Figuring out the total Dubai trading license cost isn't a simple case of looking up a single price. In reality, it’s a collection of various fees that come together, typically ranging from AED 15,000 to over AED 50,000 for the first year. The final number on your invoice really depends on the path you choose: your business jurisdiction (Mainland or a Free Zone), the specific activities you plan to undertake, and practical needs like office space and visas.

What Is the Real Cost of a Dubai Trading License?

Thinking about the cost of a Dubai trading license is a bit like planning to buy a new car. The sticker price is just the starting point. The final amount you pay depends on the model, the engine size, and all the optional extras you add on. It's the same with your business licence; the total cost is made up of several components, and each has its own price tag.

To get a real grip on the costs, it’s crucial for entrepreneurs to dive into comprehensive financial planning, looking at both the initial setup fees and the recurring operational expenses. This avoids nasty surprises down the line and ensures your budget is solid from day one. Your total investment will be shaped by a few key decisions.

The Core Components of Your License Cost

The biggest factors driving the final cost are the strategic choices you make right at the beginning. Each decision comes with different financial baggage, directly impacting your budget.

- Jurisdiction: Your most important choice is between a Mainland and a Free Zone setup. Free Zones often come with all-in-one packages, which can be convenient, whereas Mainland setups involve paying more individual government fees.

- Business Activity: A general trading licence will have a different cost structure compared to a specialised professional or industrial licence. The latter might require extra approvals from external government bodies, adding to the cost.

- Operational Needs: Don't forget the practicalities. The number of visas you need for partners and employees, plus the type of office you rent (from a simple flexi-desk to a dedicated physical office), will significantly bump up the total cost.

This initial outlay can vary massively. For instance, a basic mainland commercial license might start from AED 5,000 to AED 15,000, but more complex free zone packages can easily hit AED 50,000. For a more detailed estimate, it's worth checking out our guide on the overall UAE business setup cost.

Getting your head around these variables is the first step to building an accurate budget. By breaking down the costs, you can see exactly where your money is going and make smart decisions that line up with your business goals and financial plan.

Choosing Your Path: Mainland vs. Free Zone Costs

When you’re figuring out your Dubai trading license cost, the first big decision you’ll make is choosing between a Mainland or a Free Zone setup. This isn’t just a small detail; it’s a fork in the road that completely shapes your budget and how your business operates. Each path has its own financial perks and long-term cost implications.

Think of it this way: setting up on the Mainland is like building a custom house. You have total freedom to build anywhere and for any purpose, but you pay for every single permit, contractor, and material separately. A Free Zone, on the other hand, is like buying a home in a planned community. Many of the costs are bundled into a clear, predictable package, which often makes it a simpler and more affordable way to get started.

The Mainland Cost Structure: An À La Carte Approach

Going for a Mainland license gives your business the ultimate prize: unrestricted access to the entire UAE market. You can trade directly with any customer or company, anywhere in the country. But this freedom comes with what you could call an "à la carte" fee structure, where you pay for each piece of the puzzle individually.

This means your budget needs to cover several separate payments to different government departments. The main costs you’ll encounter are:

- Department of Economic Development (DED) Fees: This is the core charge for actually issuing your trade license.

- Chamber of Commerce Fees: A mandatory registration that officially plugs your business into Dubai’s commercial network.

- Local Sponsor or Service Agent Fees: This is a major, and usually annual, expense. For most activities, you'll need a UAE national as a partner or agent.

- Office Lease (Ejari): Having a physical office with a registered tenancy contract (Ejari) is a non-negotiable requirement for a Mainland company.

While this unbundled approach offers flexibility, you have to be meticulous with your budgeting to avoid surprise costs. These individual fees can add up fast, especially with the recurring annual sponsorship fee.

