So, you're thinking about setting up a business in Dubai. It's a fantastic move, but the first question on everyone's mind is always: "How much is this going to cost me?"

Let's get straight to it. For a new entrepreneur, the total cost of starting a business in Dubai usually lands somewhere between AED 20,000 and AED 30,000.

This initial outlay gets you through the essentials – your licence, registration, and all the necessary paperwork. Of course, the final number can shift depending on your specific business activity, where you set up (Mainland or a Free Zone), and what kind of office space you need.

Your Guide to Dubai Business Setup Costs

Launching a business here is an exciting journey, but success starts with a solid financial plan. This guide is designed to cut through the noise and give you a clear, high-level picture of the investment required. Think of it as your financial roadmap, pointing out the key costs you'll encounter along the way.

We’ll walk through the core pieces that make up your startup budget, from government licensing fees to the operational nuts and bolts. Getting a handle on these elements early on helps you forecast your expenses properly and sidestep any nasty surprises down the road.

Key Cost Components

Every business setup process, no matter the industry, involves a few fundamental expenses. While the exact amounts will vary, the categories are pretty consistent. It’s vital to budget for each one to ensure you have a smooth and stress-free launch.

- Trade Licence and Registration: This is your official green light to operate. The cost depends on whether you need a commercial, professional, or industrial licence.

- Office Space: You’ll need an address, whether it’s a physical office or a virtual one. This can range from an affordable flexi-desk in a Free Zone to a premium office suite on the Mainland.

- Visa Processing: A major, multi-step expense is securing residency for yourself as the business owner and for any staff you plan to hire.

- PRO Services: Don't underestimate the value of a good Public Relations Officer (PRO). Their services are pretty much essential for navigating government approvals and paperwork efficiently.

A well-thought-out budget is the bedrock of a successful business launch. By accounting for every potential cost—from the big government fees to the essential support services—you set your company up for steady growth right from the get-go.

To give you a clearer idea, let's break down some of the smaller fees that make up the total. Recent data shows that the initial fees for reserving your trade name and getting initial approval usually fall between AED 1,000 to AED 2,000.

The licence itself is a bigger chunk of the budget. Commercial licences often start around AED 10,000, while professional licences can be closer to AED 5,600. You'll also need to factor in notarisation costs, which add another AED 1,000 to AED 1,500. For a more granular look, you can dig into the complete cost of setting up a business in Dubai in our comprehensive guide.

Here's a quick table to summarise what you can expect.

Estimated Startup Cost Breakdown in Dubai

This table offers a snapshot of the typical cost ranges for the essential parts of setting up a business in Dubai. It’s a great starting point for putting together your initial budget.

| Expense Category | Estimated Cost Range (AED) | Notes |

|---|---|---|

| Trade Name & Initial Approval | 1,000 – 2,000 | Initial government fees to reserve your company name and get the first stage of approval. |

| Trade Licence | 5,600 – 15,000+ | The core licensing fee. Varies significantly based on your business activity (professional vs. commercial) and jurisdiction. |

| Office Space (Annual) | 5,000 – 25,000+ | Ranges from a basic flexi-desk or virtual office agreement to a small physical office space. This is a mandatory requirement. |

| Establishment Card | 2,000 – 2,500 | A necessary document that allows your company to apply for visas for its employees and investors. |

| Investor/Partner Visa | 4,000 – 5,500 | Per person cost for a 2-year residency visa, including medical tests and Emirates ID. Costs can be higher for more complex visa types. |

| PRO Services | 2,000 – 5,000 | Annual fee for a professional service agent to handle government liaison, document processing, and renewals. Highly recommended. |

| Miscellaneous Fees | 1,000 – 3,000 | Includes costs for document attestation, notarisation of MOA (Memorandum of Association), and other smaller administrative charges. |

| Total Estimated Range | 20,600 – 58,000+ | This provides a general idea. Your final cost will depend entirely on your specific choices for licence type, office, and number of visas. |

Remember, these figures are a guide. The actual costs can fluctuate based on the specifics of your business plan, but this breakdown gives you a solid foundation for your financial planning.

Breaking Down Mainland Company Formation Costs

Choosing to set up a mainland company in Dubai is like opening a shop right on the city's busiest high street. It gives you direct, unfiltered access to the entire UAE market, letting you trade freely with anyone, anywhere from Sharjah to Abu Dhabi. But this prime position comes with its own unique set of costs, which are quite different from other jurisdictions.

Getting a handle on this specific cost structure is crucial if you want to budget accurately. The process winds through several key government departments, and each one has its own fee schedule. From the moment you apply for initial approval to the day you hold your trade licence, nearly every step has a price tag.

Let's walk through the financial side of a mainland setup. We’ll break down each line item, separating the mandatory government charges from the variable operational costs, so you can build a solid and realistic budget for your new venture.

Initial Government Approvals and Name Reservation

The first financial hurdle on your mainland journey is getting the green light from the Department of Economic Development (DED). This is the stage where your business idea gets its first official nod. Think of it as reserving your spot in Dubai’s bustling commercial landscape.

