Figuring out the total Dubai free zone company setup cost isn't as simple as looking at a single price tag. You're typically looking at a range anywhere from AED 10,000 to over AED 50,000. Think of it like building a custom car—the engine you choose, the features you add, and the final paint job all determine the final price. In the same way, your specific business needs, from the type of licence you require to the size of your office, will ultimately shape your investment.

Understanding the Financial Blueprint for Your Dubai Venture

Starting a business in one of Dubai's dynamic free zones is an exciting prospect, especially with massive benefits like 100% foreign ownership and major tax advantages on the table. But before you dive in, the first step for any savvy entrepreneur is to get a firm grip on the financial requirements. It’s not about a single payment; it’s about understanding a collection of fees that together make up your initial investment.

Each cost component has a distinct role in bringing your company to life. From securing your legal right to operate to establishing a physical presence, every fee is a building block in your company's foundation. To budget effectively and avoid any surprises, it’s crucial to see the bigger picture and understand how these individual costs connect.

The Key Cost Drivers

The three biggest factors that will sway your final setup cost are your chosen free zone, your specific business activity, and your office requirements. Every free zone has its own fee structure and often specialises in certain industries, making your choice a critical financial decision from the get-go.

For instance, as of 2025, the cost to set up a company in a Dubai free zone varies wildly. A premium zone like the Dubai Airport Free Zone (DAFZA) might start around AED 41,790, while a more accessible option like Dubai Silicon Oasis (DSO) could begin from as low as AED 11,900. Meanwhile, the world's largest free zone, DMCC, has starting setup fees in the ballpark of AED 43,780. It really pays to learn more about the varied free zone setup fees in Dubai to find the best fit for your budget.

To give you a clearer idea at a glance, here’s a quick breakdown of what you might expect to pay in some of Dubai's popular free zones.

Estimated Startup Cost Range in Popular Dubai Free Zones

| Free Zone Type | Example Free Zone | Typical Starting Cost (AED) | Best For |

|---|---|---|---|

| Premium/Specialised | Dubai Airport Free Zone (DAFZA) | 40,000 – 50,000+ | Logistics, Aviation, High-end Trading |

| Commodity Focused | DMCC | 40,000 – 50,000+ | Commodity Trading, Crypto, Services |

| General Purpose/Tech | Dubai Silicon Oasis (DSO) | 12,000 – 25,000+ | Tech Startups, R&D, Consulting |

| Media & Creative | Dubai Media City (DMC) | 25,000 – 40,000+ | Media, Marketing, Creative Agencies |

| Cost-Effective | Meydan Free Zone | 12,500 – 25,000+ | General Trading, E-commerce, Freelancers |

This table provides a rough guide, but remember, the final figure will always depend on your unique business needs, like the number of visas and the type of office space you select.

Core Components of Your Initial Investment

Before we get into the nitty-gritty of each expense, it helps to know the main categories of costs you'll come across. A typical setup package involves several key payments that are absolutely essential for getting your business legally and operationally off the ground.

Here are the primary costs you should have on your radar:

- One-Time Registration and Incorporation Fees: This is the upfront charge to legally register your company name and entity with the free zone authority.

- Annual Trade Licence Fee: This is a recurring yearly cost that allows your company to legally conduct its specific business activities.

- Office Space or Facility Costs: Whether you go for a simple flexi-desk, a shared workspace, or a private office, this is a mandatory requirement for most setups.

- Visa Processing and Immigration Fees: These are the costs tied to getting residency visas for yourself, your business partners, and any employees you plan to hire.

Getting your head around these core components is the first step to building a realistic financial forecast. It ensures your journey into the Dubai market is smooth and well-planned right from the start.

Breaking Down the Core Setup Costs

Figuring out the total Dubai free zone company setup cost is a bit like putting together a puzzle. You have to see how each piece connects to get the complete financial picture. Every entrepreneur's final bill is built on four main pillars, and understanding them means no nasty surprises down the road. It’s all about smart, effective budgeting from day one.

Think of it like this: your company registration is the title deed to your plot of land. The trade licence is your building permit. Your office space is the foundation, and the share capital is the first batch of construction materials. Each one is separate but absolutely essential to build something solid. Our job is to help you optimise each of these pillars to fit what you actually need, creating the most cost-effective setup possible.

Company Registration Fees

First up, you've got the company registration fee. This is a one-time payment you make to the free zone authority to officially get your business on the books. It’s the cost of getting your company’s name on the register and receiving its official "birth certificate."

