Opening a bank account is one of the first things you’ll do when you arrive in the UAE, whether you're here for work or to set up a business. The good news is, it's a well-trodden path. You’ll need to prove your eligibility, pull together the right documents like your passport and visa, and then just follow the bank's specific application steps.

The requirements for a personal account versus a corporate one are quite different, but neither is impossible if you’re prepared. For businesses, getting some professional help can make a huge difference, especially when you're juggling everything from mainland or freezone company formation to getting that crucial corporate account up and running.

Your Essential Guide to Banking in the UAE

Getting to grips with the local financial system is a top priority for anyone moving to or doing business in the United Arab Emirates. The country has a world-class banking sector, known for its slick digital services and a huge range of products designed for a global crowd. Whether you're an entrepreneur looking to take advantage of the UAE's tax benefits or a new resident just settling in, a local bank account is an absolute must-have.

People often think the process is complicated, but it really comes down to three things: your eligibility, having the right paperwork, and understanding the application process. The UAE has worked hard to make banking accessible, and it shows.

Key Differences: Personal vs Corporate Accounts

One of the biggest points of confusion I see is the difference between opening a personal account and a corporate one. A personal account is usually straightforward for residents who have a valid visa and Emirates ID.

A corporate account, on the other hand, involves a much deeper due diligence check from the bank. This is where many entrepreneurs hit snags, often getting bogged down with documents like the Memorandum of Association or shareholder resolutions.

As you get started, it helps to know what kind of documents you’ll be dealing with. For a deep dive into what a bank statement shows, this guide is a great resource.

The UAE's push for a secure and accessible financial system is undeniable. It's actually one of the most banked nations in the world, with around 94% of residents holding at least one bank account. This reflects both the government's efforts and the massive demand from the diverse expat community here.

Knowing the basic requirements from the start will save you a lot of time and headaches. This quick table breaks down the main differences to help you see what you'll need.

Personal vs Corporate Bank Accounts at a Glance

| Requirement | Personal Account | Corporate Account |

|---|---|---|

| Primary Applicant | Individual (Resident/Non-Resident) | Legal Business Entity (Mainland/Freezone) |

| Key Documents | Passport, Visa, Emirates ID, Salary Certificate | Trade Licence, MOA, Shareholder Documents |

| Eligibility | Based on residency and/or employment status | Based on valid business licence and structure |

| Processing Time | Typically 2-7 business days | Can take 2-4 weeks or longer |

| Minimum Balance | Often required (varies by bank) | Almost always required (usually higher) |

As you can see, the path for a corporate account is a bit more involved, but getting your documents in order beforehand is the key to a smooth process for either type.

Choosing the Right Bank and Account Type

With nearly 50 banks operating across the UAE, stepping into the financial landscape can feel like a big decision. The bank you choose will be your financial partner, impacting everything from daily transactions to long-term business growth.

Making the right choice goes beyond just picking a name you recognise; it's about aligning a bank's services with your specific needs. Whether you are a salaried professional, a freelancer managing variable income, or an entrepreneur setting up a new venture, the ideal bank for you exists. The key is to look past the marketing and focus on the practical details that matter most.

Conventional vs Islamic Banking Principles

One of the first decisions you'll face is whether to opt for a conventional or an Islamic bank. This choice is often based on personal financial principles, but it's important to understand the practical differences.

Conventional banks operate on an interest-based model (Riba), where they lend money and charge interest, and also pay interest on deposits. This is the standard banking model found globally.

Islamic banks, in contrast, adhere to Shariah law. This means they do not deal with interest. Instead, they use profit-sharing models. For example, instead of a savings account earning interest, an Islamic account might offer an expected profit rate based on the bank's investments.

Key Takeaway: The primary difference lies in the handling of money. Conventional banks use interest, while Islamic banks use profit-and-loss sharing agreements. Both offer a full suite of services like current accounts, debit cards, and online banking.