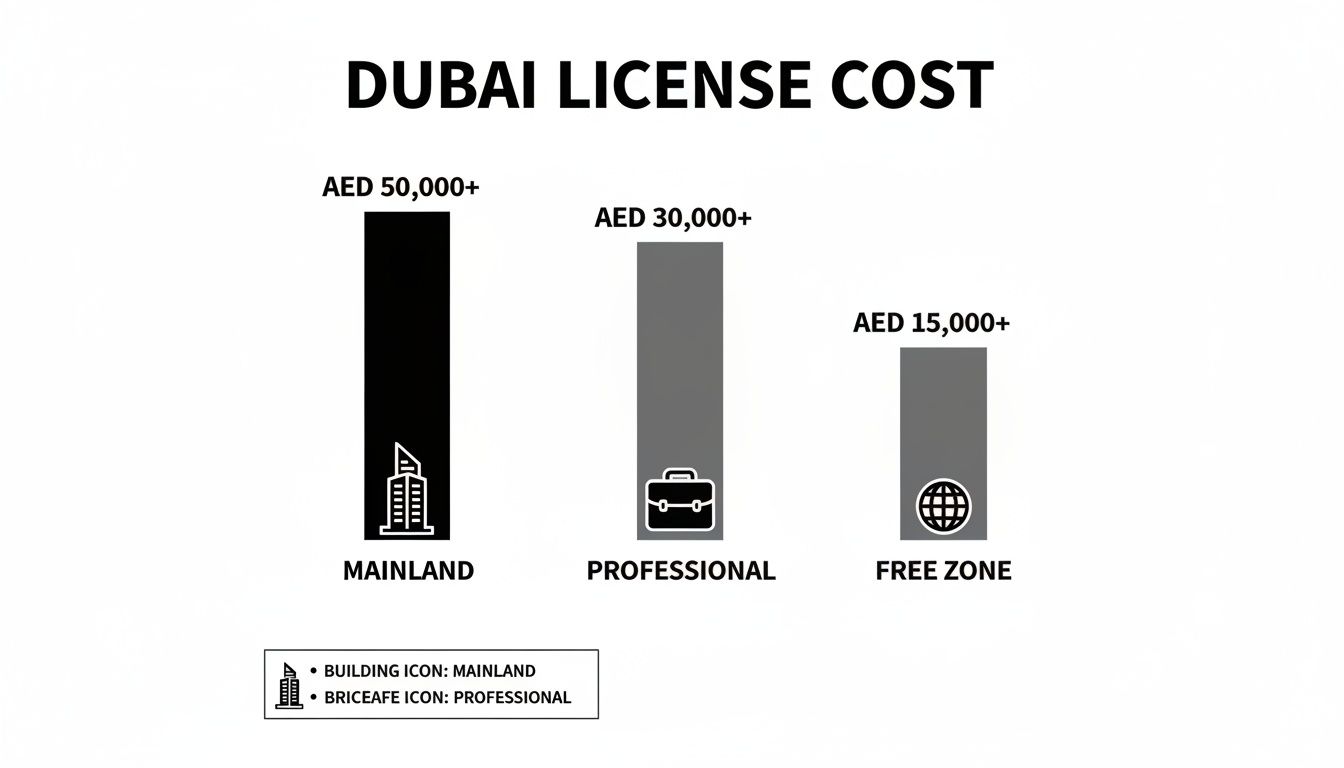

The chart below gives you a clearer picture of how the costs stack up across different setups.

As you can see, even though there’s some overlap in the initial costs, the long-term financial picture for a Mainland company is very different from a Free Zone one.

Free Zone Costs: The Power of the Package

Free Zones were specifically created to attract foreign entrepreneurs, and they do this by offering a much simpler and more predictable cost model. The biggest advantage? 100% foreign ownership. This immediately removes the need for a local sponsor, saving you the AED 10,000 to AED 50,000 you’d typically pay in annual sponsorship fees on the mainland.

Free Zones usually bundle everything you need into a single package. This often includes:

- License registration and issuance fees.

- Use of a flexi-desk or co-working space (which covers your office requirement).

- Establishment card fees.

- An allocation for a certain number of visas.

This all-in-one approach makes financial planning a whole lot easier, particularly for startups and international businesses. The cost difference is stark: a first-year mainland setup can run anywhere from AED 50,920 to AED 107,520, while some free zone packages start as low as AED 10,000. For a more detailed breakdown, check out our guide on Dubai free zone company setup costs. Some free zones even offer instant licenses for AED 3,000 to AED 5,000 for those who need to get up and running quickly.