This isn't a single, fixed price across the UAE. The fee changes depending on which free zone you go with and the legal structure you choose (like a Free Zone Establishment, or FZE, versus a Free Zone Company, or FZC). It’s the very first cheque you’ll write to claim your spot in the business world.

Annual Licence Fees

Once your company is registered, you’ll need an annual licence fee. This is a recurring cost that gives your business the legal green light to operate and carry out its specific activities for the year. Without a valid licence, you can't legally trade, provide services, or manufacture anything.

The price tag on this licence really depends on what your business does:

- Trading Licence: For businesses buying and selling goods.

- Service Licence: For consultants and professionals offering their expertise.

- Industrial Licence: For companies that are into manufacturing and production.

Each category has its own fee structure. Some specialised activities might even need extra approvals, which can nudge the price up. Looking at where the money goes, these licence fees are a major slice of the pie. For example, in a premium zone like DMCC, the one-time registration fee might start at AED 9,000, but the annual licence can run anywhere from AED 10,000 to AED 50,000, all depending on your business sector.

Office Space Costs

Every single free zone company in Dubai needs a registered physical address—it's non-negotiable. This brings us to the third big cost: office space rental. The good news is that free zones offer a whole spectrum of options, from budget-friendly virtual offices to full-blown private suites, so there’s something for every budget.

Here’s what you’ll typically find:

- Flexi-Desks: The most cost-effective choice. You get a shared workspace and a formal address, which is perfect for solo entrepreneurs and startups just getting off the ground.

- Shared Offices: A step up, offering you a dedicated desk in a collaborative space.

- Private Offices: A fully enclosed, dedicated office for businesses needing privacy and more room to grow.

Your choice here directly affects both your initial setup bill and your yearly running costs. For a deeper dive into these options, check out our guide on the overall business setup cost in Dubai.

Share Capital Requirements

Last but not least, there’s share capital. This is the money the owners have to inject into the business when it's formed. It’s meant to show that the company has a solid financial footing from the get-go.

In the past, many free zones insisted on a pretty hefty minimum share capital. Thankfully, things have changed. Today, a lot of free zones have either dropped this requirement completely or set it at a token amount that’s easy for anyone to meet.

This shift has made it much more accessible to launch a business here. It’s still really important to check the specific rules for your chosen free zone, because this can make a big difference to your initial cash outlay. Understanding these small, individual costs is key to seeing the big picture—much like how an e-commerce guide offers a detailed breakdown of platform setup costs to explain the total investment for an online store.

How Your Choice of Free Zone Impacts Your Budget

When it comes to your budget, not all free zones are created equal. In fact, the single biggest decision that will shape your total Dubai free zone company setup cost is the jurisdiction you choose. Think of it like picking a spot for a new shop; setting up a boutique on a glitzy high street comes with completely different overheads than opening a workshop in an industrial park.

Each free zone is its own ecosystem, with unique pricing, industry specialisations, and target audiences. A premium, sector-specific zone will naturally have higher fees because you're paying for world-class infrastructure and powerful networking opportunities. On the other hand, newer or more general-purpose zones often compete on price, rolling out very competitive packages to attract a wide net of entrepreneurs. Your job is to find that sweet spot where affordability, industry relevance, and strategic value meet.

A Look at Dubai's Key Players

To see how this plays out in the real world, let's compare three of Dubai's most popular free zones. Each serves a different crowd and comes with its own price tag, showing just how closely your business type is tied to your setup costs.

-

Dubai Multi Commodities Centre (DMCC): As the world's top free zone, DMCC is a premium pick, especially for businesses in commodities trading, crypto, and high-level professional services. That prestige, along with its solid infrastructure and vast networking community, comes at a higher price. Setup costs here often start from AED 40,000 and can go much higher, but that investment buys you into a highly respected and tightly regulated business environment.

-

International Free Zone Authority (IFZA): Positioned as one of the most budget-friendly options out there, IFZA is a fantastic launchpad for startups, SMEs, and consultants. It offers some of the most competitive licence packages you'll find, making it the go-to for founders who need to keep initial spending low. IFZA's flexibility and affordability have quickly made it a favourite entry point for new businesses arriving in the UAE.

