So, you're thinking about setting up a business in Dubai. It's an exciting prospect, but the very first, non-negotiable step is securing your trade license. This isn't just a piece of paper; it’s the legal key that unlocks everything else for your company in the emirate.

Think of it as your official permission slip from the government, confirming that your business is registered, legitimate, and ready to operate. Without it, you can't open a corporate bank account, sign an office lease, or even hire staff.

Your Gateway to the Dubai Business World

Trying to run a business here without a valid license is a serious misstep. The authorities don't take it lightly. You'd be looking at hefty fines and potentially getting your company—and its shareholders—blacklisted. That kind of damage to your professional reputation can make any future business ventures in the region incredibly difficult.

At its core, the trade license gives your business legitimacy. It’s what you show to clients, partners, and government agencies to prove you're a credible enterprise that plays by the rules. In a competitive market like Dubai, that trust is everything.

The Power Behind the Paper

What exactly does a Dubai trade license let you do? It officially permits you to carry out the specific business activities listed on it. Whether you're in e-commerce, consulting, or manufacturing, your license clearly defines the legal scope of what your company can and cannot do.

But it goes much further than just basic legality. It's the essential requirement for several critical business functions:

- Opening a Corporate Bank Account: No bank in the UAE will even consider opening an account for your business without a valid trade license. This is fundamental for managing your finances and processing payments.

- Sponsoring Visas: If you want to get an investor visa for yourself, employment visas for your team, or even residency visas for your family, it all starts with having a trade license.

- Leasing Commercial Property: You can’t rent an office, warehouse, or retail shop without one. Landlords and authorities will demand to see it before any contracts are signed.

- Winning Contracts: Planning to bid on government tenders or work with major corporations? Your trade license is the very first document they'll ask for to verify your company's legal status.

A Thriving Economic Landscape

There's a reason so many entrepreneurs are drawn to the UAE. The government's pro-business policies have cultivated an incredibly dynamic environment. Recently, the number of active commercial licenses in the country soared past 1.5 million—an all-time high.

In just a single 12-month period, around 200,000 new economic licenses were issued nationwide, showcasing the country's booming economy. This growth is a direct result of the government’s efforts to simplify the setup process, making it easier than ever for international entrepreneurs to establish a presence, whether on the Mainland or in a specialised Free Zone.

A trade license isn't just about compliance; it's about opportunity. It's your entry ticket to one of the world's most vibrant and rapidly growing economies, giving you the legal framework to build, scale, and succeed.

Before you jump in, it’s smart to do your homework. Running through a comprehensive due diligence checklist can help you cover all your bases from the very beginning. This initial prep work paves the way for a much smoother application process. As we’ll get into next, your choice of jurisdiction and business activity will shape every single step that follows.

Choosing Your Jurisdiction: Mainland or Free Zone

One of the first, and most critical, decisions you'll make when setting up in Dubai is where to register your company. This isn't just about picking an address; it’s a strategic choice that dictates who you can do business with, your ownership structure, and how you can grow.

The two main paths are Dubai Mainland and the various Free Zones scattered across the UAE. Each one comes with its own set of rules, benefits, and limitations. The right one for you boils down to your business model. Are you planning to serve the local UAE market directly? Or is your focus on international trade from a specialised industry hub? Let's break down the practical differences to help you decide.

Dubai Mainland: The Heart of Local Commerce

A Mainland license, issued by the Department of Economy and Tourism (DET), is your key to operating without restriction across the entire UAE. If your business plan involves selling goods or services directly to customers anywhere in Dubai, Abu Dhabi, or any other emirate, this is the way to go.

Think about a retail brand wanting to open a shop in Dubai Mall or a consultancy firm bidding on government contracts. For them, a Mainland license is non-negotiable. It gives you the freedom to:

- Trade Directly: Engage with any customer or company located anywhere in the UAE.

- Bid on Government Contracts: Access lucrative government tenders and projects.

- Set Up Anywhere: Open your office, showroom, or warehouse in any commercial district in Dubai.

- Add More Activities: You generally have more flexibility to add multiple business activities to your license.

