For any entrepreneur looking to expand internationally, setting up a business in a UAE free zone is one of the smartest moves you can make. It’s a direct route to gaining a competitive edge, offering massive advantages like 100% foreign ownership, the ability to repatriate all your profits, and of course, significant tax benefits.

This isn't just about cutting costs; it's about planting your flag in one of the most dynamic and forward-thinking commercial environments on the planet. You’re tapping into a thriving, non-oil economy and building a launchpad to scale your operations globally.

Why a UAE Free Zone Is Your Gateway to Global Business

For decades, the UAE has carefully built its reputation as a magnet for global talent and investment. The specialised free zones are the heart of this success story—these are designated economic areas specifically designed to create the best possible operating conditions for foreign-owned businesses.

These hubs are built to tear down the traditional barriers that often block market entry, making them a perfect fit for everyone from scrappy startups and growing SMEs to established multinational corporations. The core appeal is simple but incredibly powerful: complete control and total financial freedom.

Unlocking Unmatched Ownership and Financial Benefits

The number one reason founders flock to a UAE free zone business setup is the ability to maintain 100% foreign ownership. This is a game-changer. Unlike setting up on the mainland, where a local partner is sometimes required, a free zone structure gives you full, undisputed autonomy over your company’s equity and direction. If you want to dig deeper into the specifics, check out our guide on Dubai mainland business setup.

Hand-in-hand with ownership comes another critical perk: 100% repatriation of capital and profits. You can transfer every dirham you earn back to your home country with zero restrictions. For international entrepreneurs, that level of financial security and flexibility is immense. As you map out your global expansion, it's always wise to stay informed on the wider challenges of navigating the complexities of international trade and taxation.

These financial incentives are all part of a larger, government-led vision to build an economy that thrives beyond oil. When you set up in a free zone, you can expect:

- Tax Exemptions: Enjoy major relief from both corporate and personal income taxes, which directly boosts your bottom line.

- Customs Duty Exemption: Forget about customs duties for goods traded within or between free zones.

- Simplified Procedures: Each zone is managed by its own authority, meaning you benefit from a much smoother, more streamlined incorporation process.

A Thriving Economic Powerhouse

The UAE’s economic strategy isn’t just ambitious—it’s working. The country has more than 40 multidisciplinary free zones, and each one acts as a launchpad for businesses, fuelling a massive trade boom with unbeatable perks.

Just look at the numbers. Non-oil exports recently shot past USD 152 billion, a staggering 27.6% jump from the previous year. And the nation has its sights set even higher, aiming for USD 1 trillion in non-oil trade by 2031 through strategic global agreements.

Choosing a UAE free zone isn’t just about registering a company; it’s about positioning your business at the absolute crossroads of global commerce. It’s a strategic decision to join a thriving ecosystem that is purpose-built for growth, innovation, and international reach.

This is exactly where our expertise comes into play. As specialists in Freezone Company Formation across the entire UAE, we provide cost-effective setup solutions that are built around your unique goals. With our 24/7 support service, we're here to guide you through every single stage, making sure you take full advantage of every UAE tax benefit available to you.

Choosing the Right Free Zone and License for Your Venture

Getting your free zone and business license right is probably the single most important decision you'll make when setting up in the UAE. Nail this, and you’ve built a solid foundation for growth. Get it wrong, and you could be looking at operational roadblocks, surprise costs, and a whole lot of future headaches.

With over 40 free zones across the country, the goal isn't to memorise a long list. It's about figuring out which one truly fits your specific industry and business model. Are you a tech startup needing an innovation hub, or an e-commerce brand that relies on world-class logistics? The right zone acts as a strategic partner, not just a registration address.

Finding Your Business's Natural Home

Think of free zones as specialised business communities. Each one is built to support certain sectors, offering the right infrastructure, networking opportunities, and even specific regulations. The trick is to find where your company belongs.

Let's look at a few real-world examples:

- For a FinTech or Financial Services Startup: The choice is pretty clear—it's either the Dubai International Financial Centre (DIFC) or Abu Dhabi Global Market (ADGM). These aren't just free zones; they are complete financial ecosystems with their own independent legal systems, regulatory "sandboxes" for testing new ideas, and direct lines to venture capital and global banks.