Estimated First-Year Cost: Mainland vs Free Zone Trading License

To put it all into perspective, let's look at a side-by-side comparison of what you might expect to invest in your first year for a standard trading company.

| Cost Component | Estimated Mainland Cost (AED) | Estimated Free Zone Cost (AED) | Key Notes |

|---|---|---|---|

| Initial Approvals & Name | 2,000 – 3,000 | Included in Package | Mainland fees are paid individually to the DED. Free Zones typically bundle this. |

| License Registration | 15,000 – 25,000 | 10,000 – 20,000 | The core license fee. Free Zone packages often include this along with other services. |

| Local Sponsor/Agent Fee | 10,000 – 20,000 | N/A | A major saving in Free Zones, which allow 100% foreign ownership. |

| Physical Office (Annual) | 20,000 – 50,000+ | Included (Flexi-Desk) | Mainland requires a physical office. Free Zones include co-working access, saving significant rental costs. |

| Establishment Card | 2,000 | 1,500 – 2,500 | A mandatory immigration card for both jurisdictions. Often part of the Free Zone package. |

| Visa (per person) | 5,000 – 7,000 | 4,000 – 6,000 | Costs can vary, but Free Zones often include one or two visas in their standard packages. |

| Total Estimated First Year | ~AED 54,000 – 105,000+ | ~AED 15,500 – 28,500+ | The difference is significant, mainly driven by mandatory office rent and sponsorship fees on the Mainland. |

This table makes the financial difference crystal clear. The upfront and recurring costs on the mainland, driven by rent and sponsorship, are substantially higher than the bundled, all-inclusive packages offered by most free zones.

Your choice of jurisdiction is the absolute cornerstone of your business setup budget. A mainland license offers maximum market access at a potentially higher and more fragmented cost, while a free zone provides a cost-effective, predictable package ideal for international trade and startups.

Ultimately, the right choice comes down to your business model. If your goal is to sell directly to customers across the UAE, the mainland is your only real option. But if you’re focused on international trade or providing services from a UAE base, a Free Zone is an incredibly compelling and financially savvy alternative.

Decoding Your Initial Setup Fees

Before a single dirham of profit comes in, there's a series of one-time government and administrative charges you’ll need to clear. Think of these as the essential groundwork for your business—each fee is a non-negotiable step that officially puts your company on the map in Dubai.

Getting your budget right for these upfront costs is absolutely vital. It’s the key to a smooth launch without any nasty financial surprises down the line.

These aren't just random fees; every payment has a specific purpose within the legal framework of setting up a company. From reserving your unique business name to getting the official nod from economic authorities, each charge is a piece of the compliance puzzle. Breaking it down line by line is the best way to build a realistic budget right from the start.

Itemising Your Upfront Government Charges

The first phase of your setup journey involves a few key administrative hurdles, and each one comes with a fee. These are the foundational costs paid directly to government bodies to legally register your company.

Here’s a closer look at the main one-time fees you should expect:

- Trade Name Reservation: This is your very first official step. You'll need to register and pay for your company name to make sure it’s unique and follows UAE naming rules. Once your name is approved, your brand identity is secured.

- Initial Approval Certificate: Before you can even apply for the license, you need an "Initial Approval" from the Department of Economic Development (DED) or the relevant Free Zone authority. This certificate is basically the government confirming it has no objection to your business idea and legal setup.

- Memorandum of Association (MOA) Attestation: For many company types, especially on the mainland, a legally drafted MOA is a must. This document spells out the ownership structure and partner responsibilities. It has to be notarised and attested, which carries its own fee.

These one-time setup costs can add up fast. You'll need to budget for initial approval fees of AED 120 to AED 220, Ejari office lease registration from AED 2,000 to AED 5,000, and trade name reservation, which can cost between AED 600 to AED 2,000 on its own for a mainland company.

How Business Activity Impacts Initial Costs

Not all trading licenses are created equal. The specific business you're in can really change your initial setup fees. A standard general trading license might have a straightforward approval path, but more specialised activities often mean extra steps and, you guessed it, extra costs.

