When you're looking to start a business in the UAE, your first big decision is the legal structure. For most entrepreneurs I talk to, the Limited Liability Company (LLC) is hands-down the most strategic way to go.

An LLC in UAE gives you a powerful mix of flexibility, direct market access, and protection for your personal assets, making it the top choice for both international investors and local founders aiming to build a serious presence here.

Why an LLC Is Your Strongest Move in the UAE

Setting up a Limited Liability Company isn't just a box-ticking exercise; it’s a strategic decision that unlocks the entire UAE economy. While other structures might fence you in, an LLC gives you a solid foundation to grow, letting you operate directly within the bustling local markets of Dubai, Abu Dhabi, Sharjah, and beyond. This setup is specifically built for businesses that want deep market penetration and long-term success.

The biggest advantage is direct access. A mainland LLC formation means you can trade with any other business in the UAE, bid on government contracts, and open physical shops or offices wherever you like. This is a massive difference compared to many Free Zone companies, which are often restricted to doing business within their specific zone or internationally.

Unlocking Full Market Potential

Think about it this way: say your business is a high-end consultancy firm wanting to land major contracts with big corporations in Abu Dhabi. A Free Zone company could run into roadblocks, but a Mainland LLC can bid on those projects without any issues.

Or maybe your dream is to open a chain of cafes across Dubai’s vibrant neighbourhoods. The LLC structure is really the only practical path to make that happen. This level of operational freedom is a core reason why the LLC is so popular.

The Limited Liability Company is more than just a legal structure; it's your all-access pass to the UAE's domestic economy. It removes the usual barriers and sets your business up for unrestricted growth, whether you're targeting government clients or local customers.

This structure also carries a lot of weight. Banks, suppliers, and government bodies tend to view a Mainland LLC with more confidence, which makes things like opening a corporate bank account or getting credit much smoother. That perceived stability can be a real asset when you're building business relationships.

Adapting to a Modernised Legal Framework

Recent changes to the law have made forming an LLC in the UAE even more appealing for foreign entrepreneurs. For many business activities, the old requirement for a local Emirati sponsor to hold a majority stake is gone. Now, you can have 100% foreign ownership of a Mainland company.

This has been a complete game-changer. It gives international investors full control over their operations and profits while still getting all the benefits of a Mainland license.

The numbers tell the story. The Limited Liability Company (LLC) is the most common business structure in the UAE, with around 70% of businesses choosing it for its flexibility and direct market access.

It’s worth noting that LLCs are subject to a corporate tax of 9% on profits over AED 375,000, which came into effect in June 2023. You can explore more about the business landscape and understand why so many entrepreneurs choose an LLC in UAE.

Choosing Your Jurisdiction: Mainland vs Free Zone

One of the first, and most important, decisions you'll make when setting up your LLC in the UAE is where to base your operations. This isn't just about picking an office location; it's a strategic choice that will define who you can do business with, your ownership structure, and what your costs look like down the road.

The two main paths are the UAE Mainland and the dozens of specialised Free Zones dotted across the Emirates.

Your business model is the deciding factor. Are you planning to open a retail shop in a Dubai mall? Maybe you’re providing services directly to companies in Abu Dhabi or hoping to bid on government contracts. If any of these sound like your plan, then a Mainland company is your only real option. It gives you unrestricted access to the entire UAE domestic market, which is a must-have for any business focused on local trade.

But what if your business is geared towards international trade, e-commerce, or consulting for clients outside the UAE? In that case, a Free Zone offers some serious advantages. These dedicated economic hubs often provide perks like 100% foreign ownership and tax exemptions, making them a magnet for global entrepreneurs.

