So, what exactly is a Limited Liability Company (LLC) in the UAE? Think of it as a popular and robust business structure that gives entrepreneurs a crucial layer of financial protection. It creates a distinct legal entity, totally separate from you, the owner. This means your personal assets—like your home or savings—are shielded from business debts and any legal headaches the company might face. For international entrepreneurs looking to break into the local market, it's one of the most flexible and solid options out there.

Understanding the Limited Liability Company UAE Structure

Imagine your business has a protective shield around your personal finances—that's essentially what an LLC provides. It operates like a separate legal "person" that can own property, sign contracts, and be responsible for its own debts. It's this fundamental separation that delivers the "limited liability" benefit that is so attractive to business owners.

This structure is a bit of a hybrid, mixing the strong asset protection you’d get with a corporation and the simpler operational style of a partnership. For anyone coming from abroad, it offers a clear and trusted way to plant a flag in one of the world's most dynamic economic hubs. If you want to trade directly within the bustling local economies of Dubai, Abu Dhabi, or Sharjah, setting up an LLC is your key to unlocking that door.

The Shift to 100% Foreign Ownership

Now for the really big news: a truly game-changing development has completely revolutionised the UAE's business landscape. Not long ago, most mainland companies required a UAE national to hold a 51% share in the business, a system known as local sponsorship. But recent legal changes now permit 100% foreign ownership for a huge number of business activities.

This has made forming a limited liability company in the UAE more appealing than ever before, giving foreign investors complete control and autonomy. It tears down a major barrier, allowing entrepreneurs to fully own and steer their ventures on the mainland. It’s a clear signal of the UAE's commitment to building a welcoming and competitive environment for global business.

For international entrepreneurs, this means you can now establish a mainland company without a local partner, enjoying full control over your operations while still benefiting from the UAE’s strategic location and favourable tax system.

Core Advantages for Entrepreneurs

Opting for an LLC structure brings a host of immediate and long-term benefits. These advantages are precisely why so many investors choose this model for their UAE ventures.

- Direct Market Access: A mainland LLC can trade freely across the UAE and internationally. Crucially, it also allows you to bid on lucrative government contracts.

- Asset Protection: As we've touched on, your personal assets are kept safe from company liabilities, which offers invaluable peace of mind.

- Operational Flexibility: This structure is incredibly versatile, covering a wide spectrum of business activities—from trading and e-commerce to consulting and industrial operations.

- Credibility and Trust: Operating as an officially registered LLC instantly boosts your company's reputation with clients, suppliers, and banks.

- Visa Eligibility: It provides a straightforward path to getting investor visas for owners and employment visas for staff, which is essential for building your team on the ground.

Ultimately, forming an LLC is a strategic move that lays a solid legal foundation for growth. With expert guidance from specialists in mainland and free zone company formation, you can navigate the process efficiently and make sure your business is built on a compliant and powerful structure right from day one.

Why a UAE LLC is More Than Just a Licence—It’s Your Strategic Edge

Setting up a Limited Liability Company in the UAE is far more than a box-ticking exercise. Think of it as a strategic move that gives your business a serious competitive advantage right out of the gate. These aren't just abstract legal perks; they are tangible benefits that directly boost your bottom line and give you the freedom to operate and grow. For any international entrepreneur looking to make their mark here, getting to grips with these advantages is the first step toward success.

At its core, the LLC structure provides a powerful shield for your personal assets. It builds a solid wall between your business finances and your personal wealth. So, if the company ever hits a rough patch or faces a legal claim, creditors can only go after the business's assets. Your home, your savings, your personal property—they all remain safely out of reach.

Get Full Access to the Entire UAE Market

One of the biggest draws of a mainland limited liability company UAE is the complete, unrestricted market access it provides. Unlike other setups that might box you into a specific free zone, a mainland LLC can trade with any customer or company, anywhere in the UAE. From Dubai to Abu Dhabi and across all seven emirates, the market is wide open.

