So, you’re looking to open an account with Emirates NBD. It’s a solid choice, but the process can feel a bit overwhelming if you don’t know what to expect. The most important thing to get right from the start is having the correct paperwork ready to go—this single step will save you a ton of time and hassle.

Getting Started Without The Guesswork

Opening an Emirates NBD account doesn't have to be a maze. With the right preparation, it's actually quite a straightforward path. The process is built to be secure and fully compliant with UAE regulations, which just means you need to know exactly what documents are needed before you start.

Think of it as setting the foundation for your financial life here. Whether you're a resident managing your salary or an entrepreneur looking to enjoy UAE tax benefits, the account you choose is central to everything you do. The first hurdle is understanding how your residency status changes the requirements.

Residents Versus Non-Residents

If you’re a UAE resident with a valid Emirates ID and visa, the process is much simpler. You'll have access to the full suite of banking products, including salary and savings accounts. The bank just needs to confirm your legal and financial standing in the country. Easy enough.

For non-residents, it's a different story. It’s definitely possible to open an account, but your options will likely be limited to savings or fixed deposit accounts. Banks need extra documentation to meet regulatory standards, and this is where having some professional guidance can make a real difference, especially for investors eyeing a Golden Visa on Property or setting up a new business.

From our experience at PRO Deskk, the most common delay for non-residents is not providing enough proof of their financial history from back home. A simple reference letter from your current bank can make the entire process smoother.

Choosing The Right Account For Your Goals

Emirates NBD has several types of accounts, each designed for a specific need. Don’t just go for the first one you see; make sure it aligns with what you want to achieve.

Here’s a quick breakdown of the most common account types to help you decide.

Which Emirates NBD Account Is Right For You?

| Account Type | Best For | Key Feature |

|---|---|---|

| Current Account | Daily transactions, salary transfers, business use | Cheque book, debit card, easy fund access |

| Savings Account | Earning interest on deposits, long-term savings | Competitive interest rates, less focus on daily use |

| Fixed Deposit | Lump-sum investments for a fixed term | Higher interest rates in exchange for locking funds |

So, what's the takeaway? For day-to-day spending and salary, a current account is your best bet. If you want your money to grow, a savings or fixed deposit account is the way to go.

The account opening process itself follows strict rules, which is a good thing—it reflects the high regulatory standards of the UAE. Emirates NBD has also done a great job of moving much of the application process online, which cuts down on a lot of the old paperwork headaches. You can find more details in our complete guide to current account opening.

Figuring out these choices and requirements is exactly where expert support becomes invaluable. As specialists in Mainland Company Formation in Dubai, Sharjah & Abu Dhabi and Freezone Company Formation across the UAE, we make sure your business is set up correctly to meet banking requirements from day one. Our 24/7 support service is always on standby to help.

For a clear, cost-effective solution tailored to your needs:

📞 Call Us Now: +971-54-4710034

💬 WhatsApp Us Today for a Free Consultation

Mastering The Document Checklist

From my experience, I can tell you the single biggest delay in any UAE bank application comes down to one thing: paperwork. Getting your document package right from the outset is the difference between a swift approval and weeks of frustrating back-and-forth.

For a successful Emirates NBD account opening, your application needs to be complete, clear, and fully compliant. This isn't just about gathering papers; it's about presenting a coherent file that satisfies the bank's strict due diligence requirements. Every document has to align perfectly, telling the same story about who you are and what your business does.

Core Documents For Personal Accounts

For individuals, the process might seem simple, but even tiny mistakes can cause major setbacks. The bank’s compliance team will scrutinise every last detail to verify your identity and residency status.

Here are the essentials you'll need to have in perfect order:

- Valid Passport Copy: Make sure your passport has at least six months of validity remaining. A high-quality colour scan is a must—blurry or cropped images will get your application rejected instantly.

- UAE Residence Visa Page: This page must be crystal clear and show your full name and visa expiry date. It’s the primary proof of your legal status here in the UAE.