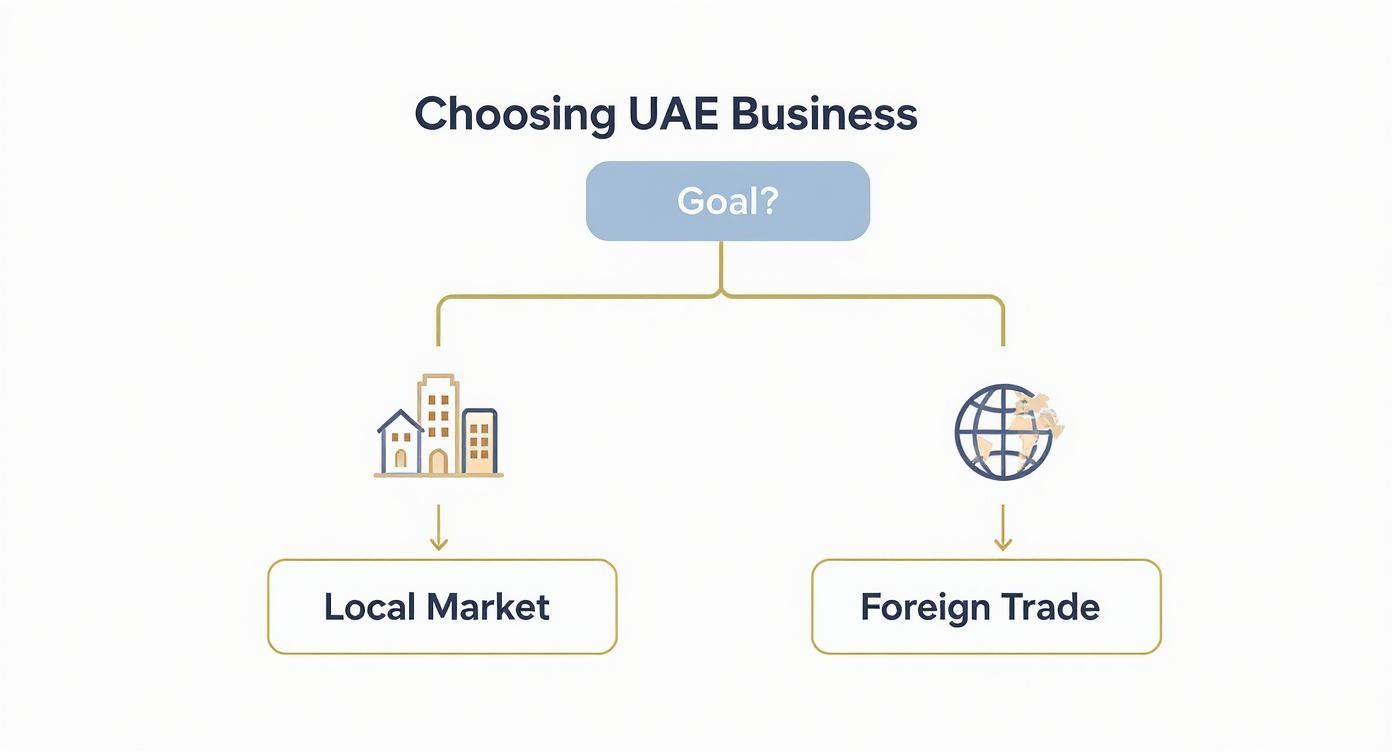

This decision tree visualises the core choice between targeting the local market with a Mainland setup or focusing on foreign trade through a Free Zone.

The key takeaway here is pretty simple: your primary business goal—serving local clients versus international ones—is the first and most important filter in this decision.

Understanding the Mainland Advantage

A Mainland LLC gives you the ultimate operational freedom within the UAE. It means you can set up shop anywhere you like—Dubai, Sharjah, Abu Dhabi—and trade without any limitations. This is absolutely critical for businesses that need a physical presence and direct access to customers on the ground.

Let's imagine you're launching a business to distribute premium Korean skincare products. To get those products into the hands of retailers and onto online platforms across the UAE, a Mainland licence is non-negotiable. It’s what allows you to legally import, store, and distribute goods anywhere in the country.

If you want to dive deeper, our guide on Mainland company formation in Dubai breaks down all the requirements and benefits in detail.

A Mainland LLC is your ticket to the entire UAE economy. It’s built for businesses that want to grow roots, build a local brand, and compete for the most lucrative contracts in the country.

