Setting up your company in a Dubai free zone is a game-changer for international entrepreneurs. Think 100% foreign ownership, zero corporate tax, and a registration process that doesn't bog you down. It’s a secure, hyper-efficient launchpad for your global ambitions, letting you thrive in a seriously business-friendly environment.

Why a Dubai Free Zone Is Your Smartest Move

When you're looking at launching a business in Dubai, you're staring at a world of opportunity. For most global entrepreneurs I talk to, the smartest path forward is a Dubai free zone company formation. These aren't just business parks; they are specialised economic ecosystems built from the ground up to nurture growth, spark innovation, and boost international trade.

The real magic is the control and financial freedom you get. Unlike a mainland setup, which might force you into a local partnership, a free zone company is all yours. That kind of autonomy is priceless—it means you can execute your vision exactly as you see it, with no compromises.

The financial upside is just as compelling. We're talking about operating your business in a place that wants you to succeed, which means you get to reinvest more of your capital right back into growing your company.

To break it down, here’s a quick look at what setting up in a free zone really gets you and why it matters for your business.

Your Core Free Zone Advantages at a Glance

| Benefit | What It Means for Your Business |

|---|---|

| Complete Foreign Ownership | You have total control. Your business, your assets, and your profits belong to you and you alone. |

| Tax Efficiency | This is a big one. You operate within the UAE’s highly favourable tax structure, directly boosting your profitability. |

| Seamless Repatriation | You can freely transfer all of your capital and profits back to your home country. No red tape, no restrictions. |

| World-Class Infrastructure | From day one, you get access to state-of-the-art offices, modern warehouses, and rock-solid connectivity. |

These advantages aren't just line items on a brochure; they are foundational pillars that support real, sustainable growth for international businesses.

For many founders, this isn't just a financial decision. It’s about planting their flag in a stable, globally-connected hub that supports long-term ambition and cuts through the complexity of international operations.

A Hub for Modern Industries

Forget the old idea that free zones are just for import-export companies. They’ve completely transformed into dynamic centres for innovation. You just have to look at the numbers—over the last few years, more than 60% of new business licences issued in these zones were for cutting-edge sectors like e-commerce, fintech, and artificial intelligence. If you want to dig deeper, you can learn more about these new UAE free zone business setup rules and see just how much the landscape has evolved.

This specialisation is key. When you pick a free zone, you’re not just renting an office space. You're plugging into a community of forward-thinkers, potential partners, and future clients. Whether you’re building a tech startup or a boutique consultancy, there's a zone that speaks your language.

With our hands-on experience in both Freezone and Mainland company formation, we help you find that perfect fit without breaking the bank. Our specialists are on call 24/7 to make sure you get it right from the start.

Choosing the Right Free Zone for Your Business

With over 40 free zones in Dubai alone, picking the right one is easily the most important decision you'll make on your Dubai free zone company formation journey. This isn't just about ticking a box; it's a strategic move that can set the entire course for your business.

Think of each free zone as its own specialised hub, built from the ground up to support specific industries. Choosing poorly can lead to annoying operational roadblocks, unexpected costs, and a real lack of networking opportunities right when you need them most.

The goal is to perfectly match your business activity with a free zone that’s designed for it. This way, you’re not just getting an office space—you’re plugging directly into an ecosystem of potential clients, suppliers, and partners who speak your language.

Aligning Your Business Activity with Industry Focus

Your very first filter has to be your business activity. You can't, for example, set up a media production house in a logistics-focused free zone and expect a smooth ride. The authorities are quite strict about this alignment to keep each zone's specialisation and integrity intact.

A fintech startup, for instance, would be right at home in the Dubai International Financial Centre (DIFC). This zone operates under its own legal framework based on English common law, which is a huge advantage for financial services and innovative tech companies.

On the other hand, a growing e-commerce business would find a much better fit in a zone like Dubai CommerCity. This hub is tailor-made for digital commerce, offering things like integrated logistics and fulfilment services, all within a community of other online retailers.

Let’s take another example. A healthcare consultant or a new clinic would naturally look at Dubai Healthcare City (DHCC). DHCC offers world-class infrastructure and a regulatory environment specifically created for medical professionals, which makes compliance and reaching the right patient base much simpler.

