Thinking about setting up a business in Dubai? Going for a Dubai mainland business setup is your ticket to the entire UAE market. It’s a direct route that opens doors to unrestricted trade and, crucially, those valuable government contracts. Unlike a free zone company, a mainland business fully embeds you in the local economy. Getting this right from the start is the foundation for your success in Dubai.

Getting to Grips With Your Dubai Mainland Business Setup

When you choose a mainland setup, you’re establishing your company directly under the Department of Economy and Tourism (DET). This is Dubai’s main governing body for all commercial activities, and being under its jurisdiction gives you incredible operational flexibility. You can do business anywhere in the UAE and internationally without any restrictions.

For any entrepreneur coming from abroad, this is a massive deal. A mainland licence isn't just a bit of paperwork; it's the key that unlocks the full economic power of the region. It means you can open actual offices, shops, or showrooms anywhere in Dubai, putting you right in front of a huge and diverse customer base.

The Big Shift: 100% Foreign Ownership is Here

One of the most important changes in UAE commercial law has made a Dubai mainland setup more attractive than it's ever been. For years, this model required a local partner—a UAE national—who had to hold at least 51% of the company's shares. But that's all changed thanks to some major regulatory reforms.

Now, foreign investors can own up to 100% of their mainland companies across a wide range of sectors, with no need for a local sponsor. This has been a complete game-changer for entrepreneurs who want full control. In fact, by 2024, reports showed that over 70% of new mainland companies in Dubai were set up with 100% foreign ownership. That tells you everything you need to know about the shift towards business autonomy.

This move towards complete foreign ownership gives you total authority over your business operations, financial decisions, and overall strategy. It makes the mainland an ideal structure for anyone looking at long-term investment and growth.

Mainland vs Free Zone: A Strategic Comparison

One of the first big decisions you'll face is whether to set up on the mainland or in a free zone. Both have their perks, but the right choice really boils down to your business model and what you're trying to achieve.

Here’s a quick look at the main differences to help you see things clearly.

Mainland vs Free Zone At a Glance

| Feature | Dubai Mainland Company | Dubai Free Zone Company |

|---|---|---|

| Market Access | Unrestricted access to the entire UAE market. | Primarily limited to operating within the specific free zone and internationally. |

| Government Projects | Eligible to bid for and work on lucrative government contracts. | Generally not eligible to work directly with government bodies. |

| Office Location | Can rent or own office space anywhere in Dubai. | Must operate from a physical or virtual office within the designated free zone. |

| Visa Quotas | Visa eligibility is typically linked to the size of your physical office space. | Visa quotas are often pre-determined by the free zone authority based on the package. |

Understanding these fundamental differences is crucial. While free zones are great for international trade or specific industries, the mainland is simply unbeatable if your focus is the local market. For a clear breakdown of the investment required, you can explore the Dubai mainland company formation cost to help with your budgeting.

Of course, getting set up is only half the battle. You also need a solid plan to build your market presence. It’s worth looking into effective strategies like Content Marketing for Small Businesses. This will give you a clear roadmap for attracting and keeping customers once your company is up and running.

So, you're ready to get your Dubai mainland company off the ground. Before you start dreaming about office decor or interviewing staff, there are two crucial decisions you need to make right at the start. Your entire setup rests on picking the right business activities and the best legal structure for your venture.

These aren't just boxes to tick on a form. These choices will dictate what your company can legally do, how you're protected from liability, and what your path to growth looks like. Getting this right from day one is like having a solid blueprint before you start building.

Finding Your Niche: Picking the Right Business Activities

First things first, what exactly will your business do? The Department of Economy and Tourism (DET) in Dubai has a massive list of over 2,000 approved business activities. Seriously, it covers just about every industry you can think of, from IT consultancy and general trading to event management and specialised manufacturing. Your job is to sift through this and pinpoint the activities that perfectly match your business plan.

One of the big perks of setting up on the mainland is that you're not stuck with just one activity. You can bundle several related activities under a single trade licence, which gives you a ton more flexibility compared to many free zones that can be quite restrictive.