-

Dubai Silicon Oasis (DSO): As a dedicated hub for technology and innovation, DSO offers a different kind of value. It’s more than just a free zone; it’s an integrated community for tech companies, complete with specialised infrastructure, funding opportunities, and a real spirit of collaboration. While it's more affordable than a premium zone like DMCC, its costs reflect its specialised nature, catering squarely to tech startups, R&D firms, and electronics businesses.

This quick rundown shows there's no single "best" or "cheapest" answer. It all comes down to balancing your bank account with what your business truly needs—whether that's a prime location, a prestigious name, or deep industry connections. For a closer look at wallet-friendly options, our guide on the cheapest free zones in the UAE is packed with useful insights.

Comparative Cost Analysis of Leading Dubai Free Zones

To really get a handle on the numbers, nothing beats a side-by-side comparison. The table below breaks down the estimated first-year costs for a basic setup across a few key free zones. This should give you a much clearer idea of where your money will be going.

| Free Zone | Target Industry | Avg. Licence Fee (AED) | Avg. Office Cost (AED/Year) | Minimum Share Capital (AED) | Estimated Total 1st Year Cost (AED) |

|---|---|---|---|---|---|

| DMCC | Commodities, Crypto, Services | 20,000 – 30,000 | 20,000 (Flexi-Desk) | 50,000 (Not always withdrawn) | 45,000 – 60,000 |

| IFZA | General Trading, Consulting | 12,000 – 18,000 | 5,000 (Flexi-Desk) | Not Required | 17,000 – 25,000 |

| DSO | Technology, R&D, Electronics | 15,000 – 25,000 | 15,000 (Flexi-Desk) | Not Required | 30,000 – 45,000 |

| DAFZA | Logistics, Aviation, Luxury Goods | 25,000 – 40,000 | 25,000 (Flexi-Desk) | 1,000 | 50,000 – 70,000 |

Note: These figures are just estimates for a basic package. The final cost can change based on how many visas you need and the specific business activities you choose.

As you can see, the total cost varies significantly from one zone to the next, reinforcing just how crucial this decision is for your startup budget.

