For any international entrepreneur looking to expand their reach, setting up a business in a UAE free zone is one of the smartest moves you can make. These specialised economic areas are a world away from the complexities of a mainland company formation, offering a direct and efficient path to launching your venture.

Your Starting Point for a UAE Free Zone Company

Let’s get straight to the point: for a foreign founder, a UAE free zone business setup is often the most appealing option on the table. Think of these zones as dedicated business hubs, specifically engineered to cut through the red tape that can often slow down new enterprises.

The biggest draw? Unlike a mainland setup that typically requires a local partner, a free zone company grants you 100% foreign ownership. This is a massive advantage for entrepreneurs who want to maintain full control over their equity and business decisions. It's your company, your rules.

The benefits don’t stop at ownership. You also get full repatriation of your capital and profits. This means every dirham you earn can be sent back to your home country without any restrictions—a cornerstone of the free zone model designed to attract serious foreign investment and top-tier talent.

Why Choose a Free Zone?

The strategic perks are compelling and tailored for the realities of modern business. Here’s what’s in it for you:

- Significant Tax Advantages: Even with the introduction of corporate tax for some activities, free zones offer major tax exemptions that directly boost your bottom line.

- World-Class Infrastructure: You get immediate access to state-of-the-art office spaces, advanced warehousing facilities, and top-notch connectivity.

- Simplified Regulations: The processes for getting your licence, visas, and managing daily operations are much more straightforward.

- Industry-Specific Hubs: You can set up shop within a thriving community of businesses in your sector, whether it's tech, media, logistics, or finance.

The UAE is home to over 40 multidisciplinary free zones, and they've been a key driver behind the country's incredible economic growth. In fact, they helped power a 24% rise in non-oil foreign trade to AED 1.7 trillion (USD 462.8 billion) in H1 2025. This dynamic environment, combined with fast-track setup procedures, makes the UAE a magnet for global business.

Of course, navigating this landscape still requires a solid plan. For a deeper look into what these entities involve, this comprehensive guide to free zone companies in Dubai is a great resource.

While the process is simplified, it's easy to make small missteps in choosing the right zone or preparing your documents. As specialists in Freezone Company Formation across the UAE, our team is here to make sure your journey is as smooth as possible. For more details, take a look at our guide on business setup in the UAE.

How to Choose the Right Free Zone and License

Picking the right free zone is probably the single most critical decision you'll make when setting up your business in the UAE. It’s easy to get overwhelmed—there are over 40 of them, and each has its own ecosystem, costs, and industry focus. My advice? Don't just chase the cheapest licence fee. That's a classic rookie mistake.

Instead of staring at a long list of names, let's flip the script. Think about your business from the ground up. What do you really do every day? Who are your customers? Where do you need to be to serve them best? The right location, community, and infrastructure are just as vital as the piece of paper that says you can operate.

A logistics or import-export company, for instance, would almost certainly feel most at home in Jebel Ali Free Zone (JAFZA), with its direct link to one of the planet's busiest ports. But if you're a creative agency or a digital marketing firm, you’d probably thrive in the collaborative vibe of Dubai Media City, where you're literally surrounded by potential clients and partners.

Aligning Your Business with the Right Zone

The goal here is simple: match the free zone’s specialty with what you actually need to run your business. A mismatch can bleed you dry with unnecessary costs or, worse, leave you isolated from key opportunities.

Let’s take an e-commerce startup as a real-world example. They're often torn between a high-tech logistics hub like Dubai CommerCity, which offers slick fulfilment services, and a more general, budget-friendly zone like IFZA (International Free Zone Authority) or RAKEZ (Ras Al Khaimah Economic Zone). The right choice boils down to their business model. Is managing in-house logistics a core part of their strategy, or is a flexible, low-overhead setup the priority right now?