Choosing the right free zone is like picking the right soil to plant a tree. The right environment provides the exact nutrients, support, and conditions needed for strong, sustainable growth. A mismatch can stifle potential before it even has a chance to flourish.

Key Factors to Analyse Beyond the Brochure

Once you've narrowed down your list of zones based on industry, it's time to look past the glossy brochures. A lot of entrepreneurs get fixated on the initial registration fees, but the real value—and the hidden costs—are buried in the details.

Here’s what you absolutely must look into:

- Geographic Location and Logistics: Does your business rely on shipping? A trading company would gain a massive edge by setting up in Jebel Ali Free Zone (JAFZA) because of its direct connection to one of the world's biggest seaports. Similarly, an air freight business should be looking at Dubai Airport Freezone (DAFZA).

- Infrastructure and Facilities: What physical resources do you actually need? This is more than just an office. Think about whether you need warehouses, specialised manufacturing units, reliable high-speed internet, or other specific utilities.

- Regulatory Environment: Every free zone plays by its own rulebook. Some, like DIFC, even have their own court system. You need to understand these regulations, especially when it comes to audits, reporting requirements, and what you’re permitted to do operationally.

- Visa Allocation Rules: This is a big one. The number of visas you can get is often tied to the size of your office. A simple flexi-desk might only get you one or two visas, whereas a proper office will unlock more. You need to plan for your team's future growth and make sure the zone can accommodate it.

- Total Cost of Ownership: Don't just look at the setup fee. Get the full picture by scrutinising annual renewal costs, visa fees, and any other "hidden" charges for essential services. The cheapest option upfront isn't always the most cost-effective in the long run.

Real-World Scenarios in Zone Selection

To see how this all comes together, let's look at a couple of different business types.

Scenario 1: The Solo Marketing Consultant

A freelance marketing consultant just needs a professional trade licence, a decent business address, and one residency visa. Their main concerns are keeping overheads low and maintaining flexibility.

For this kind of entrepreneur, a free zone like IFZA (International Free Zone Authority) or Meydan Free Zone makes a lot of sense. These zones are known for their cost-effective business setup solutions and remarkably quick registration processes. Since there's no need for major physical infrastructure, their flexi-desk packages are a perfect, affordable fit.

Scenario 2: The High-Volume Trading Company

Now consider a company that imports and re-exports electronics. Their needs are completely different. Their entire business model hinges on efficient logistics, plenty of warehouse space, and quick customs clearance.

This business would be much better off in a zone like JAFZA or Dubai CommerCity. Here, the critical factor is being close to ports and airports, with easy access to top-notch warehousing. The setup and running costs will be higher, but those expenses are easily justified by the massive logistical advantages that directly boost their profits.

By thinking through these factors, you shift from simply "starting a company" to strategically building a solid foundation for your business. As specialists in Freezone Company Formation across the UAE, we can offer you guidance that’s tailored to your specific needs, making sure you land in the perfect ecosystem, all backed by our 24/7 support service.

Getting the Paperwork and Licensing Sorted

Once you've zeroed in on the perfect free zone, it's time to tackle the paperwork. This is often the part that feels most intimidating, but honestly, it's more of a checklist exercise than a bureaucratic nightmare. The secret is just to be methodical.

This isn't just about filling out forms; you're building the legal foundation for your entire business. It all starts with two key decisions: figuring out your exact business activities and choosing a trade name that ticks all the right boxes. These early choices dictate the kind of licence you’ll need and define your company's legal identity here in the UAE.

Nailing Down Your Business Activities and Trade Name

Before you even think about submitting documents, you have to be crystal clear on your business activities. Free zone authorities are very particular about this because your licence will only allow you to do what’s listed on your application.

For instance, if you’re registered for "Marketing Consultancy," you can't suddenly start trading electronics. It pays to be precise and even think a little about where your business might grow in the future.

Next up is your trade name. The UAE has strict naming rules you need to follow. Your name can't have any religious or political undertones, and it definitely can't be offensive. If you want to use a person's name, they must be a partner or owner in the company, and you have to use their full name—no initials. Getting this right from the start saves you from annoying delays down the line.