The game has changed significantly in recent years. The old requirement of needing a local Emirati sponsor with a 51% shareholding has been removed for most business activities. Today, foreign entrepreneurs can get 100% ownership for over 2,000 commercial and industrial activities, making the Mainland a more attractive option than ever before. To get a better feel for the process, you might find our guide on how to start a business in the UAE helpful.

UAE Free Zones: Hubs for Global Business

Across the UAE, you’ll find over 40 specialised Free Zones. Each one is essentially a self-contained business ecosystem designed to nurture specific industries—think technology, media, finance, or commodities. They operate with their own independent rules and regulations, separate from the Mainland authorities.

A Free Zone license is ideal for businesses focused on international trade, re-export, or serving clients outside the UAE. For example, a software company developing an app for the global market or an import-export business using Dubai as a logistics hub would be a perfect fit for a Free Zone.

The main attractions of a Free Zone setup are clear:

- 100% Foreign Ownership: This has always been the standard in Free Zones.

- Full Repatriation of Profits: You can send all your capital and profits back to your home country without any restrictions.

- Tax Exemptions: A major draw for international businesses is the 0% corporate and personal income tax.

- Simplified Setup: The registration process is often faster and involves less paperwork than a Mainland company.

The question isn't whether Mainland or Free Zone is "better," but which is strategically "right" for your specific business. Getting this right from the start is the foundation of a successful launch in Dubai.

Mainland License vs Free Zone License: Key Differences

To put it all into perspective, a side-by-side comparison can make the decision much clearer. Here's a look at how the two jurisdictions stack up against each other on the factors that matter most.

| Feature | Mainland License | Free Zone License |

|---|---|---|

| Market Access | Unrestricted access to trade within the entire local UAE market. | Primarily for trading within the specific Free Zone and internationally. |

| Office Location | You can rent commercial space anywhere in Dubai. | You must lease property located only within your chosen Free Zone. |

| Government Approvals | Requires approvals from the DET and other relevant ministries. | All approvals are managed by the specific Free Zone Authority, which is simpler. |

| Visa Eligibility | Generally more flexible and often linked to the size of your office. | Usually comes with a pre-defined quota of visas. |

Choosing the right path can feel overwhelming, but it doesn't have to be. With deep expertise in both Mainland and Free Zone company formation, we can guide you to a cost-effective solution that aligns with your business goals, making sure you take full advantage of the UAE's favourable tax environment right from day one.

The Complete Dubai License Application Process

Getting your Dubai trade license can seem like a daunting task, but when you break it down, it's really just a series of logical steps. This isn't some generic checklist; think of it as a practical roadmap that takes you from a business idea to holding an official license in your hand.

Every decision you make at the start, especially choosing your business activities, sets the course for the rest of the journey. The entire process is built to make sure your business is properly structured and follows all local rules from day one. Understanding this flow helps cut through the red tape and sidestep common mistakes that can lead to frustrating and expensive delays.

Defining Your Business Activities and Legal Structure

Before you even dream up a trade name, you need to be crystal clear on what your business will actually do. The Department of Economy and Tourism (DET) maintains a list of over 2,000 approved business activities. What you pick here is critical because it directly determines the license type you’ll need—commercial, professional, or industrial.

For instance, if you're planning to buy and sell electronics, you'd select trading activities, which points you towards a commercial license. A marketing consultant, however, is offering a service, which means they'd need a professional license. This choice also has a big impact on your company's legal structure.

Your legal structure defines things like liability and ownership. For businesses on the Mainland, one of the most popular choices is the Limited Liability Company (LLC). If you're heading down this path, it's vital to get the details right. You can find out more in our guide on LLC company formation in Dubai Mainland.

Securing Your Trade Name and Initial Approval

With your activities and legal form sorted, the next move is to reserve your company’s trade name. This is more than just picking something catchy; it has to follow specific DET rules.

- Uniqueness is Key: The name can't be the same as or too close to an existing company's name in the UAE.

- No Offensive Language: Your chosen name must not contain words that are considered offensive or go against public morals.

- Clarity on Legal Form: The name must end with its legal acronym, like LLC or FZE.

Once your name gets the green light, you'll apply for an Initial Approval. This is basically a preliminary nod from the authorities, saying, "We have no objection to you starting this business." This document is essential because it unlocks the next steps, like drafting your legal paperwork and securing an office space.

