Setting up a company in Dubai all starts with one fundamental decision: choosing your jurisdiction.Before you get into the nitty-gritty of trade names and bank accounts, you first have to decide where your business will legally be based. This single choice—Mainland, Free Zone, or Offshore—shapes everything that comes next, from your ownership rights and office needs to the markets you can access.

It’s a critical first step.

The UAE's pro-business reforms have unleashed an incredible economic boom. Just last year, a staggering 250,000 new companies were registered, pushing the total to over 1.4 million. That's a massive 118.7% jump since the Commercial Companies Law was updated. This growth is part of a national push to hit two million companies by 2035, making it the perfect time for entrepreneurs to enjoy UAE tax benefits and get in on the action with expert guidance.

Choosing Your Business Jurisdiction in Dubai

In Dubai, your company can exist under one of three distinct legal frameworks. Each one is built for a different kind of business ambition, so let's break them down.

Mainland: The Gateway to the UAE Market

If you want to do business directly inside the UAE, a Mainland company is your ticket. Licensed by the Department of Economy and Tourism (DET), this structure is essential if you plan to trade with local customers, open a physical shop, or bid on valuable government contracts. As specialists in Mainland company formation in Dubai, Sharjah & Abu Dhabi, we know this jurisdiction is perfect for unrestricted local market access.

While a local sponsor used to be mandatory, recent legal changes now allow 100% foreign ownership for most business activities. The one non-negotiable? A Mainland company must have a physical office space with a registered tenancy contract, known as an Ejari. This is a hard requirement and directly impacts how many employee visas you can get.

Free Zone: The Hub for International Business

Dubai boasts over 40 specialised Free Zones, which are basically economic areas designed to attract foreign investment. A Free Zone company is the go-to choice for entrepreneurs whose focus is on international trade, consulting, or tech services.

The benefits are compelling:

- 100% Foreign Ownership: You keep full control without needing a local partner.

- Tax Benefits: You get to enjoy significant tax advantages, a huge draw for international founders.

- Simplified Setup: Registration is often quicker and involves less paperwork than a Mainland setup.

- Flexible Office Options: Many Free Zones offer "flexi-desk" solutions, which are cost-effective and save you from leasing a full-time physical office.

The catch? A Free Zone company can't trade directly within the UAE mainland market. As specialists in Freezone company formation across the UAE, we help clients navigate this landscape to find the perfect zone for their needs. For a more detailed look at how these two stack up, check out our guide on Free Zone vs Mainland Dubai.

Offshore: A Tool for Global Asset Management

An Offshore company, often registered in a jurisdiction like the Jebel Ali Free Zone (JAFZA), is a completely different animal. It's not for trading; it's a legal tool designed for international business structuring.

An Offshore company is primarily used as a holding company to own assets, property, or shares in other businesses. It can’t conduct business inside the UAE, sponsor visas, or lease a physical office. Its sole purpose is corporate structuring and asset protection.

This structure is specifically for international investors and entrepreneurs who need an efficient way to manage their global assets under the UAE's stable legal framework.

