Thinking about setting up a business in Dubai? It's a fantastic move, opening you up to a buzzing international marketplace. But your first big decision is where to plant your flag: on the mainland or in one of the many free zones?

While a mainland company gives you direct access to the local UAE market, Dubai's free zones offer a compelling alternative, especially for foreign investors. These are special economic areas with their own regulators, designed to cut through the usual red tape you might find elsewhere.

Why a Dubai Free Zone Is Your Next Smart Move

The appeal is crystal clear. For any international entrepreneur, being able to own 100% of your company without needing a local partner is a game-changer. This, combined with zero personal income tax and the freedom to send all your profits back home, makes it an incredibly attractive package.

The Strategic Edge of a Free Zone Setup

Dubai's free zones aren't just plots of land; they're curated business ecosystems. Each one is tailored to a specific industry, whether that's tech, media, finance, or commodities. This means you’re not just getting an office—you’re joining a community with world-class infrastructure and powerful networking opportunities right on your doorstep.

This targeted approach works. Just look at the numbers. Dubai's free zone economy is booming, with hubs like the Dubai International Financial Centre (DIFC) seeing a massive 32% surge in new company registrations in the first half of 2025 alone. It’s a trend driven by international founders, who now account for over 60% of new business setups. You can dive deeper into these trends over at Square Zone.

Here’s a crucial point to remember: a free zone company can trade freely within its own zone and internationally. But if you want to do business directly on the UAE mainland, you'll usually need to work with a local distributor or agent.

Dubai Free Zone vs Mainland Key Differences at a Glance

Choosing between a free zone and the mainland really boils down to your business model. To help you see the differences clearly, here's a quick side-by-side look.

| Feature | Dubai Free Zone | UAE Mainland |

|---|---|---|

| Ownership Structure | 100% foreign ownership for nearly all activities. | Now also allows 100% foreign ownership for most sectors. |

| Business Scope | Can trade within the free zone and internationally. | Unrestricted access to the entire UAE market and government projects. |

| Regulatory Body | Governed by its own independent free zone authority. | Regulated by the Department of Economic Development (DED). |

| Office Space | Flexible options, including cost-effective flexi-desks. | A physical office lease is mandatory. |

Ultimately, a free zone setup is often the faster and more straightforward route for international entrepreneurs. However, if your primary goal is to trade directly within the broader UAE market, a mainland license might be the better long-term strategy. Understanding these distinctions from the start is the first step to building a successful business here.

Choosing the Right Free Zone and License for Your Business

Picking the right free zone and business license isn't just a bit of admin; it's the strategic bedrock for your entire UAE operation. With nearly 30 free zones in Dubai alone, each with its own niche, costs, and culture, getting this choice right from the start is absolutely critical.

Think of each free zone as a purpose-built city for a specific industry. If you’re a fintech startup, you’ll feel right at home in the Dubai International Financial Centre (DIFC), surrounded by financial giants and venture capitalists. On the other hand, if your business is all about global trade and logistics, you’d find your perfect ecosystem at Jebel Ali Free Zone (JAFZA), with its world-class port and infrastructure.

It’s simple: your business activity really dictates your destination. The goal is to plant your company in an environment where it can truly thrive, surrounded by potential clients, partners, and the specific facilities you need.

Aligning Your Business Model With a Free Zone

To start narrowing down your options, you need to weigh your core business model against what each zone brings to the table. Don't just look at the price tag; think about the strategic value. A media production house, for example, will get immense value from the established network and studios in Dubai Media City. A health and wellness brand might flourish in Dubai Healthcare City.

As you do your homework, keep these key factors in mind:

- Industry Focus: Does the free zone actually cater to your sector? A specialised zone often means better support, relevant networking events, and a ready-made talent pool.

- Location and Accessibility: How important is it for you to be near an airport, seaport, or certain residential areas? Think about your clients and your team.

- Infrastructure and Facilities: What do you physically need to operate? High-end offices, warehouses, co-working desks, or even specialised equipment?

