Thinking about making the move to Dubai as a freelancer? You're in the right place. Securing a freelance visa in Dubai is your direct ticket to living and working legally in the UAE as your own boss. It's the key that unlocks your residency, gives you the green light to run your business, and lets you tap into everything this dynamic city has to offer.

Starting Your Dubai Freelance Journey

Ready to work for yourself in one of the world's most exciting cities? This guide breaks down exactly what you need to do to get your freelance visa in Dubai. We’ll walk you through the entire process, from figuring out the right permit to finally getting that Emirates ID in your hands.

Think of this as your personal roadmap. Moving to Dubai as a freelancer isn't just a career change; it's a massive lifestyle upgrade. The city has worked hard to position itself as a global hub for independent professionals, creating a really supportive environment for talent to thrive.

Why Go Freelance in Dubai?

The appeal goes way beyond the year-round sunshine. A freelance visa opens up some serious advantages that make Dubai a top choice for entrepreneurs and consultants from all over the world.

A few of the biggest perks include:

- Tax Advantages: This is a big one. You get to enjoy the UAE's tax benefits, including zero personal income tax. That means you keep more of what you earn.

- Market Access: You're plugging directly into a booming, diverse economy with endless opportunities in tech, media, design, and just about any other sector you can think of.

- Business Ownership: Forget being an employee. This visa gives you 100% ownership of your business and professional ventures.

- Residency and Lifestyle: The visa is your residency permit. With it, you can rent an apartment, open a bank account, and fully embrace the high-quality life Dubai is famous for.

Understanding the Permit Process

Dubai's freelance visa system has come a long way. Various free zones like Dubai Media City and Dubai Internet City now offer specialised permits that give you the legal standing to work independently in fields from tech and education to media and consulting.

The process of getting the actual permit is relatively quick, typically taking about 10 to 15 working days. Costs can vary depending on which free zone you choose and how long your licence is valid for. You can learn more about the latest freelance visa policies on persianhorizon.com.

This visa is your ticket to a thriving independent career. It’s more than just a document; it’s the foundation for building your professional brand in a city built on ambition and innovation.

Trying to figure it all out—from choosing between a mainland or free zone setup to handling corporate PRO services—can feel a bit overwhelming at first. That's where getting some expert guidance can make a world of difference. With the right support, you can find cost-effective setup solutions tailored to your specific needs and get 24/7 help to ensure your transition from aspiring freelancer to a fully licensed professional is as smooth as possible.

Choosing Between a Mainland and Free Zone Permit

Once you've decided to go freelance in Dubai, you'll hit your first major fork in the road: do you set up on the mainland or in a free zone? This isn't just about picking a location; it's a decision that will define who you can work with, how you operate, and the entire structure of your freelance career.

This choice directly shapes your freedom to operate and your access to clients. It’s crucial that your decision lines up with your specific industry, the clients you want to attract, and your long-term ambitions. Let's break down what each path really means for you.