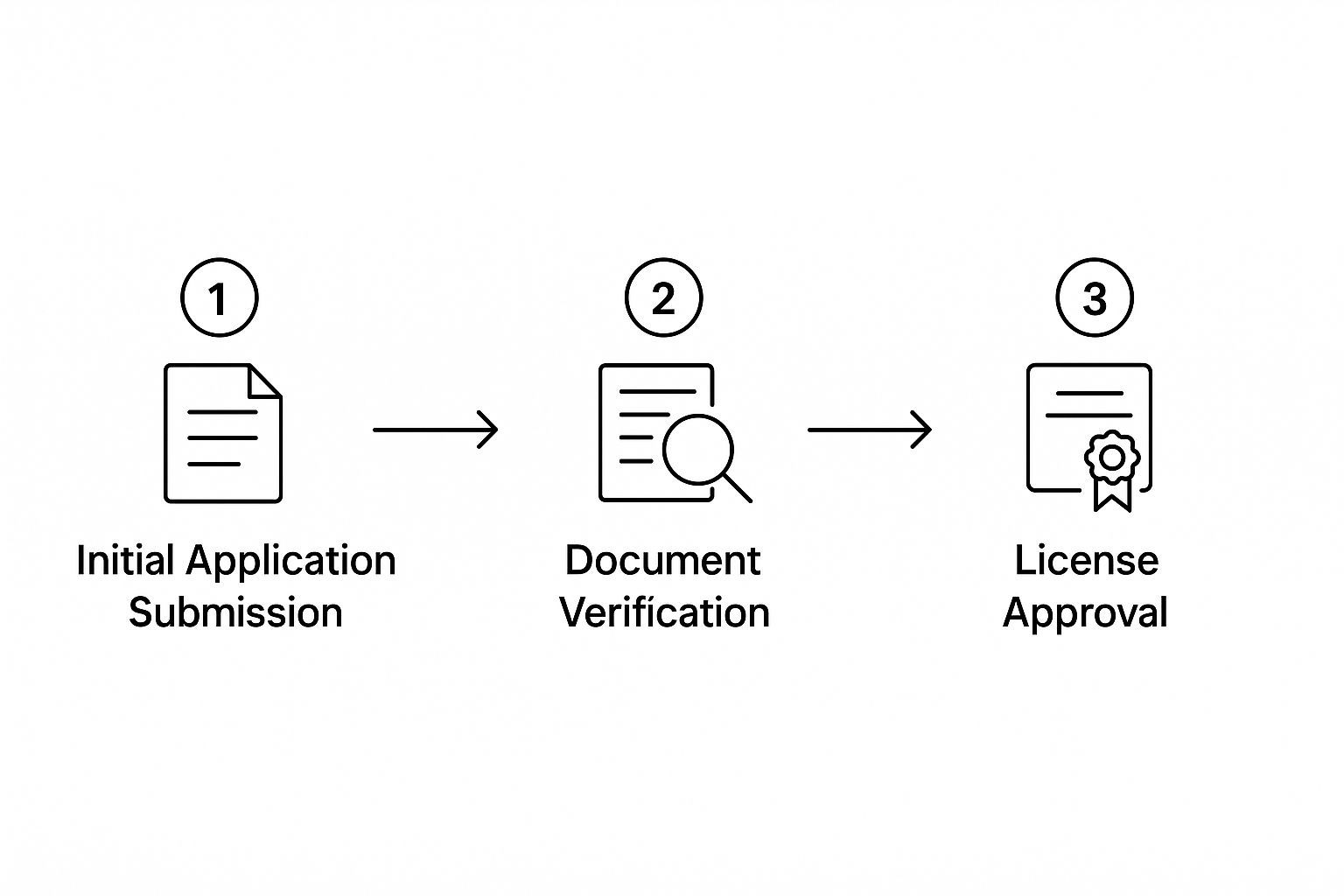

This infographic gives you a bird's-eye view of the application journey, from the first submission to the final approval.

As you can see, it's a methodical process where each stage builds on the one before it.

Preparing Your Core Legal Documents

Initial Approval in hand? Great. Now it's time to draft the legal documents that will form the foundation of your company. The most important of these is the Memorandum of Association (MOA). For any Mainland company, this document needs to be drafted with care and, in most cases, officially notarised.