Comparing Local Champions and International Giants

The UAE is home to strong local banks and major international institutions, each with unique advantages. Your choice might depend on whether you prioritise local market expertise or global connectivity.

-

Local Banks (e.g., Emirates NBD, First Abu Dhabi Bank – FAB): These banks often have the largest branch and ATM networks in the UAE. They tend to offer competitive products tailored to the local market, such as salary transfer accounts with lower minimum salary requirements. Their deep understanding of the local economy can be a significant advantage.

-

International Banks (e.g., HSBC, Standard Chartered): If you frequently move money internationally or need seamless banking across different countries, an international bank could be a better fit. They excel in multi-currency accounts and often provide a dedicated relationship manager for their premium clients, making cross-border transactions smoother.

Key Factors to Evaluate in an Account

Beyond the bank itself, you need to scrutinise the specifics of the account types on offer. The details hidden in the fine print can make a huge difference to your banking experience.

Minimum Balance Requirements

This is a common surprise for many newcomers. Most UAE bank accounts require you to maintain a minimum monthly average balance, typically ranging from AED 3,000 to AED 5,000 for standard personal accounts. Failing to meet this can result in monthly penalty fees. Corporate accounts have significantly higher requirements.

Fee Structures

Look beyond the monthly maintenance fee. Investigate other charges that could affect you:

- Fees for international transfers (both sending and receiving).

- Charges for using another bank's ATM.

- Costs for issuing a chequebook.

- Foreign exchange conversion rates.

Digital Banking Experience

In a tech-forward city like Dubai, a powerful and intuitive mobile app is non-negotiable. Check reviews of the bank's app. Can you easily pay bills, transfer funds, and manage your account without needing to visit a branch? A great digital platform saves you invaluable time.

For business owners, deciding how to open a bank account in the UAE involves more than just personal preference. When operating a company, it's vital to consider the importance of a dedicated business bank account to keep your personal and professional finances separate.

If you need assistance, check out our specialised services for opening a business bank account in Dubai. Our team handles everything, ensuring a seamless setup from mainland or freezone company formation to securing your corporate banking facilities.

Getting Your Paperwork in Order for a Smooth Application

If there’s one secret to a fast, hassle-free bank account opening in the UAE, it’s this: preparation. Banks here work under very strict regulations, which means your paperwork has to be flawless.

Even a tiny mistake—a missing signature, a blurry copy—can sideline your application, leading to some seriously frustrating delays. It's best to think of your document file as the foundation for the whole process. Get it right from the start, and you’ll save yourself a world of stress and countless trips back and forth to the bank.

Core Documents for a Personal Bank Account

For a personal account, the requirements are thankfully quite consistent across most banks. The main distinction is between residents and non-residents, with residents having a much simpler time of it.

If you’re a UAE national or an expatriate with a valid visa, the document list is pretty straightforward. You’ll definitely need your passport and Emirates ID, along with proof of where you live and usually a salary letter from your employer.

The Emirates ID is especially vital. Banks use it for almost everything, from verifying who you are to linking your account with various government e-services, which is standard practice here.

Expert Tip: Don't just make copies—make high-quality colour copies of everything. Banks can be surprisingly picky, and a poor-quality scan is an easy reason for them to reject your file. It's also a great idea to keep digital scans of everything on hand.

Diving Deeper into Corporate Account Requirements

Opening a corporate bank account is a whole different ball game. The level of scrutiny is much higher because banks need to fully understand your business—its legal structure, its owners, and its activities. This is where the document list gets a lot longer.

Honestly, this is where many new entrepreneurs get stuck. The requirements can feel overwhelming, but they all exist for a good reason: to comply with strict anti-money laundering (AML) and Know Your Customer (KYC) regulations.