This is a game-changer if your goal is to capture a wide customer base. What’s more, it makes your company eligible to bid on lucrative government contracts—a massive revenue stream that many other business types simply can't access. Being able to engage directly with the entire local economy is fundamental for long-term, sustainable growth.

Scale Your Team Without Visa Headaches

As your business expands, you'll need to hire more people. A mainland LLC gives you the flexibility to apply for multiple employee visas, which is absolutely critical for scaling your operations. You won’t be held back by the strict quotas you often find in other jurisdictions.

This means you can bring on the talent you need, exactly when you need it, and build a strong local team to drive your business forward. The LLC structure also offers a clear route for owners and investors to secure their own residency. For those with a bigger picture in mind, our specialists in the Golden Visa on Property and Investor Visa can weave your long-term residency plans right into your business setup strategy.

Take Advantage of a World-Class Tax System

The UAE’s tax-friendly environment is a huge pull for entrepreneurs worldwide, and an LLC is perfectly set up to make the most of it. The UAE has a very competitive Corporate Tax rate of just 9%, but it only applies to profits that exceed AED 375,000.

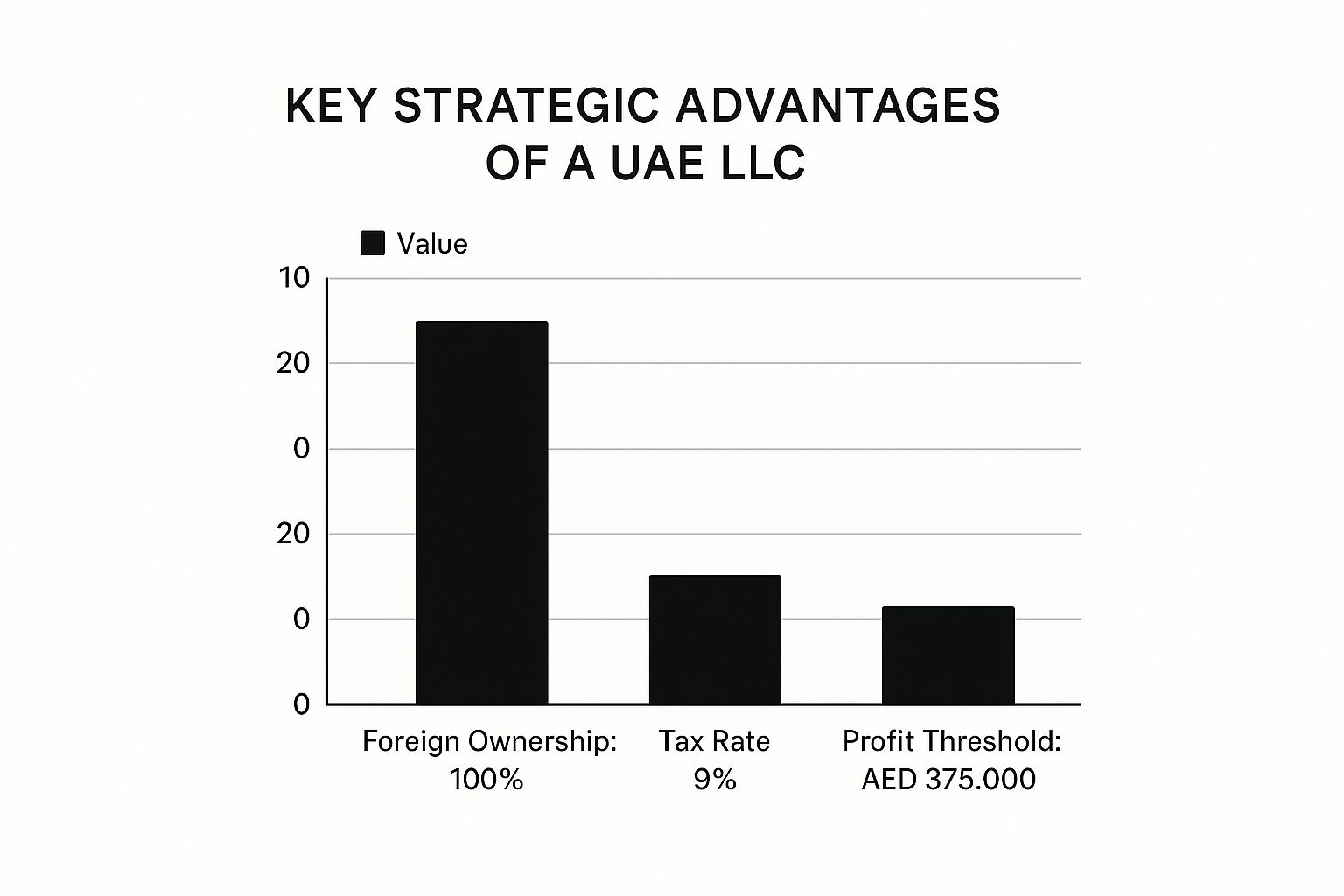

This infographic breaks down the key financial perks of a UAE LLC, from 100% foreign ownership to the attractive tax rate and profit threshold.

As you can see, the UAE framework is designed to let businesses keep more of their hard-earned money, which can then be ploughed back into the company to fuel more growth.

For most startups and small businesses, this generous threshold means a large chunk of their early earnings is completely tax-free. It creates the perfect financial ecosystem for a new venture to find its feet and thrive.

The combination of limited liability, full market access, and a low-tax framework makes the UAE LLC a uniquely powerful vehicle for both local and international business success.

Working with experts who offer cost-effective business setup solutions from day one ensures you can fully capitalise on these financial benefits. A properly structured setup not only keeps initial costs down but also guarantees you're fully compliant, letting you enjoy the UAE's tax advantages and focus your capital on what really matters—growing your business. And with our 24/7 support, we’re always here to guide you through every financial and legal step of the journey.

Choosing Your Jurisdiction: Mainland vs Free Zone