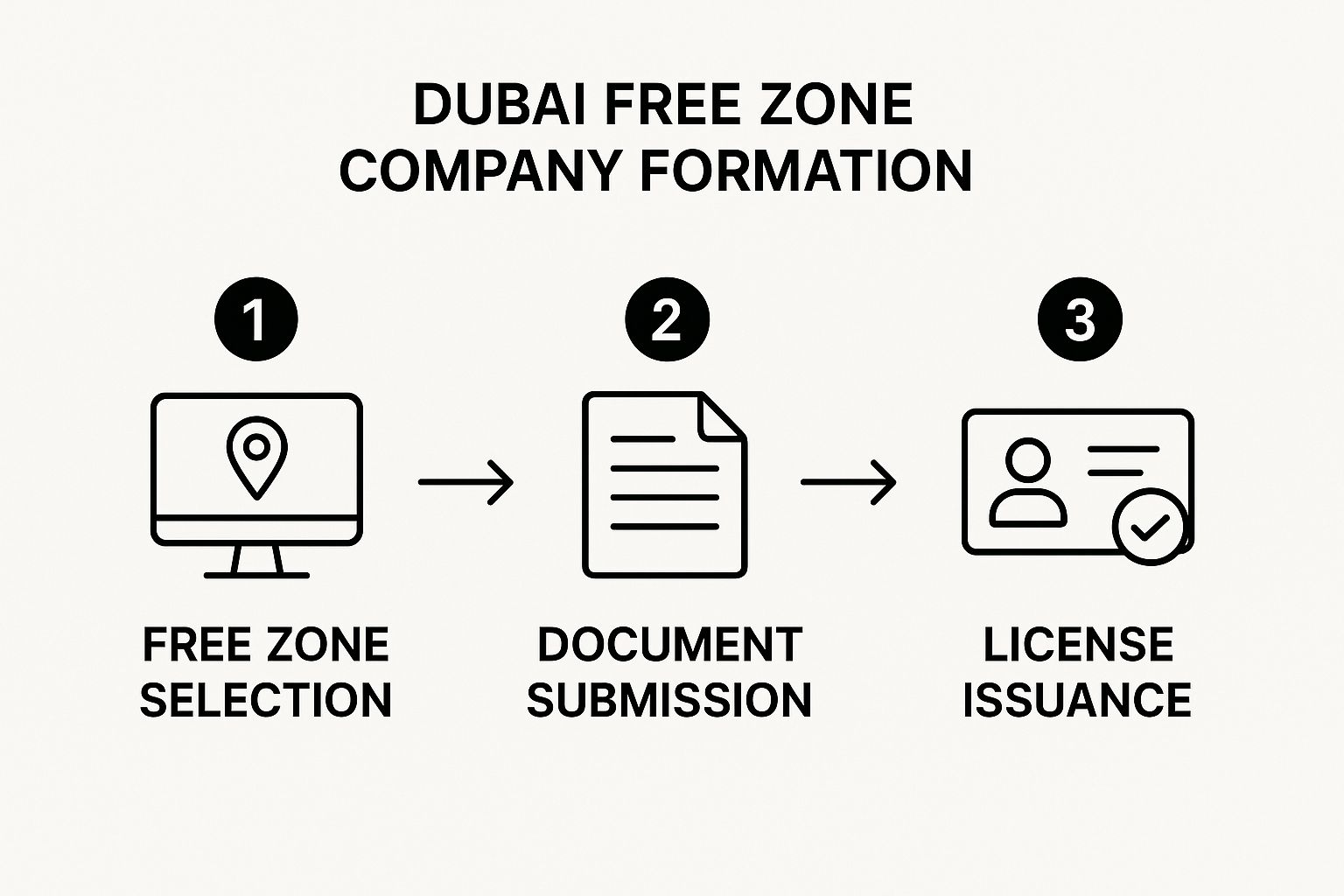

To give you a bird's-eye view of the whole journey, this chart breaks down the main stages, from choosing a zone right through to getting your licence.

As you can see, it's a step-by-step process. Each stage unlocks the next, which is why getting the initial paperwork spot-on is so important for a smooth setup.

Your Essential Document Checklist

With your activities defined and your name approved, it's time to gather the documents. The exact requirements can differ slightly from one free zone to another, but there's a core set of paperwork that's almost always required. Having these ready to go will make the whole application process a lot faster.