- Long-Term Costs: Look beyond the initial setup fee. You need to analyse the annual license renewal costs, office lease expenses, and any other potential hidden charges down the line.

A fundamental decision for any entrepreneur is the business structure itself. While many principles are universal, it's worth getting your head around the core differences by comparing limited company vs sole trader structures, which influences everything from liability to tax and admin. This choice will directly impact the type of license you end up applying for.

Decoding the Different License Types

Once you have a shortlist of potential free zones, the next step is nailing down the correct license. This is what legally defines the scope of what your business can and cannot do. It’s crucial that the license you choose matches the services you plan to offer, precisely.

Here’s a quick rundown of the most common types:

- Commercial License: This is your go-to for any business involved in buying and selling goods. Think general trading, import/export, or logistics. A company distributing electronics, for instance, would need this.

- Professional License: Built for service-oriented businesses and professionals. This covers consultants, marketing agencies, designers, and IT specialists. An architectural firm or a business consultancy would fall squarely in this category.

- E-commerce License: As the name suggests, this is specifically for online businesses selling goods and services. It’s essential for any digital storefront operating from a Dubai free zone and provides the legal framework for online payment gateways.

- Industrial License: This one’s required for companies involved in the hands-on work of manufacturing, processing, packaging, and assembling products. A business that makes custom furniture or packages food products would need an industrial license.

Choosing the wrong license can lead to significant fines and even operational restrictions. It is absolutely crucial to be precise about your business activities from day one. Our team specialises in Freezone Company Formation across the UAE and can help you make the perfect choice.

Ultimately, getting the combination of the right free zone and the correct license right creates a powerful launchpad for your business. Imagine a tech startup developing a new app. They would thrive with a Professional License in Dubai Internet City. This pairing not only gives them the legal authority to operate but also drops them right into a vibrant tech ecosystem, opening up unmatched opportunities for growth and collaboration.

Your Step-by-Step Guide to the Application Process

You've picked the perfect free zone and license, so what's next? Now comes the paperwork and the actual application process. This is where getting the details right from the start is absolutely crucial, because even small mistakes here can lead to frustrating delays. The whole workflow is quite logical, but knowing what’s coming up makes the entire journey of setting up a company in a Dubai free zone feel a lot less daunting.

The very first thing on your to-do list is to get your company’s trade name approved. This isn't just about picking a name you like; the free zone authorities have strict rules. Your name can't be offensive, reference any religious or political groups, and, most importantly, it must be unique. I always tell my clients to come prepared with a list of three to five names, ranked in order of preference. It dramatically increases your chances of getting an approval on the first try.

With your trade name given the green light, you’ll dive into the main documentation phase. Seriously, an organised checklist at this point is your best friend. It stops you from missing that one critical document that could hold everything up.

Assembling Your Core Documents

While each free zone has its own slight variations, there's a standard pack of documents you'll need for that initial approval. Think of it as creating the foundational file for your new business. Having everything ready to go will speed things up immensely.

You'll almost always be asked for these:

- Passport Copies: Clear, valid copies for all shareholders and the person you’ve appointed as the manager.

- Business Plan: A solid but concise plan that explains what your business does, who your customers are, and your financial forecasts. For more specialised licenses, some free zones will want to see a much more detailed version.

- Application Form: The official form from your chosen free zone authority, filled out completely.

- Corporate Documents (If Applicable): If another company is a shareholder, you'll need its certificate of incorporation, memorandum of association (MOA), and a board resolution. Remember, these will need to be properly attested.