This structure also carries a certain weight and credibility. You'll find that government bodies and large local corporations often prefer to work with Mainland companies, which can give you a real competitive edge.

To help clarify the differences, here is a breakdown of how the two jurisdictions stack up against each other on key business factors.

Mainland vs Free Zone LLC Key Differences

| Feature | Mainland LLC | Free Zone Company |

|---|---|---|

| Market Access | Unrestricted access to the entire UAE market | Restricted to the specific free zone and international markets. Requires a local distributor for mainland sales. |

| Ownership | 100% foreign ownership is now available for most activities | 100% foreign ownership is standard |

| Office Location | Can rent or own office space anywhere in the UAE | Must lease an office or facility within the designated free zone |

| Visa Eligibility | Generally based on office size; more flexible | Number of visas is often tied to the size of the leased facility |

| Government Contracts | Eligible to bid on government tenders and projects | Generally not eligible to bid directly on government contracts |

| Regulatory Body | Governed by the Department of Economic Development (DED) in the respective emirate | Governed by its own independent free zone authority |

Ultimately, this table shows that the choice isn't about which one is "better," but which one is the right fit for your specific business activities and long-term vision.

The Appeal of Free Zones

Free Zones are designated areas with their own set of rules and regulations, specifically designed to attract foreign investment. With over 40 Free Zones in the UAE, many are tailored to specific industries like media, tech, or commodities.

The main benefits that pull entrepreneurs towards Free Zones include:

- 100% Foreign Ownership: You keep full control of your business without needing a local partner.

- Tax Benefits: Many Free Zones offer exemptions from corporate and personal income taxes—a huge financial plus.

- Simplified Procedures: The setup process is often faster and involves less paperwork than a Mainland registration.

But there is a critical trade-off. A Free Zone company is generally restricted to doing business within its zone or internationally. To sell products or services directly on the Mainland, you usually need to go through a local distributor, which can add cost and complexity.

For instance, an e-commerce business based in a Free Zone can ship products to customers across the UAE. However, a consulting firm in that same zone can't directly service a client based in Downtown Dubai without navigating some extra regulatory hoops. This distinction is vital for aligning your jurisdiction with your growth strategy.

The LLC Formation Roadmap in the UAE

Setting up an LLC in the UAE can feel a bit like navigating a maze, especially for the first time. There's a clear sequence of steps you have to follow, and each one comes with its own set of rules and paperwork. But if you know the path, what seems complex becomes a very manageable, step-by-step process.

This is your practical guide for getting through each stage, from picking a unique business name right up to getting that official trade licence in your hands. We'll break it down, piece by piece, so you don't run into any dead ends.

The whole journey kicks off with two huge decisions that basically define your business from day one: your trade name and your business activities. Getting these right from the very start is absolutely critical for a smooth ride through the approval process.

First Things First: Your Trade Name and Business Activities

Your company's name isn't just a label; it's the very first thing people see. In the UAE, the Department of Economic Development (DED) has pretty strict guidelines for what you can call your business. Your chosen name has to be unique, can't violate public morals, and must steer clear of any religious or political references.

A crucial first step is figuring out how to effectively name your company in a way that both reflects your brand and ticks all the regulatory boxes. For instance, a name like "Global Elite Trading" is far more likely to get the green light than something vague or too casual. I always tell my clients to have a list of three to five names ready to go. That way, if your top choice is taken or doesn't meet the criteria, you're not back to square one.

At the same time, you'll need to lock in the specific business activities your LLC will carry out. The DED maintains a pre-approved list of over 2,000 activities, and your licence will clearly state exactly what you're permitted to do.

- Be specific: If you're planning to sell electronics, you must select the "Electronics Trading" activity. A generic "Trading" licence probably won't cut it.

- Think ahead: Where do you see your business in a few years? It’s often cheaper and easier to include potential future activities now, because adding them later means more fees and paperwork.

- Check for extra approvals: Be aware that certain fields like healthcare, education, or finance require special approvals from other government ministries. You absolutely have to factor this extra time into your setup plan.

