If you're looking at setting up a corporate structure in the UAE, you've almost certainly come across the term holding company. In simple terms, this is a special type of company set up mainly to own shares and assets in other businesses, which we call subsidiaries.

The holding company acts like a parent, strategically managing its investments without getting tangled up in the day-to-day grind of the companies it owns. This separation is crucial, as it shields your core assets from the operational risks faced by the subsidiaries.

What Is a UAE Holding Company and Why Is It Essential

Think of a holding company as the captain of your business portfolio. It doesn't actually make the products or deliver the services itself. Its primary job is to own things—specifically, controlling stakes in your other operating companies. This creates a powerful and clear distinction between the entity holding the valuable assets and the entities out there doing the actual business.

This "parent-and-subsidiary" model is where the strategic magic happens. The parent holding company owns the shares of its subsidiary businesses. If one of those operating companies runs into legal trouble or financial difficulty, the assets safely tucked away in the parent company are generally protected from those liabilities.

This structure creates a robust legal firewall, which is one of the biggest reasons international entrepreneurs are so keen to establish a holding company in the UAE.

The Strategic Appeal for Global Entrepreneurs

The UAE has quickly become a top choice for setting up holding structures, thanks to its incredibly pro-business environment and strategic perks. Entrepreneurs and investors are drawn to this model not just for asset protection but for the sheer efficiency it brings to managing a diverse portfolio.

Imagine you own a tech start-up, a portfolio of properties, and a retail chain. A holding company brings all of that under one roof, centralising control and making oversight much, much simpler.

The UAE's competitive corporate tax system only adds to the appeal. A holding company can be structured to optimise tax liabilities, especially when it comes to dividends and capital gains from its subsidiaries.

A huge advantage in the UAE's tax law is the "participation exemption." This allows a holding company to receive dividends and capital gains from its qualifying subsidiaries completely tax-free. This clever rule prevents double taxation and seriously boosts returns for investors.

A Hub for Substantial Wealth Management

You just have to look at the numbers to see that the UAE is a major hub for holding companies and family offices. For instance, well-known family offices like Royal Group manage assets of around $164 billion, with investments in everything from real estate to tech.

Similarly, Dubai Holding LLC has a portfolio worth about $75 billion, with major deals across countless industries. This incredible concentration of wealth really underscores the UAE's central role in global finance and asset management. You can discover more insights about top UAE family offices here.

So, to boil it down, a UAE holding company gives you a powerful framework for:

- Asset Protection: Keeping valuable assets like intellectual property, real estate, and company shares separate from operational risks.

- Centralised Control: Streamlining the management and strategic direction of multiple business ventures.

- Tax Efficiency: Making the most of the UAE's tax laws to minimise what you owe on investment income.

- Succession Planning: Making it much easier to transfer assets and business ownership to the next generation.

Getting your head around this concept is the first, most important step toward building an international business structure that's both resilient and profitable.

What Are the Real Advantages of a UAE Holding Company?

Setting up a holding company in the UAE isn't just about getting another trade licence; it's a sharp strategic move that can seriously boost your company's growth, security, and financial health. Think of this structure as the central pillar for your entire business portfolio, giving you a solid framework to hit long-term goals and protect what you've worked so hard to build.

Imagine it like this: your holding company is a fortress, and your various operating businesses are the towns and villages around it. Each town runs on its own, but the fortress provides the ultimate protection and a centralised command centre.

Bulletproof Your Assets and Cut Down on Risk

One of the biggest draws is, without a doubt, asset protection. A holding company acts as a legal firewall between itself and its subsidiaries. So, if one of your operating companies gets hit with a lawsuit, piles up debt, or faces any other financial trouble, the assets parked under the parent company—like real estate, intellectual property, or shares in other successful ventures—are kept safe and sound.

This separation is a game-changer for entrepreneurs with their hands in multiple pots. It means a problem in one business doesn't bring the whole house down. You can innovate and take calculated risks in your day-to-day operations with a lot more confidence.

A holding company is your legal shield. It ring-fences your core assets, making sure that operational troubles in one subsidiary don't start a domino effect that threatens the financial stability of your entire group.