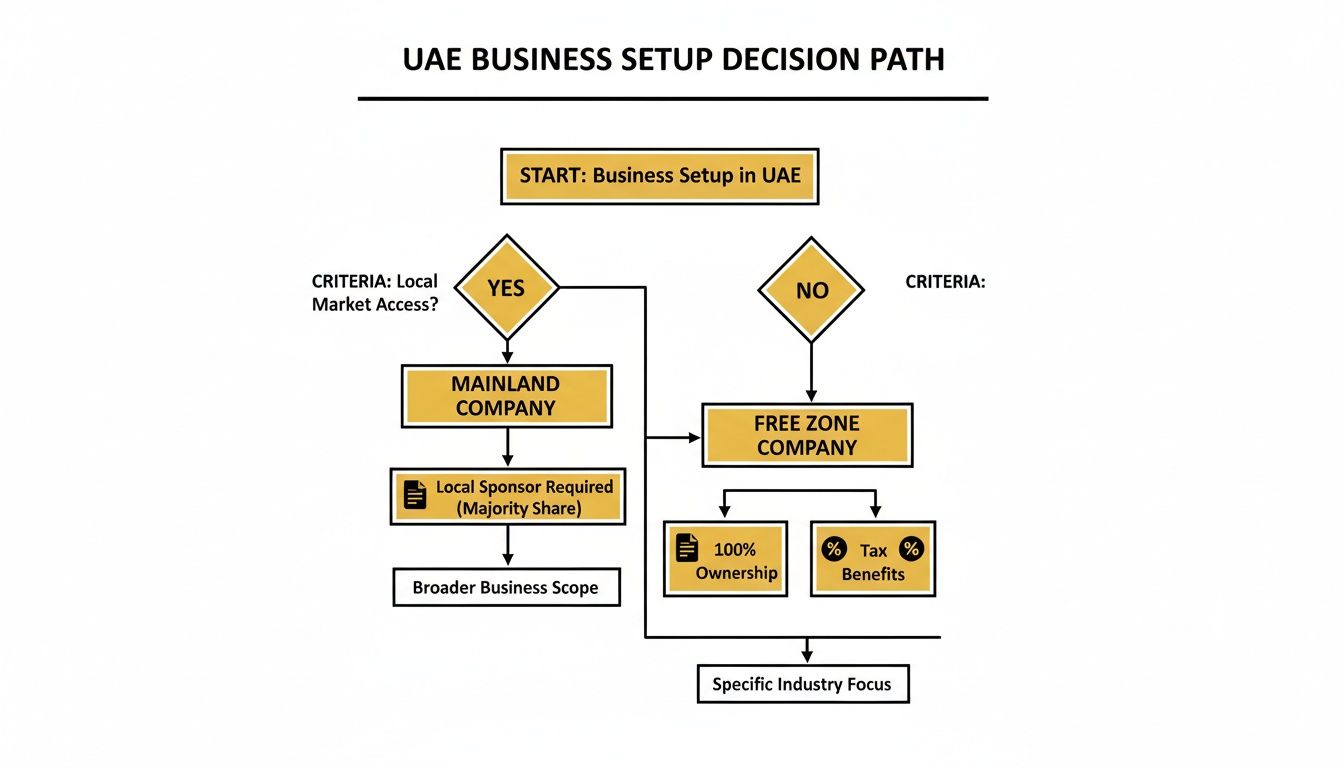

To help you picture this initial fork in the road, the flowchart below maps out the strategic choice between a mainland and a free zone setup.

As you can see, the path to a free zone is usually driven by the need for 100% foreign ownership and the attractive tax benefits—two massive draws for international entrepreneurs.