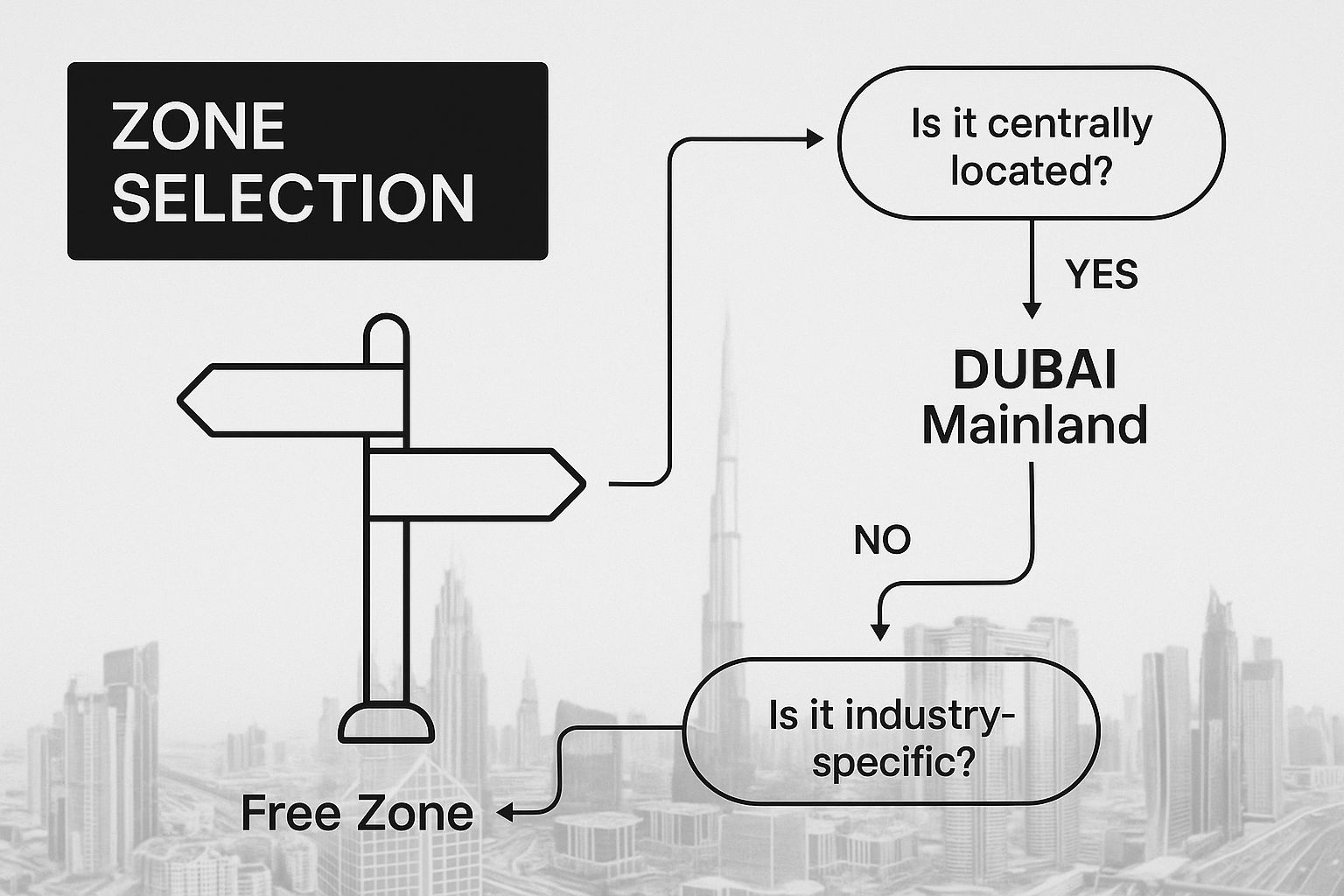

This infographic gives a great visual summary of the key decision points when weighing up a mainland versus a free zone setup.

As you can see, it really boils down to your target market—whether you're aiming to work with clients across the entire UAE or concentrate on a specific industry hub.

Understanding the Mainland Freelance Permit

A mainland permit, which is issued by the Department of Economy and Tourism (DET), gives you the ultimate level of flexibility. It essentially unlocks the entire country, allowing you to work with any client, anywhere in the UAE, with no restrictions.

This is the best route if your client list is varied and includes government bodies, other mainland-based companies, or even individual consumers across Dubai and the other Emirates. For example, a business consultant hoping to win contracts with government ministries or major local corporations must have a mainland permit to legally and directly engage with them.

The biggest plus here is unrestricted market access. You can bid on government tenders, rent an office anywhere in Dubai, and send invoices directly to any client. For freelancers whose business model depends on a wide, UAE-based clientele, this freedom is invaluable. For a deeper dive into the licensing side of things, check out our guide on how to get a trade license in Dubai.