Document Checklist for UAE Bank Accounts

To make things easier, we've put together a clear checklist. This table breaks down what you'll typically need for both personal and corporate accounts.

| Document | Required for Personal Account | Required for Corporate Account |

|---|---|---|

| Passport & UAE Visa Page (for all individuals involved) | ✔️ | ✔️ |

| Emirates ID Card (for all individuals involved) | ✔️ | ✔️ |

| Proof of Address (e.g., utility bill, Ejari) | ✔️ | ✔️ (for signatories) |

| Salary Certificate or Employment Contract | ✔️ (often required) | ❌ |

| Company Trade Licence | ❌ | ✔️ |

| Memorandum/Articles of Association (MOA/AOA) | ❌ | ✔️ |

| Board Resolution to open the account | ❌ | ✔️ |

| Business Plan / Company Profile | ❌ | ✔️ (highly recommended) |

| Bank Statements (personal or corporate, 6-12 months) | Sometimes | ✔️ |

Having these documents ready will significantly speed up your application and show the bank you're a serious, well-prepared client.

Mainland vs. Freezone Document Nuances

Where your company is registered—whether on the mainland or in a freezone—will cause small but important variations in your paperwork. The core requirements are the same, but the documents will come from different authorities and have different formats.

For instance, a Dubai Mainland company's MOA is notarised by the Dubai Courts, while its licence is issued by the Department of Economy and Tourism (DET). A company from Sharjah Media City (Shams), on the other hand, will have its licence and MOA issued directly by the Shams freezone authority. Banks know the difference, so it’s crucial you provide the correctly attested versions for your specific jurisdiction.

The Make-or-Break Step: Document Attestation

One of the most common hurdles, especially for foreign-owned companies, is document attestation. If any of your key corporate papers—like a shareholder resolution or certificate of incorporation—were issued outside the UAE, they must be legally attested.

This is a multi-stage process that involves certification in the document's home country, followed by final attestation from the UAE's Ministry of Foreign Affairs (MOFA).

There are no shortcuts here. Trying to skip this step will bring your application to a dead stop. Banks simply will not accept foreign corporate documents without the official UAE attestation stamps. This process can be tricky and take a lot of time, which is exactly why our Corporate PRO Services are so valuable. At PRO Deskk, we handle the entire attestation journey, making sure your documents are 100% compliant and preventing delays that could hurt your business.

For more hands-on guidance, our breakdown of current account opening services provides even more detail on what UAE banks are looking for.

Kicking Off the Account Opening Process

Once you’ve got all your paperwork in order, you’re ready to start the actual application. The whole journey, from handing over your documents to getting your debit card, has definitely gotten faster in recent years. Still, knowing what to expect makes everything a lot less stressful, especially if you’re figuring out how to open a bank account in the UAE for the first time.

Most UAE banks have gone digital-first. You’ll usually start your application online, uploading scanned copies of your documents. This gets your profile into the bank's system quickly so they can begin the initial checks. For a standard personal account with a simple salary transfer, the whole thing can sometimes be wrapped up with very little fuss.

But don't be surprised if the bank asks you to come in for a visit. It’s almost a given for corporate accounts or for individuals with more complex finances. Banks are required to do an in-person verification to finalise the account—it's a standard part of their security protocol.

Getting Through the Due Diligence Phase

After you hit 'submit', the bank kicks off its internal review. You'll hear this called the 'Know Your Customer' (KYC) or due diligence process. This isn't just a box-ticking exercise; it's a strict legal requirement for all financial institutions in the UAE to help prevent financial crime.

During this stage, a compliance officer will go through every document you’ve submitted with a fine-tooth comb. They are verifying:

- The authenticity of your ID documents (passport, visa, Emirates ID).

- The legitimacy of where your money is coming from (salary certificate, trade licence).

- That your business activities (for corporate accounts) are clear and match what’s on your licence.

This is the most critical phase and, frankly, where things can get held up. If the bank has questions or spots a small discrepancy, they’ll reach out. Responding quickly and clearly is the best way to keep the process moving forward.