Comparing Popular UAE Free Zones by Business Need

To make this a bit more tangible, I've put together a table comparing some of the most popular free zones. This isn't an exhaustive list, but it gives you a good sense of how different zones cater to different needs.

| Free Zone | Primary Industry Focus | Key Advantages | Best Suited For |

|---|---|---|---|

| JAFZA (Jebel Ali) | Logistics, Trading, Industrial | World-class port facilities, excellent logistics network, large warehousing options. | Import/export, manufacturing, global trading companies. |

| DMC (Dubai Media City) | Media, Advertising, Marketing | Hub for global media giants, strong industry community, networking opportunities. | Marketing agencies, production houses, publishers, PR firms. |

| IFZA (Dubai) | General Trading, Services | Fast and cost-effective setup, no physical office required, wide range of activities. | Startups, consultants, e-commerce, international entrepreneurs. |

| RAKEZ (Ras Al Khaimah) | General, Industrial | Lower setup and operational costs, dual licensing options, diverse facilities. | SMEs, industrial businesses, cost-conscious startups. |

| DMCC (Dubai) | Commodities, Crypto, Services | Prime location in JLT, leading crypto hub, strong regulatory framework. | Commodity traders, crypto businesses, professional services firms. |

Think of this table as a starting point. The best choice always comes down to the unique DNA of your business.

Decoding Your Business Licence Type

Once you’ve narrowed down your free zone options, the next puzzle piece is your business licence. This isn't just admin; it's the legal definition of what your company is allowed to do. Getting this wrong can lead to serious compliance headaches down the line.

Most licences fall into one of three main buckets:

- Commercial Licence: This is your ticket if you’re in the business of buying and selling goods. Think trading, import/export, and distribution.

- Professional Licence: Tailor-made for service-based businesses and skilled professionals. This covers consultants, designers, developers, artists—anyone selling their expertise.

- Industrial Licence: If you’re making, processing, packaging, or assembling physical products, this is the one you'll need.

It's crucial that your licence precisely covers your business activities. You can't legally start trading electronics if your professional licence is for marketing consultancy. The authorities take this very seriously, and the fines for operating outside your scope can be steep.

Expert Insight: A real game-changer in recent years is the rise of dual licensing. Many free zones now allow you to get a permit to operate on the mainland without needing a separate mainland company. This is fantastic for service businesses that want to tap into the wider UAE market while still enjoying all the perks of a free zone setup.

A Practical Checklist for Your Decision

Alright, let's pull all this together. Run through this checklist. Answering these questions honestly will give you a solid framework for choosing a free zone that actually works for your business, both today and tomorrow.

-

What Is Your Total Budget?

Think beyond the flashy initial licence fee. You need to account for annual renewals, visa processing fees, potential office rent, and any mandatory security deposits. We specialise in providing cost-effective business setup solutions tailored to your needs, mapping out all expenses from day one. -

How Many Visas Do You Need?

The number of residency visas you can get is often linked to your office space. A basic flexi-desk package might only get you one or two visas, whereas a physical office unlocks the potential for more. Plan for your team. -

What Are Your Office Requirements?

Do you really need a physical office for client meetings, or is a virtual office or co-working space enough to get started? Many free zones offer a whole spectrum of options, from shared desks to sprawling private offices. -

Where Are Your Clients and Suppliers?

Proximity is everything in business. Being close to your target market, your suppliers, or key transport hubs like airports and seaports can make a huge difference to your daily operations. For creative industries, exploring investment opportunities in Dubai Design District (D3) could place you right at the heart of the action. -

What Are Your Long-Term Goals?

Think about where you want to be in three to five years. Does the free zone make it easy to upgrade your licence, add new business activities, or expand your office as you grow? Choosing a zone that can scale with you is one of the smartest moves you can make.

Alright, you’ve shortlisted a few free zones and have a good idea of which licence you need. Now comes the part that often feels like the biggest hurdle: the paperwork.

Honestly, this stage can seem intimidating, but it's really just a logical process. Think of it less as a bureaucratic maze and more as building the legal foundation for your company. The free zone authorities aren't trying to catch you out; they just need to verify who you are, understand your business, and see that it’s a legitimate operation.

