Opting for a free zone company setup in the UAE is often the smartest move an international entrepreneur can make. It’s a model that provides a secure, efficient, and profitable foundation for any business looking to grow, whether regionally or globally. The benefits really do go far beyond what you'd find in a typical business jurisdiction.

The Advantage of a UAE Free Zone

When you start a business in a new country, you’re usually faced with a maze of complex regulations and ownership laws. UAE free zones were created specifically to cut through all of that, establishing business-friendly environments that pull in global talent and investment.

These are geographically defined areas with their own unique set of rules, completely separate from the legal structure of the UAE mainland. This distinction is the whole point. It allows international entrepreneurs to keep full control and take home all their profits without needing a local partner or sponsor—a requirement that used to be the norm for doing business here. That autonomy is really the cornerstone of the free zone advantage.

Absolute Control and Financial Freedom

The most talked-about benefit of a free zone is, without a doubt, 100% foreign ownership. For any entrepreneur coming from abroad, this means you have total command over your company's direction and finances. No mandatory local partnership is needed, which is a massive departure from business structures in many other parts of the world.

On top of that, free zones let you repatriate 100% of your capital and profits. You won’t face any restrictions on sending money back to your home country, giving you complete financial flexibility. This is a huge incentive for investors who want to be sure their earnings are always accessible.

A Favourable Tax Environment

The UAE’s tax landscape is a major reason businesses from all over the world set up here. When you establish your company in a free zone, you can expect to benefit from:

- 0% corporate tax on most business activities, which means you keep the maximum amount of your revenue.

- 0% personal income tax, a perk that helps attract and hold onto top international talent for your team.

- Exemption from customs duties on imports and exports, which is a game-changer for trading and logistics companies.

The entire structure is designed to help your business grow by keeping tax burdens low and making financial management simple.

A lot of people think free zones are only for big corporations. That's a common misconception. In reality, with so many cost-effective packages and flexible office solutions available, they're perfectly suited for startups, SMEs, and even solo consultants looking for a low-risk, high-reward launchpad.

Simplified Operations and Support

Beyond the financial perks, a free zone setup just makes daily operations easier. The registration process is much faster and has far less red tape than you'll find elsewhere.

Free zone authorities essentially act as a one-stop shop for all your administrative needs, from getting your license and registration sorted to handling visa processing. This supportive environment frees you up to focus on what you do best: running your business. To get a clearer picture of how this works in practice, it’s worth taking a look at a detailed comparison between free zone and mainland setups.

How to Select the Right UAE Free Zone

Choosing a free zone is far more than just ticking a box on your setup checklist; it's probably the most critical strategic move you'll make for your new venture. With so many options on the table, it’s easy to feel overwhelmed. The secret is to look past the flashy brochures and find a zone whose fundamental strengths match your specific business model.

A classic misstep I see all the time is entrepreneurs picking a free zone based on name recognition or a headline price alone. The reality is, the right free zone acts like a growth partner, offering an ecosystem that genuinely supports your industry, budget, and long-term goals.

Align Your Business Activity with a Specialised Hub

Your first step in the free zone company setup in the UAE should always be to match what your business does with a free zone's specialisation. Many free zones are intentionally built as dedicated hubs for certain sectors, creating these incredible networks of suppliers, potential clients, and talent pools.

For instance, if you're a tech startup building a new app, you'd feel right at home in a place like Dubai Internet City (DIC) or Dubai Silicon Oasis (DSO). These zones give you more than just a license; they plug you into a ready-made community of tech innovators, venture capitalists, and mentorship programs.

On the other hand, a business focused on global trade and logistics would thrive in Jebel Ali Free Zone (JAFZA). Its direct link to Jebel Ali Port, one of the busiest in the world, offers logistical advantages that a media-focused free zone simply can't compete with.

Think of it like this: Picking a free zone is like choosing a neighbourhood for your family. You want to be surrounded by the right resources and neighbours that help your household—or in this case, your business—flourish. A bad fit can create daily operational friction and lead to huge missed opportunities.

Evaluate Location and Infrastructure

Even in our digital-first world, your physical location still matters. Being close to airports, seaports, major highways, and your target customers can make or break your operational efficiency.