Expert Insight: If you're a business owner, I always recommend providing a concise company profile or a one-page business plan, even if the bank doesn't ask for it. It gives the compliance team a clear picture of your operations from the get-go and builds a lot of confidence in your application.

Realistic Timelines and How to Follow Up

Patience is a virtue here, but that doesn't mean you should just sit and wait. Proactive follow-up is important. Just remember that timelines can vary wildly depending on the bank, the type of account, and how complex your application is.

- Personal Accounts: You’re typically looking at 2 to 7 business days for approval once all your documents are submitted correctly.

- Corporate Accounts: This is a much deeper dive. Expect it to take anywhere from 2 to 4 weeks, sometimes even longer if you have a complicated shareholder structure or are in a high-risk industry.

If you haven’t heard anything within the expected timeframe, a polite follow-up call or email is perfectly fine. Just make sure you have your application reference number handy. Instead of just asking, "Is it done yet?", try something like, "I'm following up on my application and just wanted to check if there is any additional information you need from my side." It’s a professional approach that usually gets a more helpful response.

Why Professional Help Makes a Difference

For entrepreneurs setting up a Mainland or Freezone company, opening a bank account can feel like a huge administrative headache. This is where partnering with a specialist really pays off. A dedicated business setup consultant, like our team at PRO Deskk, does more than just help with your company formation; we become the critical link between you and the bank.

Our Corporate PRO Services include managing the entire bank account application for you. We use our established relationships with various banks to make sure your file gets the attention it deserves. We handle all the back-and-forth, answer any queries from the compliance team, and keep you in the loop every step of the way. This support ensures your application doesn’t get lost in a queue, letting you focus on what really matters—growing your business.

Ready to simplify your business setup? Call us now at +971-54-4710034 or WhatsApp us today for a free consultation. Our 24/7 support means we're always here when you need us.

Common Mistakes to Avoid When Opening Your Account

Getting a bank account in the UAE can be a smooth ride, but a few common slip-ups can bring the whole process to a screeching halt. The smartest way to get your application through without any trouble is to learn from the mistakes others have already made.

One of the biggest surprises for newcomers is how seriously banks take minimum balance requirements. It's easy to get caught up in the initial setup and forget about this, but banks will penalise accounts that drop below the required amount, which is often between AED 3,000 and AED 5,000 for personal accounts. Those monthly penalty fees can sting if you're not paying attention.

Overlooking the Hidden Fees

A low monthly maintenance fee might catch your eye, but it's vital to dig a bit deeper. So many applicants don't take the time to read the full schedule of charges, and that's when unexpected costs start to pop up.

Think about how you'll actually use the account day-to-day. If you plan on sending money back home, for instance, international transfer fees can be wildly different from one bank to another. A bank with a high percentage fee on outgoing remittances could cost you a lot more in the long run than one with a slightly higher monthly fee but better international rates.

Always check for these common charges:

- International Transfer Fees: For both sending and receiving money.

- Chequebook Issuance: Cheques are still a big deal here, especially for things like rent, and your first book isn't always on the house.

- ATM Usage: Using another bank's ATM will likely cost you.

- Account Closure Fees: Thinking of switching? Some banks will charge you if you close your account within the first year.

Underestimating Document Scrutiny

Submitting paperwork that's incomplete or has errors is the number one cause of application delays. Full stop. Banks in the UAE are bound by strict compliance rules, and their due diligence is no joke. A simple mistake, like an unattested document or a blurry passport copy, will stop your application in its tracks.

This is even more critical for business owners. A common pitfall is underestimating how long corporate verification takes. The bank will go through your Trade Licence, Memorandum of Association (MOA), and shareholder resolutions with a fine-tooth comb. Any little inconsistency will raise a red flag.

Insider Tip: Always have a clear, well-documented source of funds ready to show, particularly for a corporate account. The bank needs to know where your initial capital came from. A straightforward explanation of your business activities and funding can build trust and seriously speed up the compliance check.