For instance, if your business is in a sector like healthcare, education, or food trading, you'll need external approvals from specific ministries or municipal departments. Each of these bodies has its own application process and fee for granting a No Objection Certificate (NOC). This means you have to account for these industry-specific costs on top of the standard DED or free zone fees.

Key Takeaway: The more specialised your business is, the more likely you are to face extra approval fees. It's critical to identify all the necessary external approvals early on to get an accurate forecast of your total Dubai trading license cost.

Understanding Legal Structures and Their Costs

The legal structure you choose for your company also plays a part in the initial bill. For example, an LLC has mandatory MOA attestation fees that a sole establishment might not have to worry about. For a deep dive into the costs associated with specific legal forms, this comprehensive Dubai LLC company setup guide is an excellent resource covering licensing and visas.

By carefully accounting for every one of these one-time charges—from the trade name all the way to activity-specific approvals—you can eliminate the risk of unexpected expenses. This detailed approach to budgeting ensures your capital is used effectively, setting you up for a financially sound and successful launch in Dubai.

Budgeting for Annual and Operational Costs

Getting your Dubai trading license is a huge win, but don't close your budget spreadsheet just yet. Those initial setup fees are just the beginning. The real test of your financial planning comes down to the recurring annual and operational costs that keep your business running smoothly and legally.

Think of it this way: the setup cost is like buying the car, but the annual fees are the fuel, insurance, and maintenance. You need to shift your mindset from a one-off launch budget to a sustainable, long-term financial strategy. Let's break down exactly what you need to plan for year after year.

Annual License Renewal Fees

First up is the big one: renewing your trade license every year. This is your single most important recurring expense. While it's usually less than the initial setup fee, it’s a significant cost you absolutely have to budget for.

This payment goes to the same authority that issued your license in the first place, whether that’s the Department of Economic Development for a mainland company or the specific free zone authority. Failing to renew on time isn't an option—it can lead to serious fines, having your corporate bank account frozen, or even a complete suspension of your business activities. It’s a deadline you can’t afford to miss.

The Cost of Physical Presence and Office Space

Nearly every business in Dubai needs a registered physical address, and this is a major line item in your annual budget. How this plays out depends heavily on whether you’re on the mainland or in a free zone.

- Mainland Companies: There’s no getting around it—you need a registered office lease authenticated through the Ejari system. This means you’re looking at annual office rent, which can be a hefty expense depending on the location and size.

- Free Zone Companies: This is where you can find more flexibility. Many free zones offer packages that include a flexi-desk or access to a co-working space. This ticks the physical presence box without the high overhead of a private office. Of course, as your business grows, you might need a dedicated office, which would then become a larger annual cost.

Sponsorship and Agent Fees on the Mainland

If you're setting up on the Dubai mainland, the annual fees for a Local Service Agent (LSA) or a Corporate Sponsor are a crucial part of your financial planning. Even with recent reforms allowing 100% foreign ownership for many activities, some strategic sectors still require a UAE national partner or agent.

This isn’t a one-time fee. You’ll pay an agreed-upon annual sum to your sponsor or agent for their services, which usually involves helping you navigate government departments and processes. It's a critical component of the Dubai trading license cost for mainland companies that must be factored into your yearly budget.

Your annual budget has to cover more than just the license renewal itself. Think about office rent, sponsorship fees, and administrative renewals like your Establishment Card. These are all predictable costs that form the financial backbone of your company's compliance and ongoing operations.

Other Key Recurring Expenses

Beyond the major expenses, a few other smaller but essential fees will pop up annually. You’ll need to renew your company’s Establishment Card, which is vital for processing any employee visas. You may also have mandatory insurance policies to maintain.

Let’s put some real numbers to this. Annual office rentals can easily range from AED 15,000 to AED 50,000, making it a major budget item. Corporate PRO services on the mainland might set you back AED 5,000 to AED 10,000 annually, while in a free zone, you might pay a more manageable AED 1,500 to AED 5,000. If you need a local sponsor, that could add another AED 10,000 to AED 50,000 each year. The core trade license renewal fee itself often sits between AED 8,000 and AED 15,000 for an LLC. You can find more detailed insights about these recurring expenses to build out a solid financial plan.