Getting Your Core Legal Documents in Order

Once you have initial approval for your name and activities, it's time to draft the legal paperwork that forms the backbone of your LLC. These documents are non-negotiable; you can't get your licence without them.

The most critical document here is the Memorandum of Association (MoA). This is essentially the constitution of your company. It lays out everything from shareholder details and ownership percentages to how profits and losses are distributed and the responsibilities of each partner. The MoA must be drafted in both English and Arabic, and then notarised by a public notary in the UAE. This is one area where professional help is a smart investment to make sure everything is legally sound.

You can think of the Memorandum of Association as the blueprint for how your company is governed. A solid, well-drafted MoA can prevent a lot of headaches and shareholder disputes down the road by making everything crystal clear from the start.

Another piece of the puzzle is your office tenancy contract, which must be registered through the Ejari system in Dubai. A Mainland LLC requires a physical office address – a P.O. Box won't work. The DED needs to see proof of this registered lease agreement to issue your trade licence, as it confirms your company has a real, physical presence in the emirate.

The Final Stretch to Your Trade Licence

With your approved name, activities, notarised MoA, and Ejari all sorted, you're ready for the final submission. You'll package all these documents together with the main application form and copies of the shareholders' passports and visas and submit them to the DED.

The DED will then review your entire file. Assuming everything is in order, they'll issue a payment voucher for the licence fees. These costs can vary based on your specific business activities, the legal structure of your company, and any market fees tied to your office's location.

Once that payment is made, you're in the home stretch. The DED will issue your official trade licence. This is the document that legally allows you to start operating in the UAE. It’s the key that lets you open a corporate bank account, start hiring employees, and officially begin doing business. When handled efficiently, this whole process can be wrapped up in just a few weeks, turning your business idea into a fully operational, legally recognised LLC.

Keeping Your LLC Compliant and Healthy

Getting your trade licence is a massive milestone, but it’s the starting line, not the finish. To keep your LLC in UAE in good standing and sidestep any nasty penalties, your focus needs to shift from setup to ongoing upkeep. This means getting a handle on several non-negotiable annual tasks that are vital for your company's long-term health.

These aren't just boxes to tick; they are legal must-dos that show your company is active, legitimate, and playing by the rules. Drop the ball on these, and you could be looking at fines, blacklisting, or even having your trade licence frozen, which brings your entire business to a grinding halt.

Core Annual Obligations for Your LLC

First and foremost is the annual renewal of your trade licence. Think of it as renewing your company's permission slip to operate for another year. The process involves submitting up-to-date documents and paying government fees to the Department of Economic Development (DED) or your free zone authority.

Another piece of the puzzle is your physical office space. Your registered tenancy contract, known as Ejari, must also be renewed every year. For mainland companies, this is critical. The authorities see a valid lease as proof that your LLC has a real, tangible presence in the UAE. Letting this expire can throw a real spanner in the works for your licence renewal.

The Mandate for Audited Financial Statements

Beyond the basic renewals, there’s a much bigger compliance task that trips up many new business owners: the annual financial audit. Let me be clear—this isn't optional. Every single LLC in the UAE is legally required to prepare annual financial statements according to International Financial Reporting Standards (IFRS). These books must then be audited by an independent, UAE-licensed auditor.

This audit accomplishes several key things:

- Regulatory Compliance: It’s your proof of financial transparency and shows you’re following UAE Commercial Companies Law.

- Credibility: Need a bank loan or trying to attract investors? Audited financials are what they'll ask for.

- Corporate Tax: With UAE Corporate Tax now in effect, having clean, audited accounts is more critical than ever for accurate filing. Learn more in our guide on how to register for corporate tax in the UAE.

The requirement is spelled out clearly in the regulations. LLCs must not only renew their trade licences and report any company changes, but also bring in a registered external auditor to sign off on their financials.

An annual audit isn’t just a legal hurdle; it's a health check for your business. It gives you a clear, verified picture of your company's financial performance, builds trust, and makes sure you're ready for your tax obligations.