For certain professional roles, you might also need a specific letter from your current sponsor. To get a better handle on this, you can learn more about what a No Objection Certificate (NOC) is in the UAE and when you're likely to need one.

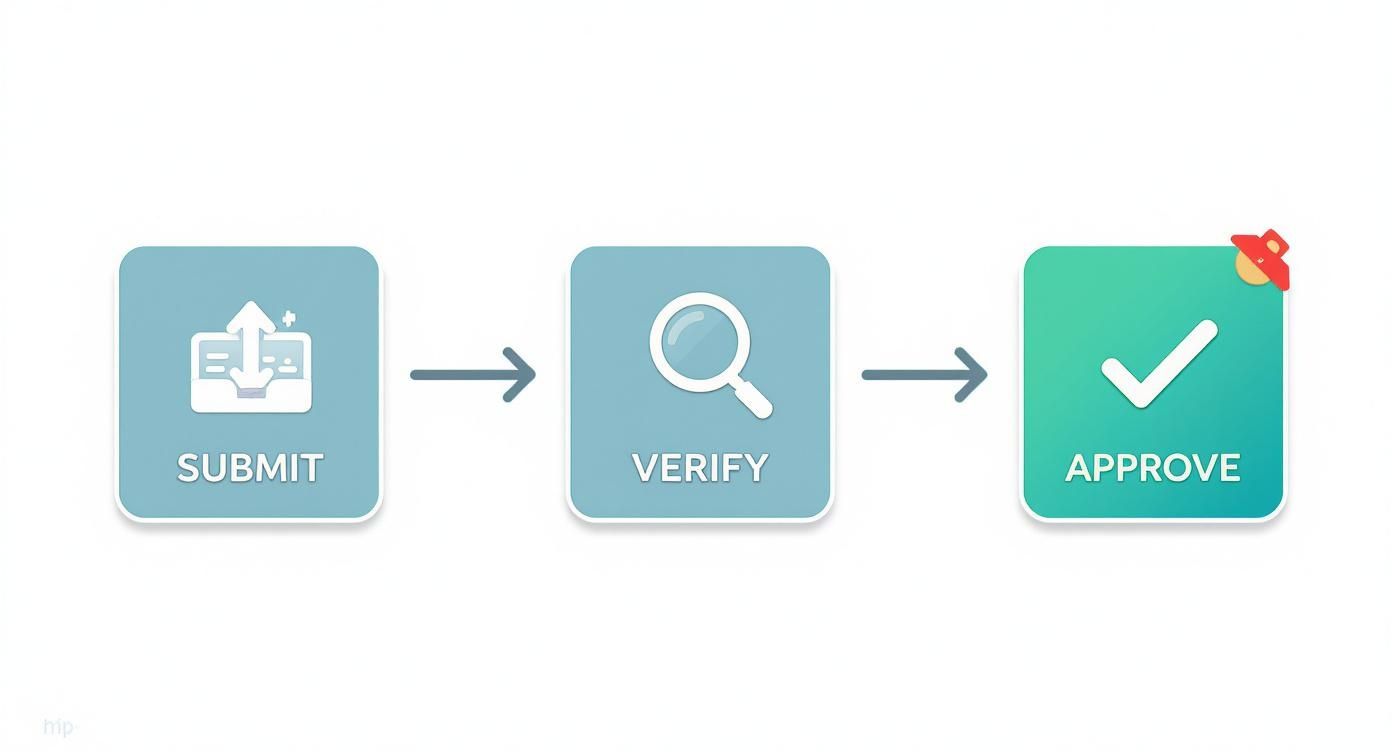

This simple flow chart gives you a clear picture of the main stages you'll go through.

As you can see, getting from submission to approval depends on successfully clearing each step, with verification being the most critical hurdle.