- For a Global Trading or Commodities Business: Nothing beats the Dubai Multi Commodities Centre (DMCC). It's tailor-made for trading everything from gold and diamonds to coffee and tea, providing the infrastructure and global network you need to succeed in this space.

- For a Tech or Media Production Company: Places like Dubai Media City, Dubai Internet City, or Abu Dhabi’s twofour54 are fantastic options. They have industry-specific facilities like production studios and data centres, and create a collaborative environment where you can easily connect with talent and major players.

- For an E-commerce or Logistics Operation: Jebel Ali Free Zone (JAFZA) and Dubai Airport Freezone (DAFZA) are logistics powerhouses. Their direct access to one of the world's busiest seaports and airports gives an unbeatable edge to businesses focused on import, export, and quick distribution.

The impact of choosing a specialised zone is massive. For example, DMCC is such a magnet for global trade that it contributes around 15% of Dubai's total foreign direct investment. It's a strategic engine for the economy.

Comparing Top UAE Free Zones for Your Business

To help you visualise this, here’s a quick comparison of some of the most popular free zones. This isn't an exhaustive list, but it gives you a good idea of how to match your business needs with the right location.

| Free Zone | Best For (Industry) | Key Advantage | Estimated Starting Cost |

|---|---|---|---|

| DMCC | Commodities, Trading, Professional Services | Global trading hub, prestigious address | AED 20,000 – 35,000 |

| JAFZA | Logistics, Manufacturing, Trading | Direct port access, massive infrastructure | AED 25,000 – 50,000 |

| DIFC | FinTech, Banking, Legal, Wealth Management | Independent common law system, financial hub | AED 50,000+ |

| DAFZA | E-commerce, Aviation, Luxury Goods | Direct airport access, fast customs | AED 22,000 – 40,000 |

| Dubai Media City | Media, Advertising, Production, PR | Creative ecosystem, industry network | AED 15,000 – 30,000 |

Note: Costs are estimates and can vary based on license activities, visa allocations, and office requirements.

Choosing the right zone is about more than just cost—it's about placing your business in an environment designed for it to thrive.

Getting Your Business License Right

Once you've narrowed down your free zone choices, the next step is picking the correct license. This document legally defines what your business is allowed to do. Choosing the wrong one can stop your operations in their tracks or lead to fines, so it’s crucial to get it right from day one.

Licenses generally fall into three main categories:

-

Commercial License: This is for any business involved in buying and selling goods—what’s often called "trading." It covers everything from import and export to distribution and general retail. If you're running an e-commerce store or an import-export agency, this is the one for you.

-

Professional License: This license is designed for service-based businesses and individuals offering their expertise. Think marketing agencies, IT consultancies, design studios, and legal or accounting firms. It's tied to the professional skills of the owner or managers.

-

Industrial License: You'll need this if your business involves manufacturing, processing, or assembling goods. This could be anything from food production to putting together electronics. These licenses usually come with specific requirements for factory or warehouse space.

A key part of this process involves understanding different types of company structures and which one fits your business best. This choice will affect everything from your personal liability to how you can raise investment down the line.

Expert Tip: Don't just pick a license that fits your business plan today. Think ahead. Some free zones let you combine several business activities under a single license, which can be a smart, cost-effective way to add new services or products later without needing a whole new setup.

As specialists in free zone formations across the UAE, this matchmaking process is what we do best. We'll sit down with you, analyse your business model and your goals for the future, and help you select the zone and license that deliver the best value and flexibility. Our cost-effective business setup solutions are tailored to your needs.

Mapping Your Setup Process: Documents, Costs, and Timelines

Once you’ve pinpointed the right free zone and licence, the real work begins. This is where your business idea starts to become a tangible, legal entity. The journey from concept to holding a trade licence has a clear, structured path, and understanding it—from the paperwork to the actual costs and timelines—is key to a smooth UAE free zone business setup.

This is the point where the paperwork piles up, but it doesn't have to be a headache. Think of it as laying a solid, compliant foundation for your company. Getting every document right at this stage is crucial for avoiding frustrating delays or rejections later on.