Most free zones will ask for a standard set of documents to get your application started. Here’s a quick rundown of what you’ll typically need to have on hand.

Your Essential Document Checklist for Setup

| Document | Key Considerations |

|---|---|

| Passport Copies | These need to be clear, colour copies for every shareholder and the manager you appoint. It’s a non-negotiable. |

| Visa Status Proof | If you're already in the UAE, a copy of your current residence visa page. If not, a copy of your visit visa will do. |

| Business Plan | A short, professional summary of your business goals, who you're selling to, and your financial projections. Some zones want more detail for certain activities. |

| Application Form | This is the official form from the free zone authority. Make sure it's filled out completely and accurately. |

| Board Resolution | If another company is a shareholder, you'll need a notarised resolution from their board authorising the new company formation. |

Getting these documents prepared in advance really is the best way to speed things along. It helps prevent any last-minute scrambling.

Pro Tip: Make sure every single document is clear, valid, and properly attested where needed. A single blurry passport copy or a missed signature can bring your entire application to a halt, costing you precious time.

Choosing the Right Business Licence

The business licence you apply for has to match your business activities perfectly. This is a critical point—operating outside the scope of your licence can lead to some hefty fines. Understanding the different licence categories is key to staying compliant and keeping your operations running smoothly.

Generally, Dubai's free zones offer three main types of licences:

- Commercial Licence: This one is for any business involved in buying, selling, importing, or exporting goods. If you’re setting up an e-commerce shop or a trading firm, this is the licence for you.

- Professional Licence: This is built for service-based businesses and professionals. Think consultancies, marketing agencies, IT services, and other professions that rely on skills and expertise.

- Industrial Licence: You'll need this if your business involves manufacturing, processing, or assembling products. These licences come with stricter rules, often requiring a physical warehouse or production facility.

Choosing the right licence is absolutely fundamental. If you're looking for more details on the different types and what they require, have a look at our complete guide on getting a Dubai trade license.

The good news is that the whole process has become much more efficient lately. Recent reforms in Dubai have made setting up a business faster and more affordable, which is great for small and medium-sized enterprises (SMEs). Thanks to full digitisation, entrepreneurs in some free zones can now get their licensing sorted in as little as 3–5 days. This shift to digital reduces paperwork and speeds up approvals, making the Dubai free zone company formation process more accessible than ever.

A Realistic Look at Your Setup Costs

Let's talk about the real numbers. Budgeting is the bedrock of a successful launch, and when it comes to a Dubai free zone company formation, getting a full financial picture is non-negotiable.

Too many entrepreneurs just look at the initial licence fee, but that’s only one piece of the puzzle. A proper budget accounts for every single expense, so you don't get any nasty surprises that could derail your momentum right out of the gate.

The trick is to think about the total cost for your first year, not just the shiny advertised price. This means factoring in one-time setup fees, the costs that will come back every year, and all the variable expenses that pop up depending on your specific structure and who you plan to hire.

Nailing this down means you can plan your capital with confidence.

Breaking Down Your One-Time Setup Fees

Your initial investment is all about the essential legal and admin steps needed to get your business officially on the books. These are the costs you'll pay upfront to get that trade licence in hand and make your company a legal entity.

Think of these as the foundation. While the exact amounts can differ between free zones, the core components are pretty consistent across the board.

Here’s what that typically looks like:

- Registration Fee: This is a straightforward administrative charge paid directly to the free zone authority. It covers processing your application and registering your company name.

- Licence Issuance Fee: This is the main cost for the trade licence itself. The final amount depends entirely on your chosen business activities and the type of licence you need (like Commercial or Professional).

- Establishment Card Fee: Don't overlook this one. It's a critical document that allows your company to start applying for visas, essentially registering your business with the immigration authorities.

- Office/Flexi-Desk Setup: You need a registered address. This could be an affordable flexi-desk package or a fully-fitted physical office, and the cost will naturally reflect your choice.

These one-time fees will make up the bulk of your initial cash outlay. Planning for them accurately ensures you have a smooth start without any last-minute financial scrambling.

Factoring in Recurring Annual Costs

Once you're up and running, your financial focus shifts to recurring annual costs. You’ll need to budget for these every year to keep your company compliant and fully operational. If you miss these, you could be looking at fines or even having your licence suspended.