The MOA spells out the critical details of your business, including:

- The names of all shareholders and how much capital each has contributed.

- The specific business activities your company is licensed to carry out.

- The management structure and the duties of the company manager.

- How profits and losses will be shared among the partners.

This document is the legal backbone of your company. Any mistakes or vague language in the MOA can cause serious headaches later on, so it’s crucial to get it perfect from the start.

Securing Your Business Address

Every Dubai trade license, whether it's for the Mainland or a Free Zone, must be tied to a registered physical address. This is a strict legal requirement with no exceptions. The kind of address you need will depend on your business activities and where you're setting up.

For many professional and service-based companies, a virtual office or a flexi-desk in a registered business centre is a smart and cost-effective solution. These options give you a legitimate address and the Ejari (tenancy contract) you need for the license application.

On the other hand, businesses involved in trading or retail will usually need a proper physical office or warehouse. The DET will ask for proof of this address in the form of a registered tenancy contract.

Getting your documentation in order is not just a formality; it's the bedrock of your company's legal standing. A meticulously prepared MOA and a verified tenancy contract are what give the authorities the confidence to issue your trade license.

The final stage involves submitting all your approved documents—the trade name reservation, initial approval, notarised MOA, and tenancy contract—to the DET or your chosen Free Zone authority. Our Corporate PRO Services team handles these submissions, ensuring everything is correctly filed to avoid rejections. With our 24/7 support, we keep you informed at every step, from final payment to the moment your official Dubai trade license is issued. This hands-on approach simplifies what can otherwise be a daunting process, allowing you to focus on what matters most: preparing to launch your business.

Costs, Paperwork, and Timelines: What to Expect

Setting up a business in Dubai successfully comes down to three key things: a solid budget, the right documents, and a realistic timeframe. Getting these sorted from the start means you can avoid surprise roadblocks and keep your launch on schedule.

Let's get into the specifics of what you'll need to invest, the paperwork you'll have to gather, and how long it should all take to get your Dubai trade license in hand.

A Transparent Look at Business Setup Fees

Understanding the costs isn't just about one big number. You'll have some initial one-time fees to get registered, plus some recurring annual costs to keep your company legally active. The final figure really depends on where you set up (Mainland or a Free Zone), your exact business activities, and your company's legal structure.

One-Time Setup Costs:

Think of these as your initial investment to get the doors open.

- Trade Name Reservation: This is the fee you pay to the Department of Economy and Tourism (DET) or the Free Zone authority to lock in your business name.

- Initial Approval Fee: A government charge for giving the preliminary green light to your proposed business activities.

- Document Attestation & Notarisation: Essential documents, like your Memorandum of Association (MOA), need to be legally verified and notarised. Our attestation specialists can handle all of this for you.

- Government Service Fees: These are various administrative charges from different government bodies you'll encounter during the application process.

Recurring Annual Costs:

These are the ongoing expenses you need to factor into your yearly budget.

- License Renewal Fees: An annual charge to keep your trade license valid and compliant.

- Office Rent: Every business needs a registered address. This could be a physical office or a more flexible virtual office, both of which come with an annual leasing cost.

- Establishment Card Fee: You'll pay this yearly fee for the card that allows your company to apply for employee visas.

For a deeper dive into the numbers, check out our detailed guide on the cost of setting up a business in Dubai.

To give you a clearer picture, here’s a quick summary of the potential costs involved.

Estimated Cost Breakdown for a Dubai Trade License

| Fee Type | Description | Estimated Cost Range (AED) |

|---|---|---|

| One-Time Fees | Initial, one-off payments required for registration and setup. | |

| Trade Name Reservation | Securing your unique business name with the relevant authority. | 600 – 800 |

| Initial Approval | Preliminary government consent for your business activities. | 150 – 250 |

| MOA Notarisation | Legal verification of your Memorandum of Association. | 500 – 2,000 |

| Government Service Fees | Various administrative charges during the application phase. | 1,000 – 3,000 |

| Annual Recurring Fees | Ongoing yearly costs to maintain legal compliance. | |

| Trade License Renewal | The annual fee to keep your license active. | 8,000 – 15,000+ |

| Office Rent (Virtual/Flexi) | Leasing a registered address for your business. | 3,000 – 10,000 |

| Establishment Card | Annual fee for the card enabling visa applications. | 500 – 2,000 |

Keep in mind these figures are estimates. The final costs will vary based on your specific setup choices.