- Emirates ID Card: You'll need scans of both the front and back of your card. This is completely non-negotiable for any resident applying for a bank account.

Beyond these basics, you will almost certainly be asked for proof of address. This is usually a recent utility bill or your tenancy contract (Ejari). If you're setting up a salary transfer account, a salary certificate from your employer is also mandatory.

Navigating The Corporate Document Maze

For businesses, the documentation required is far more extensive. Banks need to fully understand your company's legal structure, who owns it, and the exact nature of your operations. This is where many entrepreneurs, especially those new to the UAE, run into trouble.

Whether you've gone through a Mainland Company Formation in Dubai or a Freezone Company Formation, your corporate file has to be impeccable. A common red flag that will halt your application is mismatched information between your trade license and shareholder agreements.

A key takeaway from our years of experience is that the bank isn't just collecting documents; they are building a risk profile. An organised, comprehensive file signals a low-risk, professional operation, which significantly speeds up the approval process.

Essential Paperwork For Business Accounts

To prepare a file that gets approved, not questioned, you need to assemble a complete corporate package. The exact list can vary slightly depending on your company structure (like an LLC versus an FZE), but the core requirements are pretty consistent across the board.

Foundational Corporate Documents:

- Valid Trade License: This is the most critical document, proving your company is legally registered to operate in the UAE.

- Memorandum of Association (MOA): For Mainland LLCs, this document outlines the company's rules and shareholder agreements. Freezone entities will have a similar document, though it might have a different name.

- Shareholder & Director Passport Copies: You'll need clear, valid copies for all partners and anyone who will be an authorised signatory on the account.

- Company Tenancy Contract (Ejari): This is your proof of a physical office address.

- Board Resolution: A formal, signed document from the board of directors that specifically authorises opening the bank account and appoints the signatories.

In some situations, particularly if another corporate entity is a shareholder in your company, you might also need a No Objection Certificate (NOC). You can discover more about the specific requirements for a No Objection Certificate in Dubai in our detailed guide.

As specialists in Corporate PRO Services and Attestation Services, we handle this entire process for you. We don’t just gather documents; we meticulously review them for compliance, making sure every single piece of paper aligns perfectly with Emirates NBD’s requirements. Our cost-effective business setup solutions are designed specifically to prevent these common pitfalls.

Ready to get your paperwork in perfect order? WhatsApp Us Today for a Free Consultation, and let our experts handle the details.

What Really Happens During Your Application

So, you’ve meticulously gathered all your documents, triple-checked everything, and finally hit ‘submit’. Now what? It can often feel like your application has vanished into a black box, leaving you to wonder what’s going on behind the scenes. The truth is, the Emirates NBD account opening process is a highly structured, multi-stage journey designed to ensure total security and regulatory compliance. It's much more than just a quick paperwork check.

This isn't about ticking boxes for the bank; it's a thorough review where they build a complete profile of you or your business. Understanding this journey can demystify that waiting period and help you anticipate any questions that might come your way. It turns what could be a long delay into a smooth, predictable experience.