Let's say you're launching a digital marketing agency. You could group several activities together on one licence, allowing you to offer a complete service package:

- Social Media Marketing Services: For running client campaigns on all platforms.

- Web Design: To build and manage websites for your clients.

- Public Relations Management: To handle their brand image and press outreach.

This way, your agency can legally offer a full suite of services without juggling multiple, expensive licences. It's smart to think not just about what you're offering now, but what services you might want to add down the line.

Choosing Your Legal Armour: Company Structures Explained

Once you've nailed down your activities, it's time to choose a legal structure (or legal form). This is a big deal. It defines who owns the company and, more importantly, who is on the hook for its debts and legal obligations. For most foreign entrepreneurs setting up in Dubai, this choice usually comes down to a couple of popular options.

Your legal structure is the legal shield for your personal assets. Choosing a Limited Liability Company, for instance, separates your personal finances from business debts, offering a crucial layer of protection as you grow.

The two most common paths for foreign investors are the Limited Liability Company (LLC) and the Sole Establishment. They each have their own pros and cons, and as specialists in Mainland Company Formation in Dubai, Sharjah & Abu Dhabi, we've guided countless entrepreneurs through this decision.

LLC vs. Sole Establishment: Which One Is for You?

Let’s break down the practical differences with a couple of real-world scenarios.

A Limited Liability Company (LLC) is, by far, the most popular choice for businesses with foreign ownership. It's a formal corporate entity that can be owned by one or more people or even other companies. The key benefit? It limits your personal liability to whatever you've invested in the company.

- Scenario: Imagine you're launching a tech startup that needs a hefty initial investment for equipment and hiring. By setting up as an LLC, your personal assets—like your house or savings—are safe if the business runs into debt or legal trouble. It's the ideal structure for any venture with significant financial risk or plans to bring on investors.

On the flip side, a Sole Establishment is owned by a single individual. It’s generally simpler and cheaper to get started, but there's a catch: the law sees no difference between you and your business. This means you are personally responsible for all of its debts.

- Scenario: A freelance graphic designer wants to formalise their business to start working with bigger corporate clients in Dubai. A Sole Establishment is a quick and cost-effective way to get a professional trade licence. Because the business has low overheads and minimal financial risk, the lack of liability protection isn't a major worry.

Ultimately, the right choice really boils down to your business model, your appetite for risk, and where you see your company in a few years. An LLC offers solid protection for ambitious businesses geared for growth, while a Sole Establishment is perfect for individual professionals who need something simple and straightforward.

Locking In Your Trade Name and Getting Initial Approval

Once you’ve settled on your business activities and legal structure, things start to get real. The next step is giving your company an official identity by reserving a trade name and then securing Initial Approval from the Department of Economy and Tourism (DET). These are foundational milestones in your Dubai mainland business setup journey.

Think of your trade name as your business's first impression. It’s not just a name; it's a legal identifier that has to play by the rules set by the DET. Getting this right from the start will save you from frustrating delays and potential rejections down the line.

Choosing and Reserving Your Company Name

Reserving your trade name isn't just a creative exercise; it's a formal process. The DET has very clear rules to make sure names are unique, appropriate, and don't mislead anyone. A classic mistake we see is people choosing names that are too generic or already in use, which results in an immediate application denial.

To avoid this headache, always prepare three to five name options before you apply. This gives you backups if your first choice is already gone. Here are the key guidelines to stick to:

- No Religious or Political References: Your name cannot contain words like "Allah" or refer to any governing bodies.

- Must Be Unique: It can't be identical or even too similar to an existing company in the UAE.

- Show Your Legal Form: Your name must end with the correct legal abbreviation, like "LLC" for a Limited Liability Company.

- No Offensive Language: The name must not violate public morals or order.

For instance, a name like "Dubai Best Trading" would almost certainly be rejected for being too generic. But something more specific, like "Polaris Star General Trading LLC," is distinct and follows the rules, making it a much stronger candidate for approval.

The Critical Step of Initial Approval

With your trade name successfully reserved, the next big hurdle is applying for Initial Approval. This is a crucial checkpoint where the DET officially acknowledges your business concept and gives you a preliminary green light to move forward. It’s basically the government confirming that your proposed business activity is viable and allowed in Dubai.