The Essential Document Checklist

Having all your documents ready from day one is the single best thing you can do to prevent delays. The list changes slightly depending on who the shareholders are—individuals or another company.

Here’s what you’ll generally need to have on hand:

- Passport Copies: Clear, colour copies of the passports for every shareholder and the appointed manager.

- Visa and Emirates ID Copies: If any shareholders already live in the UAE, you'll need copies of their current residence visa and Emirates ID.

- Entry Stamp or Visit Visa Copy: For any shareholder who isn't a UAE resident, a copy of their UAE entry stamp or visit visa will do.

- Personal Information: A completed application form with key details for each shareholder, like their address and contact info.

If a corporate entity—either local or foreign—is a shareholder, you'll need to provide its attested corporate documents. This typically includes the parent company's Certificate of Incorporation, MOA, and a Board Resolution that officially authorises the setup of the new company in Dubai.

Setting a Realistic Timeline

So, how long does this all actually take? Getting your Dubai trade license can be as quick as a few days or take several weeks. It really hinges on your chosen jurisdiction and how complex your business activities are.

A Free Zone license is often much faster, sometimes taking just one to two weeks. A Mainland license, on the other hand, usually requires two to six weeks because it needs approvals from multiple government departments.

This timeline can stretch out if your business needs special approvals from specific ministries. For instance, a medical clinic requires a nod from the Health Authority, and an educational institute needs approval from the Knowledge and Human Development Authority (KHDA).

The good news is that business confidence in Dubai remains high, keeping the pipeline of new license applications flowing. A recent Dubai Business Survey pegged the Composite Business Confidence Index (BCI) at a strong 114.9 points. The services sector was especially optimistic, hitting a BCI of 123 points, while the trading sector was a bit more neutral. You can find more details in the Dubai Business Survey report.

At PRO Deskk, we live and breathe both Mainland and Free Zone company formations. We focus on creating cost-effective business setup solutions that fit your specific needs. And with our 24/7 support, we’re here to manage every detail, ensuring your application moves forward as smoothly and quickly as possible.

Life After Your License Is Issued

Getting your Dubai trade license in hand is a huge milestone, but it’s really just the starting line. Now, your focus has to shift from the setup paperwork to actually running your business successfully and, just as importantly, staying compliant.

Think of your trade license not as a one-time certificate, but as a living document. It needs regular attention to stay valid. If you let these ongoing responsibilities slide, you could be looking at fines, business disruptions, and a lot of stress—the last thing you want after putting in all that effort.

Staying Compliant with Annual Renewals

The single most important task after getting set up is your annual trade license renewal. This isn't optional; it's a strict legal requirement in the UAE. Missing the deadline can trigger some serious headaches, from steep financial penalties to having your corporate bank account frozen.

To make sure your renewal goes off without a hitch, you'll generally need a few key things:

- A valid tenancy contract (Ejari) for your office space.

- Passport copies for all the partners in the business.

- Any special approvals from government bodies that might be required for your specific business activities.

A good rule of thumb I always share with clients is to kick off the renewal process at least a month before your license expires. This gives you a comfortable cushion to sort out any unexpected issues without the risk of your company’s legal status lapsing.

Amending Your Dubai Trade License

Businesses change. As yours grows, you might find you need to tweak your license. Maybe you want to add a new service, change your company’s trade name, or bring a new manager on board. Whatever the change, it has to be officially registered with the authorities.

The process isn't overly complicated, but it has to be done right. It usually involves:

- Submitting an application: You’ll file a form with the Department of Economy and Tourism (DET) or your free zone authority.

- Getting initial approval: They'll give a preliminary nod to the change you want to make.

- Updating legal documents: If the change affects your company's core structure, you'll need to amend your Memorandum of Association (MOA).

- Paying the fees: There are government fees associated with any amendment.

If you don't register these changes properly, you can create legal problems for yourself later on. This is where our corporate PRO services can really help, managing these amendments efficiently to make sure your license always matches what your business is actually doing.