This setup also makes buying or selling off subsidiaries a whole lot cleaner. Because the ownership is neatly bundled within the holding company, transferring shares becomes a straightforward deal without messing up the rest of your portfolio.

Streamline Your Management and Simplify Operations

Juggling multiple businesses can quickly turn into a messy web of admin work, financial reports, and strategic headaches. A holding company brings some much-needed order to all that chaos by centralising control.

Big-picture decisions, key management functions, and financial reporting can all be handled from the top. This gives you a crystal-clear, unified view of how the whole group is performing, making it easier to move resources around, find synergies between your companies, and roll out group-wide policies. Not only is this more efficient, but it also makes you look much more credible to banks and potential investors, who always prefer a tidy and organised corporate structure.

Take Full Advantage of the UAE's Tax Benefits

The UAE’s tax-friendly environment is a huge pull for international business owners, and a holding company is the perfect vehicle to make the most of it. Even with the introduction of corporate tax, the rules were written with key provisions to support these kinds of investment structures.

A major win here is the participation exemption. As long as you meet certain conditions, this rule lets a holding company receive dividends and capital gains from its subsidiaries without paying any corporate tax on them. This is a fantastic way to avoid double taxation as profits move up through your corporate structure.

This is especially useful for international entrepreneurs, as it simplifies getting your profits back home and optimises the overall tax you pay on your global investments. You can also set up holding companies in certain Free Zones that may offer a 0% corporate tax rate on their income, making things even more financially efficient. While offshore jurisdictions offer a different set of perks, you can explore how they protect international assets by learning more about an offshore company in Dubai.

Boost Confidentiality and Plan for the Future

For many high-net-worth individuals and family offices, privacy is paramount. A holding company adds an extra layer of confidentiality around who ultimately owns the assets. The ownership details are registered at the holding company level, which can limit how much of your direct involvement in various operating businesses is public knowledge.

On top of that, this structure is an excellent tool for succession planning. Passing on an entire business portfolio becomes as simple as transferring the shares of the one holding company. It saves you from the headache of transferring ownership for each individual subsidiary, ensuring a smooth and organised handover of wealth and control to the next generation or new partners.

Choosing Your Jurisdiction: Mainland, Free Zone, or Offshore

Deciding where to set up your holding company in the UAE is probably the single most important choice you'll make. This isn't just a box-ticking exercise; it dictates everything from who you can do business with to your long-term strategic flexibility. The UAE lays out three clear paths—Mainland, Free Zone, and Offshore—and each one is built for a different kind of business ambition.

Getting this right means looking beyond simple definitions. You need to align the features of each jurisdiction with what you actually want to achieve. Is your main goal to tap into the local market? Or are you focused on asset protection and international operations? The answer will point you in the right direction.

Mainland: Your Gateway to the Local UAE Market

If your game plan involves getting right into the thick of the UAE’s domestic economy, a Mainland holding company is your best bet. Registered with the Department of Economic Development (DED) in an emirate like Dubai or Abu Dhabi, this setup gives you unparalleled freedom to operate locally.

The standout advantage here is the unrestricted ability to trade and do business anywhere in the UAE. You can bid on government contracts, set up offices across the emirates, and deal directly with local customers without needing any middlemen. It’s all about direct access.

While this route used to require a local sponsor, recent reforms have changed the game. Now, you can get 100% foreign ownership for most business activities, making the Mainland option more appealing than ever for international investors.

Free Zone: An Ecosystem for Global Operations

Think of Free Zones as dedicated economic areas with their own rules, all designed to pull in foreign investment. There are over 40 of them across the UAE, many specialising in specific industries like tech, media, finance, or logistics.

The big draw for a Free Zone holding company is the guaranteed 100% foreign ownership, plus major tax benefits like a potential 0% corporate tax on qualifying income. These zones are self-contained business hubs, complete with modern infrastructure and refreshingly straightforward setup processes.

A Free Zone company is ideal for businesses that are focused on international trade or serving clients outside the UAE. While you can't trade directly on the Mainland, it provides a secure and highly efficient base for managing a global portfolio of assets and subsidiaries.

For a closer look at how these two popular options stack up, dive into our detailed comparison of Free Zone vs Mainland Dubai to help clarify your decision.