Getting this right from the very beginning is the secret to a fast and smooth UAE free zone business setup. Simple mistakes, like sending an incomplete application or a document that hasn't been properly verified, are almost always the reason for delays. If you understand why they're asking for each document, the whole process becomes much clearer. For instance, a solid business plan isn't just a box-ticking exercise—it shows the authorities your venture is viable and that your activities fit within their rules.

Assembling Your Essential Documents

While the specifics can differ slightly from one free zone to another, there's a standard set of documents you'll almost certainly need. Getting these organised ahead of time will put you way ahead of the game.

Here’s a practical checklist of the usual suspects:

- Passport Copies: This one’s non-negotiable. You’ll need clear, valid copies for every shareholder and the person you appoint as the company manager.

- Visa Status Proof: Already a UAE resident? You'll need to provide a copy of your current residence visa and Emirates ID.

- A Concise Business Plan: This doesn't have to be a 50-page epic. A clear, straightforward document outlining your business activities, who you plan to sell to, and some basic financial projections is all that’s needed.

- Application Form: Each free zone has its own form. It’s crucial to fill this out completely and accurately—no blank spaces where there shouldn't be!

If another company is going to be a shareholder in your new entity, you'll need to bring in more paperwork. This typically includes the parent company’s certificate of incorporation, its memorandum of association, and a formal board resolution approving the new venture.

Choosing Your Legal Structure: FZE vs. FZC

During the application process, you'll need to make a key decision about your company's legal structure. In the world of UAE free zones, it almost always boils down to two choices: a Free Zone Establishment (FZE) or a Free Zone Company (FZC).

The difference is refreshingly simple. It all comes down to the number of owners.

- Free Zone Establishment (FZE): This is for the solo founder. If you're a single shareholder—whether you're a consultant, a freelancer, or an entrepreneur going it alone—the FZE is your perfect match. It’s clean, simple, and gives you a distinct legal entity.

- Free Zone Company (FZC): This is the go-to for any business with two or more shareholders. Think tech startups with a couple of co-founders, consultancies with multiple partners, or any venture with several investors.

Imagine a solo management consultant setting up her own firm. An FZE gives her all the legal protection she needs without any extra complexity. On the other hand, if two friends are launching a new digital marketing agency together, they'd choose an FZC to clearly define their shared ownership right from the start.

Expert Takeaway: Don't underestimate this decision. Your choice between an FZE and FZC affects everything from how decisions are made to how profits are shared. Getting the structure right from day one saves you from complicated and expensive restructuring down the line.

The Critical Role of Document Attestation

Here’s one of the biggest—and most common—tripwires in a UAE free zone business setup: document attestation.

Many documents issued outside the UAE simply aren't considered valid here until they've been legally attested. This could be anything from your university degree (often required for professional licences) to the corporate paperwork for a parent company.

Attestation is a multi-step journey. A document typically has to be verified by a notary in its home country, then by that country's Ministry of Foreign Affairs, and finally stamped by the UAE Embassy there. If you miss a step or get it wrong, your documents will be rejected flat out, bringing your entire application to a halt.

This is exactly where having an expert in your corner makes all the difference. As specialists in Corporate PRO Services and Attestation Services, we handle this entire chain of command for our clients. We know the precise requirements for the UAE government and each free zone, which prevents those frustrating delays. Frankly, getting your attestations right the first time is one of the single most effective ways to keep your setup process on schedule.

Budgeting for Your Business Setup Costs and Timelines

No entrepreneur wants financial surprises, especially during the critical launch phase of their business. A clear understanding of the real costs involved in a UAE free zone business setup is absolutely essential for a smooth start.

The total investment isn't just the initial licence fee you see advertised; it’s a mix of one-time payments, recurring annual costs, and other expenses that really depend on your specific business model.

A classic mistake we see is people budgeting only for the trade licence, then getting caught off guard by other mandatory fees. To sidestep this, you need to map out every single cost from day one. This means everything from initial government approvals right down to the final visa stamping for you and your team.