Keep these location-based questions in mind:

- Logistics and Trading: Does your business handle physical goods? Then proximity to ports (like JAFZA) or airports (like Dubai Airport Freezone – DAFZA) is non-negotiable.

- Client Meetings: If you're a consultant who needs to meet clients in the city, a central free zone like Dubai Multi Commodities Centre (DMCC) makes a lot more sense than one on the outskirts.

- Employee Commute: Don't forget about your future team. A location with good public transport links will make it much easier to attract and keep top talent.

The UAE is home to over 40 multidisciplinary free zones, with Dubai alone boasting 30 active special economic zones. These hubs are serious economic drivers, accounting for roughly 40% of the country's total exports. Industry-specific powerhouses like DMCC host over 24,000 companies, offering incredible flexibility. This variety means there’s an ecosystem tailored for almost any business, from a solo tech founder to a global trading firm.

Analysing Costs and Budgetary Constraints

While cost shouldn't be your only guide, let's be realistic—it's a massive factor. Free zone setup costs are not one-size-fits-all. They can vary wildly depending on the emirate, the type of license, the office facilities you need, and how many visas you're applying for.

A premium free zone in Dubai might offer amazing networking but will come with higher registration and annual renewal fees. By contrast, free zones in the northern emirates like Ras Al Khaimah (RAKEZ) or Sharjah (SHAMS) often provide much more budget-friendly setup packages.

Here's a quick look at what you need to budget for:

- Initial Registration Fee: This is the one-time payment to get your company established.

- Annual License Fee: A recurring cost to keep your license active each year.

- Office/Flexi-Desk Costs: This can range from an affordable shared desk to a full private office.

- Visa Costs: Fees for your own investor visa plus any employee visas you need.

It's vital to get a full, transparent quote that covers all these elements. To help you plan your finances from day one and avoid nasty surprises, check out our detailed guide on the cheapest free zones in the UAE. Working with a specialist in free zone formation can help you navigate these costs and find a package that fits your financial plan perfectly.

To give you a clearer picture, here’s a quick comparison of some of the most popular options.

UAE Free Zone Comparison Snapshot

| Free Zone | Ideal For | Starting Cost (Approx.) | Key Feature |

|---|---|---|---|

| IFZA (Dubai) | General Trading, Services, E-commerce | AED 11,900 | Highly cost-effective packages and a streamlined, quick setup process. |

| DMCC (Dubai) | Commodities Trading, Professional Services | AED 50,000 | Prestigious JLT location and a massive business networking community. |

| JAFZA (Dubai) | Logistics, Manufacturing, Trading | AED 45,000 | Direct access to Jebel Ali Port, ideal for import/export businesses. |

| Meydan (Dubai) | Consulting, Tech, Media | AED 12,500 | Offers over 1,500 business activities with a central Dubai address. |

| RAKEZ (Ras Al Khaimah) | Industrial, Trading, Services | AED 11,200 | Affordable solutions and access to a major seaport and international airport. |

| SHAMS (Sharjah) | Media, E-commerce, Creative Industries | AED 5,750 | One of the most affordable options, perfect for media and creative freelancers. |

This table is just a starting point, of course. The best choice always comes down to the unique needs of your business. Getting expert advice can help you weigh the pros and cons of each and ensure you land in the perfect spot to grow.

Nailing Down Your License and Company Structure

Once you’ve zeroed in on the perfect free zone, the next big decision is choosing the right license and legal structure for your company. This isn't just about paperwork; it's the very foundation of your business. It dictates exactly what you can do, defines your liability, and can even affect how easily you can grow down the line. Getting this right from the start saves you from expensive changes and major operational headaches later on.

Think of your business license as the government’s official green light, authorising you to carry out very specific activities. If your actual business operations don't match what's on your license, you could face hefty fines or even a suspension.