This certificate isn't your final trade licence, but you absolutely cannot proceed without it. It's the key that unlocks the next steps, like drafting your company's Memorandum of Association (MOA) and starting the hunt for an office space.

Think of the Initial Approval as a formal 'no objection' from the authorities. It confirms that the government has reviewed your proposed business and sees no immediate obstacles to its formation, paving the way for the next stages of your setup.

Securing this approval means submitting a specific set of documents. Being meticulous here is non-negotiable; any missing or incorrect paperwork will bring your progress to a screeching halt. While the exact requirements can shift slightly depending on your business activity and legal structure, the core documents are generally consistent.

Here’s a typical checklist of what you'll need for the Initial Approval application:

- Completed Application Form: Fully filled out with all the details about your business and its owners.

- Passport Copies: Clear copies of the passports for every shareholder and the appointed manager.

- Trade Name Reservation Certificate: This is the proof that your chosen company name has been approved and reserved for you.

- Business Plan (if required): Some professional or specialised activities may require a detailed business plan outlining your objectives and operations.

Getting these documents right the first time is the secret to a smooth process. Working with a specialist can make this much simpler, as they can manage the entire submission for you. We provide cost-effective business setup solutions tailored to your needs, ensuring you have a smooth and affordable path through every stage of registration.

With your Initial Approval secured, you're now moving from the planning stage to the real nuts and bolts of your Dubai mainland business setup. This is where things get tangible. You’ll be creating your company's legal backbone and giving it a physical home—both essential steps before you can get your final trade license.

The first order of business is your Memorandum of Association (MOA). Think of this as the legal constitution for your company. It's a formal document that spells out what your business does, who owns what, and the duties of each partner. It needs to be drafted perfectly, because any grey areas here can cause serious headaches down the road.

Once the MOA is ready, all shareholders have to sign it in front of a public notary. This official step makes the agreement legally binding and is a non-negotiable part of the process before you can move on to the Department of Economy and Tourism (DET).

Securing Your Physical Presence in Dubai

Unlike setting up in a free zone, a mainland company in Dubai absolutely must have a physical office. This isn’t a friendly suggestion; it’s a core legal requirement. You’ll need an office lease contract registered through the official Ejari system, and this document is one of the most critical pieces of paper you'll submit for your trade license.

The government views a physical office as proof of a legitimate, operational business. Beyond that, the size of your office is directly linked to how many employee visas you can apply for, which is a massive consideration for your growth plans.

For example, a new consulting firm might just need a small, flexible workspace to keep costs low at the start. On the other hand, a trading company that plans to build a sales team will need a bigger space right away to secure enough visas.

Your office isn't just a place to work; it's a strategic asset in your mainland setup. The physical address legitimises your business, and the lease agreement is the key that unlocks both your trade license and your ability to sponsor employees.

Understanding Office and Visa Quotas

The connection between office space and visa eligibility is simple but crucial. As a rule of thumb, the DET allocates roughly one visa per 100 square feet of office space. So, a small 200 square feet office would typically allow for two employee visas—often perfect for a new startup.

When you look at the numbers for a mainland setup, a clear picture emerges. The initial licensing fee for a standard commercial license usually lands somewhere between AED 15,000 to AED 26,000. On top of that, you have the mandatory office lease, with a minimum size often set at 200 square feet. It's vital to factor these costs into your budget from day one.

You’ve got a few options for finding a compliant office:

- Traditional Office Rental: This gives you a dedicated, private space. It’s the best choice for established businesses or those who know they'll need a decent number of visas.

- Business Centre or Co-working Space: Many business centres offer DET-approved flexible desks or small offices. This is a great, cost-effective route for startups and solo entrepreneurs who need a proper address and an Ejari without the long-term commitment.