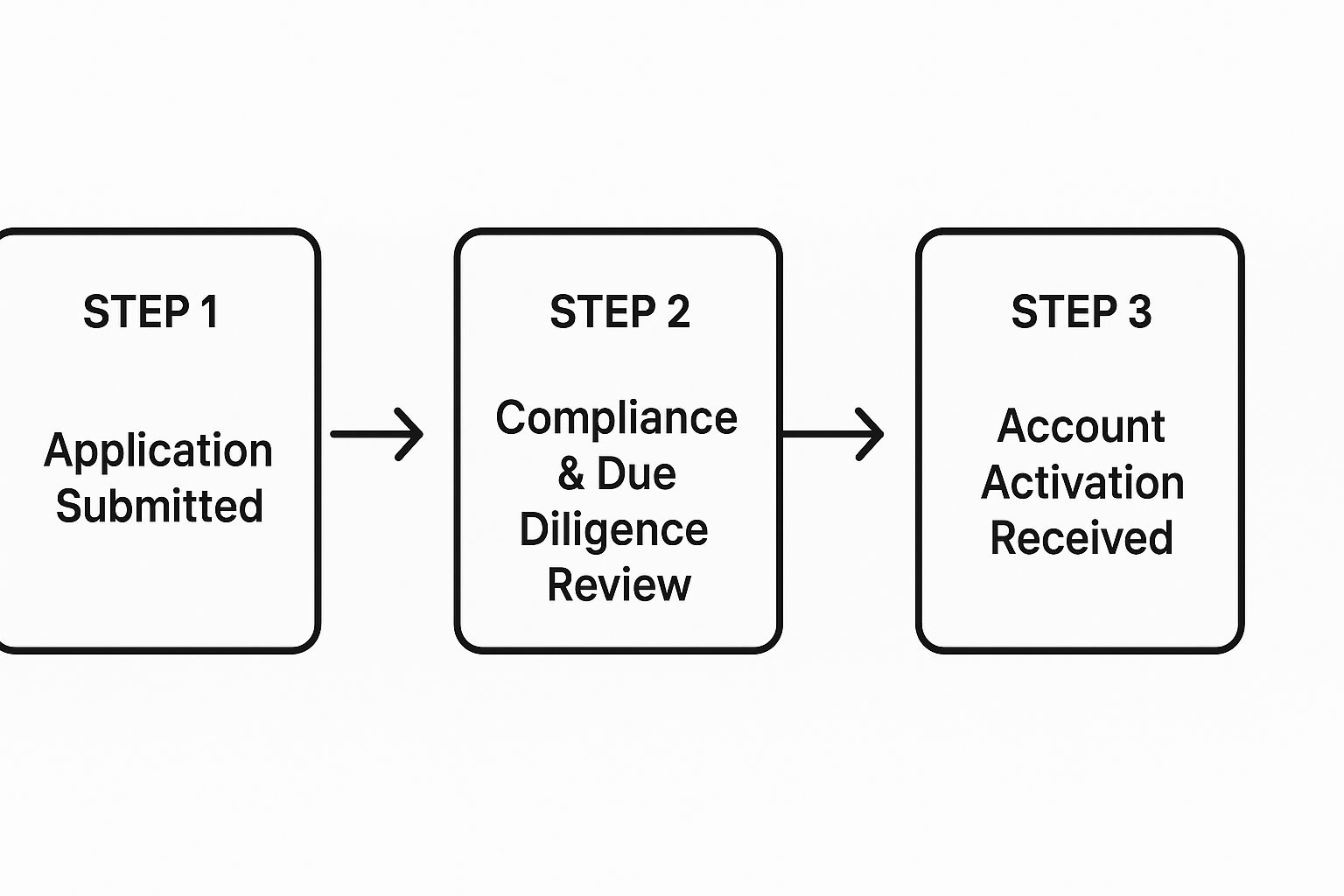

This infographic gives a simple snapshot of the journey from submission to activation.

As you can see, once you've submitted your application, the core of the process is the bank's internal review. This is easily the most critical and time-consuming stage before your account finally goes live.

The Initial Screening Phase

The very first thing that happens is a quick initial screening. Think of it as a first pass. An automated system or a frontline officer glances over your submission to make sure all the mandatory fields are filled out and every required document has been attached. It's a basic completeness check.

If something obvious is missing—a signature on the board resolution, maybe, or a passport copy that’s a bit blurry—your application will be flagged and sent back almost immediately. It’s the easiest hurdle to clear, but you'd be surprised how many applications stumble right here. A professional review, like the kind we provide at PRO Deskk, catches these simple mistakes before they even reach the bank.

