Getting an investor visa in the UAE is all about making a real economic contribution. This usually means one of two things: buying property or investing in a business. Think of this visa as more than just a stamp in your passport; it's your key to living and working long-term in one of the most dynamic, tax-friendly economies on the planet.

This visa is specifically designed for international entrepreneurs and investors who want to put down roots in the UAE. It rewards your financial commitment by granting you, and often your family, the right to live here and enjoy the country's significant lifestyle and tax advantages.

Decoding the UAE Investor Visa Programme

So, what exactly is the UAE Investor Visa? It's not a single, one-size-fits-all document. Instead, it’s a category of residency permits for people who bring capital into the country. It’s the government’s way of welcoming those who want to contribute to and benefit from the local economy.

The programme essentially splits into two main routes: investing in real estate or setting up (or investing in) a business. Each pathway has its own specific requirements, visa lengths, and benefits, so choosing the right one depends entirely on your goals.

Key Investment Pathways

Before we get into the nitty-gritty details, let's look at the two main options from a high level.

-

Real Estate Investment: This is a popular route. It involves buying a property that meets a certain minimum value. This path is often directly linked to the coveted 10-year Golden Visa, making it a great choice for those seeking long-term stability.

-

Business Investment: This is the classic entrepreneurial route. You can either start a brand-new company—either on the mainland or in one of the many free zones—or invest in a pre-existing business. This is the perfect option if you plan to actively run a business in the UAE.

To give you a clearer picture, here’s a quick breakdown of how these pathways compare.

Investor Visa Pathways At a Glance

| Investment Pathway | Typical Visa Duration | Key Requirement |

|---|---|---|

| Real Estate Investment | 2 to 10 years | Owning a property valued at AED 750,000 or more |

| Business Investment | 5 to 10 years | Investing in or establishing a UAE-based company |

Choosing between these options is the first critical step. It’s all about matching your personal and financial ambitions with the right residency strategy. Whether you're considering mainland or free zone company formation, our specialists can guide you through the process to secure your visa smoothly.

The Golden Visa: A New Standard for Global Investors

While a standard investor visa gives you a solid foothold in the UAE, the UAE Golden Visa is in a league of its own. It's the gold standard for long-term residency, offering a prestigious 10-year, renewable visa for those looking to plant deep roots for themselves and their families.

This isn't just about a temporary stay; it's about establishing a real sense of permanence in one of the world's most dynamic economies. Think of it as the difference between a short-term lease and owning a long-term stake in the region's future. It's no surprise the programme's popularity has skyrocketed.

The numbers really tell the story. First introduced in 2019, the programme saw Dubai issue a staggering 158,000 Golden Visas in 2023 alone—nearly double the total from the year before. This boom was fuelled by smart policy updates, like removing the minimum down payment for real estate investors, which opened the door for many more people to secure residency. You can learn more about these trends here: https://prodesk.ae/services/golden-visa-dubai/

Unmatched Benefits and Flexibility

What really makes the Golden Visa stand out are the incredible benefits. It offers a level of freedom and personal security that other residency permits simply can't match.

Here's what sets it apart:

- No Sponsor Required: You're in complete control. Your residency isn't tied to a company or another person, giving you total autonomy.

- Extended Stays Abroad: Most visas become void if you're out of the UAE for more than six months. The Golden Visa lets you stay abroad for as long as you need without any risk to your status.

- Comprehensive Family Sponsorship: You can easily sponsor your spouse and children, with no age limits on unmarried sons and daughters. You can also sponsor an unlimited number of domestic support staff.

The Golden Visa fundamentally changes your relationship with the UAE. You're no longer just a temporary resident; you become a long-term stakeholder. It's a powerful signal of commitment from the UAE, giving you the confidence to build a life, grow a business, and plan for the future.

These advantages make pursuing the Golden Visa a truly worthwhile goal. Our team are experts in navigating the criteria, whether through property investment or setting up a business, and we can guide you through a smooth and successful application process.

Choosing Your Investment Pathway to Residency

When it comes to securing an investor visa in the UAE, your journey really boils down to one key decision: how you want to invest your capital. The two most travelled roads are putting your money into property or establishing a business.

While investing in a business has its own strong appeal, it's the real estate route that has seen a surge in popularity, especially for the coveted Golden Visa. Let's break down what each path looks like in practice.

The Real Estate Investment Route

For many aspiring residents, property ownership feels like the most tangible and straightforward way to plant roots in the UAE. If you're leaning this way, getting a handle on how to invest in Dubai real estate is the perfect starting point.