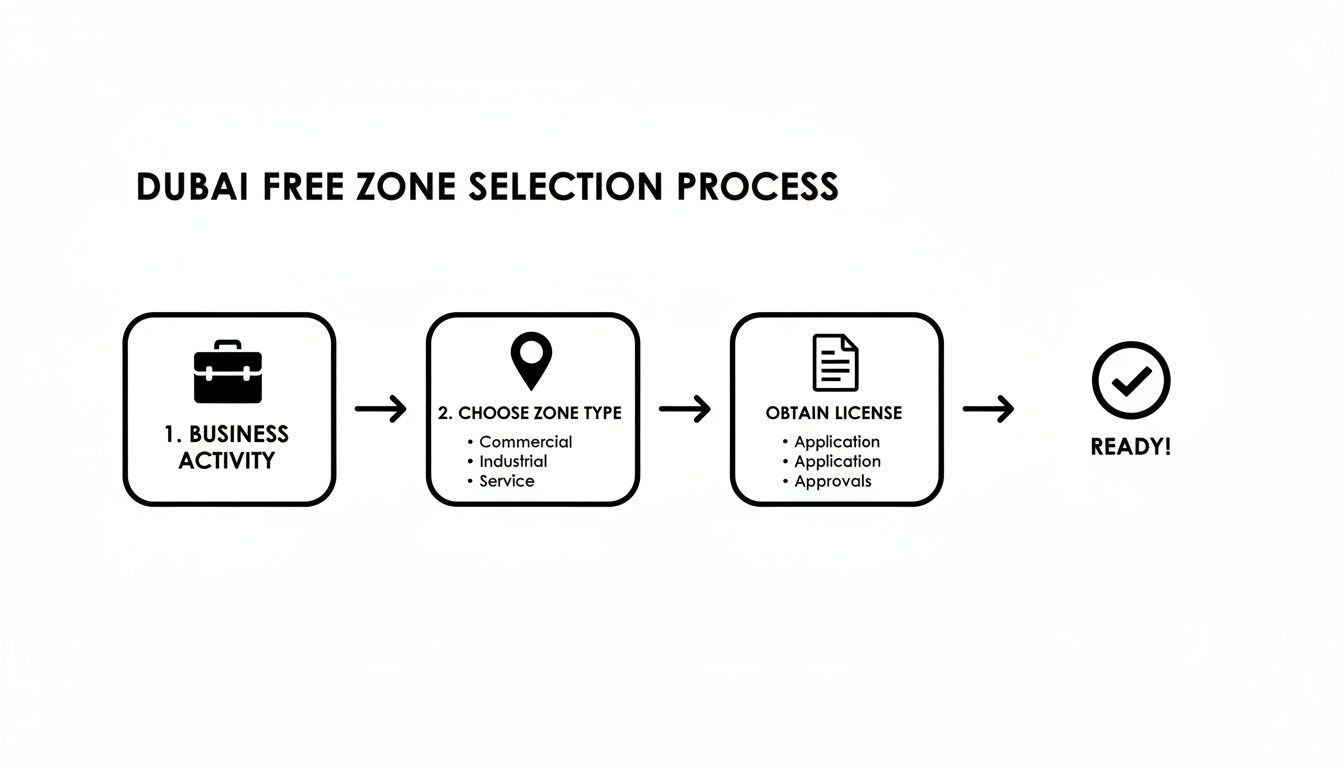

This flowchart breaks down the high-level process, showing how you get from defining your business activity to choosing the right zone and license, which all happens before you hit this documentation stage.

As you can see, each step logically builds on the last one, creating a clear pathway to getting your Dubai free zone company incorporated.

Drafting Key Legal and Lease Agreements

Once your initial documents are submitted and approved, you'll move on to formalising your company's legal structure and its physical address. A key part of this is the Memorandum of Association (MOA). This document is essentially your company's constitution, detailing the shareholding structure and business objectives. Most free zones provide a template, but it's vital to make sure it perfectly matches your shareholders' agreement.

At the same time, you need to sort out your office space. Every company in a free zone must have a registered address, which is linked directly to your lease agreement.

Here's a critical piece of advice: your choice of office space directly impacts the number of residency visas you can apply for. A basic flexi-desk package might only get you one or two visas, while a dedicated physical office unlocks a higher quota. This is a strategic decision that affects your future hiring plans.

For instance, a solo consultant starting out will find a flexi-desk is more than enough. But if you're a tech startup planning to hire three developers in your first year, you should really lease a small, serviced office right from the get-go to secure that visa allocation.