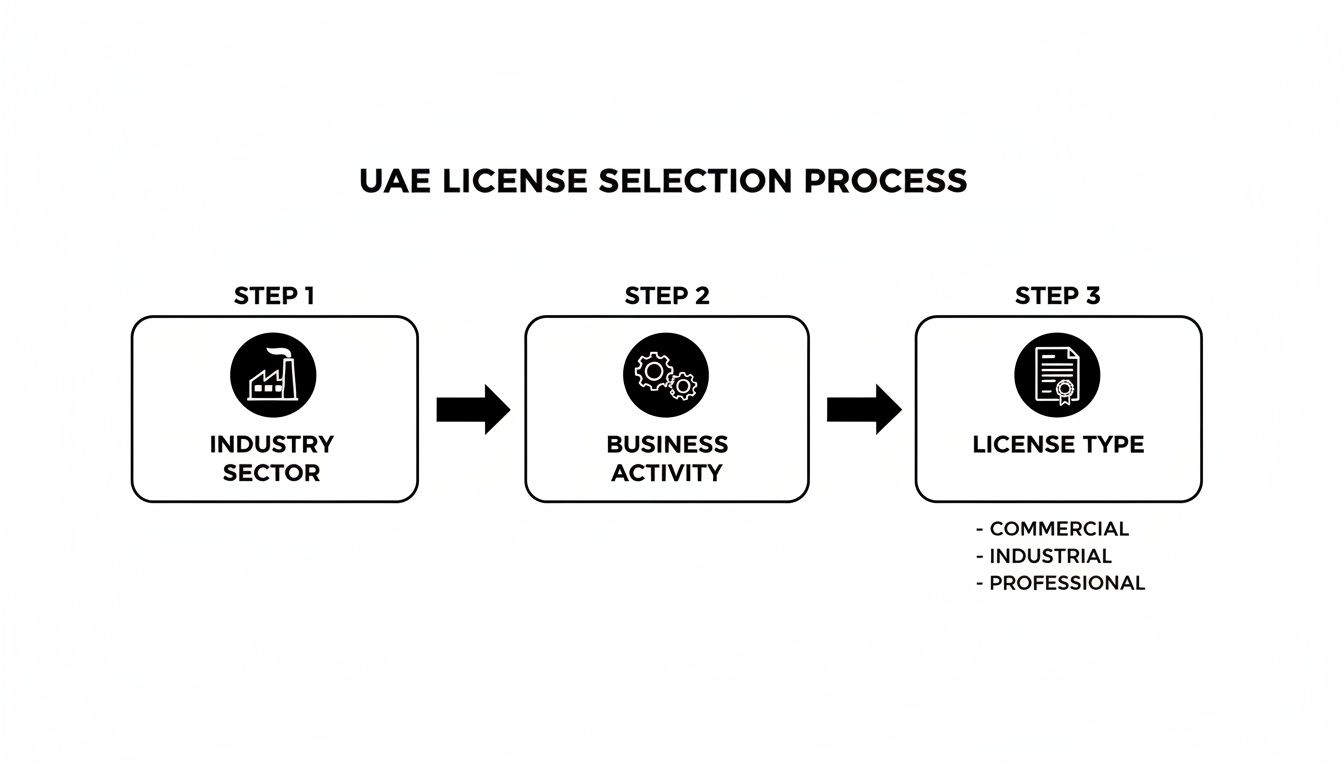

The chart below breaks down how to approach your licence selection, starting with your industry and drilling down to the specific activities you'll be conducting.

Following a structured approach like this ensures your licence perfectly matches what your business actually does, saving you trouble in the long run.

Your Essential Document Checklist

While every free zone has its own nuances, a standard set of documents is almost always required to get the ball rolling. Having these ready to go will make a huge difference in how quickly your application moves forward.

Here's what you'll typically need to submit upfront:

- Passport Copies: Clear, colour copies for all shareholders and the company manager.

- Visa and Emirates ID Copies: For any shareholders who are already UAE residents.

- A Detailed Business Plan: Many free zones, particularly those in specialised fields, want to see a concise plan that covers your objectives, activities, and financial forecasts.

- Completed Application Forms: These are specific to each free zone authority and must be filled out perfectly.

- Proof of Address: A recent utility bill for each shareholder usually does the trick.

It sounds simple, but you'd be surprised how often a blurry copy or an expired passport causes an application to be rejected right out of the gate.

Insider Tip: Document attestation is a non-negotiable step that often trips people up. Corporate documents or even your university degree might need to be attested in your home country and then again by the UAE's Ministry of Foreign Affairs. Skipping this will bring your application to a dead stop.