Exploring the Free Zone Freelance Permit

On the other hand, a free zone permit connects you to a specific, industry-focused jurisdiction. The UAE has over 40 free zones, and each one is a dedicated hub for certain sectors. Think Dubai Media City for media pros, Dubai Design District (d3) for creatives, or the Dubai International Financial Centre (DIFC) for finance experts.

When you opt for a free zone, you're primarily allowed to work with other companies registered within that same free zone, or with clients based outside the UAE. A graphic designer with a permit from Dubai Design District, for instance, can easily collaborate with the fashion houses and architecture firms right there in that zone.

Free zones are built to create industry-specific ecosystems. They offer amazing networking opportunities and a built-in community of like-minded professionals, which can be a huge advantage for collaboration and growth.

While working directly with mainland companies is restricted, it’s not totally off-limits. You can often engage them through a registered agent or a special agreement, but it does add an extra layer of administration. The main draw of a free zone is the specialised environment and, often, a more straightforward setup process.

Mainland vs Free Zone Permit Comparison

To really make the right call, it helps to see the key differences side-by-side. Your choice here will impact your business for years to come.

| Feature | Mainland Permit | Free Zone Permit |

|---|---|---|

| Client Access | Unrestricted access to any client in the UAE, including government. | Primarily limited to companies within the same free zone and international clients. |

| Operational Scope | Full freedom to operate anywhere in the UAE mainland. | Operations are generally restricted to the designated free zone. |

| Office Space | Option to rent a physical office anywhere in Dubai. | Often requires leasing a desk or office space within the free zone. |

| Government Approvals | Requires approvals from DET and potentially other ministries. | Approvals are managed by the specific free zone authority, often a simpler process. |

| Business Setup | Can be more complex and require more steps. | Generally a more straightforward and faster setup process. |

| Ownership | 100% ownership for professional service activities. | 100% foreign ownership is a standard benefit of free zones. |

Ultimately, the best path is the one that aligns with your professional goals. A web developer targeting international tech startups would feel right at home in a tech-focused free zone like Dubai Internet City. In contrast, an event planner organising corporate functions for local hotels and businesses would get far more value from the unrestricted access of a mainland freelance permit.

Our team are specialists in both Mainland and Freezone Company Formation. We can provide advice based on your unique situation, making sure your freelance visa in Dubai sets you up for success right from the start.

Preparing Your Essential Documents

Getting your paperwork organised from the very beginning is the single best way to make sure your freelance visa application goes through smoothly. Trust me, a small mistake here can lead to weeks of frustrating delays. Think of this less as a checklist and more as your game plan for putting together a rejection-proof application.

The authorities want to see a clear picture of who you are, what you do, and the value you're bringing to the UAE. We'll go beyond the basic list and get into the nitty-gritty of how to present each document to meet local expectations, drawing on our experience helping hundreds of freelancers avoid the common traps.

Nailing Your Professional Profile

This part is all about proving your credibility. Your professional documents need to shout "expert" the moment someone looks at them.

-

Your CV or Resume: This isn't the time for that generic CV you send out. You need to tailor it to highlight your freelance projects, specific skills, and key achievements. Keep the language sharp and focus on results that show you’re a self-starter.

-

A Simple Business Plan: While it's not always a mandatory requirement, a straightforward, one-page business plan can seriously boost your application. Just outline the services you'll offer, who your target clients are in the UAE, and a basic financial projection for your first year. It shows you're serious and have a viable plan.

-

A Professional Portfolio: For anyone in a creative, tech, or consulting field, a portfolio is absolutely essential. Don't just dump everything in there; curate your best work that’s relevant to the Dubai market. This is your chance to visually prove what you can do.

A strong, well-put-together professional profile gives the authorities confidence in you, which can make the whole approval process a lot faster.

Your Personal and Financial Paperwork

Alongside your professional credentials, you’ll need to provide a standard set of personal documents to verify your identity and show you're financially stable. Precision is everything here—double-check that every detail is accurate and matches across all your documents.

First up, you'll need a high-quality colour copy of your passport. Make sure it has at least six months of validity left. You'll also need a recent, passport-sized photograph that meets the UAE's specific standards—that usually means a white background with a clear, neutral expression.