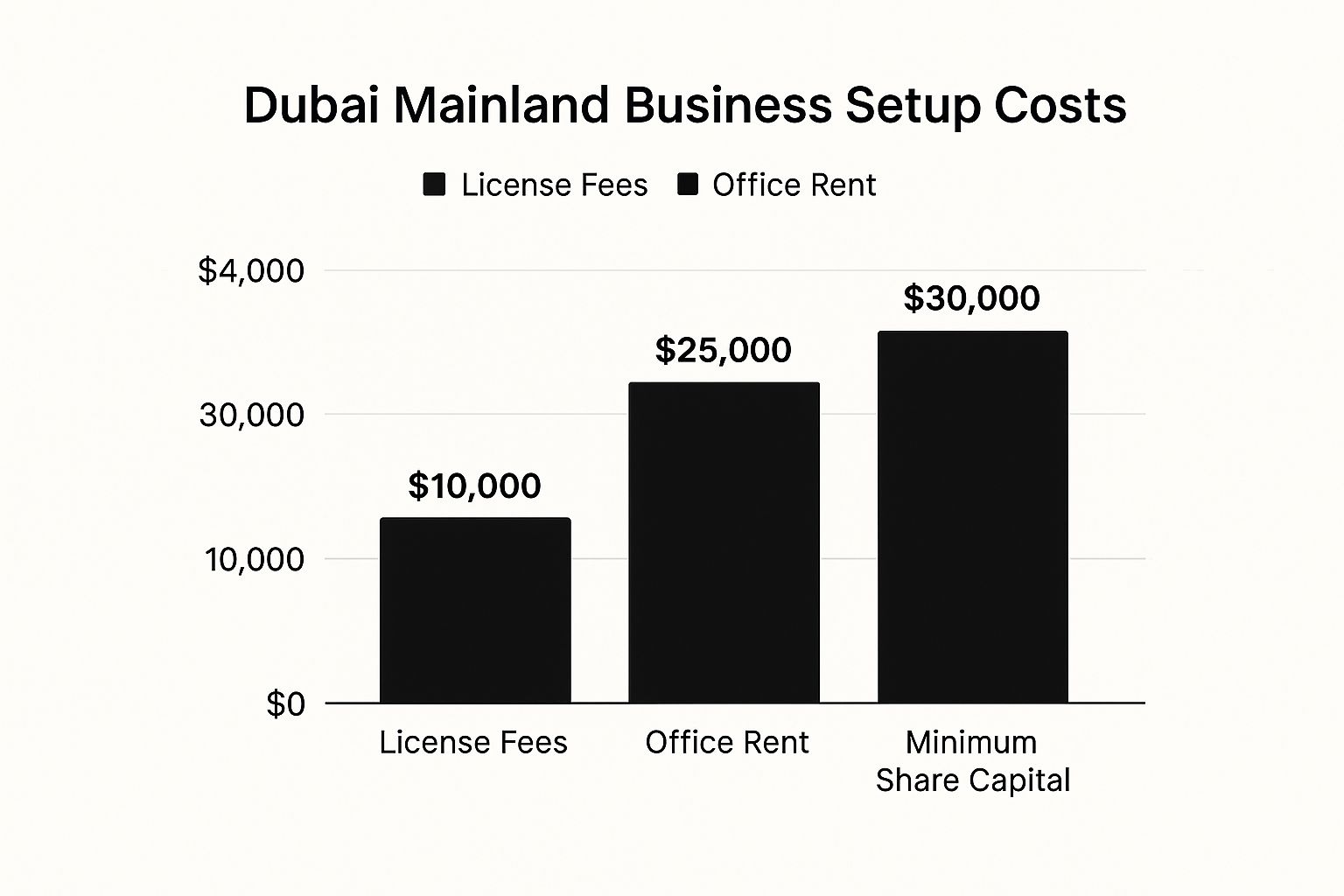

This infographic breaks down the typical costs you should anticipate for your Dubai mainland setup.

As you can see, office rent is often a huge chunk of your initial investment, which really drives home how important it is to pick a space that fits both your wallet and your visa strategy.