This is exactly where having an expert in your corner pays off. Our specialists in Corporate PRO Services and Attestation Services handle these complexities every day. We make sure every single document is prepared, verified, and attested to the letter of the law. To learn more, check out our professional document clearing services in the UAE.

Unpacking the Real Costs of Setup

The question we hear most often is, "So, what's the real total cost?" It’s easy to get drawn in by low-cost package deals, but a proper budget needs to account for every single fee to avoid nasty surprises.

Here’s a realistic breakdown of the costs you should anticipate:

- Registration and Licence Fees: This is the main fee you'll pay to the free zone authority. It can vary wildly depending on the zone, licence type, and number of business activities.

- Establishment Card Fee: A mandatory card that registers your company with immigration, allowing you to start applying for visas.

- Office and Facility Costs: This is an annual, recurring cost, whether you choose a flexi-desk, a virtual office, or a physical space. Many free zones bundle this with the licence.

- Visa Expenses: Each visa comes with its own string of fees for the entry permit, medical test, Emirates ID application, and the final visa stamping.

- Professional Service Fees: This covers the cost of having a setup consultant manage the entire process for you—a small price for peace of mind.

Our approach is built on total transparency. We provide a clear, itemised quote from day one, so you know exactly where your money is going. No hidden charges, no last-minute additions.

A Realistic Timeline From Start to Finish

You'll see ads promising a trade licence in a few days, and while that's technically possible, the full end-to-end process takes longer. Having a realistic timeline helps you plan your launch and manage expectations.

- Initial Approval & Licence Issuance (1-2 weeks): This stage covers document submission, trade name approval, and getting the green light from the authorities. Once you pay, the licence is usually issued fairly quickly.

- Establishment Card & Visa Processing (2-4 weeks): After your licence is in hand, you'll get your establishment card. Only then can you start the visa process for yourself or your staff, which involves the medical test and biometrics.

- Bank Account Opening (1-3 weeks): This can often be the most time-consuming step. UAE banks have strict compliance checks and will need your complete company file before they approve an account.

With our 24/7 support service, we're always here when you need us, providing an update or answering a question, and keeping you in the loop at every single stage.

Securing Your Residency and Corporate Bank Account

So, you have your new trade licence in hand. That’s a huge milestone, and it's tempting to think you've crossed the finish line. But this is where the real groundwork begins for getting your life and business truly operational in the UAE.

Before you can start trading, there are two massive, interconnected steps left: getting your residency visa sorted and opening that all-important corporate bank account. This is often where entrepreneurs run into unexpected delays and frustrations. Let's break down how to navigate this final stretch.

The Residency Visa Process Unpacked

Your residency visa is more than just a stamp in your passport; it's your key to living and working legally in the UAE. It’s mandatory for you as the business owner, and it’s the gateway to sponsoring your family and employees. As specialists in Golden Visa on Property and Investor Visa, we've guided countless clients through this maze.

Getting your residency involves a few key appointments that you’ll have to attend in person:

- Medical Fitness Test: This is a standard requirement for all new residents. It involves a blood test and a chest X-ray to screen for any communicable diseases. It's a routine check-up, but it's a non-negotiable step.

- Emirates ID Biometrics: You'll need to visit an official centre to provide your fingerprints and have a photograph taken. This data is used to issue your Emirates ID, which will be your primary identification card across the UAE.

- Final Visa Stamping: After you've cleared the medical test and completed your biometrics, the final step is to submit your passport to have the residency visa physically stamped inside.

While the process sounds straightforward, managing the appointments, paperwork, and timelines can be a headache. Our PRO team takes care of all the coordination, telling you exactly where and when you need to be, which helps sidestep those frustrating delays.

From our experience, the biggest hold-ups in the residency process come from small mismatches in documentation. Ensuring every detail on your application perfectly aligns with your trade licence and immigration records is absolutely critical to a smooth experience.

Overcoming the Corporate Bank Account Hurdle

Now for what is, without a doubt, the single biggest challenge for new business owners in the UAE: opening a corporate bank account. Banks here operate under incredibly strict compliance and Know Your Customer (KYC) regulations.