The main benchmark for this visa is tied directly to the prestigious 10-year Golden Visa, and it comes with a clear financial requirement.

- Minimum Property Value: You need to own a property, or a portfolio of properties, worth at least AED 2 million.

- Qualifying Properties: The great thing is you have options. Your investment can be in a ready-to-move-in home or even an off-plan property from an approved developer, which adds a lot of flexibility.

What's really opened this pathway up recently are the updated regulations. The old rules required a substantial down payment, but that has been scrapped, making it much easier for global investors to qualify.

The Business Investment Route

If you’re more of an entrepreneur at heart, then the business investment route is probably calling your name. This is all about establishing a commercial footprint, either by starting a new company from scratch or by investing in an existing one.

The specific requirements here depend heavily on where you decide to set up shop.

Your first big decision is choosing between a mainland or a free zone company. A mainland setup gives you the freedom to trade directly within the entire UAE market. On the other hand, free zones are incredibly popular for international business because they offer perks like 100% foreign ownership and major tax exemptions.

Each jurisdiction has its own rules, from capital requirements to operational guidelines. For instance, setting up a mainland LLC typically involves a local partner, which isn't a requirement in a free zone.

We can guide you through the pros and cons to find the right fit, whether it's a Mainland Company Formation or a Freezone Company Formation. If you're curious about a specific zone, our guide to https://prodesk.ae/services/ifza-freezone-visa-services/ offers a good look at what's involved.

Navigating the Visa Application Process Step by Step

Getting your investor visa is a well-defined journey. If you understand the roadmap from the get-go, moving from preparing your paperwork to getting that final visa stamp in your passport becomes a much smoother experience.

First things first, you'll need to get all your documents in order and properly attested. Once that's done, you'll submit your application through the official government portals—either the Federal Authority for Identity, Citizenship, Customs & Port Security (ICA) or Dubai's General Directorate of Residency and Foreigners Affairs (GDRFA). Stick to these channels; there are no shortcuts.

Be wary of any claims about simplified, one-time fee routes. The UAE government has officially denied these rumours and keeps the application process tightly controlled. This strictness is what maintains the integrity of the visa programme and ensures it attracts genuine investors who want to contribute to the economy. You can get more insight into the UAE's strategy for attracting investors on PraxisGroup.com.