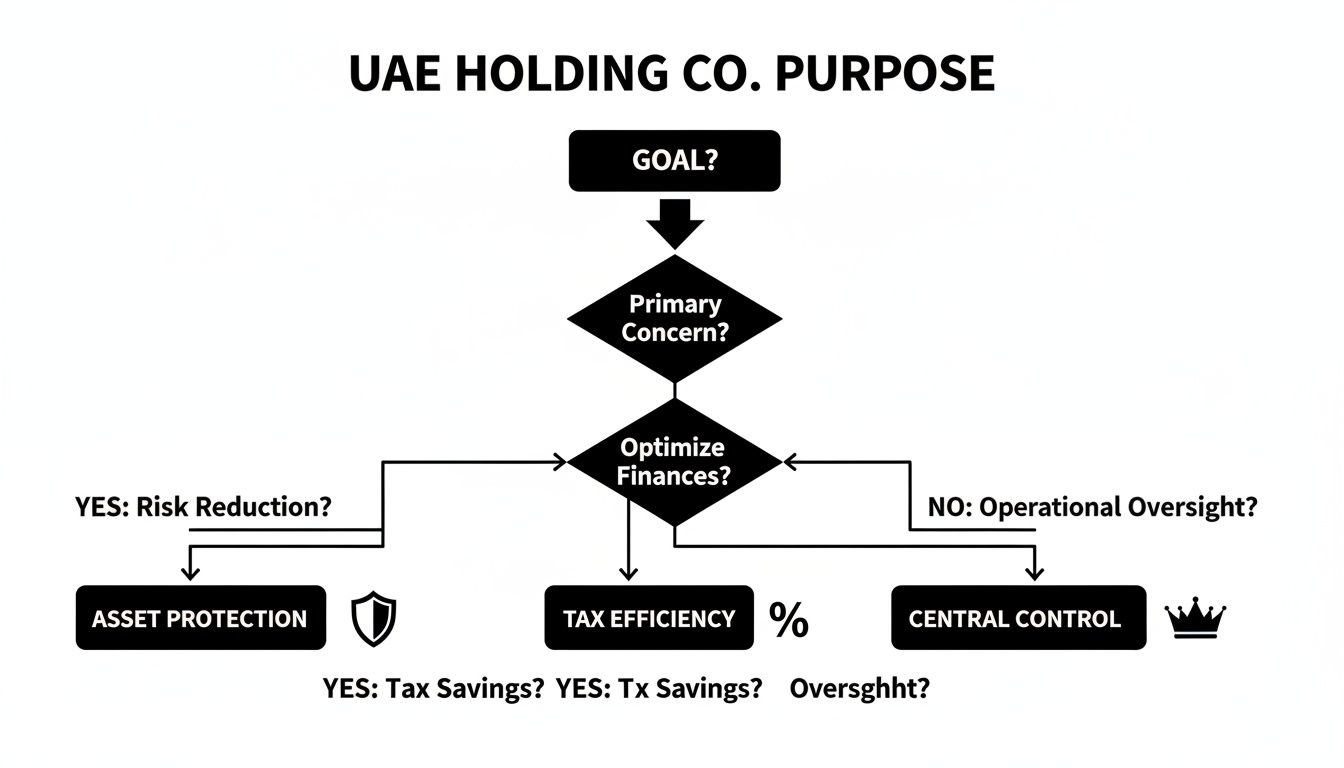

Thinking through your company's purpose can often simplify the choice, as this guide shows.

This decision tree illustrates how your primary goal—whether it's asset protection, tax efficiency, or centralised control—naturally leads to a specific jurisdictional strategy.

Offshore: A Secure Vault for Asset Protection

An Offshore company, often registered in a jurisdiction like Ras Al Khaimah International Corporate Centre (RAK ICC), has a very distinct and focused role. It’s a non-resident legal entity created almost exclusively for international investment, holding assets, and estate planning.

Legally, Offshore companies cannot conduct any business inside the UAE. Their power lies elsewhere: providing a confidential and tax-neutral structure for owning international property, intellectual property rights, or shares in other companies across the globe.