Next, you need to prove you're financially sound. A bank reference letter is what they're looking for here. This is an official letter from your personal or business bank, on their letterhead, confirming you're a customer in good standing. It doesn't need to show a massive balance, but it does need to prove you have a stable financial history.

A very common mistake we see is people submitting a simple bank statement instead of a reference letter. The authorities specifically ask for the reference letter because it's a formal endorsement from your bank, which adds a layer of credibility that a statement just doesn't have.

The All-Important Step: Document Attestation

One of the biggest hold-ups in any visa process here is document attestation. Certain documents, especially your university degree, have to be legally verified before the UAE authorities will accept them.

Your university degree or highest educational certificate is the main document that needs this. The process is multi-layered: it has to be certified by the Ministry of Foreign Affairs in your home country, then by the UAE Embassy in that country, and finally stamped by the Ministry of Foreign Affairs (MOFA) here in the UAE. It's a complex chain, and one missed step sends you back to the start.

Also, if you're currently employed and plan to freelance on the side, you might need a No Objection Certificate (NOC). This is just a formal letter from your current employer stating they are fine with you getting a freelance permit. You can get all the specifics on what's required in our guide to getting a No Objection Certificate in Dubai.

Handling these attested documents and NOCs correctly is non-negotiable. Getting expert help ensures you tick every box without any last-minute surprises.

Navigating the Application and Visa Process

Once you’ve gathered all your documents, you’re ready to jump into the application itself. It’s helpful to think of this not as one single task, but as a series of clear milestones. Knowing what’s coming up, how long each part takes, and what it costs will help you navigate the process without any nasty surprises.

Each step you complete gets you closer to the end goal: that fresh freelance visa Dubai stamp in your passport. Let's walk through the entire flow, from getting your first permit to holding your new Emirates ID.

Securing Your Initial Permit and Establishment Card

The first real move is to submit your application to your chosen authority. This could be one of the many free zones or, for a mainland permit, the Dubai Department of Economy and Tourism (DET). After they review and approve it, you'll be issued your official freelance permit or licence, which is the document that legally allows you to operate.

With that permit secured, the next piece of the puzzle is the Establishment Card. This is a critical document that links your new freelance licence to the immigration system. It essentially registers your freelance business as an entity, and you absolutely need it before you can apply for your own residence visa.

- Timeline: Expect this stage—getting both the permit and the Establishment Card—to take around 5 to 10 working days.

- Practical Tip: Double- and triple-check that the name on your application is an exact match to your passport. Even a tiny spelling mistake or a missing middle name can cause frustrating delays right at the start.

The Visa Stamping Journey

After you receive your Establishment Card, the process shifts from your business to your personal residency. This part is managed by the immigration authorities and involves a few key appointments.

First, you'll be issued an entry permit. Think of this as a temporary visa that lets you legally stay in the UAE while the rest of the process unfolds. If you're already in the country on a tourist visa, you'll need to do what's called a "status change" to activate this permit without having to fly out and back in.

This is often where having professional Corporate PRO Services really pays off. An expert can handle all the submissions, keep track of your application's progress, and advise on the fastest way to get the status change done, saving you a ton of time and stress.

Next up are two mandatory appointments:

- Medical Fitness Test: This is a standard health screening that includes a blood test and a chest X-ray. It’s done to check for specific communicable diseases and can be completed at any government-approved medical centre in Dubai.

- Biometrics Appointment: You'll need to visit a centre for the Federal Authority for Identity and Citizenship (ICA). Here, they'll take your fingerprints and a photo, which are used to create your Emirates ID card.

Completing the Final Steps

Once your medical test results are clear and your biometrics are in the system, your application is on the home stretch. The very last step is handing over your passport to get the residence visa stamped inside. This is the physical sticker that confirms you're a UAE resident for the duration of your permit, which is usually for one to three years.