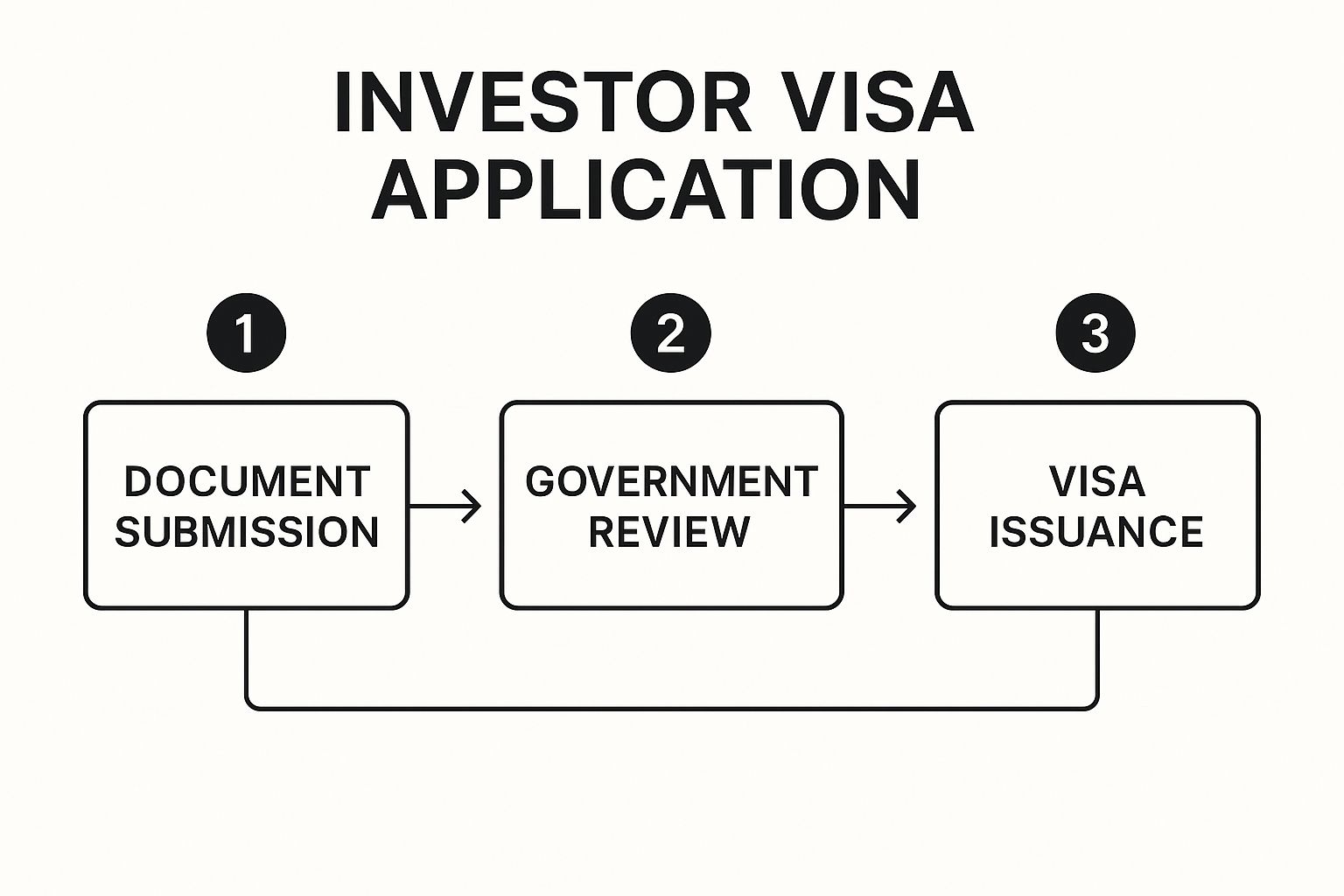

The infographic below gives you a bird's-eye view of the main stages.

As you can see, it’s a logical flow: submit your documents, wait for the government review, and then, if all is well, get your visa.

Key Milestones in Your Application

After your initial application gets the green light, there are a few final, but crucial, steps to complete before your residency is official.

-

Medical Fitness Test: Anyone 18 years or older has to complete a medical screening at a government-approved health centre. It’s a standard procedure to test for certain communicable diseases, all for the sake of public health.

-

Biometrics and Emirates ID: Next, you'll visit a designated centre to give your biometrics—basically, your fingerprints and a photo. This information is then used to create your Emirates ID, which is your essential identification card for life in the UAE.

-

Visa Stamping: This is the final step. Once you've passed the medical test and your application is fully approved, your passport gets stamped with the residency visa. That stamp is what officially confirms your new status as a UAE resident investor.

This might all sound a bit daunting, but working with professional Corporate PRO Services can turn a complex process into a simple checklist. Our experts handle everything from document attestation and government liaison to scheduling your appointments. With 24/7 support, we're here to guide you every step of the way.

Your Documentation and Cost Checklist

Getting your visa application right the first time comes down to being incredibly organised. Trust me, even one missing document can throw a wrench in the works, causing frustrating delays to what should be a smooth process. To hit all the investor visa UAE requirements, you'll need to gather a complete file of both personal and investment-related paperwork.

Think of it as building a solid case for your residency. Your personal documents are the foundation, proving who you are and that you're in good standing. The investment documents are the main event, showcasing your financial commitment to the UAE.

Essential Personal Documents

Before you can even touch on your investment, you need to firmly establish your identity. This part is an absolute must-do, and it pays to be meticulous, especially with official attestations.

- Valid Passport Copy: Make sure your passport has at least six months of validity left on it. This is a common trip-up.

- Passport-Sized Photographs: These aren't just any photos. They must follow the strict UAE government guidelines for size and background colour.

- Proof of Good Standing: You'll need a certificate confirming a clean criminal record from your country of origin.

Getting these documents right from the start is a game-changer. Using a professional attestation service can be a lifesaver, ensuring your certificates are properly authenticated for the UAE and helping you sidestep common hurdles.

Investment Proof and Associated Costs

With your personal file in order, the next step is providing clear, undeniable proof of your qualifying investment. The specific documents you need will depend entirely on whether you're taking the real estate or business investment route.

If you’re a property investor, the key document is a title deed or a Sale and Purchase Agreement (SPA) from a government-approved developer. For those investing in a business, you'll need your company’s trade license and its Memorandum of Association (MOA).

Having a clear picture of the costs is just as vital for budgeting. You should plan for government fees covering the application itself, the mandatory medical test, and your Emirates ID, which will add up to several thousand dirhams. It's also wise to factor in the cost of professional guidance; our PRO services, for instance, are designed to handle every step for you, making the investment well worth it.