When you decide to form your limited liability company in the UAE, one of the very first—and most critical—decisions you'll make is where to actually set it up. The choice between a Mainland and a Free Zone jurisdiction isn't just about picking a location on a map. It fundamentally shapes how your business can operate, who you can sell to, and what your long-term growth potential looks like.

Each path offers a completely different set of advantages, designed for different kinds of businesses. Let's break down what that means for you.

Think of the UAE Mainland as the country's main economic artery. A Mainland LLC has the freedom to trade directly with any customer or company anywhere in the UAE, from Abu Dhabi to Sharjah and all the emirates in between. This total, unrestricted market access is its biggest selling point and a huge plus for businesses looking to tap into the local customer base.

A Free Zone, on the other hand, is like a specialised business park with its own rules and regulator. These zones are often built around specific industries—like tech, media, or commodities—creating powerful ecosystems. They are the go-to option for businesses focused on international trade, offering major perks like customs exemptions.

Understanding the Mainland Advantage

The main draw of a Mainland company is its operational freedom. If your business plan involves selling products or services directly to people and companies within the UAE, a Mainland setup is almost always the way to go. It’s the only structure that lets you operate across the entire domestic market without any barriers.

What's more, a Mainland LLC can bid on lucrative government contracts, a massive revenue stream that's typically off-limits to Free Zone companies. This makes it the clear choice for sectors like construction, high-level consulting, and any field that serves government bodies. And with the recent change allowing 100% foreign ownership for most activities, the Mainland has become even more appealing, offering full control and unmatched market access.

You can dig deeper into the specifics in our complete guide to mainland company formation in Dubai.

Exploring the Pull of Free Zones

Free Zones offer a different but equally compelling set of benefits. With over 40 Free Zones scattered across the UAE, each is tailored to specific business activities. This creates a powerful networking environment where you're surrounded by peers, partners, and potential clients in your exact industry.

The key benefits of a Free Zone usually include:

- 100% foreign ownership, which has always been the standard here.

- Customs duty exemptions on imports and exports, a major incentive for trading companies.

- Full repatriation of profits and capital, meaning you can move your money without restrictions.