Choosing the Wrong Account for Your Needs

Finally, a classic mistake is picking an account that just doesn't fit what you do. For example, a freelancer getting paid in several different currencies would be much better off with a multi-currency account. Instead, they often go for a standard one and end up losing money on conversion fees with every payment.

It's the same for entrepreneurs. Someone setting up a mainland company in Dubai needs a proper corporate account with features that can support their business. Grabbing a basic business account might seem cheaper at first, but it can really hold back your company's financial operations as you start to grow. It pays to take the time to match the account's features with your long-term vision.

At PRO Deskk, our specialists offer guidance specifically to help you avoid these common traps. From making sure your documents are perfectly in order to helping you choose the right bank, our cost-effective business setup solutions are all about getting it right the first time. WhatsApp us today for a free consultation.

Your Questions on UAE Banking Answered

As you get closer to opening your bank account in the UAE, it's natural to have a few final questions pop up. The process can seem full of specific rules, and sometimes a small piece of missing information can cause a lot of confusion.

To help clear up any lingering uncertainties, we’ve put together answers to the most common queries we hear from entrepreneurs and new residents. This is the practical, straightforward advice you need to finalise your banking plans with confidence.

Can a Non-Resident Open a Bank Account in the UAE?

Yes, it’s definitely possible for a non-resident to open a bank account, but your options will be a bit more limited. Most banks will only offer non-residents a savings account, not a current account. This is a crucial distinction.

A savings account lets you hold funds and make transfers, but it typically won't come with a chequebook. Since cheques are still widely used in the UAE for major payments like yearly rent, this can be a significant drawback. Banks also tend to impose higher minimum balance requirements on non-resident accounts, and the due diligence process is much stricter.

What Is the Typical Minimum Salary for an Account?

For a standard personal current account in Dubai, the minimum salary requirement is a key factor. While it varies from bank to bank, a common threshold is around AED 5,000 per month.

Some banks do offer accounts for those with salaries as low as AED 3,000, but these might come with fewer features or higher fees. If you meet the salary requirement, the bank sees you as having a stable income source, which makes the whole approval process much smoother. For business owners, the focus shifts from personal salary to the company's projected turnover and initial capital injection.

How Long Does It Take to Open a Corporate Account?

This is a critical question for any entrepreneur, as business operations can't truly begin without a functioning bank account. While a personal account can often be opened in just a few days, a corporate account is a much more involved process.

Realistically, you should budget anywhere from two to four weeks from the moment you submit a complete and correct application. This timeline can stretch out if your company has a complex ownership structure or operates in an industry that requires extra scrutiny from the bank's compliance department.

A Note on Delays: The most common reason for delays is incomplete documentation. Partnering with a specialist in corporate PRO services ensures every document, from your MOA to attested shareholder papers, is perfect before submission, which can significantly shorten this waiting period.

Can I Open a Joint Account Before My Spouse's Visa is Issued?

Generally, no. To open a joint account, both applicants must be UAE residents with valid Emirates IDs. Banks require the physical Emirates ID for verification before they can add a second person to an account.

The most practical approach is for one spouse to open a personal account first, once their residency visa and Emirates ID are processed. After the other spouse completes their residency formalities and gets their own Emirates ID, they can then be added to the account as a joint holder. Trying to do it beforehand will almost certainly lead to the application being rejected.

Navigating the complexities of company formation and bank account opening is what PRO Deskk does best. We are:

✅ Specialists in Mainland Company Formation in Dubai, Sharjah & Abu Dhabi

✅ Specialists in Freezone Company Formation across the UAE

✅ Specialists in Golden Visa on Property and Investor Visa

✅ Specialists in Corporate PRO Services and Attestation Services

With our 24/7 support service, cost-effective business setup solutions, and deep expertise in helping entrepreneurs enjoy UAE tax benefits, you're never alone in the process.

📞 Call Us Now: +971-54-4710034

💬 WhatsApp Us Today for a Free Consultation: https://prodesk.ae