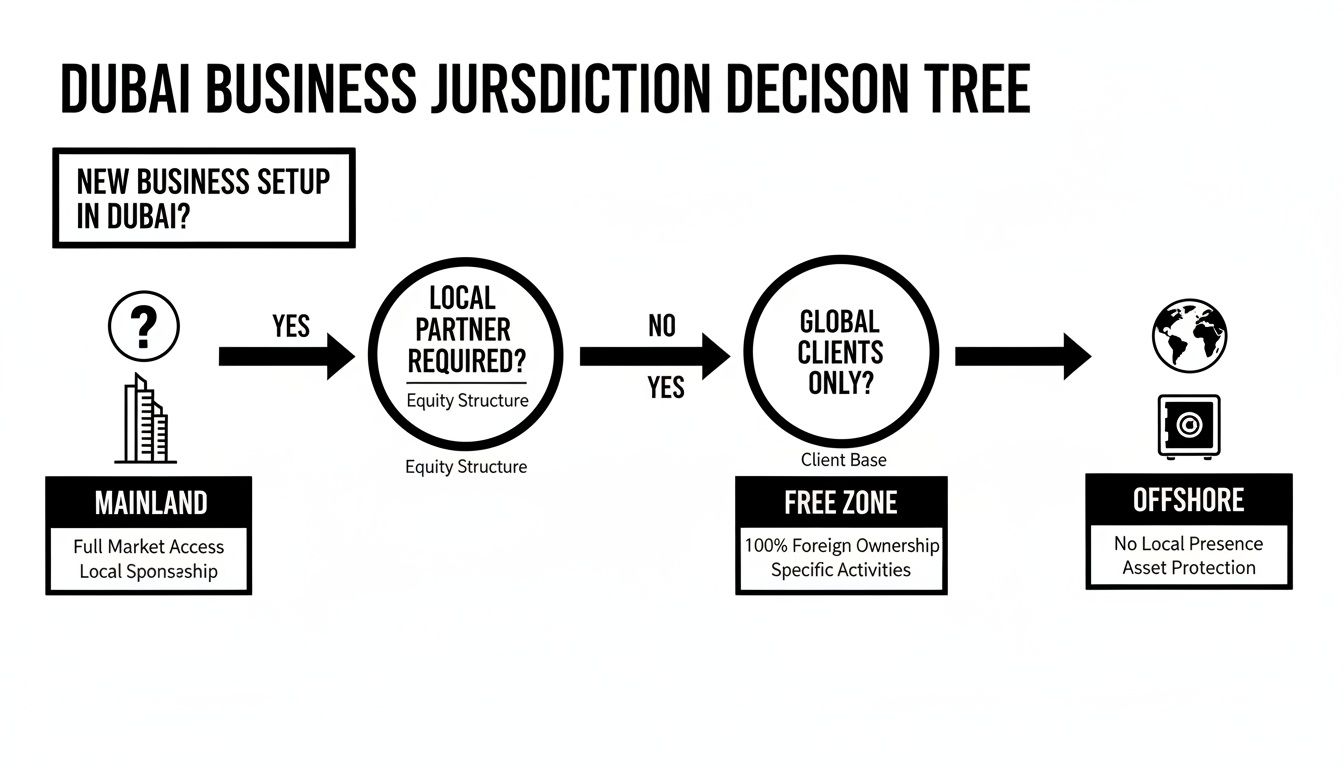

To help you decide, this decision tree gives you a quick visual guide to which jurisdiction—Mainland, Free Zone, or Offshore—makes the most sense for your business model.

As you can see, if local trade is your game, Mainland is the answer. For international operations, a Free Zone is ideal. And for holding assets, Offshore is the specialized choice.

Mainland vs Free Zone vs Offshore at a Glance

Choosing the right jurisdiction can feel overwhelming, so this table breaks down the key differences to help you see which option aligns best with your business goals.

| Feature | Mainland Company | Free Zone Company | Offshore Company |

|---|---|---|---|

| Ownership | Up to 100% foreign ownership for most activities | 100% foreign ownership guaranteed | 100% foreign ownership guaranteed |

| Business Scope | Can trade anywhere in the UAE and internationally | Limited to trading within the Free Zone or overseas | Cannot trade within the UAE; for holding assets only |

| Office Requirement | Mandatory physical office with Ejari | Flexible options, including "flexi-desks" | No physical office allowed; only a registered agent address |

| Visas | Can apply for employee visas (tied to office size) | Can apply for employee visas (number varies by zone) | No employee visas allowed |

| Local Partner | No longer required for most commercial/industrial licenses | Not required | Not required |

| Annual Audits | Mandatory for most LLCs | Varies by Free Zone; often required | Required in most jurisdictions (e.g., JAFZA, RAKEZ) |

| Best For | Retail, restaurants, local services, government contracts | Consulting, e-commerce, international trading, tech | Asset protection, property holding, international investment |

Ultimately, the best choice depends entirely on what you want to achieve. A Mainland setup offers unrestricted access to the local market, a Free Zone provides an ideal platform for global trade, and an Offshore company serves as a powerful tool for asset management.

The Nuts and Bolts of the Registration Process

Once you’ve locked in your jurisdiction, it's time to get down to the real work of registering your company. This part of the journey isn’t just filling out one form; it’s a series of official steps with government bodies, where each one sets the stage for the next. You're essentially building the legal and commercial foundation of your new business, piece by piece.

Think of it like building a house. You can't put up the walls until the foundation is poured, and the roof can't go on until the walls are secure. Every step, from defining your business activities to securing your office space, is a critical layer in building a compliant and operational company in Dubai.