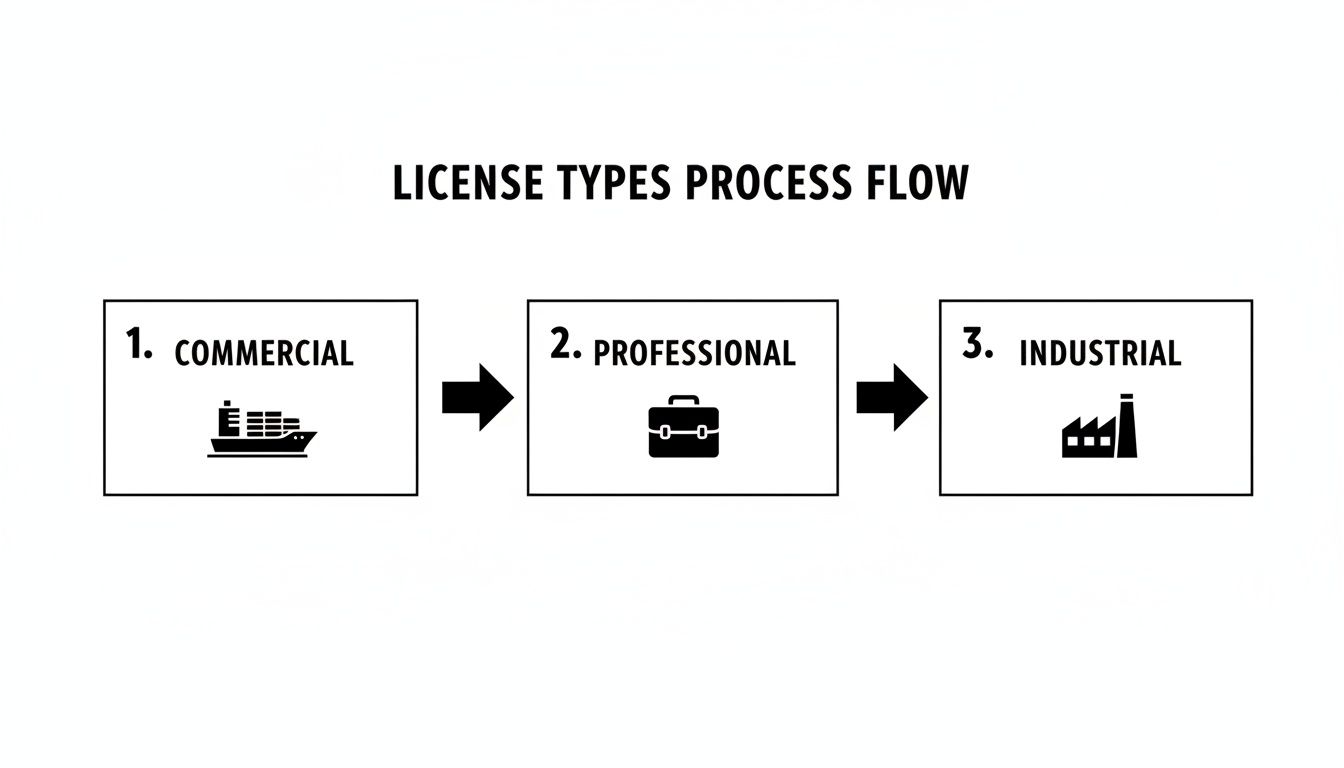

A Look at the Main License Types

Most UAE free zones offer three core license categories, each tailored to a different kind of business. It's crucial to understand what each one covers.

-

Commercial License: This one is for any business that buys and sells goods. It covers everything from import and export to distribution and general trading. If you're running an e-commerce store, a fashion boutique, or trading raw materials, this is the license for you.

-

Professional License: Are you offering services based on your expertise? Then you'll need a professional license. This is designed for consultants, designers, marketers, and other service providers. Think marketing agencies, IT consulting firms, and business management consultants. Here, the focus is on the skill you provide, not a physical product.

-

Industrial License: This license is mandatory for any business involved in manufacturing, production, or assembly. If your plan is to process raw materials or manufacture goods inside your free zone facility, an industrial license is what you'll need. These often come with stricter rules for your physical space and environmental approvals.