With the visa stamped, your Emirates ID card will be printed and delivered to you, typically within a week. This card is your official proof of identity in the UAE and you'll need it for just about everything—opening a bank account, signing a lease for an apartment, or even getting a mobile phone plan.

Here’s a quick breakdown of the final timelines:

- Medical Test Results: You'll usually get these back within 24-48 hours.

- Emirates ID Biometrics: The appointment itself is fast, but it’s a good idea to book it in advance to avoid waiting.

- Visa Stamping: After you submit your passport, this can take anywhere from 3 to 7 working days.

One of the biggest draws for freelancers and entrepreneurs moving here is the financial upside. You get to enjoy UAE Tax Benefits for International Entrepreneurs, which means zero personal income tax on your earnings. That’s a massive advantage right from day one.

Finally, with your visa and Emirates ID in hand, you can open a corporate bank account. This is a crucial step for keeping your business finances separate and professional. Our team offers cost-effective business setup solutions that include hands-on assistance with opening your bank account, making sure you have a reliable partner every step of the way.

Getting to Grips with the Costs and Financial Planning

Kicking off your freelance journey in Dubai is an exciting move, but let's be real – you need a clear picture of the costs involved to get started on the right foot. Nobody likes financial surprises, so this is where we break down every dirham you’ll need to spend to get your freelance visa Dubai. This will help you budget properly and avoid any last-minute stress.

The expenses essentially fall into two buckets: the one-time setup costs to get you up and running, and the annual fees to keep you legal. Planning for both from day one is key.

Your Initial, One-Time Investment

These are the upfront costs you'll face to get your permit sorted and your residency visa stamped. Think of it as the foundational investment in your new freelance business.

- Initial Permit and Application Fees: This is the big one. It covers the actual issuance of your freelance permit, and the price can swing quite a bit depending on whether you go for a mainland or free zone setup.

- Establishment Card Fee: As we touched on earlier, this little card is what officially links your freelance business to the immigration system. It’s a non-negotiable step you have to complete before you can even start the visa application itself.

- Visa Stamping and Medical Test: This lump sum covers all the government-related fees for your medical fitness test, the Emirates ID application, and the final, satisfying moment of getting that residence visa stamped into your passport.

For a better sense of what these figures look like in practice, have a look at our detailed guide on the typical trading license cost in Dubai. Many of the principles and cost items there apply to freelance permits, too.

The Ongoing Annual Expenses

Once you're all set up, a couple of recurring costs will pop up each year to maintain your legal status. The good news is that they're predictable, so you can easily factor them into your annual budget.

The main one to remember is your annual licence renewal. To keep operating legally as a freelancer, you have to renew your permit every year. It’s usually less than what you paid initially, but it's a vital part of your operational budget.

A bit of advice from experience: set aside the money for your renewal well ahead of time. Treat it like any other fixed business cost, the same way you would for your software subscriptions or marketing budget. It’s a simple habit that will save you from any financial scrambling when the renewal date sneaks up on you.

Beyond just the visa costs, solid financial planning for freelancers is absolutely essential if you want to succeed long-term here. Getting a handle on your income, expenses, and savings is what will fuel your growth. Our team specialises in creating clear, cost-effective setup plans so you know exactly what your financial roadmap looks like from the get-go.

The Financial Upside and What You Can Earn

While there's an initial outlay, the financial rewards of freelancing in Dubai can be huge. The biggest draw? You enjoy UAE tax benefits for international entrepreneurs, which means zero personal income tax.

That’s right. You get to keep 100% of what you earn.

The freelance market here is not just stable; it's booming. For freelancers with in-demand skills like data analytics or project management, daily rates can go as high as $1,000 (AED 3,600). When you pair that kind of earning potential with the fact that you're not paying income tax, it creates a seriously compelling reason to build your freelance career right here in Dubai.

Thriving as a Freelancer in Dubai

Getting your freelance visa Dubai in hand is a fantastic milestone, but it's really just the starting line. Now comes the real adventure: building a solid, sustainable business in one of the world's most dynamic markets.

Making it here is about more than just landing a few gigs. It’s about diving into the local business culture and truly building a life for yourself.