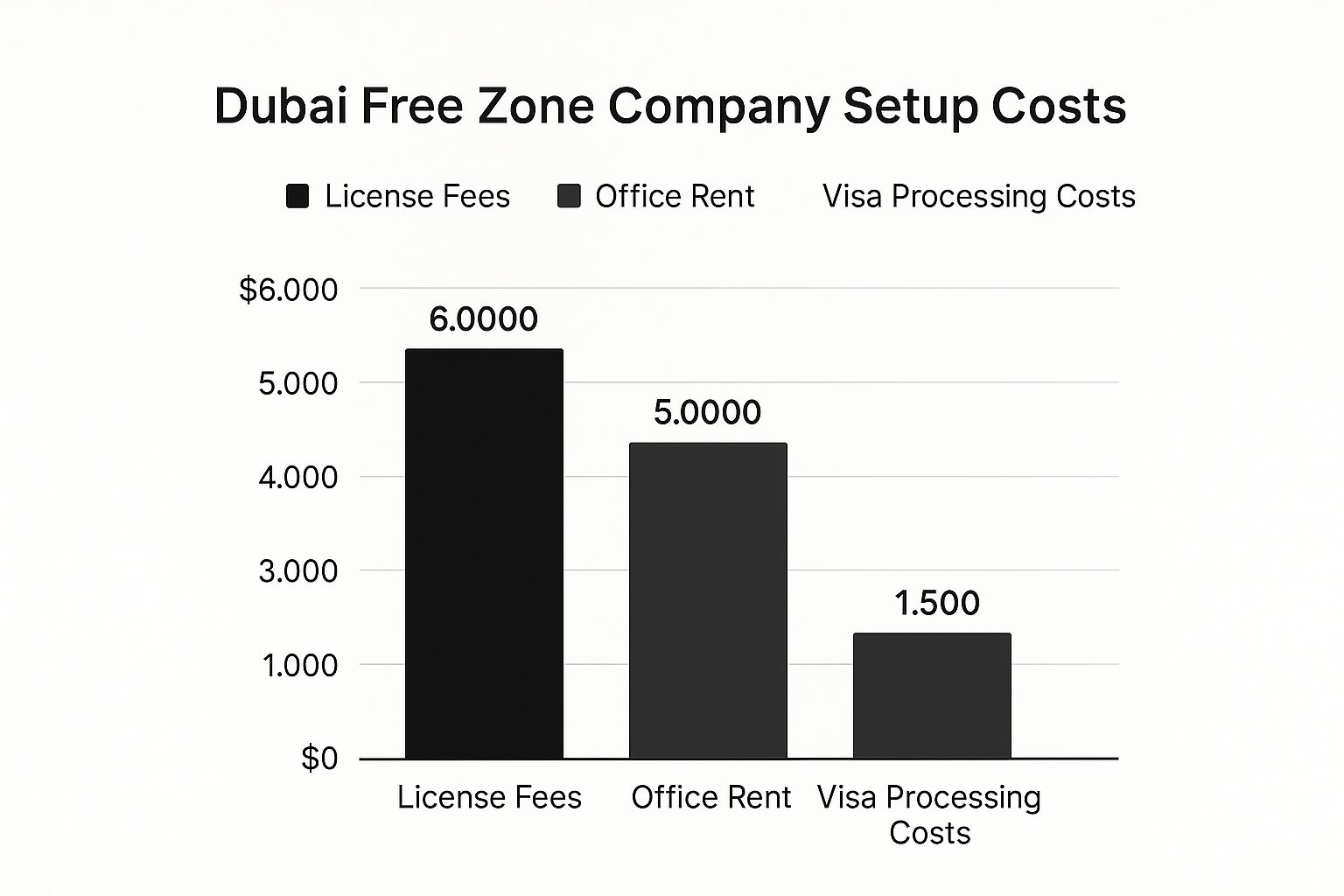

The visual below breaks down the main cost components you'll face during your Dubai free zone company setup.

It’s pretty clear that your licence and office fees will eat up the biggest slice of your initial investment, which again highlights why picking the right free zone from the start is so important.

Making the Right Financial and Strategic Choice

Picking a free zone is about so much more than just finding the cheapest price tag. It's a strategic move that can set the course for your business's future. Overspending on a premium zone with perks you'll never use can bleed your startup capital dry before you even get going.

The key is to perfectly align your business goals with what a free zone offers. A tech startup will absolutely thrive in the collaborative vibe of DSO, while a global commodities trader needs the credibility and rock-solid infrastructure of a place like DMCC.

By carefully weighing what each zone brings to the table—from its reputation and networking events to its physical location and back-office support—you can make a truly informed choice. This way, you ensure every dirham you put into your Dubai free zone company setup cost is working towards your long-term success, instead of just paying for a fancy name or facilities that don't help your bottom line.

Uncovering the Hidden and Recurring Expenses

To successfully budget for your Dubai free zone company setup cost, you have to look far beyond the initial registration and licence fees. A truly accurate financial roadmap means shining a light on all the ongoing and often overlooked expenses that can catch new entrepreneurs by surprise.

Think of it this way: budgeting only for the initial setup is like buying a car and completely forgetting about fuel, insurance, and maintenance. These recurring costs are what keep your business engine running smoothly, year in and year out.

Understanding these expenses from day one is the best way to prevent nasty financial surprises that could disrupt your operations down the line. By planning for these predictable—but sometimes hidden—fees, you're not just creating a cost estimate; you're building a sustainable, long-term financial strategy.

Essential Administrative and Immigration Costs

Beyond your trade licence, you’ll find several mandatory cards and processes that carry their own fees. These are completely non-negotiable for operating legally and securing residency in the UAE.

First up is the Establishment Card. This crucial document officially registers your new company with the immigration authorities, and you absolutely cannot apply for any residence visas under your company’s name without it. Keep in mind, this card has an annual renewal fee that needs a permanent spot in your yearly budget.

Then you have the UAE residence visa processing fees for yourself, any business partners, and your employees. These are significant costs that involve much more than a simple application fee. Each visa is a multi-step process, with each stage having its own charge:

- Entry Permit Issuance: This is the first step, giving an individual permission to enter the UAE for residency.

- Medical Fitness Test: A mandatory health screening for all residence visa applicants.

- Emirates ID Application: The fee for issuing the UAE's national identity card, which is essential for pretty much everything here.

Because these costs are per person, they can multiply quickly if you plan on hiring a team. It's vital to factor these into your staffing and operational forecasts, especially for the first two years.

Other Potential and Ongoing Expenses

Your financial planning doesn't stop with visas and admin cards. Depending on your specific business activity and how you choose to operate, another layer of costs can emerge, adding to the total Dubai free zone company setup cost.