Deep Dive Into Compliance and Due Diligence

Once your application clears that initial check, it moves on to the compliance and due diligence team. This is where the real scrutiny begins. This team is legally required to verify every single piece of information you've provided, all to comply with UAE Central Bank regulations and global standards for anti-money laundering (AML) and know-your-customer (KYC).

They’ll run a series of checks, which usually include:

- Identity Verification: Making sure the details on your passport, visa, and Emirates ID are authentic and consistent across all your documents.

- Business Legitimacy Check: For corporate accounts, they will verify your trade licence directly with the relevant economic department or free zone authority to confirm your company is active and in good standing.

- Shareholder Background Checks: The team will run checks on all named shareholders and signatories against international watchlists to ensure there are no red flags.

- Activity Verification: They’ll take a close look at your stated business activities to understand the nature of your transactions. If you've put down something broad like "general trading," expect them to come back asking for more specifics.

A common scenario we see is a bank requesting a detailed business plan for a new company. This isn't a sign of distrust; it's just a standard part of their due diligence to understand your projected revenue, key clients, and the expected flow of funds. Having a clear, concise business plan ready to go can dramatically speed up this stage.

Understanding Communication Timelines

During this review period, communication can sometimes feel a bit slow. It’s really important to manage your expectations here. The standard timeline for a corporate account opening can be anywhere from two to four weeks, but this isn't set in stone. If your business involves international trade or has a complex ownership structure, the due diligence process will naturally take longer.

For example, if you're setting up a Mainland Company in Dubai with several corporate shareholders based in different countries, the bank needs to verify each of those entities. This is where having a dedicated corporate PRO service becomes invaluable. We act as that crucial bridge between you and the bank, providing timely updates and responding to their queries efficiently on your behalf.

From Approval To Account Activation

Once the compliance team gives the final green light, the last stage is pretty straightforward. You’ll receive a welcome message via SMS or email confirming your account has been approved, which will include your new account number (IBAN).

Shortly after, a welcome pack with your debit card and cheque book will be sent out by courier, usually arriving within a few working days. At this point, your Emirates NBD account opening is complete. Your account is fully active and ready for you to use.

Navigating this intricate process is exactly what we specialise in. Our 24/7 support service ensures you're never left in the dark, wondering about the status of your application. We make the entire journey transparent and efficient.

Ready to get started without the guesswork? Call Us Now: +971-54-4710034 for expert assistance.

Turning Your Bank Account Into A Growth Engine

Getting your Emirates NBD account opening finalised is a huge milestone. But it's much more than just ticking a box. Think of it as the start of a valuable financial partnership. Your new account isn’t just a place to park cash and handle daily transactions—it’s the launchpad for your biggest ambitions in the UAE, whether personal or professional.

When you cultivate a strong relationship with a top-tier bank like Emirates NBD, you're building a foundation for future growth. A healthy, consistently managed account acts as your financial CV. It tells the bank you're reliable and stable, which is exactly what paves the way for everything from a car loan to major corporate credit lines down the road.

Positioning Your Business For Financial Access

For any entrepreneur, a well-managed corporate account is a core strategic asset. It's the first thing a bank reviews when you ask for funding. Maintaining a steady cash flow and a respectable average balance sends a clear message: your business is healthy and creditworthy.

Picture this: you need financing for new equipment, a bigger office, or a bulk inventory order. The very first place the bank will look is your transaction history with them. A clean, active account makes that conversation a whole lot smoother.

This is true whether you have a Mainland Company Formation in Dubai or a Freezone Company Formation. A solid banking history, combined with the right business structure, is what truly positions you for success. If you need expert guidance on setting up your company for maximum financial advantage, take a look at our services for your business setup in the UAE.

From Healthy History To Tangible Opportunities

A strong banking relationship directly unlocks a range of financial products designed to fuel your growth. It's not just theory; here’s how a good account history translates into real-world benefits:

- Access to Credit Lines: A proven track record makes you a prime candidate for business overdrafts and lines of credit, giving you that crucial working capital right when you need it.