Breaking Down the Core Costs

So, what are you actually paying for? Let's dissect the typical expenses you'll encounter. Getting a handle on these individual pieces helps you build a much more accurate and realistic budget for your new venture.

- One-Time Registration Fees: This covers the initial heavy lifting: reserving your company name, getting the initial nod from the free zone authority, and issuing your incorporation documents. It’s the foundational cost of creating your legal entity.

- Annual Licence Fee: This is your main recurring cost to keep the company's legal status active. The fee can vary wildly depending on the free zone, how many business activities you list, and the licence type (e.g., Commercial, Professional, or Industrial).

- Visa Processing Charges: Every residency visa for shareholders and employees has its own set of costs. Think entry permits, medical fitness tests, Emirates ID applications, and the final visa stamping in the passport.

- Office Space Expenses: Whether you grab a simple flexi-desk, join a co-working space, or lease a dedicated physical office, this will be a major part of your budget. Crucially, many free zones link the number of visas you can apply for directly to the size and type of your office space.

Real-World Cost Scenarios

To put this into perspective, let's compare two very different setups. A freelance consultant looking for a basic permit with a single visa and a virtual office package might see a total setup cost starting from around AED 15,000 to AED 25,000. It's a lean, effective way to get up and running.

On the other hand, a trading company with two shareholders needing a commercial licence, three employee visas, and a small physical office could see their initial outlay jump to anywhere from AED 40,000 to AED 70,000 or more. It all depends on the free zone and office location. This really shows why a one-size-fits-all budget just doesn't work here.

For a more granular look, you can explore our guide on the Dubai free zone company setup cost.

Expert Insight: Don't forget to factor in the less obvious costs. Things like the Establishment Card fee (which registers your company with immigration) and any mandatory health insurance for visa holders are small but necessary expenses that can definitely add up.

Setting Realistic Timelines

While some free zones advertise incredibly quick setup times, the reality on the ground depends on a few key things. The actual speed of your UAE free zone business setup is influenced by how complex your business activity is, the accuracy of your submitted documents, and how quickly any external approvals are granted.

Generally, you can expect the process to unfold like this:

- Initial Approval & Company Registration (2-5 working days): This is usually the quickest part. Once your name is approved and documents are submitted correctly, the free zone can issue your initial company documents quite fast.

- Establishment Card & Entry Permit (5-7 working days): After the company is formed, it needs to be registered with immigration. Only then can entry permits be issued for shareholders who need visas.

- Visa Stamping Process (7-10 working days): This is the final leg, involving the medical test, biometrics for the Emirates ID, and finally, getting the residence visa stamped in your passport.

All in all, a straightforward setup from start to finish typically takes between three to four weeks.

But, be warned: any errors in your application or delays in document attestation can easily stretch this timeline. This is where getting expert guidance from specialists offering cost-effective business setup solutions becomes invaluable. An experienced hand ensures every step is executed correctly the first time, helping you stick to both your budget and your launch schedule.

Securing Visas and Opening a Corporate Bank Account

Once your company registration is complete, you've hit two major milestones: getting your residency visas and opening a corporate bank account. This is the point where your business goes from a legal entity on paper to a real, operational venture. While these steps can feel a bit intimidating, knowing what to expect makes the whole process quite straightforward.

Think of it this way: the visa is your ticket to living and working in the UAE, and the bank account is the financial engine that will drive your business forward. Let’s walk through exactly what you need to do to handle both smoothly.

The UAE Residency Visa Process Explained

Getting a residency visa for yourself as an investor, and later for your employees, is a structured process. As soon as your company's Establishment Card is issued, you can kick things off.

The path to residency has a few key stages:

- Entry Permit: The free zone authority applies for an entry permit for you. This lets you enter the UAE (if you're abroad) or adjust your status (if you're already here).