By carefully planning for these yearly costs, you move beyond just starting a business to running a truly sustainable one. This kind of foresight keeps your company compliant, financially healthy, and ready to grab the next big opportunity in Dubai's fast-paced market.

Calculating Visa and PRO Service Expenses

So, you've got your trading license sorted. That's a huge step, but the spending doesn't stop there. Now, you need to budget for the people who will actually run the business—yourself, your partners, and any staff you plan to hire.

These costs, mainly for visas and government liaison services, are a crucial part of your total Dubai trading license cost. Think of it as building your team; without the right visas, you can't legally live and work in the UAE, and without someone handling the paperwork, you risk delays that can stop you in your tracks.

Demystifying Visa Costs

A visa is your golden ticket to living and working in Dubai, but getting one involves several steps, and each one has a fee. The process is pretty similar whether it's for an investor or an employee, but knowing what to expect can save you from any nasty financial surprises down the line.

Here’s a quick look at the typical visa journey and where you'll be paying:

- Entry Permit: This is the first piece of the puzzle. It’s the document that lets you or your employee enter the UAE for residency.

- Status Change: If you’re already in the country on a tourist visa, you'll need to formally change your status from a visitor to a resident.

- Medical Fitness Test: Everyone applying for residency has to go through a mandatory health screening to check for certain communicable diseases.

- Emirates ID Application: This is the final step. It involves providing your biometric data (like fingerprints) and officially applying for your UAE residency card.

These expenses add up. You should budget between AED 3,000 and AED 7,000 for each investor visa and AED 3,000 to AED 6,000 for each employee visa. On top of that, the medical tests and Emirates ID fees will set you back another AED 1,000 to AED 2,000 per person. You can learn more about how these crucial visa fees impact business setup expenditure to get a clearer picture.

The Value of Professional PRO Services

Trying to handle all the government paperwork for visas, licenses, and other approvals yourself can quickly become a full-time job. It’s a maze of forms, deadlines, and specific procedures. This is where a Public Relations Officer (PRO) comes in.

A PRO is a specialist who takes all that government-related work off your plate. Many new business owners see this as just another expense, but it’s really an investment. A single mistake on a form or a missed deadline can lead to fines or weeks of frustrating delays. A good PRO makes sure everything is done right the first time.

Think of a PRO as your company's ambassador to the government. They understand the language, the procedures, and the people, turning a potentially frustrating bureaucratic process into a smooth, predictable one.

In-House PRO vs Outsourcing: An Important Cost Decision

When it comes to managing your company’s government dealings, you have two choices: hire a full-time PRO or outsource the work to a specialist firm like PRO Deskk. For most new businesses and SMEs, the financial argument is pretty clear.

Hiring an in-house PRO means paying a full salary, plus their own visa costs and benefits—a significant fixed cost every month. Outsourcing, on the other hand, gives you access to an entire team of experts for a single, predictable annual fee.

This approach doesn't just save you money; it gives you access to a wealth of experience, as these firms handle countless cases every day. By outsourcing, you turn a major fixed cost into a manageable operational expense, giving you better control over your Dubai trading license cost.

Let a Pro Handle the Paperwork, You Handle the Business

Trying to navigate Dubai’s business setup process on your own can feel like putting together a complex puzzle with half the pieces missing. It’s a journey that’s often full of surprise fees and small administrative mistakes that can blow up your Dubai trading license cost before you even get started. This is where getting the right advice isn't just helpful—it's your most valuable asset. It turns a confusing process into a clear, strategic investment.

When you bring in a specialist, the entire game changes. Working with a team that lives and breathes Mainland, Freezone, and Golden Visa rules gives you an immediate upper hand. We know the exact cost structures inside and out, which means we can build a plan for you that's not just fully compliant but also smart with your money and perfectly suited to your budget.