The biggest recurring cost is almost always your annual licence renewal. This is the fee you pay to the free zone authority to keep your trade licence active, and it's usually similar to what you paid for the initial licence.

Beyond that, you have to account for your office space rental. Whether it's a flexi-desk, a spot in a co-working space, or a private office, that lease will need to be renewed each year. For businesses that need a higher visa quota, a larger physical office is often mandatory, which makes this a more significant recurring expense.

For a really detailed breakdown, check out our comprehensive guide on the Dubai free zone company setup cost.

Your first year’s budget isn't complete without accounting for renewal fees. So many entrepreneurs forget this and get caught off guard when the second-year invoices land. Plan for it from day one.

The Often-Overlooked Variable Costs

This is where a lot of budgets fall short. Variable costs are the expenses that fluctuate based on your specific needs—especially the number of employees you hire and their visa requirements. These can add up fast if you haven't planned for them.

Some of the key variable costs to watch out for include:

- Residency Visas: Every visa you process—for yourself, your partners, or your employees—comes with its own set of fees. This covers the entry permit, medical fitness test, Emirates ID application, and the final visa stamping in the passport.

- Medical Insurance: In Dubai, basic medical insurance is mandatory for every single visa holder. The cost here will vary depending on the level of coverage you choose.

- Corporate PRO Services: While you can try to handle government paperwork yourself, hiring Corporate PRO Services can save an immense amount of time and prevent costly mistakes, particularly with things like visa processing and document attestations.

- Bank Account Opening: Some banks might require an initial deposit to activate the account, and you may find minor administrative fees associated with the setup process.

As specialists in Freezone Company Formation across the UAE, we focus on providing cost-effective business setup solutions that give you a transparent, all-inclusive quote from the start. Our 24/7 support service is there to make sure you have complete clarity on every single cost, from the licence fee all the way to the final visa stamp.

Getting Your Business Bank Account and Visas

Holding your brand-new trade license is a huge moment in your Dubai free zone company formation journey, but you're not quite at the finish line. Next up are two crucial steps that will take your business from a name on paper to a fully functioning company with legal residency: opening your corporate bank account and sorting out your visas.

This is where a lot of new business owners can get tripped up by the details and paperwork. But if you know what to expect and come prepared, you can sail through this final stage without any frustrating delays.

Securing Your Corporate Bank Account

Opening a business bank account here in the UAE is a serious process. It’s more involved than just showing up with your new trade license. Banks are incredibly thorough with their due diligence to meet global compliance standards. They really need to know who you are, what your business actually does, and that your operations are legitimate.

Don’t try to rush this. It requires putting together a solid file of documents and presenting your business in a professional light. For a really detailed look at what's needed and how to pick the right bank for you, check out our guide on how to open a business bank account in Dubai.

Generally, you'll need to have these documents ready:

- Your Complete Company File: This means your trade license, certificate of incorporation, Memorandum of Association (MOA), and your office lease agreement.

- Personal Details for Shareholders & Managers: Be ready with passport copies, visa pages (if you have them), and Emirates IDs for every shareholder and the company manager.

- Proof Your Business is Real: You’ll need a well-thought-out business plan, information on your potential clients or suppliers, and sometimes even the CVs of the key people involved.

A lot of people make the mistake of thinking one bank is just like another. The reality is some banks are far more comfortable with certain free zones or business types. Picking a bank that gets the needs of international entrepreneurs and free zone companies can make a world of difference to your application time.

Navigating the UAE Residency Visa Process

Once your company's establishment card is issued, you can officially kick off the visa process for yourself, your business partners, and any employees you're hiring. This is the process that grants you the legal right to live and work in the UAE, and it moves through several government departments in a very specific order.

It all starts with applying for an entry permit. Think of this as your ticket to either enter the UAE for work or, if you’re already here, to change your current visa status. As soon as that permit is issued, a 60-day countdown begins for the next steps.

Within those 60 days, you have to complete the in-country formalities. These are mandatory and have to be done in sequence.

- Medical Fitness Test: This is a standard health check-up involving a blood test and a chest X-ray. It's a quick and simple procedure done at government-approved health centres all over Dubai.