- Medical Fitness Test: This is a mandatory health check-up, involving a blood test and a chest X-ray. It’s done at a government-approved medical centre.

- Emirates ID Biometrics: You'll need to visit a Federal Authority for Identity and Citizenship (ICA) centre to provide your fingerprints and have your photo taken for your Emirates ID.

- Visa Stamping: After clearing the medical test and biometrics, your passport is submitted to have the final residence visa stamped inside.

Here's a critical detail many overlook: your office choice directly affects how many visas you can get. A flexi-desk or virtual office package usually allows for just one or two visas. If your plan is to build a larger team, you'll have to lease a physical office, because visa quotas are tied to office size. This makes planning your team's growth crucial right from the start of your UAE free zone business setup.

As specialists in Golden Visa on Property and Investor Visa, we've seen it all. Our 24/7 Support Service means we are always here when you need us, managing this entire journey through our expert Corporate PRO Services to ensure every step is handled without a hitch.

Navigating Corporate Bank Account Opening

For many new entrepreneurs, opening a corporate bank account is often the trickiest part of the post-setup phase. UAE banks adhere to strict international compliance and anti-money laundering (AML) regulations, which means they perform very thorough due diligence on every applicant. Getting an application rejected can set you back significantly.

Your goal is to present a solid case that your business is legitimate, well-thought-out, and low-risk. The banks want to see a clear, tangible business operation.

Insider Tip: Banks in the UAE really value a physical presence. A virtual office alone can sometimes raise a red flag. We've found that securing even a small physical office or a dedicated desk in a well-regarded business centre can dramatically increase your chances of getting approved.

The bank will want to see a comprehensive file of documents. Having everything ready to go is half the battle.

Key Documents Banks Typically Request:

- Your complete set of company documents (trade licence, certificate of incorporation, MOA).

- Passport, visa, and Emirates ID copies for every shareholder.

- A solid business plan with believable financial projections.

- A six-month bank statement (personal or corporate) for shareholders to prove their financial standing.

- Proof of your business address (your tenancy contract or Ejari).

- Profiles or CVs for all partners, detailing their professional background.

- Any invoices, contracts, or letters of intent from potential clients to show real business activity.

Getting through this process really comes down to being prepared and presenting your business professionally. For a deeper dive into the requirements and strategies for a smooth approval, check out our complete guide on how to open a business bank account in Dubai. Using professional relationships and making sure your application is perfect from day one can turn this potential headache into a straightforward success.

So, you’ve got your trade licence in hand. It’s a huge moment, but think of it as the starting line, not the finish. The real work of building a successful business in the UAE begins right now, and it boils down to two critical things: staying compliant and figuring out how to scale.

Setting up in a UAE free zone isn't a one-and-done deal; it comes with ongoing responsibilities that are essential to protect your company’s good standing and keep you in business.

Think of it like regular car maintenance. Your company needs scheduled check-ups to run smoothly. If you ignore them, you're heading for trouble—fines, your operations being frozen, or even worse, finding out your licence can't be renewed.

Your Ongoing Compliance Checklist

The absolute first priority is staying on top of your annual obligations. These are non-negotiable. They’re what keep your business legally sound in the eyes of both your free zone authority and the wider UAE government.

Here’s what that looks like in practice:

- Annual Licence Renewal: This is the big one. You must renew your trade licence every single year before it expires. No exceptions if you want to keep operating legally.

- Financial Auditing: Many free zones will ask you to submit an audited financial report each year. My advice? Keep clean books from day one. It makes this process completely painless instead of a last-minute scramble.

- UBO Register: You’re legally required to maintain a current register of your company’s Ultimate Beneficial Owners (UBOs). This is a crucial part of the UAE's commitment to financial transparency.

Sustained success demands consistent administrative care. I've seen promising new businesses get derailed surprisingly fast simply by letting these compliance tasks slide. This is where expert corporate PRO services become invaluable, handling these crucial renewals and submissions so you can focus on actually growing the business.