Building a Foundation for Sustainable Growth

Staying compliant is about more than just paperwork; it’s about building a solid operational foundation. This means keeping proper books, renewing employee visas and labour cards on time, and immediately notifying the authorities about any changes to your company structure, like bringing on a new manager or shareholder.

For example, if you add a new business partner, you must officially amend your Memorandum of Association (MoA) and update your records with the DED. Skipping this step can lead to serious legal headaches later on. It's also smart to protect your intellectual property to safeguard your LLC's most valuable assets.

A proactive approach here means your business can run smoothly, without the stress of fines or interruptions, letting you focus on what really matters: growth.

Why PRO Services Are Your Secret Weapon

Thinking of handling all the UAE government paperwork yourself? It's a common trap for new entrepreneurs, and honestly, it almost always ends in frustration, wasted time, and expensive mistakes. This is precisely where professional PRO (Public Relations Officer) services become your most valuable asset when setting up an LLC in UAE.

Think of a dedicated PRO team as your personal guide through the maze of UAE administration. They take on the complex, time-consuming processes that can easily overwhelm a business owner, freeing you up to actually run your company.

More Than Just Paperwork Pushers

It’s easy to think of PROs as just messengers running documents back and forth, but that’s a huge misconception. A top-tier corporate PRO service is a strategic partner, managing all your critical government interactions. We're talking about everything from getting your initial trade licence approvals and amendments to securing visas for you, your family, and your entire team.

These are specialists who know the exact, often unwritten, rules of different government departments, from the Department of Economic Development to the Ministry of Human Resources and Emiratisation. Their expertise is your best defence against the tiny errors that can derail your entire business launch.

Picture this: You’ve submitted a visa application, but a small detail in the Arabic translation of a job title isn't quite right. That one little slip-up could get the whole application rejected, forcing you to start the multi-week process all over again. An experienced PRO spots these potential problems before they even leave the office.

The Real Value of Expert Navigation

The benefits of using a professional PRO service go way beyond simple convenience. It's a direct investment in your company's efficiency, compliance, and speed to market.

Here’s what a good PRO service really brings to your business:

- Time Savings: Forget spending hours standing in queues at government offices. Your PRO handles all the submissions, follow-ups, and document collections for you.

- Error Prevention: With an in-depth understanding of the latest regulations, PROs ensure your applications are filled out correctly the first time, dramatically cutting the risk of rejection.

- Document Management: They manage the entire chain of paperwork—from document attestation and legal translation to corporate filings—making sure everything is properly prepared and certified.

- Visa Processing: This is a big one. PROs take care of the complete visa application lifecycle, including investor visas, employment visas for your staff, and residence visas for their families.

A professional PRO service is your company's official liaison with the government. They transform a confusing, time-consuming maze of regulations into a clear, managed process, ensuring your business stays compliant and operational from day one.

This kind of support is absolutely vital for international entrepreneurs who might not be familiar with local laws or fluent in Arabic.

A Practical Look at PRO Support

Let's look at a real-world scenario. A new e-commerce LLC in Dubai needs to bring on five employees to run its warehouse and logistics. That means securing work permits and residence visas for every single one of them.

A PRO service would manage this entire workflow from start to finish.

They’d begin by applying for the company’s establishment card and then move on to the visa quota application. Once that’s approved, they would guide each employee through their medical tests and biometrics appointments, submitting every required document to the immigration authorities. While all that is happening, you can focus on what matters—sourcing products and building your website.

This is the kind of hands-on management that makes these services so essential. To get a better sense of the full scope of support, you can explore detailed information on PRO services in Dubai and see how they can fit into your business setup plan. It’s about ensuring you can build your business, not get stuck in bureaucracy.

Your Partner for Success in the UAE

This guide has walked you through the essentials of setting up a successful LLC in the UAE, from the big Mainland versus Free Zone decision to keeping everything above board with compliance. It's a journey that takes careful planning and solid expertise, especially as the local business environment continues to shift.

