is a stable, legitimate, and transparent partner they can trust.

A huge signal of commitment is having a real, physical presence in the UAE. While a shared desk or a virtual office might tick the box for your trade licence, banks often see these setups as a red flag. A dedicated office space, backed by a proper Ejari (tenancy contract), proves you're invested in the local economy and helps squash any fears that you're just a "paper" company.

Articulating Your Business Vision

Your business plan isn't just a formality—it's your single most important sales pitch to the bank. A generic two-page summary simply won't cut it.

A solid business plan needs to clearly explain your company's value, who you're selling to, how you operate, and what your financial projections look like for the first 1 to 3 years. You need to be realistic here.

Try to see it from their perspective. The bank’s compliance team is trying to answer a few key questions:

- Source of Funds: Where is your initial capital coming from? You’ll need to be ready to show proof.

- Transaction Flow: Who will you be paying? Who will be paying you? Get specific. Naming key suppliers or potential clients adds a massive amount of credibility.

- Business Activities: Explain what your company actually does in simple, clear language. Ditch the industry jargon that might confuse the relationship manager.

Giving them this level of detail helps the bank build a proper risk profile and shows them you've actually thought through your strategy.

Professionalism and Transparency Are Key

That in-person meeting with the relationship manager? It's a critical moment. Treat it like you're pitching to a major investor.

Dress professionally, show up on time, and have all your original documents organised and ready to go. How you present yourself in this meeting says a lot about your professionalism and directly impacts their impression of you.

Expert Insight: Be completely upfront about your business. If you have a complicated ownership structure or unusual transaction models, explain them clearly and confidently. Trying to hide details or being vague is the quickest way to raise red flags during the compliance review.

Ultimately, getting through this process smoothly often comes down to having expert guidance. Our team simplifies the whole company formation and banking maze. We handle the details for Mainland, Freezone, and Golden Visa setups, backed by full PRO services and 24/7 support. We focus on cost-effective solutions to help international entrepreneurs make the most of the UAE's tax benefits and hit their business goals.

This hands-on approach, combined with a sharp understanding of how banks work and the rise of digital innovation in the banking sector, is what gets your application on the fast track for approval.

Common Questions About Dubai Business Banking

You've prepared the documents, shortlisted a few banks, and are ready to go. But a few nagging questions often pop up right at the finish line. That’s completely normal.

Getting clear, straightforward answers to these final queries can make all the difference. This is where years of hands-on experience comes in handy. Here are the most common questions we get from clients, answered directly.

Can I Open a Business Account Without a UAE Residence Visa?

Let's be direct: trying to open a business bank account in Dubai without a residence visa is a near-impossible task.

While you might hear stories of it happening in some rare, specific cases, the reality on the ground is very different. UAE banks are bound by strict Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. For their compliance teams, an application without local residency is a major red flag.

Almost every bank will insist that at least one signatory on the account holds a valid UAE residence visa and Emirates ID. It's their way of confirming you have a real, physical presence and commitment to the country. Our advice is always the same: have a key shareholder or manager secure their residency before you even start the bank application. It will save you a world of frustration.

What Are the Top Reasons for Application Rejection?

Bank rejections almost always come down to two things: clarity and compliance. If you know the common pitfalls, you can steer clear of them from the start.

Here’s what trips most people up:

- A Vague Business Plan: If the bank can’t quickly understand your business model and see solid financial projections, they’ll get nervous.

- Incomplete or Incorrect Paperwork: This is a big one. A single missing signature, an expired document, or a poorly scanned copy can bring everything to a halt.

- Unclear Source of Funds: You must be able to explain—and prove—exactly where your startup capital is coming from. Banks need a clear paper trail.

- High-Risk Business Activities: If your trade licence says "General Trading" but you can't specify your product lines, expect extra scrutiny. The same goes for businesses related to cryptocurrency.

- Failed Due Diligence: Banks run background checks on all shareholders. Any inconsistencies or red flags that pop up are an instant deal-breaker.

Sometimes, it's just a simple mismatch. A small startup applying to a top-tier corporate bank that deals with huge multinationals might not be seen as the right fit for them.

Our Experience Shows: Preparation is everything. A professionally drafted business plan, perfectly organised documents, and clear, honest communication with the bank manager can smooth over almost any potential issue before it becomes a real problem.

How Long Does It Realistically Take to Open the Account?

This is the million-dirham question, and the answer varies wildly. It all depends on your chosen bank, how complex your company structure is, and how well-prepared your application is.

In a perfect world, where every single document is in order and compliance has no questions, you could have an account open in two to four weeks.

But let’s talk reality. For most businesses, a more typical timeframe is four to eight weeks. This accounts for the inevitable back-and-forth as the bank’s compliance department does its work. Delays are part of the process, especially if they ask for more information or decide to dig deeper into your business activities.

What Is a Minimum Average Balance?

This is a key term to understand. The minimum average balance isn't about having a certain amount in your account every single day. Instead, it’s the average amount of money you need to keep in the account over a full month.

The bank calculates it by adding up your closing balance for each day of the month and then dividing that total by the number of days in that month.

If your monthly average dips below their required threshold, you'll be hit with a penalty fee. This can be anywhere from AED 150 to over AED 500, depending on the bank and your account package. Doing this repeatedly won't just cost you money; it can sour your relationship with the bank and could even lead to them closing your account.

Navigating the complexities of company formation and securing a business bank account in Dubai is what we do best. Our services include:

✅ Specialists in Mainland Company Formation in Dubai, Sharjah & Abu Dhabi

✅ Specialists in Freezone Company Formation across the UAE

✅ Specialists in Golden Visa on Property and Investor Visa

✅ Specialists in Corporate PRO Services and Attestation Services

✅ 24/7 Support Service – Always here when you need us

✅ Cost-Effective Business Setup Solutions tailored to your needs

✅ Enjoy UAE Tax Benefits for International Entrepreneurs

📞 Call Us Now: +971-54-4710034

💬 WhatsApp Us Today for a Free Consultation at https://prodesk.ae