Choosing the right trade license zone in Dubai is the single most important decision you'll make as an entrepreneur here. It sets the stage for everything that follows: who you can sell to, your ownership structure, and the rules you'll operate under.

There are three main options on the table—Mainland, Free Zone, and Offshore. Each is built for a different kind of business, so picking the right one from the get-go is critical for your long-term success.

Choosing Your Business Jurisdiction in Dubai

Think of it like choosing a location for a shop. Do you need a spot on the high street, right in the middle of the action with local customers walking past every day? Or would a specialised business park, full of similar companies and offering unique perks, be a better fit? Maybe you don't need a physical shop at all, just a prestigious address for handling international deals.

Each choice has huge implications for how you'll run your business.

To make it simple, let's break it down with that analogy:

- Dubai Mainland: This is your high-street shop. Setting up here gives you total freedom to trade directly with anyone in the UAE market. You can bid on big government projects and open your office anywhere you like in the emirate.

- Free Zone: This is the specialised business park. Dubai has over 45 of these, each one a mini-ecosystem for specific industries like tech, media, or commodities. The big draws here are 100% foreign ownership and major tax exemptions.

- Offshore: This is your virtual office or international HQ. An offshore company is registered in the UAE, but it can't trade here. It's designed for holding assets, managing investments, and conducting global trade while enjoying significant tax advantages.

Mainland vs Free Zone vs Offshore: A Quick Comparison

Getting a handle on the core differences is the first step. Each setup is designed to meet different business goals, whether that's breaking into the local market or protecting international assets.