To help you plan, here's a rough idea of what a budget for a standard small commercial LLC might look like:

Typical Dubai Mainland Setup Budget Breakdown

| Expense Item | Estimated Cost Range (AED) |

|---|---|

| Initial Approval & Name Reservation | 1,000 – 1,500 |

| Trade License Issuance Fee | 15,000 – 26,000 |

| MOA Notarisation Fees | 1,500 – 2,500 |

| Annual Office Rent (Ejari) | 20,000 – 45,000+ |

| Establishment Card | 2,000 – 2,500 |

| Mandatory Health Insurance | 1,000 – 3,000 per person |

| Total Estimated Initial Cost | 40,500 – 80,500+ |

These figures are just estimates and can vary based on your specific business activity and office choice, but they provide a solid starting point for your financial planning.

Submitting for Your Final Trade License

With your MOA notarised and your Ejari registered, you've gathered all the key documents. Now it’s time to head back to the DET to submit your complete application file for the final review and payment.

Your submission package should contain:

- The signed and notarised Memorandum of Association (MOA).

- The Initial Approval certificate you received earlier.

- A copy of your registered Ejari (tenancy contract).

- Passport copies and other IDs for all partners and the appointed manager.

Once you’ve submitted everything and paid the final government fees, the DET will issue your official trade license. This is the document that legally empowers your company to start operating in Dubai. For a closer look at the different license types available, check out our detailed guide on getting a trade license in Dubai.

With that license in your hands, you're officially in business.

Managing Visas, Bank Accounts, and Compliance

Getting your new trade licence in hand is a fantastic milestone, but it's really just the starting line. Now the real work begins to get your business up and running. This next phase is all about sorting out visas, opening your corporate bank account, and putting a solid compliance system in place. These post-incorporation steps are what bring your Dubai mainland business setup to life.

Your very first move after the licence is issued? Apply for the company’s Establishment Card. This is a non-negotiable step. The card, issued by immigration authorities, officially registers your company with the General Directorate of Residency and Foreigners Affairs (GDRFA). Without it, you can't even start the visa application process for yourself or your team.

Navigating the Visa Application Process

Once the Establishment Card is secured, you can kick off the residency visa process for the company's investors and staff. It’s a multi-stage procedure that demands real attention to detail—one small mistake can lead to frustrating delays.

While it seems complex, the path is quite clear. It generally unfolds like this:

- Entry Permit: First, an entry permit is issued. This allows the individual to enter the UAE specifically for residency or employment purposes.

- Status Change: If the person is already in the UAE on a visit visa, they'll need to do a "status change" once the entry permit is out.

- Medical Fitness Test: Every applicant must pass a mandatory medical exam at a government-approved health centre.

- Emirates ID Application: At the same time, you'll apply for the Emirates ID, which is the official identification card for all UAE residents.

- Visa Stamping: The final step is getting the residence visa physically stamped inside the passport. This officially confirms their resident status.

We specialise in Golden Visa on Property and Investor Visa applications, so we're well-versed in making this journey smoother for you and your key personnel. Our experience helps cut through the red tape, minimising hold-ups and simplifying the whole affair.

Opening Your Corporate Bank Account

For many new businesses in Dubai, securing a corporate bank account turns out to be one of the biggest challenges. UAE banks perform very thorough due diligence and compliance checks, so walking in unprepared is not an option. You need to show up with a perfectly compiled set of documents.

Every bank has slightly different internal criteria, but you'll almost always need to provide:

- Company Trade Licence

- Memorandum of Association (MOA)

- Share Certificates

- Passport and Visa copies for all shareholders

- A detailed business plan and company profile

Banks are looking for a clear, credible business. A well-written company profile that details your operations, target customers, and anticipated transactions can make a world of difference. It shows you're transparent and helps them understand your financial needs, which can seriously speed things up.

Patience and a complete document file are your best friends here. For a much deeper look into the specific requirements and strategies, have a look at our detailed guide on how to successfully open a business bank account in Dubai.

Staying Ahead of Ongoing Compliance

Your work isn't done once the business is operational. To maintain good legal standing in Dubai, you have to stay on top of several ongoing compliance duties. Ignoring these can lead to steep fines or, in serious cases, the suspension of your trade licence.