Simply walking in with a trade licence isn't enough anymore. Banks want to see a tangible, legitimate business with a clear operational plan before they’ll even consider an application. This is where you need to be thoroughly prepared.

Crafting a Winning Bank Account Application

To even have a chance at a quick approval, your application file needs to be bulletproof. You need to build a compelling case that gives the bank’s compliance team complete confidence in your business. This is where our strong relationships with various banks make a real difference.

Here’s what you absolutely must have ready:

- A Detailed Company Profile: Go way beyond your initial business plan. Clearly outline your business model, target audience, projected revenue streams, and crucially, the source of your startup capital.

- Shareholder Profiles: Each shareholder needs a professional CV that highlights their industry experience. Banks want to see the expertise and credibility behind the company name.

- Proof of Business Legitimacy: This is huge. Gather any existing contracts, letters of intent from potential clients, or even a professional business website. The more evidence you can show of an active, real-world business, the better your odds.

- Understanding Initial Deposits: Be ready for this. Banks often require a significant initial deposit that may need to be held in the account for a set period. These requirements vary wildly from bank to bank.

The economic power of free zones is built on companies being able to operate effectively. Major hubs like JAFZA (Jebel Ali Free Zone Authority) are home to over 11,000 companies that generate USD 190 billion in trade. That doesn't happen without robust banking.

Our team doesn't just submit paperwork; we help you build a comprehensive application package and introduce you to the right banking contacts who actually understand the unique needs of free zone businesses. For a deeper look, check out our complete guide on how to open a business bank account in Dubai.

With our 24/7 support service, we’re here to help you clear this final, and most critical, hurdle.

Common Pitfalls to Avoid on Your Free Zone Journey

Setting up a business in a UAE free zone is an exciting time, but it's a path with its share of hidden traps. We've seen countless entrepreneurs navigate this journey, and spotting potential mistakes early can be the difference between a smooth launch and one bogged down by costly delays.

This isn't just generic advice. Let's walk through some of the specific, expensive missteps that can derail your plans before you even get started. Knowing what to watch out for is the first step to building a compliant and successful company from day one.

Choosing the Wrong Business Activity

This is easily the number one mistake we see. An entrepreneur, eager to get their licence, picks a business activity that sounds about right but doesn’t quite cover their long-term plans. They might register for "IT Consultancy" but soon find they want to branch into software development or hardware sales.

That creates an immediate compliance problem. Your trade licence strictly defines what your business is legally allowed to do. If you operate outside that scope, you risk fines or even having your licence suspended.

Here's a real-world scenario: A marketing consultant registers her business under a general consulting activity. Six months later, she lands a major client who also needs her to manage their paid advertising spend. Because "Media Buying" wasn't on her initial licence, she's stuck. She either has to turn down the extra work or begin a costly and time-consuming amendment process.

Underestimating the Total Budget

Many entrepreneurs get drawn in by the attractive "starting from" prices you see advertised for free zone packages. The reality is, these baseline figures rarely tell the whole story. That initial package price is just one piece of a much larger financial puzzle.

It's critical to map out the all-in cost, which often includes things like:

- Visa Fees: Don't forget the separate costs for entry permits, medical tests, Emirates ID biometrics, and the final visa stamping.

- Establishment Card: This is a mandatory fee for your company's immigration file.

- Hidden Admin Fees: Some free zones have small but cumulative charges for things like document processing or name approvals.

- Bank Account Deposits: Many UAE banks require a minimum balance or a hefty initial deposit, which ties up your working capital.

Getting this wrong can put you in a tough cash-flow position right when you need funds the most. We believe in total transparency, which is why we provide cost-effective, tailored, and itemised quotes so you have a realistic financial picture from the get-go.

Getting your budget wrong isn't just an inconvenience; it can cripple your business before it even starts. Always add a 20-25% contingency to your initial setup estimate to cover unforeseen costs and give yourself a financial buffer.

Misunderstanding Free Zone Limitations

A free zone licence is fantastic for international trade and 100% ownership, but it comes with one very important limitation: you cannot trade directly with customers on the UAE mainland. This is a fundamental rule that many newcomers completely overlook.

Imagine this: An e-commerce business sets up in a free zone, building its entire model around selling products directly to consumers in Dubai and Abu Dhabi. They quickly discover they can't legally do this without engaging a mainland distributor or setting up a whole separate mainland entity. Their business plan is based on a flawed assumption.