Defining Your Business Activities and Legal Form

First things first: you have to decide exactly what your company is going to do. The Department of Economy and Tourism (DET) in Dubai maintains a list of over 2,000 approved business activities. You need to pick the ones that perfectly describe your operations because this choice dictates the kind of trade licence you'll get—Commercial, Professional, or Industrial.

This decision is far from a simple formality. It has a direct knock-on effect on your legal structure. A tech consultancy, for instance, would likely fall under a Professional Licence, whereas an e-commerce store needs a Commercial Licence.

For most entrepreneurs, the Limited Liability Company (LLC) is the go-to legal structure. Why? Because it shields your personal assets from business liabilities, which is a crucial safety net for any new venture. For solo practitioners like consultants or artists, a Sole Establishment is another solid option, especially within a Free Zone.

Reserving Your Trade Name

With your activities and legal form sorted, the next move is to pick and reserve your company's trade name. This is more than just a branding exercise; it's a legal requirement governed by some pretty strict rules. Your proposed name has to be unique and follow UAE naming conventions to the letter.

Here's what you need to keep in mind:

- No religious or offensive terms. Names can't reference Allah or other religious figures, and they certainly can't contain anything profane.

- It must be relevant. There should be a logical link between the name and your business activities.

- Full names only. Using just a first name or initials usually won't fly. If you use a person's name, it must be the full name of a partner in the company.

You'll submit your top choice along with a couple of backup options to the relevant authority—either the DET for a Mainland company or the specific Free Zone authority. Approval is generally quick, often coming through in a day or two.

Securing Initial Approval and Drafting Legal Documents

Once your trade name gets the nod, you apply for an Initial Approval Certificate. This is basically a green light from the authorities, an 'in-principle' confirmation that they have no objection to your proposed business. It’s a key document that allows you to move forward with drafting legal paperwork and leasing an office.

Next up is the Memorandum of Association (MOA). For an LLC, this is the constitutional document of your company. It outlines the structure, shareholding percentages, and operational rules. It needs to be drafted with care, signed by all partners, and then notarised by a public notary in the UAE. Our team specialises in drafting and attesting these critical documents, making sure they tick every legal box.

Expert Tip: Don't just grab a template for your MOA and sign it. A well-drafted MOA can be your best defense against future shareholder disputes. Take the time to customise clauses on profit distribution, management roles, and exit strategies to truly reflect your partnership agreement.

Establishing Your Physical Presence with an Ejari

For a Mainland company, having a physical office is non-negotiable. You’ll need to find a commercial property, sign a tenancy contract, and register it through Dubai's Ejari system. The Ejari certificate you receive is mandatory for your final licence application. This requirement is exactly why our business setup solutions often include guidance on finding and securing the right office space at a good cost.

This step also has a direct impact on how many employee visas you can get, as your visa quota is often tied to the size of your office. Free Zones offer a bit more flexibility here with their desk-space options, but for Mainland operations, the Ejari is an absolute must.

Finally, with all these pieces in place—your trade name reservation, initial approval, notarised MOA, and your Ejari—you are ready to submit the final application. All the documents get compiled and presented to the DET or your chosen Free Zone authority. After their final review and payment of the licence fees, you'll be issued your official https://prodesk.ae/trade-license-in-dubai/. This is the ultimate goal of the process, giving you the legal power to finally start operating.

To get a wider view of the foundational steps involved in launching a new venture, it's worth checking out a founder's guide to business incorporation. While it focuses on a different jurisdiction, the core principles of structuring a business offer valuable insights for any entrepreneur.

Your Essential Document Checklist

Nothing kills the momentum of a new business venture faster than paperwork problems. When you’re ready to register your company in Dubai, having every single document prepared, correctly formatted, and properly attested isn't just a good idea—it’s the only way to guarantee a smooth process. Trust me, one tiny oversight can lead to frustrating and completely avoidable delays.

Think of this list as your definitive guide. Get everything here sorted out before you start, and you’ll sidestep the common mistakes that trip up so many entrepreneurs. The exact requirements change slightly depending on whether the shareholders are individuals or an existing company, so let's break down both scenarios.

Documents For Individual Shareholders

For founders and partners setting up as individuals, the paperwork is fairly straightforward. The main goal for the authorities is simply to verify who you are and confirm your legal standing.