We're seeing major regulatory changes, like the new foreign ownership rules and the introduction of corporate tax, which are reshaping how business gets done here. In fact, 94% of UAE businesses are now reporting that compliance has become more complex because of corporate tax. At the same time, foreign investment approvals have jumped by an incredible 67% since ownership rules were relaxed.

Navigating these updates is absolutely critical. You can learn more about what's happening in our deep dive into UAE corporate law trends.

Let us be your partner in turning your business vision into a reality. We specialise in handling these complexities so you can stay focused on what you do best: growing your company.

Your Dedicated Support System

✅ Specialists in Mainland Company Formation in Dubai, Sharjah & Abu Dhabi

We have deep experience across every critical area of company formation and management.

✅ Specialists in Freezone Company Formation across the UAE

Let us guide you to the right jurisdiction for your international business goals.

✅ Specialists in Golden Visa on Property and Investor Visa

Secure your long-term residency in the UAE with our expert visa assistance.

✅ Specialists in Corporate PRO Services and Attestation Services

Our team handles all government liaison and document processing to keep you compliant.

✅ 24/7 Support Service – Always here when you need us

You've always got someone in your corner to answer your questions and provide support.

✅ Cost-Effective Business Setup Solutions tailored to your needs

We put together practical packages built around what you actually require.

✅ Enjoy UAE Tax Benefits for International Entrepreneurs

We'll help you take full advantage of the UAE tax benefits available to global business owners.

Let’s work together to grab the incredible opportunities the UAE offers.

📞 Call Us Now: +971-54-4710034

💬 WhatsApp Us Today for a Free Consultation

Common Questions About Setting Up a UAE LLC

When entrepreneurs start exploring an LLC formation in the UAE, the same few questions always pop up. Let's tackle them head-on with some clear, straightforward answers based on what we see every day.

What's the Biggest Advantage of a Mainland LLC?

Hands down, the single greatest advantage is unrestricted market access. Think of a Mainland LLC as your all-access pass to the entire domestic UAE economy. This structure lets you trade directly with any customer or business anywhere in the country, whether they're in Dubai, Abu Dhabi, or any of the other emirates.

Beyond that, a Mainland LLC can bid for those valuable government contracts—an opportunity that's typically off-limits to companies based in a Free Zone. If your goal is deep market penetration and growing your business within the local commercial scene, this direct access is a game-changer.

Does Opening an LLC Get Me a Residence Visa?

Yes, absolutely. As an owner or shareholder in your new LLC, you're eligible to apply for an investor visa. This visa is your UAE residence permit, making it possible for you to live and work here legally.

Once your own investor visa is sorted, you can then sponsor residence visas for your family, like your spouse and children. You can also sponsor your employees, as long as your company meets the requirements set by the immigration and labour authorities. For international entrepreneurs looking to relocate and build a team in the UAE, this is a well-trodden and essential path.

One of the most significant personal benefits of establishing an LLC is the direct route it provides to UAE residency for yourself, your family, and your key staff, solidifying your long-term presence in the region.

What Are the Main Annual Costs for an LLC?

It's crucial to look beyond the initial setup fees and budget for the recurring annual costs that keep your LLC running and compliant. These aren't one-off expenses; they're ongoing commitments that are vital for keeping your company in good legal standing.

Here are the primary annual costs you should plan for:

- Trade Licence Renewal: This is a mandatory annual fee you'll pay to the Department of Economic Development (DED) to keep your business operations active.

- Office Rent: A physical office address is a legal must-have for a Mainland LLC. Your tenancy contract renewal will be a significant recurring cost.

- Visa Renewals: Every investor, employee, and family visa has renewal fees that need to be paid on time to remain valid.

- Annual Financial Audit: Your company is required by law to have its financial statements audited by a licensed firm each year, which is another necessary operational cost to factor in.

Keeping a close eye on these annual expenses is fundamental to the long-term health and success of your business here.

At PRO Deskk, we provide clear guidance and expert support through every stage of your business journey, from initial setup to ongoing compliance. Let us handle the complexities so you can focus on building your success in the UAE. Explore our complete business setup services at https://prodesk.ae.