This structure offers the highest level of privacy and is a powerful tool for succession planning and shielding wealth from international liabilities. It isn't an operating company; it's a secure legal vault for your most valuable assets.

UAE Holding Company Jurisdiction Comparison

To help you visualise the differences, here’s a straightforward comparison of the key features across all three jurisdictions.

| Feature | Mainland Company | Free Zone Company | Offshore Company |

|---|---|---|---|

| Primary Purpose | Direct trade within the UAE market and holding local assets. | International trade, service provision, and regional headquarters. | Holding international assets, intellectual property, and shares. |

| Ownership Structure | 100% foreign ownership available for most activities. | 100% foreign ownership is a standard feature. | 100% foreign ownership is guaranteed. |

| Market Access | Unrestricted access to the entire UAE local market. | Trade is limited to within the Free Zone and internationally. | No permission to conduct any business within the UAE. |

| Visa Eligibility | High eligibility for employee and investor visas. | Visa eligibility is available but may be limited by office size. | No eligibility for residency visas. |

| Office Requirement | A physical office lease is mandatory for licensing. | Flexible options, including virtual and flexi-desks. | No physical office is required or permitted. |

| Confidentiality | Shareholder details are on public record. | Varies by Free Zone, but generally offers good privacy. | Maximum confidentiality with shareholder details kept private. |

Ultimately, choosing the right jurisdiction for your holding company in the UAE comes down to having a clear vision for your business. Whether you need the market access of the Mainland, the global reach of a Free Zone, or the asset security of an Offshore entity, PRO Deskk is here to provide the expert guidance you need to ensure your structure is perfectly aligned with your strategic goals.

Your Step-by-Step Incorporation Checklist

Turning the idea of a holding company in UAE into a real, legally recognised business involves a pretty clear-cut process. While the exact steps might change a bit depending on whether you choose a Mainland, Free Zone, or Offshore setup, the basic roadmap is the same. This checklist breaks that journey down into simple, manageable actions.

Think of it like building a house—you wouldn't start pouring concrete without a solid blueprint. This checklist is your blueprint. Following it will help you sidestep common mistakes that can cause expensive delays.

Phase 1: Foundational Decisions and Approvals

Before a single document is filed, you need to lay the groundwork. This first phase is all about making the big decisions that will shape your company's legal identity and structure. Getting these things right from the very beginning is key to a smooth setup.

-

Define Your Corporate Structure: First things first, you need to map out who the shareholders are and what percentage of shares each person will own. You also have to pick a legal form. For most holding companies on the Mainland or in a Free Zone, a Limited Liability Company (LLC) is the most popular and flexible option.

-

Select a Compliant Trade Name: Your company name has to be unique and follow the UAE's naming rules. It can't be offensive, use religious references, or sound too much like another company's name. You’ll need to submit a few choices to the authorities for approval.

-

Secure Initial Approval: This is a huge milestone. You'll submit your proposed business activity (which is holding investments), shareholder information, and your chosen trade name to the right governing body. That’s either the Department of Economic Development (DED) for a Mainland company or the specific Free Zone authority. This gives you the preliminary green light to move forward.

A common mistake is picking a trade name that gets rejected, which can really slow things down. It's always a good idea to have three to five name options ready, listed in order of preference, to keep the process moving.

Phase 2: Legal Documentation and Formalities

Once you have that initial approval, it's time to draft and finalise the legal documents that will govern your company. This is where your corporate structure comes to life on paper, and you need to pay close attention to the details.

You might need professional official document translation services during this stage, particularly if you have international shareholders or legal paperwork from other countries.

-

Draft the Memorandum of Association (MOA): The MOA is basically your company's constitution. It clearly states the company's purpose, shareholder responsibilities, the share capital breakdown, and how profits and losses are shared. This document needs to be drafted carefully to make sure it accurately reflects everyone's agreement.

-

Notarise Legal Documents: The MOA, along with any other key documents like a Power of Attorney (if you're using a representative), must be signed by all shareholders in front of a public notary. This is what makes the agreements legally binding.