Understanding this distinction is key. As specialists in both Freezone and Mainland Company Formation in Dubai, Sharjah & Abu Dhabi, we help you design a corporate structure that actually gives you the market access you need.

Ignoring Post-Setup Compliance

Getting your licence and visa is a huge milestone, but it's not the end of your administrative duties. The UAE has several critical compliance regulations that apply to all businesses, including those in free zones.

Two of the most important ones to stay on top of are:

- Economic Substance Regulations (ESR): This requires companies to prove they have a genuine operational presence and are conducting core income-generating activities in the UAE.

- Ultimate Beneficial Ownership (UBO): This mandates the declaration and registration of the ultimate owners or controllers of the company.

Ignoring these annual filings can lead to substantial financial penalties. Our Corporate PRO Services are designed to keep you ahead of these deadlines, ensuring your business stays compliant long after the initial setup is complete. With our 24/7 support service, you always have a partner to turn to for guidance.

Common Questions About Setting Up in a UAE Free Zone

When you're looking to set up a business in the UAE, a lot of questions come up. Here are some of the most common ones we get from entrepreneurs, with straightforward answers to help you plan your next move.

Can I Do Business on the UAE Mainland with a Free Zone Licence?

This is a big one, and it’s crucial to get it right from the start. As a general rule, a free zone company is restricted to doing business within its specific free zone or internationally. You can't just go out and start trading directly with customers on the UAE mainland.

If you need to reach the mainland market, you'll have to work with a local distributor or an agent. Another path is to set up a mainland branch of your free zone company, but that comes with its own registration process and costs.

Getting this right is absolutely fundamental to your business model's success. As specialists in both Freezone Company Formation and Mainland Company Formation in Dubai, Sharjah & Abu Dhabi, we can walk you through the best structure if you need a foot in both worlds.

What Is the Real Total Cost to Set Up a Free Zone Company?

You’ve probably seen ads for setup packages as low as AED 12,000, but it's important to know what you're actually getting. Those headline-grabbing numbers often leave out some pretty essential costs.

For a more realistic picture, a solo entrepreneur setting up with one visa should budget somewhere between AED 25,000 and AED 40,000 for the first year. This figure gives you a much better all-inclusive estimate that covers everything you'll actually need:

- Trade licence and registration fees

- The all-important Establishment Card

- Complete visa processing (entry permit, medical test, Emirates ID, and stamping)

- A flexi-desk or virtual office lease

- Our professional service fees

We believe in total transparency. Our quotes are always itemised, so you see exactly what you're paying for. No surprises, no hidden fees.

How Long Does the Entire Setup Process Actually Take?

Getting the trade licence can be surprisingly quick, sometimes just a couple of working days. But that’s only one piece of the puzzle. The full end-to-end journey—from submitting your first documents to having a residency visa in your passport and a corporate bank account ready to go—realistically takes about four to six weeks.

What causes delays? Usually, it's small things like incomplete paperwork, slow background checks, or the banks doing their thorough compliance checks. This is where having an experienced team makes a huge difference. Our expertise in Corporate PRO Services means we get everything right the first time, keeping your setup moving forward smoothly. Plus, with our 24/7 support service, you’re always in the loop.

Do I Really Need a Physical Office in a Free Zone?

Not always. Many free zones are incredibly flexible, especially for startups, consultants, or international entrepreneurs who don't need a big office space. You can get licensed and secure one or two residency visas with more cost-effective options.

Here’s what’s usually on offer:

- Flexi-Desk: This is the most popular choice. It gives you access to a shared co-working space for a certain number of hours each month and is very budget-friendly.

- Virtual Office: Essentially a business address for mail and official correspondence. It looks professional but doesn't include any physical workspace.

- Physical Office: If your business activities require it, or if you plan on hiring a larger team and need more employee visas, you'll need a dedicated, private office space.

We can help you figure out what you actually need so you're not paying for space you won't use. It’s all about finding the smartest, most efficient solution for your business.

Ready to start your UAE free zone business setup with a team that offers practical solutions and unmatched support? As specialists in company formation, visa services, and more, PRO Deskk is here to guide you every step of the way.

📞 Call Us Now: +971-54-4710034

💬 WhatsApp Us Today for a Free Consultation