- Favourable Loan Terms: When you apply for a loan, your positive history can lead to better interest rates and more flexible repayment plans.

- Real Estate Investment: A healthy account is fundamental when you're seeking a mortgage for a commercial property or your family home. It can even be a stepping stone towards a Golden Visa on Property.

The demand for credit is a powerful sign of a healthy economy, and Emirates NBD is a major player in financing this expansion. The bank's lending recently shot up by a remarkable AED 41 billion—an 8% increase in just the first half of a year—driven by strong demand from both retail and corporate clients. This reflects a vibrant environment where businesses are actively investing in their future.

Your bank account tells a story about your financial discipline. By managing it strategically from day one, you are writing a story of reliability that will be read by lenders when you seek capital for your next big move.

Your Emirates NBD account is a powerful foundation, but making it a real growth engine often means looking at the bigger picture. If you're ready to take the next step, this comprehensive guide on how to start investing is a great resource.

As specialists in corporate services, we provide cost-effective business setup solutions tailored to your needs. Our 24/7 support service is always here to guide you.

Ready to build your financial future in the UAE? WhatsApp Us Today for a Free Consultation.

How We Guarantee A Smooth Account Opening

Let's be direct: navigating UAE banking bureaucracy can be a real headache, especially if you're a new entrepreneur. The path to getting an Emirates NBD account is paved with strict compliance checks and a mountain of detailed paperwork. This is exactly where PRO Deskk steps in to become your strategic partner, turning a stressful process into a straightforward one.

We do a lot more than just fill out forms. We actively manage the entire account opening journey from start to finish. Our approach comes from a deep, hands-on understanding of the UAE's corporate landscape, built on years of experience with both Mainland Company Formation in Dubai, Sharjah & Abu Dhabi and Freezone Company Formation across the country.

Proactive Vetting Before Submission

The single biggest reason for delays? Submitting an application with hidden red flags. The very first thing we do is a meticulous pre-screening of your entire document package. We'll look at your company structure, shareholder details, and your business plan to spot any inconsistencies that might trigger a question from the bank's compliance team.

This proactive vetting means we catch potential problems long before the bank ever sees them. For instance, a common mistake is when the business activities on your trade licence don't perfectly match the description in your application. It's the number one cause of stalls, and we make sure that alignment is perfect for a smooth approval.

Our expertise covers even complex situations, whether you're securing a Golden Visa on Property or need specialised Corporate PRO Services and Attestation Services. We make sure every piece of your financial and legal identity tells a clear, consistent story.

Direct Liaison With Bank Management

Submitting an application online often means you're left waiting in the dark with no one to call. We get rid of that uncertainty by using our established relationships with bank managers at Emirates NBD. Instead of being just another application in the digital queue, your case gets presented with professional clarity.

This direct line of communication lets us:

- Provide Context: We can explain the finer points of your business model directly to the people making the decision.

- Resolve Queries Instantly: If the bank has a question, we handle it immediately. This avoids the back-and-forth emails that can drag the process out for weeks.

- Advocate on Your Behalf: We actively champion your application, making sure it gets the attention it deserves.

Our role is to act as the professional bridge between your business and the bank. We speak their language, understand their due diligence requirements, and present your file in a way that builds confidence and accelerates approval.

This hands-on management makes a huge difference in the timeline. While standard applications can easily take weeks, our proven method is built for efficiency.

Ensuring Flawless Due Diligence Alignment

The bank's due diligence process is non-negotiable, and we don't try to sidestep it. Our goal is to make your application so well-prepared that it sails right through these checks. We organise your documents to line up perfectly with the bank’s stringent Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols.

The bank's popularity speaks for itself. Emirates NBD recently saw a massive surge in deposits, which grew by AED 70 billion—a 10% increase—mostly from new Current and Savings Accounts. This shows not only the bank's strong market position but also how rigorous its process is for vetting new clients. It's a process we help you navigate successfully. You can learn more about Emirates NBD's remarkable growth.