Here’s what you’ll need to have ready:

- High-Resolution Passport Copies: Clear, colour copies for all shareholders and the appointed manager are non-negotiable.

- UAE Visa Page Copy: If you’re already a UAE resident, you'll need a copy of your current visa page.

- Emirates ID Copy: Also a standard requirement for any UAE resident involved.

- Passport-Sized Photographs: Make sure these are recent, taken against a plain white background, and meet the specific government standards.

- Proof of Address: This is often requested to confirm your residential address. A recent utility bill or bank statement usually does the trick.

Having clear, digital copies of these on hand will make the initial application stages much, much faster.

Documents For Corporate Shareholders

This is where things get more complex. If an existing company (often called a "parent company") is a shareholder in your new Dubai business, the documentation requirements ramp up significantly. The authorities need to verify the legal existence, ownership, and good standing of that parent company.

This brings us to the critical process of attestation.

Attestation is the official, multi-step process of certifying a document's authenticity so it's legally recognised in the UAE. It involves getting stamps and seals from government bodies in both your home country and here in the Emirates.

The corporate documents you’ll need attested typically include:

- Certificate of Incorporation or Business Registration

- Memorandum and Articles of Association (MOA & AOA)

- A Board Resolution officially authorising the setup of the new Dubai company

- A Power of Attorney appointing a manager or representative for the new entity

- A Certificate of Good Standing for the parent company

Navigating The Attestation Maze

Don't underestimate this part. Each of those corporate documents must go through a precise journey of verification. You can’t skip a single step.

- Home Country Verification: First, the documents are notarised by a public notary in the parent company's home country.

- Embassy Legalisation: Next, they go to the UAE Embassy in that same country to be legalised.

- UAE MOFA Attestation: Finally, once the documents arrive in the UAE, they must be attested by the Ministry of Foreign Affairs (MOFA).

This meticulous chain of verification is what proves to the Dubai authorities that your corporate paperwork is genuine. Getting any part of this wrong will bring your entire application to a dead stop. This is exactly where our specialists in Corporate PRO and Attestation Services become invaluable, as we manage this entire labyrinth to prevent any hold-ups. For a deeper look into one of the most critical legal documents, you can learn more about what a Memorandum of Association entails and why getting it right is so important.

By diligently organising this paperwork, you're building a solid, compliant foundation for your company's launch in Dubai.

Making Your Business Fully Operational After Licensing

Getting your trade licence is a huge milestone, but think of it as the starting line, not the finish. While the licence gives your business the legal right to exist, the next phase is all about building the operational backbone that lets you actually hire people, manage money, and function in the UAE market. This is where your company goes from a name on a piece of paper to a real, operational business.

The very first thing you’ll need is your Establishment Card. It's a small card, but it’s essentially your company's official ID with the immigration and labour authorities. Without it, you can't sponsor a single visa—not for yourself, your partners, or any future employees. It’s the key that unlocks your ability to build a team.

Once you have that card, the next step is registering your company with the Ministry of Human Resources and Emiratisation (MOHRE). This is non-negotiable for any business that plans on hiring staff, as it ensures you’re compliant with UAE labour laws from day one. These two pieces—the Establishment Card and MOHRE registration—work together to get your company ready for growth.

Securing Visas for Yourself and Your Team

With those foundational registrations sorted, you can dive into the visa process. It’s a layered procedure that almost always starts with securing your own residency as the business owner. This is typically an Investor Visa, a permit that’s usually valid for two to three years and solidifies your legal status in the UAE.

After your own visa is stamped in your passport, you can then start sponsoring visas for your employees. The journey for each employee follows a clear path:

- Entry Permit Application: First, an initial permit is secured that allows the employee to enter the UAE for work.

- Medical Fitness Test: Every new resident has to go through a mandatory medical screening at an approved government health centre.

- Emirates ID Biometrics: The employee provides their fingerprints and photo for their official Emirates ID card.

- Visa Stamping: Finally, the residence visa is stamped into the employee's passport, making their employment and residency official.

We handle this entire lifecycle. As specialists in Investor Visa and Golden Visa on Property, we manage every detail, ensuring a seamless transition for you and your staff.