For example, certain business activities demand third-party or external approvals from specific government bodies. If you’re venturing into healthcare, education, or food trading, expect to seek clearances from authorities like the Dubai Health Authority (DHA) or Dubai Municipality. These approvals come with their own application and inspection fees.

One area you really shouldn't skimp on is professional assistance. While it might feel like an extra expense upfront, getting expert help can save you from making costly mistakes later. This includes services for corporate bank account opening and handling annual compliance tasks like audit report submissions, which are mandatory in many free zones.

Don't forget about mandatory health insurance either—it's a legal requirement for every single residence visa holder in Dubai. The price tag varies depending on the level of coverage, but it's a significant annual expense for every person sponsored by your company.

To put it in perspective, visa fees alone can range from AED 3,000 to AED 7,000 per person. When you add consultancy fees (AED 5,000–15,000) and help with setting up a corporate bank account (AED 2,000–5,000), these extra costs become a substantial part of your overall budget. You can find more details about how these additional business costs stack up by reading these insights.

Smart Ways to Bring Down Your Setup Costs

Lowering your Dubai free zone company setup cost isn't about cutting corners or taking risks. It’s about making smart, strategic moves right from the start. A thoughtful approach to your initial investment frees up cash that can be put to much better use—fuelling growth, marketing, and day-to-day operations.

Think of it like packing for a long trip. An experienced traveller packs light but brings exactly what they need. In the same way, a savvy entrepreneur picks setup options that fit their actual business needs, avoiding the dead weight of unnecessary expenses. This isn't about being cheap; it's about being efficient.

Choose Your Workspace Wisely

Your office space is one of the biggest and most flexible costs you’ll face. While every free zone company needs a registered address, that doesn't mean you need a private, physical office from day one, especially if you can work remotely.

Consider these much more cost-effective options:

- Flexi-Desks: This is easily the most popular and budget-friendly choice for startups and consultants. A flexi-desk gives you a proper business address and access to shared workspace facilities when you need them. It can slash your annual rental costs dramatically compared to a dedicated office.

- Virtual Offices: Some free zones offer packages that just provide an address, mail handling, and phone services without any physical desk space. This is perfect for international entrepreneurs who don’t need a physical base in Dubai right away.

Just by choosing a flexi-desk, you could save thousands of dirhams every year. It’s a powerful first step in getting your budget under control.

Unlock Long-Term Savings and Bundle Services

Free zone authorities are always competing to attract new businesses, and they often have great incentives up for grabs. You can use this to your advantage by looking for packages that offer long-term value or bundle several services together at a discount.

A key strategy is to look into multi-year licence packages. Many free zones, like IFZA, offer two, three, or even five-year licences at a lower annual rate. It means a bigger payment upfront, but it can lead to major savings over time and shields you from yearly fee increases.

Also, keep an eye out for setup packages that bundle essentials like your registration, licence, establishment card, and even a few visas. These all-in-one deals are usually much more competitive than paying for each item on its own. It also simplifies the whole process and gives you a clear, fixed cost right from the beginning.

Be Precise With Your Business Activities

Here’s a more subtle but very effective way to manage your Dubai free zone company setup cost: be extremely careful when defining your business activities. The price of your trade licence is directly tied to the number and type of activities you choose.

Adding too many activities or choosing ones that are too broad can needlessly push up your licence fee. Even worse, picking an activity that needs outside approvals from government bodies like the Dubai Health Authority or the Knowledge and Human Development Authority will add extra costs and make your setup take longer.

It’s best to work with a specialist to pick only the activities you absolutely need for your business right now. You can always add more later as your company grows. This focused approach means you’re only paying for what you need today. A big part of this financial planning is also understanding the wider economic picture; for instance, you can enjoy UAE Tax Benefits for International Entrepreneurs.

The Value of a Free Consultation

Finally, don't overlook the power of getting professional advice. A free consultation with a business setup specialist isn't just a sales pitch; it's a strategic planning session. An expert can look at your specific situation and map out a cost-effective plan just for you.

They know all about the latest free zone promotions, understand the small details in different packages, and can guide you toward the smartest financial choices. This ensures your entrepreneurial journey in Dubai starts on the best possible financial footing.

Why a Setup Specialist Is Your Best Investment

Trying to figure out the Dubai free zone company setup cost on your own can feel like navigating a maze blindfolded. You might think the DIY route saves you cash, but it’s a path littered with potential pitfalls.