As specialists in Freezone Company Formation, we help clients find cost-effective solutions that fit their needs now and their plans for the future. Feel free to reach out for a Free Consultation on WhatsApp to talk through your options. After this, the final steps are signing the lease, finalising the MOA, and submitting everything to get your trade license issued.

Nailing Down the Costs and Timelines for Your Setup

Budgeting and planning your timeline are two of the most critical parts of setting up a company in a Dubai free zone. Getting a clear picture of the financial outlay and how long each stage will take is absolutely essential for a smooth launch, helping you avoid any nasty surprises down the road.

The costs aren't just a single fee; they're a collection of different charges that cover your registration, licensing, and physical presence. Think of it as a package where each component is vital for your legal operation. You need to account for everything, from initial one-time payments to the recurring annual expenses that keep your business in good standing.

Breaking Down the Core Setup Costs

So, what are you actually paying for? The main expenses fall into a few key areas. Every free zone has its own fee structure, but the components are generally consistent across the board, which makes it a bit easier to compare your options.

Here are the main costs you’ll run into:

- Company Registration Fee: This is a one-time charge paid to the free zone authority to officially register your new company. The amount can vary based on your chosen company structure.

- Annual License Fee: A recurring cost, this is what you pay each year to keep your business license active. The price often depends on the type of business activities you're doing, usually ranging from AED 10,000 to AED 50,000 annually.

- Office Lease Expenses: Having a physical space is mandatory. Options range from affordable flexi-desks, which might cost around AED 15,000 to AED 20,000, to fully serviced offices. The choice you make here also directly impacts your visa eligibility.

- Visa Processing Charges: Each residency visa you apply for, whether for yourself or an employee, comes with its own set of government fees for processing, medical tests, and Emirates ID issuance.

Even with these costs, the financial advantages of the free zone model are compelling. While the UAE introduced a 9% corporate tax in 2023, qualifying companies in free zones can still benefit from a 0% rate on qualifying income. With free zone licenses starting from around AED 12,000 for basic packages, the entry point is remarkably accessible.

A key takeaway is that initial setup costs are just one part of the equation. Always factor in the annual renewal fees for your license and office lease to create an accurate three-year financial forecast. This prevents cash flow issues in your second year of operation.

Gauging Your Setup Timeline

Time is money, and knowing how long the process takes is just as important as knowing the cost. The timeline for setting up a company in a Dubai free zone can vary quite a bit, so it’s smart to plan for a realistic window rather than just the best-case scenario.

For a straightforward application with all your documents in perfect order, some free zones can issue a license in just a few working days. However, for more complex structures or specialised business activities that need external approvals, the process could stretch out to several weeks.

A typical timeline looks something like this:

- Initial Approval & Name Reservation: Usually takes 1-3 business days.

- Document Submission & Registration: This part takes about 5-10 business days.

- License Issuance: Happens 2-4 business days after all documents are approved and fees are paid.

- Establishment Card & Visa Processing: This can take an additional 2-4 weeks after your license is issued.

Our team are specialists in both Mainland and Freezone Company Formation across the UAE, offering cost-effective solutions tailored to your needs. For a detailed breakdown of potential expenses, check out our guide on Dubai free zone company setup costs. We're always here to help with 24/7 support.

Managing Visas, Bank Accounts, and Compliance After Setup

Holding your new trade licence is a fantastic milestone, but it really just signals the beginning of the next critical phase. The paperwork marathon isn't quite over. Now, your focus has to shift from simply incorporating the company to making it fully operational. This means activating your legal status, sorting out residency for your team, and getting your financial foundations in place.

The very first thing you need to do is apply for your company’s Establishment Card. Think of it as your company's official ID for immigration purposes. It's a small, credit card-sized document, but it's absolutely essential. Without it, your company legally cannot sponsor a single visa. This card is what officially registers your free zone entity with the immigration department, linking your trade licence to the entire visa system.