Sometimes the lines can blur. A software company that both develops and sells its product might need a license that covers activities from different categories. This is where getting expert advice is a game-changer, ensuring your license covers every single part of your business. To get a better sense of the options, check out our detailed guide on business licenses in the UAE.

FZE vs. FZCO: Choosing Your Legal Structure

Hand in hand with your license, you need to pick a legal structure. In the UAE free zones, the two most common choices are a Free Zone Establishment (FZE) and a Free Zone Company (FZCO). The main difference between them boils down to the number of owners.

A Free Zone Establishment (FZE) is a legal entity set up with a single shareholder. This structure is ideal for solo entrepreneurs or a business owned by one parent company. It keeps the setup process straightforward and the governance simple.

On the other hand, a Free Zone Company (FZCO)—also known as a Free Zone Limited Liability Company (FZ-LLC) in some zones—is built for businesses with two or more shareholders. This is the go-to structure for partnerships, joint ventures, or any company with multiple individual or corporate owners.

It's also worth noting that specific free zones have their own detailed rules, like the well-known DMCC company regulations, which could play a big role in your decision.

The Smart Way to Combine Business Activities

One of the biggest misconceptions is that you need a separate license for every single business activity. The truth is, many modern free zones are incredibly flexible, letting you bundle multiple related activities under one license. This is a brilliant and cost-effective strategy.

For example, a marketing consultant with a Professional License might also want to offer e-commerce management for their clients. Instead of getting two different licenses, they can often just add an e-commerce activity to their existing professional license for a small fee. This doesn't just cut down on annual renewal costs; it also expands your service offerings and opens up new ways to make money.

This kind of flexibility is a massive advantage of setting up in the UAE. We can help you look at your business plan, identify every possible activity you might want to engage in, and package them into the most efficient license possible, setting you up for success right from the start.

The Company Formation Process From Start to Finish

Setting up a free zone company in the UAE can feel like a puzzle, but once you understand the pieces, it all clicks into place. While every free zone has its own way of doing things, the fundamental steps are pretty consistent across the board. This is where your business idea starts becoming a real, legal entity.

Getting this stage right is all about precision. A simple mistake on a form or a poorly chosen company name can lead to frustrating delays that cost you real time and money. Knowing the flow of the process is your best defence against these common headaches.

Securing Your Trade Name

First things first, your business needs a name. Your first actionable step is to reserve a trade name with the free zone authority you've chosen. The name has to be unique and follow the UAE's specific naming rules.

Don't rush this part. Names that sound too generic, are just initials, or include words like "international" or "global" can often be rejected or require special justification. The goal is a name that's distinct, professional, and doesn't violate any public morals. A company formation expert can quickly check if your preferred name is available and suggest alternatives if it's taken, saving you from a frustrating back-and-forth with the authorities.

Once your name is approved, you'll be applying for one of the core license types, which dictates what comes next.

This visual breaks down the main business functions—trading goods, providing professional services, or manufacturing—which determines the specific documents you'll need to gather.

Assembling and Submitting Your Documents

With your trade name locked in, it's time to gather and submit your application package. This is the most paper-heavy part of the setup, and attention to detail is everything.

The exact document list changes depending on your free zone, license, and whether you're setting up an FZE or FZCO. But generally, you'll need to prepare:

- Shareholder and Manager Documents: Clear passport copies for everyone involved, plus their UAE visa or entry stamp pages if they're already in the country.

- Application Form: The official registration form from the free zone authority, filled out completely.

- Business Plan: Some free zones, especially for specialized activities, will ask for a brief business plan covering your goals, target market, and financial forecasts.

- No Objection Certificate (NOC): If a shareholder is a UAE resident on an employment visa, their current sponsor might need to provide an NOC.

This is a critical checkpoint. One tiny mismatched detail or an incorrectly formatted document can grind the entire process to a halt. This is exactly where professional PRO services make a huge difference. We make sure every document is perfect before it's submitted, preventing those unnecessary delays.

A common slip-up we see is entrepreneurs underestimating document attestation. If you're using corporate documents from outside the UAE (like a parent company's registration), they must be legally attested by the UAE Embassy in the home country and then by the Ministry of Foreign Affairs (MOFA) here. This can take weeks, so you need to plan for it well in advance.