These zones are a perfect fit for businesses that primarily deal with clients outside the UAE, such as import/export firms, international consultancies, or e-commerce stores serving a global market.

The decision isn't about which option is "better," but which one strategically fits your business goals. A local café needs Mainland access to serve its community, while an international software company might flourish in a tech-focused Free Zone.

A Head-to-Head Comparison

To help you see the differences more clearly, let's put the two options side-by-side. This table breaks down the core factors you need to think about.

Mainland LLC vs Free Zone Company Key Differences

Choosing between these two structures depends entirely on your business model and long-term vision. This table highlights the fundamental differences to guide your decision.

| Feature | Mainland Limited Liability Company | Free Zone Company |

|---|---|---|

| Market Access | Unrestricted access to the entire UAE local market. | Restricted to operating within the Free Zone and internationally. |

| Business Scope | Can trade with any company in the UAE and internationally. | Trading with Mainland companies often requires a local distributor. |

| Government Contracts | Eligible to bid for and work on government projects. | Generally not eligible to bid on government contracts. |

| Office Requirements | A physical office with a registered tenancy contract (Ejari) is mandatory. | Offers flexible office solutions, including flexi-desks and virtual offices. |

| Visa Quotas | Generally offers more flexibility and a higher quota for employee visas. | Visa eligibility is often linked to the size of the office space. |

| Approvals | Approvals are needed from the Department of Economic Development (DED) and others. | Approvals are handled by the specific Free Zone authority. |

The choice is more complex than it used to be, especially now that ownership rules on the Mainland have relaxed. What was once a straightforward decision now requires a hard look at your long-term plan. Getting this right from day one is crucial for building a successful and sustainable business in the UAE.

Your Step-by-Step UAE LLC Formation Roadmap

Turning your business idea into a fully licensed limited liability company in the UAE can seem like a mountain of paperwork. But really, it’s just a series of logical steps. Once you break it down into a clear roadmap, the journey becomes much less intimidating and a lot more straightforward.

Think of this as your checklist. Each step builds on the last, creating a solid legal foundation for your new company. From deciding exactly what your business will do to getting that final trade licence, following this structured path is the key to a smooth launch.

Step 1: Define Your Business Activities

Before you even dream up a company name, you need to lock in your business activities. The Department of Economic Development (DED) in each emirate has a list of over 2,000 approved activities to choose from. This decision is huge—it directly impacts the type of licence you'll need and any special approvals that might come into play.

A general trading company, for example, has very different requirements than a specialised IT consultancy. Nailing this down from the get-go saves you from costly changes and frustrating delays later on. It’s the cornerstone of your entire setup.

Step 2: Secure Your Trade Name and Initial Approval

With your activities defined, it's time to pick a unique trade name for your LLC. Your chosen name has to follow the UAE’s naming rules—it can't be offensive, blasphemous, or already taken. You’ll submit a few options, and once one is approved, you can move on to getting your Initial Approval.

The Initial Approval is basically a preliminary green light from the authorities. It’s their way of saying they have no objection to you starting your business, which clears the way for you to start drafting legal documents.

This early stage is where many entrepreneurs hit their first administrative speed bumps. Getting the paperwork right and sticking to the specific guidelines isn't just recommended; it's essential for a hassle-free process.

Step 3: Draft and Notarise Your MOA

Your Memorandum of Association (MOA) is the legal backbone of your limited liability company UAE. This crucial document lays out everything from the ownership structure and profit distribution to partner responsibilities and how the company will be run. It’s the foundational contract between all the shareholders.

The MOA must be drafted in both English and Arabic, then notarised by a public notary in the UAE. This step makes the agreement between partners official and is a mandatory part of your licence application.

Step 4: Finalise Your Office Lease

For a mainland LLC, having a physical office space is a must. You'll need a registered tenancy contract, known as an Ejari in Dubai. This registered lease proves your company has a legitimate physical address in the UAE.

This is a major difference compared to many free zone setups, which often allow for flexible desk options. The DED requires this physical presence to issue your final trade licence, ensuring your business is properly established on the mainland. For a deeper dive into licence requirements, our guide on how to get a trade license in Dubai has you covered.