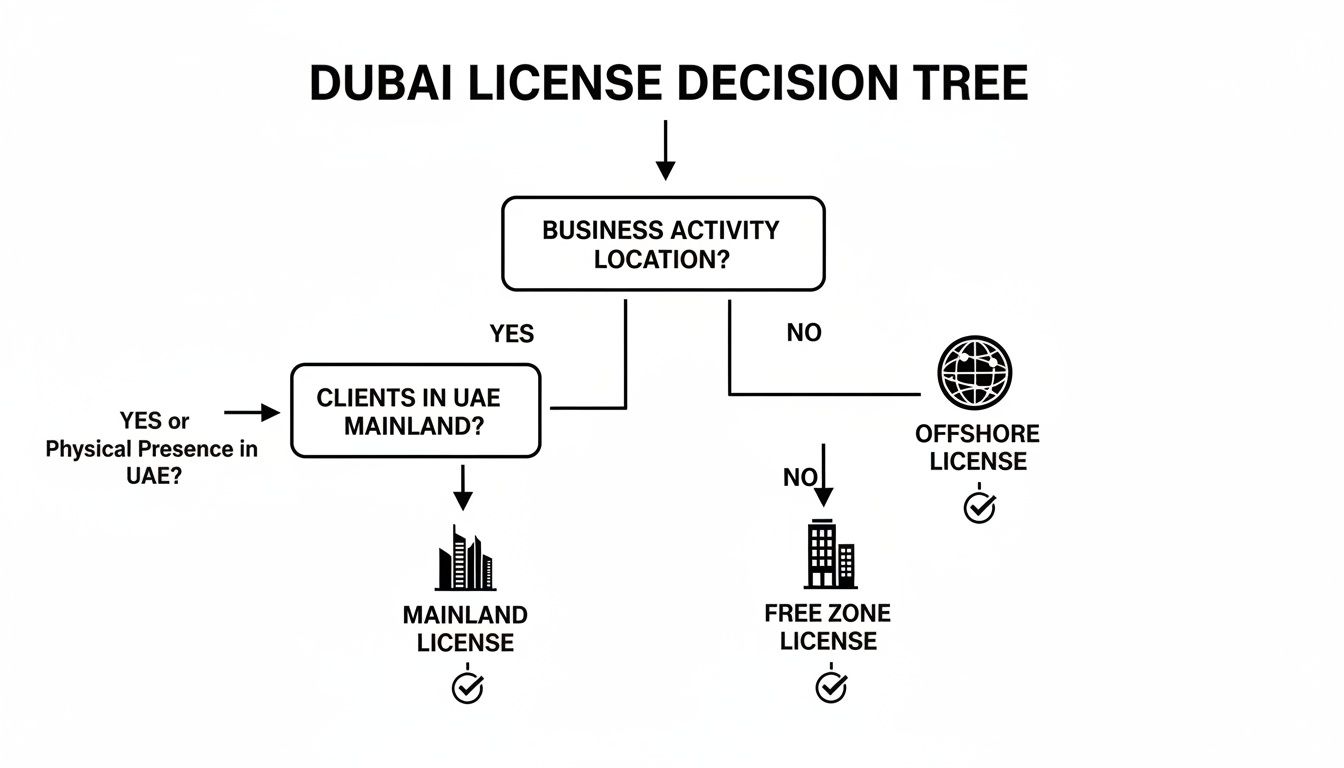

This decision tree gives you a clear visual path to figuring out which jurisdiction—Mainland, Free Zone, or Offshore—makes the most sense for what you want to achieve.

As you can see, your primary business activity and target customers will point you directly to the best licensing option. For a deeper look at the two most popular choices, check out our detailed guide on Free Zone vs Mainland in Dubai.

To spell it out even more clearly, here’s how they stack up against each other:

| Feature | Dubai Mainland | Dubai Free Zone | Dubai Offshore |

|---|---|---|---|

| Primary Market | Unrestricted access to the entire UAE market | Primarily international and other free zone trade | Exclusively international; no UAE trade |

| Ownership | 100% foreign ownership for most activities | 100% foreign ownership is standard | 100% foreign ownership is standard |

| Office Location | Can operate from any commercial space in Dubai | Restricted to within the chosen free zone | Virtual office only; no physical presence |

| Visa Eligibility | Yes, number of visas depends on office size | Yes, visa packages are typically included | No residency visas are issued |

| Best For | Retail, restaurants, local services, construction | Import/export, consulting, tech, global trade | Holding company, asset management, real estate |

Making the right choice from the start saves you from expensive and complicated restructuring down the road. It ensures your business is built on a solid foundation, perfectly aligning your operations with your vision for growth in the UAE's dynamic economy.

Dubai Mainland: Your Gateway to the Local UAE Market

If your business plan involves setting up a café in Downtown Dubai, opening a shop in a bustling mall, or launching a construction firm to bid on government projects, then a Dubai Mainland license is what you’re looking for. It’s the go-to choice for any entrepreneur who needs to trade directly with the local UAE market, without any restrictions.

Think of it as the master key to the city. It gives you the freedom to operate anywhere you like, from the historic streets of Deira to the modern towers of Dubai Marina.

This is what truly sets a Mainland setup apart—it removes the barriers between your business and your local customers. It’s the natural fit for restaurants, clinics, consulting firms with local clients, and any service company that needs a physical presence to connect with the domestic economy.

The appeal of direct market access is undeniable, and it reflects the UAE’s booming economic health. In fact, by the end of September 2025, the country is expected to have one million active commercial licenses, a huge indicator of investor confidence. Dubai is at the forefront of this growth, with sectors like building contracting and e-commerce seeing a massive surge in new licenses. You can explore more data on UAE business growth here.

Understanding Mainland License Types

In Dubai, the Department of Economy and Tourism (DET) is the authority that issues Mainland licenses. Picking the right one is absolutely critical for keeping your operations smooth and compliant.

There are three main categories you’ll encounter:

- Commercial License: This is for any business that involves buying and selling goods. Think of general trading companies, retail stores selling clothing or electronics, and import/export businesses.

- Professional License: Tailored for service-based businesses and skilled professionals. This covers everything from IT consultants and marketing agencies to beauty salons, artisans, and educational trainers.

- Industrial License: This license is required for any business that manufactures, produces, or processes goods. This applies to factories, food processing units, and assembly plants.