Beyond Residency: The True Value of a UAE Investor Visa

https://www.youtube.com/embed/6-pU02MSHNs

Thinking of a UAE investor visa as just a residency permit is missing the bigger picture. It's actually your entry ticket into a dynamic lifestyle and business ecosystem, turning your initial investment into a long-term foundation for success for you and your family.

This visa doesn't just let you live here; it plugs you directly into one of the world's most vital economic crossroads. Perfectly positioned between East and West, the UAE serves as an incredible launchpad for global business, all backed by world-class infrastructure that makes international trade and travel feel effortless.

Tapping into Financial and Lifestyle Advantages

For many, the biggest draw is the UAE's famously friendly tax environment. As a resident, you benefit from zero personal income tax. This isn't just a small perk; it means you keep more of your hard-earned money, freeing up capital to reinvest and grow your wealth.

But the appeal goes far beyond finances. The quality of life here is truly exceptional. The country is known for its safety and stability, complemented by top-tier healthcare, schools, and entertainment. Your investment secures more than a visa—it unlocks a secure and enriching environment for your family to thrive.

An investor visa is a partnership with the UAE's vision for the future. By contributing to its economy, you gain a stake in its remarkable growth story, benefiting directly from the nation's progress and stability.

This powerful partnership is reflected in the numbers. The issuance of 158,000 Golden Visas in 2023 happened alongside a huge influx of wealth, with an estimated 9,800 millionaires projected to move to the UAE in 2025. This migration, fuelled by strategic visa policies, has solidified the UAE’s reputation as a premier global wealth hub, sharing top tax-friendly scores with places like Monaco. You can read more about this trend and the UAE's growing appeal on Hubbis.com.

Common Questions About the Investor Visa

It's only natural to have questions when you're navigating the UAE's investor visa process. We get them all the time. To give you some clarity and confidence, here are straightforward answers to the queries that pop up most often.

Can I Get an Investor Visa with an Off-Plan Property?

Yes, you absolutely can. This is actually a very popular route these days. You can secure an investor visa, even the coveted Golden Visa, by purchasing an off-plan property.

The main thing to remember is that the property's value must hit the minimum investment mark—currently AED 2 million for the Golden Visa—and the developer must be government-approved. You'll just need to show the official Sale and Purchase Agreement (SPA) and a statement from the developer confirming how much you've already paid.

Does the Investor Visa Lead to UAE Citizenship?

This is a common misconception. While an investor visa grants you long-term residency, it doesn't automatically put you on a path to a UAE passport. The Golden Visa, for instance, is a renewable 10-year residency. It lets you live, work, and study here for the long haul, provided you keep your investment.

Getting UAE citizenship is a completely different ball game. It's a highly selective process, usually reserved for individuals who have made truly exceptional contributions to the nation over a long period.

Think of the investor visa as a secure key to long-term residency. It offers incredible stability and access to all the UAE has to offer, but it isn't a direct route to citizenship.

What Happens if I Sell My Qualifying Investment?

Your visa is directly linked to the asset that qualified you for it. So, if you sell the property or liquidate the business that's backing your investor visa, your residency status will be impacted.

Typically, you'll be given a grace period—often about 30 days—to find another qualifying investment to keep your visa active. It's really important to get professional advice before you make any changes to your investment. This ensures you stay compliant and avoid any risk of visa cancellation. Our corporate PRO team can walk you through this, and for more general info, you can check out the frequently asked questions on our website.

Can My Family Members Work on My Visa?

As the main visa holder, you can definitely sponsor your spouse and children to live here with you. That's one of the best perks.

However, if they want to work, they'll need their own work permit, which is issued by the Ministry of Human Resources and Emiratisation (MOHRE). This is a standard process they'll go through once they have a job offer from a company in the UAE. So, your visa provides them with residency, but their employer secures their permit to work.

You don't have to figure out the investor visa puzzle on your own. At PRO Deskk, we are:

✅ Specialists in Mainland Company Formation in Dubai, Sharjah & Abu Dhabi

✅ Specialists in Freezone Company Formation across the UAE

✅ Specialists in Golden Visa on Property and Investor Visa

✅ Specialists in Corporate PRO Services and Attestation Services

✅ 24/7 Support Service – Always here when you need us

✅ Cost-Effective Business Setup Solutions tailored to your needs

✅ Enjoy UAE Tax Benefits for International Entrepreneurs

Let us handle the paperwork so you can focus on what matters—your investment.

📞 Call Us Now: +971-54-4710034 or WhatsApp Us Today for a Free Consultation to get your application started with confidence.

Article created using Outrank