Step 5: Submit Your Final Application

With your Initial Approval, notarised MOA, and registered tenancy contract all sorted, you’re on the home stretch. The final step is submitting all your paperwork to the DED for one last review. At this stage, accuracy is everything—one small mistake could send you right back to the beginning.

This final push often means coordinating with several government departments, which can eat up a lot of your time. And this is exactly where professional help can be a game-changer. For digital businesses, it's also worth understanding the specific nuances of the legal setup for an e-commerce website in Dubai as part of your planning.

Working with specialists in Corporate PRO Services and Attestation Services takes that administrative headache away. These experts handle the entire submission, talk to government bodies for you, and fix any issues that pop up, ensuring you get your trade licence quickly and without any errors.

Navigating Post-Setup Legal and Financial Duties

Getting your trade licence is a huge milestone, but it's really the starting line, not the finish. Running a limited liability company in the UAE means you've stepped into a world of ongoing legal and financial responsibilities. These aren't just bureaucratic boxes to tick; they’re the very framework that keeps your business in good standing and helps maintain the country's strong economic reputation.

First up is the annual renewal of your trade licence. Think of it as a yearly health check-up for your company—it's absolutely non-negotiable. This involves submitting updated documents, most importantly your office tenancy contract (Ejari), and settling the renewal fees with the economic department.

Falling behind on this can lead to some serious headaches, including hefty fines, getting your company blacklisted, or even having your business activities frozen. Keeping a close eye on that renewal date is just fundamental to your company’s survival and smooth operation.

Keeping Your Financial House in Order

Beyond the licence renewal, every LLC is expected to maintain squeaky-clean financial records. This isn’t just good business practice; it’s a critical part of staying compliant, and UAE authorities are watching closely.

Proper bookkeeping is the backbone of it all. You need to keep accurate, up-to-date accounting records that tell a clear story of your company's financial health. For many businesses, this also means having your annual financial statements audited by a UAE-licensed professional.

The UAE has also doubled down on corporate transparency to fight financial crime. This means LLCs are required to prepare financial statements according to International Financial Reporting Standards (IFRS) and appoint external auditors. Another key piece of this puzzle is the Ultimate Beneficial Owner (UBO) disclosure rule, which has been in place since 2020. This requires companies to maintain a detailed register of anyone who owns or controls 25% or more of the business.

Getting to Grips with UAE Corporate Tax

One of the biggest recent changes for every limited liability company UAE is the introduction of a federal Corporate Tax. While the UAE is still a fantastic low-tax environment, understanding your new obligations is crucial to stay on the right side of the law.

The system is pretty straightforward, but you can't afford to ignore it. Here are the key things you need to know:

- Tax Rate: A very competitive 9% rate is applied to your company's taxable profits.

- Tax-Free Threshold: The first AED 375,000 of your profit is taxed at 0%. This is a huge relief for startups and smaller businesses.

- Mandatory Registration: Every single LLC must register for Corporate Tax with the Federal Tax Authority (FTA), no matter how much you earn.

- Annual Filing: You have to file a Corporate Tax return every year, even if your profits are below the taxable threshold.

This new tax landscape makes meticulous financial record-keeping more important than ever. Your accounting books are the foundation of your tax return, and any mistakes could trigger an audit and penalties from the FTA.

Getting your head around these new rules, from registration deadlines to calculating what’s taxable, can feel overwhelming. To help you get started, check out our guide on how to register for corporate tax in the UAE, which breaks the whole thing down. Getting professional support here is a smart move—it ensures everything is accurate and on time, leaving you free to focus on what you do best: running your business.

How We Make Your UAE Business Setup Seamless

Starting a limited liability company in the UAE is a journey filled with critical decisions and complex steps. This is where having an experienced guide makes all the difference, turning what could be a maze of obstacles into a clear, direct path to launching your business. We don't just offer services; we provide a complete partnership.