The Critical Step of Opening a Corporate Bank Account

This is, hands down, one of the biggest hurdles for new entrepreneurs after getting their licence. Opening a corporate bank account in the UAE isn't a simple walk-in affair. Banks here perform intense Know Your Customer (KYC) and due diligence checks to prevent financial crime, and a rejected application can bring your operations to a screeching halt.

Banks need to see a legitimate, well-structured business. They’ll dig into your:

- Business Plan: Is it clear, credible, and well-thought-out?

- Shareholder Profile: Who are the owners? What’s their background?

- Source of Funds: Where is the initial investment capital coming from? You’ll need to prove it.

- Physical Presence: Do you have a genuine office address, or just a P.O. Box?

A common mistake is approaching a bank with half-baked documents or a vague business story. UAE banks are looking for substance. Your application needs to paint a picture of a viable business, not just a shell company.

Working with specialists who already have strong relationships with multiple banks can make a world of difference. We know what each bank looks for and can help you prepare the exact documentation they want to see, dramatically improving your chances of a quick approval.

Ensuring Long-Term Compliance and Governance

As your company gets licensed and you gear up to launch, it’s vital to establish strong anti-corruption policies from the get-go. This builds trust with partners, customers, and financial institutions and ensures you’re meeting international standards for ethical governance.

You can see just how efficient this post-licensing phase can be by looking at hubs like the Dubai International Financial Centre (DIFC). In the first half of the year alone, a record 1,081 new companies set up shop there—a 32% increase from the previous year. This rapid growth, bringing the total number of active firms to 7,700, shows just how quickly businesses can get up and running with the right support. Our mission is to bring that same level of efficiency to your setup, no matter where you are in the UAE.

Breaking Down the Costs and Timelines

Alright, let's talk numbers and schedules. Planning your budget and understanding how long everything takes are easily two of the most critical parts of setting up your company in Dubai. A clear financial roadmap stops any nasty surprises down the line, and a realistic schedule helps you manage your own expectations and plan your launch.

The buzz around Dubai is real. In the first half of this year alone, the Dubai Chamber of Commerce welcomed over 35,000 new companies, pushing its total active membership past a staggering 210,000. This isn't just a statistic; it shows how streamlined the process has become for entrepreneurs from all over the world. Even one of the very first steps, reserving your trade name with the Department of Economic Development (DED), can often be knocked out online in just a day or two. You can read more about this incredible growth in a recent article from The Startup Scene.

Unpacking the Financial Investment

So, what’s this actually going to cost? The final figure really depends on your choice of jurisdiction—Mainland or Free Zone—and what your business actually does. But generally, the costs fall into a few main buckets.

- Initial Government Fees: This is your biggest one-time hit. It covers reserving your trade name, getting the initial approval, and paying for the trade licence itself.

- Office and Visa Costs: If you're setting up on the Mainland, you'll need to factor in annual office rent and your Ejari registration. For a Free Zone, you might get away with a more affordable flexi-desk package. Don't forget the visa costs for yourself and any staff you plan to hire; they add up.

- Third-Party and Service Fees: Think of these as the miscellaneous costs—things like getting documents attested, notarising your Memorandum of Association (MOA), and paying for professional help from business setup consultants.

A quick tip: working with a business setup specialist can genuinely save you money. We offer cost-effective business setup solutions tailored to your needs, which stops you from overpaying on individual fees and ensures you’re not caught out by hidden costs.

Estimated Costs for Dubai Company Formation

To give you a better feel for the numbers, here's a breakdown of what you might expect to pay. Just remember, these are estimates. Your final costs will depend on your specific setup.

| Cost Component | Mainland LLC (Approx. AED) | Free Zone Company (Approx. AED) |

|---|---|---|

| Trade Licence & Registration | AED 15,000 – 30,000+ (depending on activity) | AED 12,000 – 25,000 (often part of a package) |

| Office Space (Annual) | AED 20,000+ (for a small office) | AED 5,000 – 15,000 (for a flexi-desk or shared office) |

| Investor/Partner Visa | AED 4,000 – 6,000 (per person, valid for 2-3 years) | AED 3,500 – 5,500 (per person, valid for 2-3 years) |

| Establishment Card | Approx. AED 2,000 | Approx. AED 1,500 |

| Document Attestation | Varies based on home country (if corporate shareholder) | Varies based on home country (if corporate shareholder) |

| PRO Services & Setup Fees | Included in our setup packages, providing significant savings. | Included in our setup packages for a hassle-free experience. |

As you can see, the choice between Mainland and a Free Zone has a big impact on your initial outlay, especially when it comes to office space.