In Dubai, your network is your net worth. It’s everything. Start attending industry events and get active in professional groups on platforms like LinkedIn. The city is a melting pot of local talent and expats, which means there are endless chances to connect with potential clients, partners, and collaborators.

Building Your Business and Lifestyle

Finding those first clients takes a proactive game plan. You'll want to tailor your portfolio to show you understand the local market and then actively reach out to companies in your specific niche.

Remember that business etiquette here really values relationships and face-to-face meetings. This small cultural insight can give you a massive edge over competitors who only communicate from behind a screen.

Beyond the work, Dubai offers an incredible lifestyle. Your freelance visa is your key to sponsoring your family, making it a brilliant place to put down roots and call home. As you get more established, you can start thinking about longer-term residency options, too.

A lot of successful freelancers I've worked with eventually set their sights on a Golden Visa on property or an Investor Visa. It offers much greater stability and long-term security for you and your family, really cementing your future in the UAE.

Your Partner for Long-Term Success

The journey from a newly-arrived freelancer to a seasoned professional is filled with ongoing admin and big strategic decisions. As you grow, protecting your digital work and client data becomes critical. It's well worth reading this comprehensive cybersecurity guide for small businesses to make sure your operations are secure from the get-go.

Having a reliable partner to handle the complexities as your business evolves is a game-changer. Our support goes way beyond the initial visa setup. Whether you need a hand with renewals, want to explore visa upgrades, or require ongoing corporate PRO services, our 24/7 support service means we're always here when you need us.

Your Top Questions Answered

When you're looking into getting a freelance visa in Dubai, a lot of questions pop up. It's a big move, after all. We get asked these all the time, so here are some straight answers to help clear things up.

Can I Freelance While Holding a Full-Time Job?

Absolutely. This is a very common scenario. You can definitely get a freelance permit even if you're already employed full-time.

The key piece of paper you’ll need is a No Objection Certificate (NOC) from your current employer. Think of it as a formal letter from them giving you the green light to pursue your freelance work on the side.

What Does It Take to Sponsor My Family?

Once your own freelance visa and Emirates ID are sorted, you can bring your family over. Sponsoring your spouse and children is a massive perk of becoming a resident.

Generally, you'll need to have a few documents ready:

- An attested marriage certificate.

- Your children’s attested birth certificates.

- Proof that you meet a minimum monthly salary (this figure can change, so it's always best to check the latest requirement).

- A registered tenancy contract (Ejari) for your home in the UAE.

Having a valid freelance visa transforms your status from a visitor to a resident, unlocking the ability to build a stable life for your entire family in Dubai. We are also specialists in the Golden Visa on property, which offers another long-term residency path.

How Do I Handle Taxes and VAT as a Freelancer?

Here’s one of the best parts about freelancing in the UAE: there is no personal income tax. What you earn is yours to keep.

But, you do need to keep an eye on your total income. If your freelance earnings go above AED 375,000 in a year, you’ll have to register for Value Added Tax (VAT) and start filing regular VAT returns.

Is a Local Bank Account Really Necessary?

Yes, a local corporate bank account is a must-have. It’s not just about looking professional; it’s about making your financial life so much easier.

Having a separate account helps you keep your business and personal money apart, which is crucial for tracking your finances. Plus, it simplifies getting paid by clients here in the UAE. Your new freelance permit and Emirates ID are the main documents you'll need to get one opened.

✅ Specialists in Mainland Company Formation in Dubai, Sharjah & Abu Dhabi

✅ Specialists in Freezone Company Formation across the UAE

✅ Specialists in Golden Visa on Property and Investor Visa

✅ Specialists in Corporate PRO Services and Attestation Services

✅ 24/7 Support Service – Always here when you need us

✅ Cost-Effective Business Setup Solutions tailored to your needs

✅ Enjoy UAE Tax Benefits for International Entrepreneurs

📞 Call Us Now: +971-54-4710034

💬 WhatsApp Us Today for a Free Consultation