Smart Strategies for Scaling Your Business

Once you have a solid compliance routine in place, you can confidently shift your focus to the exciting part: expansion. Your free zone company is a powerful platform for growth, not just within the UAE but internationally. The trick is to scale smartly, making calculated moves that truly align with your goals.

As specialists in Mainland Company Formation in Dubai, Sharjah & Abu Dhabi, we understand that growth might mean expanding beyond the free zone. We can guide you on the best path forward, whether that involves dual licensing or a full mainland setup.

Expanding Your Operations

Ready to take that next step? Here are the most common growth pathways we see:

- Hiring Your First Employees: As your business grows, you'll inevitably need to bring on more talent. This means amending your Establishment Card and managing the visa process for new staff. It all has to be done through the proper official channels.

- Amending Your Licence: What if you want to add a new service or start trading a completely new product line? You’ll need to formally amend your business licence. This step ensures your activities always match what you’re legally permitted to do.

- International Expansion: With a stable and compliant UAE company, you can use it as a launchpad to enter other markets across the Middle East, Africa, and Asia. A UAE free zone entity provides the credibility and structure needed for smooth international trade.

Navigating these growth stages requires the same sharp attention to detail as your initial setup. From handling new employment visas to ensuring your licence amendments are processed correctly, having specialist support makes all the difference. We offer 24/7 support and cost-effective business setup solutions designed not just for day one, but for your entire business lifecycle.

Give us a call at +971-54-4710034 to talk about your growth plans, or WhatsApp Us Today for a Free Consultation.

Your UAE Free Zone Questions, Answered

When you're looking at setting up a business in a UAE free zone, a lot of specific questions pop up. It's completely normal. Let's walk through some of the most common ones we hear from entrepreneurs every day.

Can My Free Zone Company Do Business on the UAE Mainland?

Yes, but it's not a free-for-all. A free zone company can't just start invoicing clients directly on the mainland. Think of it like a members-only club; your business operates within the free zone's jurisdiction.

However, there's a great workaround many free zones now offer: a dual licence. This is a special permit that lets you carry out certain business activities on the mainland, without the hassle and expense of setting up a completely separate mainland company. It's a game-changer for service businesses like consultants or marketing agencies.

If you're trading physical goods, the process is a bit different. You'll typically need to partner with a mainland distributor who can handle the local sales for you.

Do I Absolutely Need a Physical Office in a Free Zone?

Not always. This is a common misconception. Many free zones have become incredibly flexible, offering packages that include virtual offices or access to flexi-desks. For startups, solo entrepreneurs, or international businesses that don't need a full-time physical base, these are fantastic, budget-friendly options.

But here's the crucial part: your office choice is directly linked to how many residency visas you can get. A virtual package might only allow for one or two visas. If you plan on building a team in the UAE, you'll need a physical office space to unlock a larger visa allocation.

Key Takeaway: Don't just think about today's costs. Your office package is a strategic choice that affects your budget and your ability to hire. Make sure it aligns with where you see your business in one, two, or even five years.

Are All Free Zone Companies Completely Tax-Free?

While the UAE's tax environment is incredibly attractive, "tax-free" isn't the whole story. For you and your employees, there is 0% personal income tax—what you earn is what you keep.

On the corporate side, things changed in 2023 with the introduction of a 9% corporate tax. The good news is that many free zone companies can still achieve a 0% rate by meeting the criteria for a "Qualifying Free Zone Person." This status depends heavily on what your business does and your yearly revenue. We help our clients navigate these rules to ensure they can fully enjoy UAE tax benefits for international entrepreneurs.

Ready to make your move? At PRO Deskk, we're specialists in mainland and free zone company formation across the UAE, as well as Golden Visas and Corporate PRO services. With 24/7 support, we deliver straightforward, cost-effective solutions to get your business up and running smoothly.

Contact us today for a free consultation at PRO Deskk.