Phase 3: Finalising Your Physical and Legal Presence

The last few steps are about locking down your company’s physical address and submitting all the final paperwork to get your official licence. This is the home stretch, where all your work comes together to create a fully operational legal entity.

The UAE's capital markets are thriving, which really underscores why getting your corporate structure right from day one is so important. The total number of listed domestic companies has hit 154, with businesses raising around $13 billion from IPOs in just one year. This activity brought in about 63,000 new investors in 2023 alone—and with 47% of them being foreign, it’s clear there’s huge global confidence in the UAE market.

-

Arrange Your Office Lease: Even a holding company needs a registered physical address. For Mainland companies, this means leasing an actual office space. Free Zones are a bit more flexible, offering options like flexi-desks or virtual offices that still meet the licensing requirements.

-

Submit Final Documentation: Finally, you'll gather the notarised MOA, your signed lease agreement, the initial approval certificate, and copies of the shareholders' passports and submit them to the authority. After a final review, they will issue your official trade licence. Your holding company is now officially incorporated

Managing Visas, Banking, and Ongoing Compliance

Getting your trade licence is a huge milestone, but it’s really just the starting line. Now the real work begins to get your holding company in the UAE fully operational. There’s a checklist of post-setup tasks you need to tackle to ensure your company isn't just a piece of paper, but a functional, compliant entity.

From sorting out residency for shareholders and opening a corporate bank account to keeping up with your legal duties, this next phase is absolutely critical. Skipping these steps can cause major headaches, operational delays, and even penalties later on.

Securing Investor Visas and The Golden Visa

One of the best perks of setting up a company here is gaining eligibility for UAE residency. Shareholders and key managers can apply for an Investor Visa, which gives them the right to live and work in the country. For any entrepreneur planning to manage their assets from the ground in the UAE, this is a non-negotiable step.

For those with a more significant investment portfolio, the prestigious Golden Visa is an even better option. It provides long-term residency for up to 10 years without needing a sponsor, offering incredible stability for you and your family. This really turns the UAE into a long-term base for both your business and personal life. At PRO Deskk, we handle the ins and outs of both investor and Golden Visa applications every day, making sure the process is as smooth as possible for our clients.

Opening a Corporate Bank Account

You might be surprised to learn that opening a corporate bank account for a holding company can be a complex affair. UAE banks are extremely diligent, with strict anti-money laundering (AML) and know-your-customer (KYC) rules they have to follow. This means you need to come prepared.

You’ll be asked to provide a comprehensive file with documents like:

- Corporate Documents: Your trade licence, Memorandum of Association (MOA), and shareholder registry.

- Personal Documents: Passports, visa copies, and Emirates IDs for all shareholders.

- Business Plan: A clear outline explaining the holding company’s purpose, what it plans to invest in, and where the funds are from.

- Proof of Address: For both the company and its shareholders.

Picking the right bank is just as important as having your paperwork in order. Banks have different risk appetites, and some are simply more comfortable and experienced with holding company structures than others. We can help you navigate this maze; for a deeper dive, check out our guide on how to open a bank account in the UAE.

Navigating Ongoing Compliance Duties

Staying compliant isn’t a one-and-done task; it’s an ongoing commitment. The UAE has several key regulations your holding company must follow to ensure transparency and good governance. Keeping everything organised is crucial. To make sure all your records are in order, from your initial setup documents to annual filings, it helps to streamline your document management.

Here are the key responsibilities you'll need to manage:

- Annual Licence Renewal: Your trade licence isn't permanent. It must be renewed every year with the issuing authority to keep your company active.

- Ultimate Beneficial Owner (UBO) Register: You are required to maintain an accurate, up-to-date register of the company's ultimate beneficial owners and submit it to the authorities.

- Economic Substance Regulations (ESR): If your holding company performs certain activities, you’ll need to comply with ESR by proving you have a genuine economic presence in the UAE.

- Corporate Tax Filings: All companies must register for corporate tax. You'll also need to be ready to file annual returns, even if you don't expect to pay any tax due to exemptions.

The UAE’s powerful financial sector is built on a strong regulatory foundation. Across the wider MENA region, the top 100 listed companies hold a staggering $5.4 trillion in assets, with UAE-based firms accounting for 33 of the GCC's 91 entries on that list. This just goes to show how important it is to maintain a flawless legal and financial standing to succeed in this dynamic market.