Our team lives and breathes the UAE business landscape. Here’s what sets us apart:

- ✅ Specialists in Mainland Company Formation in Dubai, Sharjah & Abu Dhabi

- ✅ Specialists in Freezone Company Formation across the UAE

- ✅ Specialists in Golden Visa on Property and Investor Visa

- ✅ Specialists in Corporate PRO Services and Attestation Services

- ✅ 24/7 Support Service – Always here when you need us

- ✅ Cost-Effective Business Setup Solutions tailored to your needs

- ✅ Enjoy UAE Tax Benefits for International Entrepreneurs

A Partnership Built on Real Support

Setting up a company here is about more than just submitting paperwork—it’s about laying a rock-solid foundation for your future success. Our dedicated team is here to take the bureaucratic headaches off your plate with expert Corporate PRO Services and Attestation Services. Think of us as your direct line to the government, managing all the liaisons, document submissions, and approvals so you don't have to. This saves you a massive amount of time and prevents those small, costly mistakes that can derail a new venture.

We will guide you on how to properly structure your business to take full advantage of the UAE's favourable tax environment—a game-changer for international entrepreneurs.

Your business journey doesn’t stick to a 9-to-5 schedule, and neither do we. Our 24/7 Support Service means you always have a reliable expert to turn to for guidance, no matter when you need it.

Ultimately, our job is to be your one-stop solution. We tie together every essential service—from legal structuring and visa processing to tax guidance—into one seamless, integrated experience. Let us handle the complexities, so you can focus on what really matters: growing your new business in the UAE.

Ready to start your journey with a partner you can trust?

📞 Call Us Now: +971-54-4710034

💬 WhatsApp Us Today for a Free Consultation

Your Top Questions About UAE LLCs, Answered

When you're looking to set up a limited liability company in the UAE, a few questions always pop up. We get it. Here are some clear, straightforward answers to the things entrepreneurs ask us the most, so you can plan your next steps with total clarity.

Can a Foreigner Own 100% of a Mainland LLC?

Yes, in most cases, you absolutely can. Thanks to some major updates in UAE company law, the old requirement for a local Emirati sponsor has been scrapped for the majority of commercial and industrial businesses. This means foreign investors can now hold 100% ownership of their mainland LLC.

It's a game-changer. That said, a handful of business activities considered to be of strategic national importance might still need an Emirati partner. It’s always best to check with a specialist to see exactly where your specific business activity falls.

What Is the Minimum Capital Needed for an LLC?

This is a common point of confusion. The UAE government has actually done away with the old, rigid rule of a fixed minimum share capital for LLCs.

Instead, the law now simply states that the capital you declare in your company’s Memorandum of Association (MOA) must be "sufficient" for your business to meet its goals. This is a much more practical approach, allowing you to decide on a realistic amount that truly matches your business plan, rather than hitting an arbitrary number.

How Long Does LLC Registration Take in the UAE?

The timeline can really vary, but you’re typically looking at anywhere from a few days to a couple of weeks. It all boils down to a few key things:

- Where you set up: Mainland and free zone authorities work at different paces.

- What you do: Certain business activities need a thumbs-up from other government ministries, which can add a bit of time to the process.

- Your paperwork: This is the big one. Getting all your documents in perfect order from day one is the fastest way to a smooth registration. Any mistakes or missing papers can cause delays.

This is where having an expert in your corner makes a huge difference. They make sure everything is spot-on the first time, which really speeds things up.

Is a Physical Office Mandatory for an LLC?

It completely depends on where your limited liability company in the UAE is registered. If you're setting up on the mainland, then yes, a physical office is a must. You'll need a registered tenancy contract, known in Dubai as an Ejari, to prove it.

Free zones, on the other hand, are much more flexible. Many offer options like flexi-desks or virtual office packages. These are perfect for startups, consultants, and anyone who doesn't need a permanent physical base, and they're a lot more budget-friendly.

Ready to launch your business with confidence? Let PRO Deskk handle the complexities of your LLC formation so you can focus on growth. Explore our services and start your journey today at https://prodesk.ae.