- Emirates ID Biometrics: With the medical test done, your next stop is an Emirates ID service centre. Here, they'll take your fingerprints and a photo for your official residency card. This is a vital step.

- Visa Stamping: After your medical results come back clear and your biometrics are in the system, your application goes for the final green light. The residency visa is then physically stamped into your passport, which officially makes you a UAE resident.

The whole visa journey, from getting the entry permit to the final stamp in your passport, usually takes about 2-3 weeks. Once your own residency visa is sorted, you can then sponsor your family, like your spouse and children, to come and live with you in the UAE.

As specialists in the Golden Visa on Property and other investor visas, we can also guide you on longer-term residency paths. Our Corporate PRO Services team is here to make sure every step is handled correctly, and our 24/7 support service means you're always in the loop.

Your Questions About Dubai Free Zones Answered

When you're looking to set up a company in a Dubai free zone, a lot of questions come up. It's completely normal. This section is here to clear the air, giving you straightforward answers to the queries we hear most often from entrepreneurs just like you. The idea is to give you the confidence to take the next step.

Can I Do Business in Mainland Dubai With a Free Zone Licence?

This is easily one of the most common questions we get, and the answer isn't a simple yes or no. A free zone licence is your ticket to operating within your chosen free zone and, crucially, to doing business internationally.

If you want to tap into the local UAE market—say, selling products directly in a Dubai mall or offering services to clients based on the mainland—you generally need a local partner. This usually means working with a local distributor or agent. Another popular route is to set up a branch of your free zone company on the mainland for more direct access.

That said, some professional service activities are permitted to serve mainland clients directly, but this really boils down to the specific regulations of your free zone. For any serious trading, retail, or other mainland operations, a proper mainland licence is the way to go.

Getting the rules right for mainland versus free zone operations is critical. It's always best to get expert advice to make sure you're fully compliant and avoid any unexpected fines. Think of it as a small investment to protect your business's future.

What Is the Difference Between an FZE and an FZC?

The distinction between a Free Zone Establishment (FZE) and a Free Zone Company (FZC) is actually quite simple. It all comes down to the number of shareholders.

- Free Zone Establishment (FZE): This setup is for a single shareholder. That shareholder can be you as an individual or another corporate company.

- Free Zone Company (FZC): This is the option for businesses with two or more shareholders. The maximum number of shareholders varies by free zone but is often around 50.

Both an FZE and an FZC give you the exact same powerful benefits, like 100% foreign ownership and the UAE's favourable tax environment. Your choice is purely about your company's ownership structure, not what it can do.

Do I Really Need a Physical Office in the Free Zone?

Whether you need a physical office depends on two things: what your business does and how many residency visas you need. The good news is that many free zones have incredibly flexible options.

For consultants, freelancers, or startups that only need one or two visas, a flexi-desk package is often the perfect fit. It’s a cost-effective solution that gives you a legitimate business address and meets the minimum physical presence required for your licence.

However, if you're planning to build a larger team and require more employee visas, then a physical office is non-negotiable. The size of your office space is directly tied to your visa quota. And for certain activities, like trading or logistics, you'll almost always need a warehouse or dedicated office space right from the start.

How Long Does the Entire Company Formation Process Take?

The timeline can shift depending on the free zone you choose, the complexity of your business, and how quickly you get all your documents in order.

As a general guide, you can expect the initial company registration and trade licence to be issued within one to three weeks. Once you have that licence, the next phase is the visa and residency process. This involves your medical fitness test and Emirates ID biometrics, which usually takes another two to three weeks.

So, a realistic estimate for the whole journey—from submitting your application to getting your residency visa stamped in your passport—is about four to six weeks.

Navigating these questions is simpler with an expert partner.

✅ Specialists in Mainland Company Formation in Dubai, Sharjah & Abu Dhabi

✅ Specialists in Freezone Company Formation across the UAE

✅ Specialists in Golden Visa on Property and Investor Visa

✅ Specialists in Corporate PRO Services and Attestation Services

✅ 24/7 Support Service – Always here when you need us

✅ Cost-Effective Business Setup Solutions tailored to your needs

✅ Enjoy UAE Tax Benefits for International Entrepreneurs

📞 Call Us Now: +971-54-4710034

💬 WhatsApp Us Today for a Free Consultation at https://prodesk.ae