Your trade license is the absolute foundation of your business's legal standing in the UAE. Being proactive with management, renewing on time, and properly documenting any changes are crucial for protecting your investment and ensuring your business can grow without interruption.

Ongoing Business Responsibilities

Beyond just keeping your license up to date, running a business in Dubai comes with other key responsibilities. You'll need to get to grips with the UAE's Corporate Tax system—every business must register for tax and file returns. This means basic bookkeeping is no longer just a good habit; it's a legal requirement for compliance.

And if you’re planning to hire people, you must follow UAE Labour Law. This means issuing proper employment contracts, sponsoring visas, and sticking to the rules on wages and working hours. As specialists in Investor Visas and Golden Visas on property, we can walk you through the complexities of sponsoring yourself and your team, keeping you compliant from day one. Our 24/7 support service is always on standby to help you handle these post-setup steps.

Your Dubai Trade License Questions Answered

Setting up a business in Dubai is an exciting prospect, but it naturally comes with a lot of questions. We get asked about the ins and outs of the Dubai trade license process all the time. To help you get some clarity, we've answered a few of the most common queries we hear from entrepreneurs just like you.

Can I Get a Dubai Trade License Without a Physical Office?

Yes, you absolutely can, and it's a very popular route for new businesses trying to manage their startup costs. The authorities recognise solutions like virtual offices or flexi-desks, which are offered by registered business centres.

These options provide you with a legitimate business address and the all-important tenancy contract (Ejari) needed for your license application. It's an ideal setup for consultants, tech startups, and other service-based companies. Just remember that some business activities, particularly those involving physical goods like retail or trading, will still require a proper warehouse or storefront. It’s always best to double-check the specific premise requirements for your chosen activities.

Do I Still Need a Local Sponsor for a Mainland License?

Good news on this front: for the vast majority of business activities, a local sponsor is no longer required. Thanks to major legal reforms, 100% foreign ownership is now possible for most commercial and industrial licenses on the Dubai Mainland.

This has been a massive shift, really opening up the UAE market for international entrepreneurs.

There's one exception. If you're setting up a professional license, like a consultancy, you'll still need a UAE National to act as a Local Service Agent (LSA). The key difference is that an LSA holds no shares in your company, has zero decision-making power, and is simply paid an annual fee for their services.

The move to 100% foreign ownership on the Mainland has truly levelled the playing field. It's made Dubai an even more compelling destination for global investors who want full control of their business.

What Happens If I Don't Renew My Trade License on Time?

Letting your trade license expire is something you really want to avoid. The consequences can be quite serious and costly. For starters, you'll be hit with daily or monthly fines from the economic department, and these can add up surprisingly fast.

But the financial penalties are just the beginning. Your company could be blacklisted, which would prevent you from sponsoring or renewing employee visas. Even worse, your corporate bank account could be frozen, bringing your business operations to a complete halt. To stay safe, always start the renewal process at least a month before your license is due to expire.

How Long Does the Entire Trade License Process Take?

The timeline really depends on the type of license and the complexity of your business. A straightforward Free Zone application is usually the fastest path, sometimes taking as little as one to two weeks from start to finish.

A Mainland license generally takes a bit longer, typically anywhere from two to six weeks. This is because it involves getting approvals from multiple government departments, such as the Department of Economy and Tourism. If your business activity requires special permissions from external ministries—for example, in healthcare or education—the process can take even longer. The best way to keep things moving smoothly is to make sure all your paperwork is in perfect order from day one.

Figuring out the complexities of a Dubai trade license is much easier when you have an expert in your corner. We are:

✅ Specialists in Mainland Company Formation in Dubai, Sharjah & Abu Dhabi

✅ Specialists in Freezone Company Formation across the UAE

✅ Specialists in Golden Visa on Property and Investor Visa

✅ Specialists in Corporate PRO Services and Attestation Services

✅ 24/7 Support Service – Always here when you need us

✅ Cost-Effective Business Setup Solutions tailored to your needs

✅ Enjoy UAE Tax Benefits for International Entrepreneurs

📞 Call Us Now: +971-54-4710034

💬 WhatsApp Us Today for a Free Consultation