Securing Residency Visas for Your Team

Once the Establishment Card is in hand, you can finally start the residency visa process. For most international entrepreneurs moving to Dubai, this is the most anticipated step. It’s a methodical process with several stages, whether you're applying for yourself as the investor, bringing over key staff, or sponsoring your family.

Here’s what the typical workflow looks like:

- Entry Permit Issuance: This is the first document you'll get. It allows the applicant to enter the UAE or, if they're already here on a tourist visa, to change their status without leaving the country.

- Medical Fitness Test: A non-negotiable government requirement. It involves a standard blood test and a chest X-ray to screen for any communicable diseases.

- Emirates ID Biometrics: The applicant then has to visit a designated centre to give their fingerprints and have a photograph taken for their official Emirates ID card.

- Visa Stamping: After all the checks clear, the residency visa is physically stamped into the applicant's passport. This is the final step that makes their stay in the UAE official.

Once your company is set up, looking after the well-being of yourself and your employees is paramount. It’s a good idea to explore expat health insurance options in the UAE to understand the requirements and find the right coverage. Our team specialises in both the Golden Visa on Property and Investor Visas, offering end-to-end support to make the application as smooth as possible.

A critical insight for new business owners is that this entire process, from getting the entry permit to the final visa stamp, typically takes two to four weeks. Planning for this timeline helps manage expectations, especially for relocating staff, and ensures a much smoother transition.

Opening Your Corporate Bank Account

Opening a corporate bank account is another top priority. I'll be honest—this can be one of the most frustrating parts of the post-setup journey. UAE banks have incredibly strict due diligence and 'Know Your Customer' (KYC) requirements, and applications get rejected more often than you'd think, usually due to incomplete paperwork or an unclear business profile.

To give yourself the best chance, you need to present a clear, credible picture of your business. Banks want to see a solid business plan, proof of your professional background (a detailed CV helps), and evidence that your company has a real physical presence in the UAE.

A strong application usually needs:

- Comprehensive Company Documents: This means your trade licence, Memorandum of Association (MOA), and any share certificates.

- Shareholder and Manager Details: Have copies of passports, visas, and Emirates IDs for all key individuals ready.

- Proof of Business Activity: This is key. Show them initial invoices, draft contracts with potential clients, or even a professional company website.

Having a strong application from the get-go is everything. You can learn more about the specifics in our detailed guide on how to open a business bank account in Dubai.

Staying Compliant from Day One

Finally, your responsibilities don't end once the doors are open. The UAE has several ongoing compliance requirements that your free zone company must follow. Falling behind can lead to hefty penalties, so it’s vital to stay organised right from the start.

Key areas to watch are the Economic Substance Regulations (ESR) and Ultimate Beneficial Ownership (UBO) declarations. These rules require companies to prove they have genuine economic activity in the UAE and to maintain a clear register of who ultimately owns the business. Managing these filings properly ensures you remain in good standing with the authorities. As specialists in Corporate PRO Services, we handle these administrative headaches, allowing you to focus on growth with our 24/7 support service.

When to Partner with a PRO Services Expert

Let's be honest. Navigating the maze of government portals, document attestations, and free zone authority requirements can feel like a full-time job. This is usually the moment entrepreneurs realise that hiring a corporate services provider—often called a PRO services expert—is a strategic move, not just another cost.

Think of them as your official representative on the ground. These specialists liaise directly with government departments and free zone authorities for you. Their entire job is to handle the time-consuming admin that can easily pull your focus away from what really matters: building your business, connecting with clients, and mapping out your market entry.

The Value of an On-the-Ground Partner

Imagine you need a critical document attested by three different government bodies. Each one has its own unique process, specific working hours, and subtle nuances. A PRO services expert knows exactly where to go, who to talk to, and how to get the paperwork stamped and returned in record time. They can prevent weeks of potential delays.

Their expertise covers a whole range of essential tasks, including:

- Document Submission and Clearing: Making sure every form is filled out perfectly and submitted to the right department, avoiding common errors that cause rejections.

- Visa Processing Management: Handling the entire workflow for investor, employee, and family visas, from the initial application to the final stamping.