The UAE's pro-business stance has led to incredible growth, with 250,000 new companies added in a single year, pushing the total to around 1.4 million. Much of this boom comes from free zones offering streamlined setups and full foreign ownership. In this competitive environment, having a flawless application can put you on the fast track to approval. You can read more about the UAE's economic growth and company formation trends.

Receiving Initial Approval and Making Payments

After the free zone authority reviews your application and gives it the thumbs-up, they'll issue an initial approval. This is your green light to move to the final steps.

You'll then get an invoice for the registration and license fees. It’s crucial to pay this quickly to keep things moving. As soon as the payment is confirmed, the free zone will start preparing your official company documents.

Issuance of Your License and Corporate Documents

This is the moment you've been working for. Once all documents are verified and fees are paid, the free zone authority issues your official business license.

You'll usually receive a package of corporate documents along with the license, including:

- Certificate of Incorporation

- Share Certificates for each owner

- Memorandum of Association (MOA)

- Articles of Association (AOA)

- Lease Agreement for your office or flexi-desk space

With these documents, your company is officially registered and legally exists. You are now a recognized business entity in the UAE. The journey isn’t quite over, though—the next step is getting visas and a corporate bank account to become fully operational.

Life After Your License Is Issued

Getting that official trade license in your hands is a huge milestone. It’s the moment your free zone company setup UAE journey gets real. But think of it as the starting line, not the finish. Now, the focus shifts from just getting registered to becoming a fully operational business ready to make its mark.

This next phase is all about sorting out your residency, opening your financial doors with a bank account, and setting up the systems to stay compliant for the long haul. Getting these post-license steps right is what builds momentum and helps you avoid frustrating delays just when you’re eager to get going.

Securing Your Residency Visa and Emirates ID

With your company’s legal papers sorted, the very next thing on the list is securing your own UAE residency. The process kicks off with getting an establishment card, which is what officially registers your new company with the immigration authorities so it can sponsor visas. Once that’s issued, you can finally apply for your own investor or employment visa.

The visa process itself follows a well-defined path:

- Entry Permit: First, your company applies for an entry permit. This lets you stay in the UAE legally while everything else is processed.

- Status Change: If you’re already in the country on a tourist visa, you’ll do a quick "status change" to activate the new permit.

- Medical Fitness Test: This is a standard requirement for all residents. It’s a straightforward health screening involving a blood test and a chest X-ray.

- Emirates ID Biometrics: You’ll visit a designated center to give your fingerprints and have your photo taken for your official Emirates ID card.

- Visa Stamping: The final step. Your passport is submitted to have the official residency visa stamped inside it.

Juggling all these appointments and paperwork requires careful coordination. This is where our corporate PRO services come in—we manage every single step, from booking appointments to submitting the right documents, making the whole experience seamless. It frees you up to concentrate on your business while we handle the back-and-forth with government departments.

Opening Your Corporate Bank Account

A corporate bank account is absolutely essential for doing business here, but honestly, it can be one of the trickiest parts of the setup process. UAE banks are extremely diligent due to strict international anti-money laundering (AML) and know-your-customer (KYC) rules. Just showing up with a new license often isn't enough; you need to present a solid, credible business case.

To give yourself the best shot at a quick approval, you need to prepare a proper file. Make sure you have:

- All your new company documents (your license, MOA, share certificates).

- Passport copies and visa pages for all company shareholders.

- A detailed business plan that clearly explains what you do, who your customers are, and how you'll make money.

- A professional profile or CV for each of the business owners.

- Proof of your physical address, which is your office lease agreement.

Banks want to see a legitimate business run by serious people. One of the most common reasons for rejection is walking into a meeting with a thin folder of documents or giving vague answers about your business model. We help our clients build a robust application package and can introduce them to bankers who understand and are open to working with new free zone companies.

Staying Compliant and Focused on Growth

Your responsibilities don't stop once the doors are open. Staying in good legal standing is an ongoing job. The most critical task you'll have each year is your license renewal. If you miss that deadline, you could face hefty fines and even have your company’s activities—including your employee visas—suspended.