Ownership and Key Considerations

One of the biggest game-changers for Mainland company formation has been the move to allow 100% foreign ownership for most commercial activities. This has made the Mainland an even more competitive trade license zone in Dubai, putting it on par with many free zones in terms of ownership control.

Of course, some strategic sectors might still have specific ownership rules. It’s also important to note that certain Professional Licenses require you to appoint a Local Service Agent (LSA).

An LSA is a UAE national who acts as your company's representative for administrative tasks with government departments. They don’t hold any shares or have a say in how you run your business. Their role is purely to help with paperwork and ensure official processes run smoothly.

Appointing an LSA is a small trade-off when you consider the huge benefits that come with a Mainland setup.

Weighing the Pros and Cons

Choosing a Mainland license means balancing its powerful advantages against a few practical considerations. Getting a clear picture of both sides will help you make a decision that supports your long-term goals.

Advantages of a Mainland License:

- Unrestricted Market Access: You can trade directly with any customer or company anywhere in the UAE. No limits.

- Prime Location Flexibility: Set up your office, shop, or clinic wherever you want in Dubai.

- Government Contracts: Your company will be eligible to bid on large and often lucrative government tenders.

- 100% Foreign Ownership: For most activities, you maintain full control of your business.

Points to Consider:

- Local Service Agent (LSA): This is a requirement for many professional licenses and comes with an annual fee.

- Higher Initial Costs: In some cases, the setup fees and office rental costs can be higher than what you might find in a free zone.

Ultimately, a Dubai Mainland license is a strategic move for any business serious about tapping into the local UAE market. It offers the freedom and flexibility you need to build a strong brand and capture a real share of the domestic economy.

Exploring Dubai Free Zones: Your Gateway to Global Trade

While a Mainland licence gets you into the local UAE market, a Free Zone trade license is what you need to operate on the world stage. For international entrepreneurs, consulting firms, and e-commerce businesses, Dubai's Free Zones are powerful ecosystems built specifically for global growth, efficiency, and profit.

Think of a Free Zone as a specialised business district with its own set of rules designed to help you succeed internationally. These are designated economic areas with independent legal and regulatory frameworks, offering some serious incentives to attract foreign investment. For a lot of global businesses, this is the most compelling trade license zone Dubai has to offer.

What’s the big draw? It really boils down to three game-changing benefits:

- 100% Foreign Ownership: You keep full control over your company. There's no requirement for a local Emirati partner.

- 0% Corporate and Personal Taxes: This is a massive advantage, letting you maximise your profits and reinvest in your business.

- Full Repatriation of Profits: You have the freedom to send all your capital and profits back to your home country, with no restrictions holding you back.

A Quick Tour of Dubai's Top Free Zones

Dubai has more than 45 Free Zones, and each one is a buzzing hub tailored for specific industries. This creates a powerful network effect, putting you right next to your peers, suppliers, and potential clients in the same field. Figuring out their specialisations is the first step to choosing the right home for your business.

For instance, the Dubai Multi Commodities Centre (DMCC) is a global powerhouse for trading everything from gold and diamonds to tea and coffee. Then there's the Dubai International Financial Centre (DIFC), which basically operates like a city within a city. It has its own independent judicial system based on English common law, making it the undisputed epicentre for finance, banking, and fintech in the region.

Meanwhile, Dubai Silicon Oasis (DSO) is a dedicated tech park for everything from semiconductors to software development. Each zone offers a unique mix of infrastructure, networking events, and regulatory support to help businesses in its sector thrive. For a deeper dive into all your options, feel free to explore our detailed guide on Dubai Free Zone business setup.

Dubai Free Zone Comparison At a Glance

Choosing the right Free Zone is a huge decision. It directly impacts your costs, daily operations, and long-term growth. With so many choices on the table, it’s crucial to lay them out side-by-side and see how they stack up against your specific business needs.