How We Can Help Set Up Your Holding Company

Figuring out the legal and admin side of setting up a holding company in the UAE can feel complicated, but that’s where having an expert partner makes all the difference. We become your single point of contact, handling every little detail so you can stay focused on your investment strategy, not the paperwork.

Our team knows the ins and outs of UAE company formation. We specialise in setting up businesses across all the key jurisdictions, making sure you make the right choice from the very beginning.

Your End-to-End Formation Partner

We provide clear, cost-effective business setup solutions tailored to your needs. Our process is designed to be straightforward and efficient, cutting through the usual red tape that causes delays and surprise costs. We make sure your new company is structured properly so you can enjoy UAE tax benefits for international entrepreneurs.

Our specialised services include:

- Specialists in Mainland Company Formation in Dubai, Sharjah & Abu Dhabi for direct access to the local market.

- Specialists in Freezone Company Formation across the UAE, giving you 100% foreign ownership.

- Specialists in Golden Visa on Property and Investor Visa services to help secure your long-term residency.

- Specialists in Corporate PRO Services and Attestation Services to manage all government paperwork and document legalisation.

With our dedicated 24/7 support service, you’re never going through this alone. We are always here when you need us, giving you peace of mind from the first conversation to long after your company is up and running.

Choosing the right partner is a critical first step. We don’t just set up your holding company; we help build the foundation for its long-term success.

Ready to establish your holding company in the UAE with confidence?

📞 Call Us Now: +971-54-4710034

💬 WhatsApp Us Today for a Free Consultation

Answering Your Key Questions

When you're thinking about setting up a holding company in the UAE, a few practical questions always come up. Here are some clear, direct answers to the most common queries we hear, helping you get to grips with what this powerful corporate structure involves.

What Is the Minimum Capital for a UAE Holding Company?

This is a classic "it depends" situation. There's no single, fixed rule for minimum share capital; it really changes depending on the jurisdiction and legal structure you choose.

For most Mainland and Free Zone authorities, the old-school thinking of a strict minimum capital figure has faded. Now, the focus is on making sure the capital is simply "sufficient" for what your company plans to do. That said, some of the more premium free zones might still have specific capital requirements. The best way to know for sure is to speak with a consultant who has the latest information for your target location.

Can a Holding Company in the UAE Own Real Estate?

Yes, absolutely. In fact, a holding company is one of the most popular and effective ways to own property in the UAE. It offers a fantastic layer of asset protection and keeps the ownership structure clean and simple.

The specifics, again, come down to where your company is registered. A Mainland company generally has wide-ranging rights to own property anywhere in the emirates. A Free Zone company can usually own property within its own zone and in designated freehold areas across the UAE. Offshore companies are also an incredibly popular and secure choice for holding real estate in these freehold zones.

Do I Need to Be a UAE Resident to Start a Holding Company?

No, you don't need to be a UAE resident to get started. The UAE government has made it a priority to attract foreign investment, which is why they permit 100% foreign ownership for most business activities, whether on the Mainland or in a Free Zone.

With the right help from a firm like PRO Deskk, the entire setup can often be handled remotely without you ever needing to be in the country. Once your company is officially incorporated, you and the other shareholders then become eligible to apply for an investor visa or even the sought-after Golden Visa, which opens the door to long-term UAE residency.

How Is a Holding Company Different from an Operating Company?

The biggest difference is what they do. Think of an operating company as the one on the front lines—it’s actively doing business, selling products, or offering services directly to customers.

A holding company, on the other hand, plays a more passive role. Its main job is to "hold" assets. This usually means owning a controlling number of shares in other operating companies, which are called its subsidiaries. Its income comes from the dividends and capital gains from these investments, not from day-to-day commercial trade. In short, the operating company does the business, while the holding company owns it.

Partner with PRO Deskk to navigate the complexities of setting up your holding company in the UAE. Our team offers cost-effective, specialised solutions for Mainland and Freezone formations, expert visa services, and 24/7 support to ensure a seamless and successful incorporation. Start your journey with a free consultation today.