Mapping Out Your Timeline

Time is money, especially when you're launching a business. Knowing the typical timeline helps you plan everything from your personal move to your first marketing campaign.

- Initial Approval (1-3 Business Days): This part is usually quite fast. Once you've submitted your application and sorted your trade name, the initial green light comes through quickly.

- Licence Issuance (1-2 Weeks): After you've signed your MOA and secured your office lease, the final trade licence is typically in your hands within a week or two.

- Establishment Card & Visas (2-4 Weeks): This is the final stretch. Once the licence is issued, you'll apply for the Establishment Card. After that, it's time for your investor visa process, which includes the medical test and biometrics. This can take another two to four weeks.

All in, you should probably budget for about one to two months from start to finish. By the end of that period, you should have a fully licensed company, your visa stamped in your passport, and your application for a corporate bank account well underway. Our 24/7 support service is always here when you need us, ensuring this whole process is as quick and smooth as it can possibly be.

Your Top Questions Answered

When you're looking at how to register a company in Dubai, a lot of specific questions pop up. It’s only natural. To help clear things up, we've put together some straightforward answers to the questions we hear most often from entrepreneurs just like you.

Can a Foreigner Really Own 100% of a Dubai Mainland Company?

Yes, for the most part, you absolutely can. A major game-changer in the UAE Commercial Companies Law now allows foreigners to have 100% ownership of their mainland businesses. This did away with the old rule that required a UAE national to hold a 51% stake.

This is a huge deal, opening up full ownership for over 1,000 different commercial and industrial activities. Keep in mind, though, that some strategic sectors like oil and gas or certain financial services still have restrictions. The best first step is to check your specific business activity with the Department of Economy and Tourism (DET) to be sure. Our team can handle that verification for you in no time.

Do I Actually Need a Physical Office to Register My Company?

That really comes down to where you decide to set up. If you go for a Dubai Mainland company, then yes, a physical office with a registered tenancy contract (Ejari) is non-negotiable. In fact, the size of your office is directly tied to your visa quota—a bigger space means you can hire more people.

Free Zones, on the other hand, are built for flexibility. They're a popular choice for international startups precisely because they're more cost-effective. You can usually get started with a flexi-desk or a co-working space package. This ticks the legal box for having an address without the heavy cost and commitment of a full-time office.

How Long Does It Really Take to Open a Corporate Bank Account?

Be prepared for a bit of a wait here. Opening a corporate bank account in Dubai isn’t an overnight process. Realistically, you’re looking at anywhere from two weeks to two months. The final timeline depends on which bank you go with, how complex your business is, the nationalities of the shareholders, and how well-prepared your paperwork is.

UAE banks are incredibly thorough with their due diligence and Know Your Customer (KYC) checks to meet global anti-money laundering standards. The single biggest reason for delays or outright rejections is an incomplete or poorly prepared application.

To speed things up, have every key document ready to go from the start: your trade licence, Memorandum of Association (MOA), Establishment Card, passports for all shareholders, and a solid, detailed business plan. Having a business setup consultant with good relationships with the major banks can make a world of difference here.

What’s the Difference Between an Investor Visa and a Golden Visa?

Both grant you residency, but they're designed for different scenarios and offer very different perks.

The Investor Visa is tied directly to your business. It's usually valid for two or three years and is given to the owners or partners of a company set up in the UAE. To keep it active, you generally need to spend a certain amount of time in the country.

The Golden Visa is in another league. It’s a prestigious long-term residency visa, valid for ten years. This is awarded to people making a significant economic impact, like investing at least AED 2 million in real estate or a local fund. The biggest benefit? You can stay outside the UAE for as long as you want without your visa being cancelled. We specialise in helping entrepreneurs figure out which path is right for them and securing the visa that fits their long-term goals.

Getting through the maze of company registration, visa rules, and bank account setups is a lot easier with an expert guide. At PRO Deskk, we take care of every single step, making sure your business setup is smooth, fast, and cost-effective. Our specialists in Mainland, Freezone, and Golden Visa services are on call 24/7 to help bring your business plans to life.

📞 Call Us Now: +971-54-4710034

💬 WhatsApp Us Today for a Free Consultation