The most critical tasks are renewing your trade licence annually with the DET and making sure your office lease (Ejari) is always current. You also have to maintain a register of the Ultimate Beneficial Owners (UBO) and submit it to the authorities, updating it any time company ownership changes.

These aren't just suggestions; they're fundamental to keeping your business running smoothly and legally. After you're set up, it's a smart move to learn how to streamline business processes so you can manage these administrative duties without them becoming a headache.

Common Questions About Dubai Mainland Setup

Setting up a business on the Dubai mainland is an exciting step, but it naturally brings up a lot of questions. As you move from your initial idea to becoming a fully operational company, you’ll likely have queries about the process, costs, and what it all means for the future.

We’ve put together clear, direct answers to some of the most frequent questions we hear from entrepreneurs just like you. Getting straight to the point helps you plan better and move forward with confidence.

Can I Really Own 100% of My Mainland Company?

Yes, absolutely. This is one of the most significant and welcome changes to UAE commercial law in recent years. For the vast majority of business activities, foreign entrepreneurs can now own 100% of their mainland company without needing an Emirati partner or sponsor.

This shift has been a game-changer. It puts mainland setups on par with many free zones when it comes to ownership, giving you full authority over your business decisions and profits. It's a major reason why the mainland has become the top choice for so many international investors who want to tap directly into the local UAE market.

How Long Does the Entire Setup Process Take?

From start to finish, a realistic timeline for setting up a Dubai mainland company is usually between one and three weeks. This covers everything from reserving your trade name to getting your final licence in hand.

However, a few things can influence that timeframe:

- Document Readiness: This is the single biggest factor. Having all your paperwork correct and ready to go from day one is the best way to avoid delays.

- External Approvals: Certain specialised activities, like healthcare or education, need an extra green light from specific government ministries, which can add a bit of time.

- Bank Account Opening: While your company can be formed quickly, opening a corporate bank account can sometimes take a few extra weeks. Banks have their own due diligence processes to follow.

What Ongoing Costs Should I Budget For?

The initial setup fee is just the beginning. To keep your company in good standing, you’ll need to plan for annual recurring costs. Knowing these upfront helps you manage your finances and avoid any surprises down the line.

The main ongoing expenses you can expect are:

- Trade Licence Renewal: This is your annual fee paid to the Department of Economy and Tourism (DET) to keep your business licence active.

- Office Lease Renewal: Your physical office lease, or Ejari, must be renewed each year.

- Establishment Card Renewal: This card is essential for processing visas and also needs to be renewed annually.

- Corporate PRO Services: Many businesses choose to retain professional services to handle all the renewals, amendments, and ongoing government paperwork.

What Does "Operational Freedom" Really Mean Compared to a Free Zone?

When people talk about operational freedom on the mainland, they’re talking about the complete absence of geographical and commercial restrictions. A mainland licence gives you the legal authority to trade directly with any customer or business, anywhere in the UAE.

A free zone company is typically restricted to doing business within its specific zone or internationally. To reach the mainland market, they often have to go through a local distributor. A mainland company faces no such hurdles, offering true, unrestricted access to the entire domestic economy.

This freedom also extends to government contracts. Only mainland-registered companies are eligible to bid for and win lucrative projects from UAE government departments. This opens up a massive potential revenue stream that is completely off-limits to free zone entities. Our 24/7 support service means we are always here when you need us, ready to answer your questions and provide expert guidance at any time as you navigate these strategic decisions.

At PRO Deskk, we take the complexity out of setting up your business in the UAE. We are:

✅ Specialists in Mainland Company Formation in Dubai, Sharjah & Abu Dhabi

✅ Specialists in Freezone Company Formation across the UAE

✅ Specialists in Golden Visa on Property and Investor Visa

✅ Specialists in Corporate PRO Services and Attestation Services

✅ Cost-Effective Business Setup Solutions tailored to your needs

✅ Ready to help you enjoy UAE Tax Benefits for International Entrepreneurs

✅ Always here when you need us with our 24/7 Support Service

Ready to launch your Dubai venture?

📞 Call Us Now: +971-54-4710034

💬 WhatsApp Us Today for a Free Consultation

Visit us at https://prodesk.ae to get started today.