✅ Specialists in Mainland Company Formation in Dubai, Sharjah & Abu Dhabi

✅ Specialists in Freezone Company Formation across the UAE

✅ Specialists in Golden Visa on Property and Investor Visa

✅ Specialists in Corporate PRO Services and Attestation Services

✅ 24/7 Support Service – Always here when you need us

✅ Cost-Effective Business Setup Solutions tailored to your needs

✅ Enjoy UAE Tax Benefits for International Entrepreneurs

📞 Call Us Now: +971-54-4710034

💬 WhatsApp Us Today for a Free Consultation

No One-Size-Fits-All Solutions

Your business is one of a kind, and your setup plan should be too. We focus on creating personalised setup solutions, whether you're launching on the Mainland in Dubai, Sharjah, Abu Dhabi, or taking advantage of a Freezone. This way, you only pay for what you actually need, and not a dirham more.

We also make sure you’re set up to fully benefit from the UAE's incredible tax advantages for international entrepreneurs. Our guidance helps structure your company to make the most of this favourable financial environment right from day one.

Your Licence Is Just the Start—We’re Here for the Long Haul

Getting your trading licence is a huge milestone, but it's really just the beginning. The real work is keeping up with all the ongoing admin and government paperwork. This is where dedicated corporate PRO services become essential to stay compliant and keep things running smoothly.

Think of it this way: partnering with a professional team means you're not just buying a service; you're investing in peace of mind. With 24/7 support, you'll always have an expert to call, making sure small issues get sorted before they turn into big, expensive problems.

Our support goes way beyond just getting your company registered. We can help with everything from visa applications and document attestation to handling all your government-related paperwork. By letting us manage these critical tasks, you avoid costly delays and errors, freeing you up to focus on what you do best: growing your business.

To see how this works in practice, learn more about our professional corporate PRO services in Dubai. This kind of partnership is the key to managing your costs effectively, sidestepping common pitfalls, and building a successful, lasting business in the UAE.

Frequently Asked Questions

Working out the finances for your new Dubai business is a big step, and it’s natural to have a lot of questions. To give you some clarity, we've put together answers to the queries we hear most often from entrepreneurs about the Dubai trading license cost. This should help you lock down your budget and plan your next moves with more confidence.

What Is the Cheapest Trading License in Dubai?

If you're looking for the most budget-friendly route, your best bet is usually one of the Free Zones. Many of them offer packages that swap a pricey physical office for a flexi-desk, which keeps initial costs down.

On the Mainland, you could look into an "instant license." It’s a lower-cost way to get started for certain business activities, but just be aware that it might come with a few operational limits. Both options are really designed to get startups up and running without a massive initial investment.

Can I Get a Trading License Without Renting an Office?

For a Mainland license, having a registered office address with a registered tenancy contract (Ejari) is non-negotiable. There’s simply no way around it.

However, the Free Zones are much more flexible. A lot of them have cost-effective packages that include a flexi-desk or access to a co-working space. This ticks the box for having a physical presence without you having to shell out for a dedicated private office.

Understanding the difference here is key. A Mainland Ejari is a must-have, but Free Zones offer clever workarounds that can really help your budget and business model.

How Much Does It Cost to Renew a Trading License Annually?

The good news is that your yearly renewal is almost always cheaper than the initial setup. The total cost will cover your license renewal fee, the Establishment Card renewal, and any ongoing costs like your office lease or local agent fees.

As a general rule, you can expect to budget somewhere between AED 8,000 and AED 20,000 for your annual renewal. The final figure really depends on where you're set up (Mainland or Free Zone) and how complex your company structure is.

Are There Hidden Costs I Should Be Aware Of?

Yes, there can definitely be 'hidden' or unexpected costs if you haven't planned for them. These often pop up as fees for special approvals needed for certain business activities, costs for translating and attesting official documents, and various government service fees that can change without much notice.

The best way to avoid any nasty surprises is to work with an experienced business setup consultant. They know what to look for and can map out all these potential costs for you right from the start, so everything is completely transparent.

Ready to make your Dubai business dream a reality without the financial guesswork? The team at PRO Deskk is here to guide you with clear, affordable solutions, whether you're setting up on the Mainland or in a Free Zone. We handle everything from licensing to visa processing and offer 24/7 support to make sure your journey is a success.

📞 Call Us Now: +971-54-4710034

💬 WhatsApp Us Today for a Free Consultation at https://prodesk.ae