It’s easy to end up with costly mistakes, unexpected delays, and long-term compliance headaches. Choosing the wrong free zone, getting tangled in paperwork, or missing a crucial fee can quickly turn your exciting new venture into a frustrating ordeal. This is exactly where bringing in a setup specialist stops being an expense and becomes one of your smartest investments.

From Confusion to Clarity

A good setup specialist cuts through the noise. Instead of you losing weeks researching dozens of free zones, they bring their deep market knowledge directly to you. They’ll listen to what your business actually does and match it to the perfect free zone for your activity and budget.

This means you won't be paying for fancy facilities or perks you’ll never use. Their expertise is about finding the best value, not just the cheapest price tag.

They'll hand you a clear, all-in cost breakdown from the start, so you don't get ambushed by the hidden fees that can wreck a DIY budget. From getting your documents attested to sorting out your visa, they make sure every step is handled efficiently.

The real value of a specialist is their ability to spot potential roadblocks and steer you around them before they even become problems. It’s this proactive approach that saves you both time and money, getting your business off to the strongest possible start.

Comprehensive Support Beyond Setup

And the support doesn't stop once your company is incorporated. The best specialists act as long-term partners, ready to help your business grow and adapt in the UAE.

✅ Specialists in Mainland Company Formation in Dubai, Sharjah & Abu Dhabi

✅ Specialists in Freezone Company Formation across the UAE

✅ Specialists in Golden Visa on Property and Investor Visa

✅ Specialists in Corporate PRO Services and Attestation Services

✅ 24/7 Support Service – Always here when you need us

✅ Cost-Effective Business Setup Solutions tailored to your needs

We offer this level of dedicated service because we are specialists in every detail of a free zone company setup in Dubai. You get a clear roadmap to success, not a journey filled with uncertainty.

📞 Call Us Now: +971-54-4710034

💬 WhatsApp Us Today for a Free Consultation

Frequently Asked Questions

When you're looking at setting up a business in Dubai, the financial side of things can bring up a lot of questions. Let's break down some of the most common queries entrepreneurs have about the Dubai free zone company setup cost to help you plan your next move with a bit more clarity.

What Is the Absolute Cheapest Way to Set Up a Free Zone Company in Dubai?

For those looking for the most budget-friendly entry point, a freelancer permit or a basic e-commerce or services licence is usually the way to go. You’ll find that cost-effective free zones like IFZA or Meydan offer packages that bundle in a flexi-desk and a single visa, which keeps those initial costs right down.

Just keep in mind, while this lean setup saves you money upfront, it's really important to make sure it genuinely fits your business goals and what you need to operate day-to-day.

What Are the Main Recurring Annual Costs to Budget For?

Thinking ahead about recurring costs is smart. Your main annual expenses will be renewing your trade licence and establishment card. You'll also have to budget for your office facility rent, even if it's just a flexi-desk.

On top of that, you need to account for renewing the residence visas for yourself and any staff, plus their mandatory medical insurance. Don't forget, some free zones also require an annual audit of your financials, which comes with its own professional fees.

Can I Get a Residence Visa Without a Physical Office?

Yes, you absolutely can, and it's one of the big perks of many free zones. They often have packages that give you full visa eligibility with just a flexi-desk or shared workspace. This is a game-changer for entrepreneurs who want to secure a UAE residency without splashing out on a private office.

The catch, however, is that the number of visas you can get is directly linked to the type of facility you choose.

A flexi-desk setup typically gets you an allocation of one to three visas. If you're planning on building a team, you'll need a dedicated physical office, as that comes with a much larger visa quota.

How Long Does the Setup Process Take and When Do I Pay?

The whole process can be surprisingly quick, taking anywhere from a few days to a couple of weeks. It really depends on which free zone you choose, how complex your business activity is, and how fast you can get all the necessary documents together.

As for payment, the initial setup costs—which cover your registration and the first year's licence fee—are almost always required upfront before anything gets started. Bringing in a business setup specialist can really speed things along and make sure all the payments and paperwork are handled correctly from the get-go.

At PRO Deskk, we're here to provide the expert guidance you need to make your entry into the UAE market smooth and cost-effective. Our specialists offer solutions for both free zone and mainland setups, visa services, and ongoing PRO support. Let us manage the complexities so you can stay focused on growth. For a detailed, no-obligation quote, get in touch with us today.

Learn more about our business setup services at prodesk.ae