This table gives you a quick snapshot of the key differences between some of the most popular jurisdictions.

| Free Zone Name | Primary Industry Focus | Key Benefits | Ideal For |

|---|---|---|---|

| DMCC | Commodities, Crypto, and Global Trade | World-class infrastructure, prestigious address, and strong networking community. | Trading companies, consultants, crypto-related businesses. |

| DIFC | Finance, Banking, and Legal Services | Independent legal framework, access to capital markets, and a global talent pool. | Banks, asset managers, law firms, and fintech startups. |

| JAFZA | Logistics, Trading, and Manufacturing | Direct access to Jebel Ali Port, excellent logistics network, and warehouse facilities. | Import/export, manufacturing, and distribution companies. |

| Dubai Silicon Oasis | Technology and Innovation | Integrated tech ecosystem, R&D support, and smart city infrastructure. | Tech startups, software developers, and IT service providers. |

| Sharjah Media City (Shams) | Media, Creative, and E-commerce | Cost-effective packages, flexible licensing options, and a simple setup process. | Freelancers, media agencies, and e-commerce businesses. |

Making sense of these options is the first step, but the nuances between them can make or break your setup experience.

Why You Shouldn't Go It Alone

Navigating Dubai's diverse Free Zone landscape takes real local knowledge. Every zone has its own rulebook, documentation requirements, and fee structures. If you try to manage this process on your own, you can easily run into expensive delays and compliance headaches. This is where getting professional support becomes a real asset.

Dubai's free zones are the engine of its business growth, accounting for a massive 53% of all free zone licenses in the UAE, with over 112,000 licenses active as of late 2024. This popularity is fuelled by a post-pandemic boom that saw the sector grow by nearly 200% since 2020. This intense competition makes expert guidance key to entering the market successfully.

Working with specialists in Freezone Company Formation makes the entire setup process smooth and efficient. An expert partner will help you pinpoint the perfect zone for your business, prepare all the necessary legal documents, and handle communications with the authorities for you. It frees you up to focus on your business strategy, knowing all the administrative heavy lifting is being taken care of correctly from day one.

The Strategic Edge of an Offshore Company

While Mainland and Free Zone companies are all about operating within the UAE, an offshore company plays a completely different game. It’s not a license for trading here but a powerful tool for managing your international business, assets, and investments from a secure, tax-friendly base.

Think of it like this: an offshore company is your global command centre or a secure vault with a prestigious UAE registration. It exists legally but doesn't have a physical office or conduct any business inside the country. Its real purpose is to provide a solid corporate structure for entrepreneurs and investors who operate on the world stage.

This unique setup is the go-to choice for very specific international goals where local trading just isn't part of the plan.

Core Functions of an Offshore Company

An offshore setup isn’t for every business—it's a specialised instrument designed for international operations. Entrepreneurs typically use it to gain strategic advantages that a regular trading company simply can't offer.

So, why would you set one up? The most common reasons include:

- Asset Holding: Securely holding shares in other companies, whether they're inside or outside the UAE. This makes it a perfect parent or holding company.

- Property Ownership: Owning real estate in approved freehold areas within Dubai or anywhere else in the world.

- Intellectual Property Management: Holding copyrights, patents, and trademarks, which makes collecting international royalties much more straightforward.

- International Consulting: Providing professional services to clients located anywhere outside of the UAE.

For anyone structuring complex international ventures, the offshore option is often an essential piece of the puzzle. For a deeper dive into the setup process, you can explore our guide on setting up an Offshore company in Dubai.

Leading Offshore Jurisdictions in the UAE

When you're looking at this particular trade license zone in Dubai, two jurisdictions really stand out because of their strong legal frameworks and global reputation. Both offer a secure and respected environment for your business activities.

An offshore company is fundamentally a non-resident entity. This means it is prohibited from conducting any trade within the UAE, cannot lease a physical office, and is not eligible to sponsor residency visas for its shareholders or employees.

The top choices for setting up an offshore company are:

-

Jebel Ali Free Zone Authority (JAFZA): A globally recognised name. A JAFZA Offshore company is highly respected by international banks and institutions, making it a prime choice for corporate structuring and holding assets, especially real estate in Dubai.