When you partner with PRO Deskk, you get more than just assistance; you get a guaranteed path to securing your business bank account. Our cost-effective business setup solutions are designed around your specific needs, all backed by our 24/7 support service.

Eliminate the guesswork and delays.

✅ Specialists in Mainland Company Formation in Dubai, Sharjah & Abu Dhabi

✅ Specialists in Freezone Company Formation across the UAE

✅ Specialists in Golden Visa on Property and Investor Visa

✅ Specialists in Corporate PRO Services and Attestation Services

✅ 24/7 Support Service – Always here when you need us

✅ Cost-Effective Business Setup Solutions tailored to your needs

✅ Enjoy UAE Tax Benefits for International Entrepreneurs

📞 Call Us Now: +971-54-4710034

💬 WhatsApp Us Today for a Free Consultation

Your Questions Answered

Opening an Emirates NBD account can feel complex, and it’s natural to have questions. We’ve put together some straightforward answers to the queries we hear most often from entrepreneurs just like you.

Can A Non-Resident Open An Emirates NBD Account Completely Online?

While you can definitely kick off the application online, it’s highly unlikely a non-resident can get the whole thing done without some physical interaction. UAE banks are incredibly diligent with their checks and almost always need extra steps to complete their due diligence.

This usually means an in-person meeting at a branch or sending original, attested documents through a secure courier. What they ask for often depends on your nationality, the type of business you're running, and your overall financial standing. This is exactly where our Corporate PRO Services make a real difference—we figure out these requirements for you ahead of time, get the paperwork in order, and cut down on potential delays or the need for you to travel.

What Is The Top Reason Corporate Bank Accounts Get Delayed?

Based on our experience, the number one reason for delays is messy or inconsistent paperwork. Hands down. Problems almost always come from a mismatch in the details between the trade license, the Memorandum of Association, and how the business activities are described on the application form.

Banks have to follow strict Anti-Money Laundering (AML) rules. Any grey area around your shareholder structure, where your funds are coming from, or the exact nature of your business will instantly trigger a request for more information. That back-and-forth is what turns a two-week process into a two-month headache.

We have a pre-submission review process designed to catch and fix these exact issues. We make sure your application tells a clear, compliant story that satisfies the bank's requirements from day one, whether you have a Mainland or Freezone company formation.

What Is The Minimum Balance For An Emirates NBD Business Account?

There’s no single answer here, as the minimum balance requirement really depends on which business account you go for. Basic packages aimed at startups or smaller businesses will naturally have lower monthly balance requirements.

On the other hand, premium accounts built for larger companies with more features will demand a much higher average monthly balance. It's really important to know that if you don't maintain this minimum, you'll be hit with monthly service fees, which can slowly chip away at your profits. We help you choose a package that’s a realistic fit for your company’s expected cash flow so you can avoid those extra costs.

My Application Was Rejected. How Can PRO Deskk Help?

Getting a rejection can feel like a major setback, but it’s rarely a dead end. If your application was turned down, our first move is to do a deep dive to find out exactly why. Was it a paperwork issue? Was your business plan not clear enough? Or maybe your company profile just wasn't the right match for that particular bank.

Once we've identified the root of the problem, we work with you to fix it. This could mean correcting documents, fleshing out your business plan, or providing extra paperwork to clarify your source of funds. Because we have strong relationships with multiple banks, we can often re-present your case in a more effective way. And if Emirates NBD isn't the right fit after all, we can point you to another bank that’s better suited to your business, saving you the stress of starting from scratch. Our 24/7 support service is always on standby for moments just like this.

At PRO Deskk, we provide cost-effective, end-to-end solutions for your business setup and banking needs, ensuring you can focus on growth while we handle the complexities.

📞 Call Us Now: +971-54-4710034

💬 WhatsApp Us Today for a Free Consultation at https://prodesk.ae