- Attestation Services: Managing the complicated process of getting corporate or personal documents legally verified for official use here in the UAE.

- Liaising with Authorities: Acting as your direct line of communication with free zone and government officials to sort out any queries without you having to step in.

Partnering with a PRO is about gaining an operational advantage. It's an investment in speed, accuracy, and peace of mind, allowing you to sidestep common pitfalls and accelerate your setup timeline.

Real-World Impact on Timelines and Efficiency

The efficiency of setting up a Dubai free zone company has improved dramatically. We’re now seeing some companies fully registered in just 6 to 15 days, and with an expert's help, most of this can be handled remotely. In fact, some free zones have streamlined their processes so much that they can issue a licence in less than an hour.

This is where a specialist truly proves their worth. Our team of experts in Corporate PRO Services provides cost-effective solutions designed for your specific needs, complete with 24/7 support. By taking the administrative weight off your shoulders, we ensure your journey to setting up a company in a Dubai free zone is as smooth as possible.

You can explore our complete range of PRO services in the UAE to see how we can help you get started faster.

Your Questions Answered: Dubai Free Zone Setup

When you're looking to set up a company in a Dubai free zone, a lot of questions pop up. Getting the right answers is key to planning your next steps with confidence. Let's tackle some of the most common queries we hear from entrepreneurs just like you.

Can My Free Zone Company Do Business on the Mainland?

This is easily one of the most frequent questions we get, and the answer isn't a simple yes or no. A free zone company is licensed to operate within its designated zone and internationally. However, it cannot trade directly with the UAE mainland market.

So, how do you reach mainland customers? Typically, you'll need to work with a local distributor or an agent who holds a license from the Department of Economic Development (DED). For service-based businesses, you can often issue invoices to mainland clients without a problem. But if you plan on selling goods directly or need a physical presence, you'll have to explore a proper mainland setup or find that local partner.

Our specialists can walk you through the best structure for your specific goals, whether that’s a Freezone Company Formation or a Mainland setup in Dubai, Sharjah, or Abu Dhabi.

What Is the Minimum Share Capital I Need?

The required share capital can vary dramatically from one free zone to the next. Some zones have done away with it completely, while others might ask for anything from AED 1,000 to AED 50,000 or more, depending on your business activity and company structure.

A good rule of thumb is that many of the popular free zones for startups have a standard requirement of around AED 50,000. It's crucial to confirm this with your chosen free zone authority, as you'll often need to deposit this amount into your new corporate bank account as proof of funds.

How Many Visas Can I Get with My License?

This is a common point of confusion. The number of residency visas you're eligible for isn't tied to your license itself, but directly to the size and type of your office facility. It all comes down to your lease agreement.

- Flexi-Desk or Co-working Space: This is the most budget-friendly option and usually gets you between 1 to 3 visas.

- Small Serviced Office: Leasing a small, private office can bump up your visa quota to anywhere from 2 to 6 visas.

- Larger Physical Office: For companies needing more room to grow, your visa allocation increases proportionally with the office size, which is measured in square metres.

As specialists in Investor Visas and Golden Visas, we make sure your office choice aligns perfectly with your hiring plans, so you get the visa allocation you need from day one.

At PRO Deskk, we're more than just a service provider; we're your strategic partner in the UAE. From navigating complex regulations to securing your visas and providing 24/7 support, we handle the administrative details so you can focus on growth.

✅ Specialists in Mainland Company Formation in Dubai, Sharjah & Abu Dhabi

✅ Specialists in Freezone Company Formation across the UAE

✅ Specialists in Golden Visa on Property and Investor Visa

✅ Specialists in Corporate PRO Services and Attestation Services

✅ 24/7 Support Service – Always here when you need us

✅ Cost-Effective Business Setup Solutions tailored to your needs

✅ Enjoy UAE Tax Benefits for International Entrepreneurs

📞 Call Us Now: +971-54-4710034

💬 WhatsApp Us Today for a Free Consultation: https://prodesk.ae