-

Ras Al Khaimah International Corporate Centre (RAK ICC): Known for being flexible and cost-effective, RAK ICC is a popular option for international trade, wealth management, and holding global assets. It also offers a modern legal framework based on common law principles.

Both jurisdictions deliver the core benefits investors are looking for: confidentiality, simplified compliance, and asset protection. By choosing an offshore company, you’re creating a strategic vehicle designed to protect your assets and optimise your international tax planning, all while taking advantage of the UAE's stable and reputable corporate environment.

How to Get Your Dubai Trade License Step by Step

Getting your trade license in Dubai isn't some complex puzzle; it's really just a sequence of logical steps. Think of it like building a house – you need a solid foundation before you can even think about putting up the walls.

The whole process starts long before you fill out a single form. It begins with you, mapping out the core of your business—what you’ll do, who you’ll serve, and crucially, where you'll operate from.

Stage 1: Laying the Groundwork

Before you even dream of approaching the authorities, there are three foundational decisions you have to nail down. These choices will set the entire path for your business setup, dictating everything from the paperwork you’ll need to the final cost. Getting this stage right is the key to a smooth ride.

First up, you need to define your business activities. Are you setting up a café, an e-commerce store, a consulting firm, or a small manufacturing unit? This decision is what determines whether you'll need a Commercial, Professional, or Industrial license.

Next, you've got to choose your legal structure. A lot of entrepreneurs go for a Sole Establishment if they're the single owner, or a Limited Liability Company (LLC) if there are multiple shareholders. This choice impacts your personal liability and how the business is run day-to-day.

Finally, you need to select a trade name for your company. This isn't just about branding; the name has to be unique and follow the UAE's naming rules—that means no offensive language or religious references. Once you've picked a name, you’ll reserve it with the authorities to make sure it’s yours for the taking.

Stage 2: The Official Application Process

With your business blueprint ready, it's time to make things official. This is where your vision starts to become a legal reality, and it involves gathering documents and getting the right permissions to operate.

Your first move is to apply for an Initial Approval. This is basically a preliminary green light from the Department of Economy and Tourism (DET) or your chosen Free Zone authority. They’re essentially saying, "We have no objection to your business idea." It's a critical step to get before you sign any rental contracts or spend serious money.

Once you have that approval, you'll need to prepare some key legal documents. For most company types, this means drafting a Memorandum of Association (MOA). This document is like your company's constitution, outlining the business activities, shareholder details, and ownership splits. For some professional licenses, you might also need to bring a Local Service Agent on board.

A non-negotiable part of getting any trade license is having a registered physical address. You must sign a tenancy contract—for an office, a flexi-desk, or a warehouse—and get it registered through the Ejari system for mainland companies. This is your proof that you have a physical presence in Dubai.

Stage 3: Finalising Your License and Visas

With all your documents in hand and your office space secured, you're on the home stretch. Now you can submit your final application and get that trade license.

Here's what that looks like:

- Submit all your paperwork to the right authority. This usually includes passport copies for all partners, the MOA, your tenancy contract, and the initial approval certificate.

- Pay the final government fees. Depending on your license type, jurisdiction, and how many visas you need, this can range anywhere from AED 15,000 to AED 35,000.

- Receive your trade license. After your payment is confirmed and all documents are verified, the authority will issue your license. This typically happens within 3 to 7 business days.

Once you have that shiny new trade license, you can apply for your company’s Establishment Card. This then allows you to start the visa process for yourself, your employees, and even your family. This is the final step that turns your registered company into a fully operational business, ready to make its mark in Dubai.

Why a Business Setup Partner Is Your Smartest Move

Let's be honest: figuring out which trade license zone Dubai is right for you can feel like a full-time job. The process is a maze of critical decisions, mountains of paperwork, and back-and-forth with government departments. It's enough to pull your focus away from what you should be doing—growing your business.

This is exactly where a business setup partner comes in. Think of us not just as a service provider, but as a strategic ally dedicated to getting you across the finish line smoothly. Instead of you spending hours trying to understand regulations and chase down approvals, our team of specialists handles every single detail.