Besides renewals, you might need help with things like document attestation for international deals or making amendments to your license as your business pivots or grows. With ongoing PRO support, you can be sure these administrative tasks are handled before they become problems, so there’s no disruption to your work.

As you start to grow, you'll also want to bring in tools to work smarter. Once your company is up and running, choosing the right CRM system is a crucial next step for managing your customer pipeline and driving growth. It's a good idea to explore the best CRM software options in Dubai to find a platform that scales with your new venture. This kind of forward-thinking keeps you efficient. And with our 24/7 support, we’re always here to help you navigate what comes next, ensuring your business is set up to thrive long after day one.

Frequently Asked Questions

When you're looking into a free zone company setup in the UAE, a lot of questions come up. It's completely normal. Getting clear, practical answers is the best way to move forward with confidence and sidestep any common mistakes. Here are some of the most frequent queries we get from entrepreneurs just like you.

Can My Free Zone Company Do Business in Mainland UAE?

This is probably the most critical question we hear, and for good reason. A free zone company is licensed to operate within its specific zone and internationally. But if you want to trade directly with customers or offer services on the UAE mainland, there are a few pathways you need to consider.

You can't just rent a shop in a mainland mall with your free zone license. To operate legally on the mainland, you generally need to:

- Work with a local distributor or an agent. They can legally sell your products across the mainland on your behalf.

- Set up a proper branch of your free zone company on the mainland. This is a separate registration process with its own requirements.

- Look into a dual license. Some free zones offer these, allowing certain service-based activities on the mainland. It's often a smart, cost-effective option for consultants and other service providers.

How Much Does a Full Free Zone Setup Cost?

There's no single, fixed price for setting up in a free zone. The final figure really depends on your specific needs. Key factors include which free zone you pick, the type of license your business needs, how many visas you're applying for, and what kind of office space you require.

For a basic package with a flexi-desk and one visa, you might be looking at a starting cost of around AED 11,000. On the other hand, a more complex setup in a premium Dubai free zone with a private office and several visas could easily push the cost above AED 50,000. It's crucial to ask for a detailed, itemized quote that breaks down all one-time and annual fees so there are no surprises down the line.

How Long Will the Setup Process Take?

The timeline for a free zone company setup in the UAE can vary quite a bit. Some of the newer, more digitized free zones like Meydan or SHAMS can get a license issued in just a couple of days, provided all your paperwork is perfect.

A more realistic average, however, is somewhere between one and three weeks. This window accounts for getting the name approved, the initial review, submitting documents, processing payments, and the final license being issued. If you need a more complex industrial license or require approvals from external bodies, expect it to take longer. Working with a specialist can often speed things up because we make sure your application is right the first time.

Do I Need to Be in the UAE for the Setup?

One of the best things about setting up in a modern free zone is that you can get the company registration started remotely. Thanks to online portals and digital submissions, you can handle the entire application and payment from your home country.

You don't need to fly into the UAE just to sign papers. However, you will need to be physically present to complete the final steps of your residency visa. This includes the mandatory medical fitness test and the biometrics appointment for your Emirates ID.

This flexibility is a huge plus. It lets you get your business legally established before you make any big travel plans, saving you both time and money.

Your Partner for Success in the UAE

Ready to navigate your free zone company setup in the UAE with an expert by your side? At PRO Deskk, we specialize in creating cost-effective, tailored solutions for entrepreneurs. From selecting the perfect free zone and handling all government paperwork to securing your investor visa, we provide end-to-end support.

✅ Specialists in Mainland Company Formation in Dubai, Sharjah & Abu Dhabi

✅ Specialists in Freezone Company Formation across the UAE

✅ Specialists in Golden Visa on Property and Investor Visa

✅ Specialists in Corporate PRO Services and Attestation Services

✅ 24/7 Support Service – Always here when you need us

✅ Cost-Effective Business Setup Solutions tailored to your needs

✅ Enjoy UAE Tax Benefits for International Entrepreneurs

📞 Call Us Now: +971-54-4710034

💬 WhatsApp Us Today for a Free Consultation at https://prodesk.ae