Your End-to-End Support System

A real partner doesn't just help you form a company and then disappear. We're here for the entire journey, offering a complete suite of services designed to keep your business compliant and successful long-term.

Our team has deep expertise in:

- ✅ Specialists in Mainland Company Formation in Dubai, Sharjah & Abu Dhabi

- ✅ Specialists in Freezone Company Formation across the UAE

- ✅ Specialists in Golden Visa on Property and Investor Visa

- ✅ Specialists in Corporate PRO Services and Attestation Services

Dubai's business world is always shifting. The Department of Economy and Tourism (DET) is constantly rolling out reforms to make things easier for foreign investors, especially under the D33 agenda. While these changes are great news, you need up-to-the-minute knowledge to actually benefit from them. Learn more about Dubai’s latest trade license reforms here.

More Than a Service, A Partnership

Choosing the right partner means you're never navigating this process alone. With our 24/7 support service, you have a direct line to an expert whenever a question pops up. We're always here when you need us. That peace of mind is priceless, freeing you up to concentrate on your core operations.

The greatest benefit is efficiency. A business setup partner streamlines every process, from initial registration to securing visas and opening bank accounts, preventing costly delays and ensuring you become operational faster.

To really succeed here, your business needs more than just a license. It needs a solid financial footing, which is why effective financial planning is so critical. We deliver cost-effective business setup solutions tailored to your needs, helping you manage your budget while you enjoy UAE tax benefits for international entrepreneurs. This holistic approach ensures your new venture is built to last in one of the world's most exciting markets.

Frequently Asked Questions About Dubai Trade Licenses

Getting your head around Dubai's business setup rules can bring up a lot of questions. Here, we've tackled some of the most common queries we hear from entrepreneurs when they're trying to choose the right trade license zone in Dubai.

What Is the Total Cost of a Dubai Trade License?

This is the big question, and the answer really depends on your specific business. As a ballpark figure, you can expect the total cost for a new license to fall somewhere between AED 15,000 and AED 35,000.

What causes such a wide range? A few key things:

- Jurisdiction: Mainland and free zone setups have completely different fee structures.

- Business Activity: If your business needs special approvals from external ministries, that will add to the cost.

- Office Space: A simple flexi-desk is much cheaper than a dedicated physical office or warehouse.

- Visa Quota: The more employee visas you need, the higher the government fees will be.

For a clear picture of what your business will cost, it's always best to chat with a setup specialist who can give you a detailed breakdown based on your needs.

Can a Foreigner Own 100% of a Business in Dubai?

Yes, absolutely. This is one of the biggest and most welcome changes in recent years. For most business activities, 100% foreign ownership is now the standard on the Dubai Mainland.

And in the free zones? That’s always been one of their main attractions. You get complete control over your company without ever needing a local Emirati partner or sponsor.

How Long Does It Take to Get a Trade License?

The process is surprisingly quick and efficient. Once you’ve submitted all the correct documents and paid the fees, you can typically have your trade license in hand within 3 to 7 business days.

Some free zones even offer fast-track options that can speed things up further. Of course, the timeline can shift depending on how complex your business activity is and which jurisdiction you’ve chosen.

Working with a professional firm is the best way to avoid common mistakes that cause delays. We make sure your application is perfect the first time, getting you up and running as fast as possible.

Do I Need to Live in Dubai to Own a Company?

No, you don't. You are not required to be a UAE resident to own a company here. Many international entrepreneurs run their Dubai businesses successfully from all over the world.

However, if you do want to live and work in the UAE, your company can sponsor your residency visa. It's a very straightforward process once the trade license and company Establishment Card are issued. This flexibility is what makes Dubai such a popular hub for global business owners.

Navigating the specifics of each trade license zone in Dubai is what we do best. At PRO Deskk, we provide cost-effective, end-to-end solutions, from Mainland and Freezone company formation to visa processing and PRO services, all backed by 24/7 support.

📞 Call Us Now: +971-54-4710034

💬 WhatsApp Us Today for a Free Consultation at https://prodesk.ae