The costs here are split into a few specific fees. You’ll have to pay for the initial approval, which basically confirms that your business activity is allowed. At the same time, there's a fee for reserving your chosen trade name to make sure it’s unique and follows UAE naming rules.

These early steps are foundational. The costs are non-negotiable government charges, and they mark the official start of your company's legal life on the mainland.

The Core Licensing and Legal Documentation Fees

Once you’ve got your initial approvals sorted, the next step is to formalise your company’s legal structure. This part of the process includes some of the biggest one-time costs you'll face. A major component here is drafting and notarising your Memorandum of Association (MoA).

The MoA is essentially your company's constitution. It lays out what your business does, who owns what, and how it will operate. This document has to be professionally drafted and then attested by a public notary, which means you'll pay separate fees for both the drafting and the verification services.

Securing your mainland trade licence is the most significant milestone in the setup process. This is the official permit that allows you to operate legally, and its cost is influenced by your specific business activities and legal structure.

After the MoA is done, your business also needs to be registered with the Ministry of Economy. This is another mandatory step that adds a significant fee to your startup budget. These legal and registration fees are what make your company fully compliant with both UAE federal and local laws.

Office Space and Local Partner Considerations

One of the key things that sets a mainland company apart is the need for a physical office space. Unlike some setups that are fine with a virtual office, the DED requires a physical address backed up by a registered lease agreement, known as an Ejari. The cost of office space is a huge variable in the overall cost of starting a business in Dubai.

This expense depends heavily on the size and location you pick. For example, renting a small office in a prime spot like Downtown Dubai will be a lot more expensive than a similar space in Deira. On average, you can expect commercial rent to be AED 200 or more per square foot annually.

On top of that, many mainland business structures require a partnership with a UAE national, who might be called a Local Service Agent or a Local Partner. The fees for this partnership can run anywhere from AED 5,000 to AED 25,000 each year, depending on the agreement and how involved the partner is. This is a critical ongoing expense to factor into your budget.

A close look at the numbers shows that setting up a mainland business involves multiple government and operational expenses that usually go beyond AED 12,000. For instance, the initial DED approval costs about AED 267, while verifying your trade name adds another AED 767. Other big costs include the MoA verification fee of around AED 1,200, Ministry of Economy registration at AED 3,000, and a government market fee that’s roughly 5% of your shop's rent. You can explore a full analysis of these expenses and discover more insights about mainland company setup costs to get your budget right.

A Closer Look at Free Zone Company Setup Costs

Dubai's free zones are a massive draw for international entrepreneurs, and it’s easy to see why. They offer incredible perks like 100% foreign ownership and significant tax breaks. You can think of them as specialised business hubs, each with its own set of rules, industry focus, and, crucially, a completely unique fee structure. This makes a direct cost comparison an essential first step.

Getting a handle on the financial side of a free zone is the key to enjoying its benefits without any surprise expenses. The cost of starting a business in Dubai can swing wildly from one free zone to another, so it’s vital to weigh your options carefully.

Breaking Down Free Zone Packages

Most free zones offer "all-in-one" setup packages, which are a fantastic way to simplify the whole process. These bundles typically roll up the costs for registration, a trade licence covering a certain number of business activities, and a basic office solution. However, it's really important to look beyond the attractive headline price.

While these packages are convenient, they can come with limitations. For instance, a starter package might only allow for one or two business activities or cap you at zero employee visas. If you need to upgrade these elements later on, it often costs a lot more. So, understanding exactly what's included from day one is critical for accurate budgeting.

The true cost of a free zone package is hidden in the details. A package that looks cheap at first glance might become expensive once you factor in the cost of necessary visas, extra activities, or office upgrades. Always make sure the package inclusions match your business's needs, both for today and the near future.

For example, a major hub like the Dubai Multi Commodities Centre (DMCC) provides a very clear cost framework designed for different business sizes. The minimum share capital requirement here is usually AED 50,000. Their packages vary quite a bit: the Basic Biz option starts at AED 35,484 for a one-year licence covering up to three activities. For startups, their Jump Start package runs from AED 43,780 for one year to AED 120,000 for three years. Larger companies might look at the Prime Plus Package, which is around AED 40,145 per year.

These totals are pieced together from core costs like application fees (AED 1,035), registration (AED 9,020), licence fees (often over AED 20,000), and the establishment card (AED 1,825).

The Office Space Question: Flexi-Desk vs. Permanent Office

One of the biggest variables in your free zone setup cost will be your choice of office. Unlike mainland setups that almost always demand a physical office lease, free zones offer much more flexible—and budget-friendly—solutions. This decision has a direct impact on both your costs and your visa eligibility.

- Virtual Office / Flexi-Desk: This is your most wallet-friendly choice. It gives you a legal business address and access to shared desk space when you need it. It’s perfect for startups and solo entrepreneurs but usually comes with very limited visa quotas.

- Serviced Office: A step up from a flexi-desk, this is a private, furnished office inside a business centre. It offers more privacy and a higher visa allowance, making it a great fit for small teams.

- Permanent Office: This is the traditional route—an unfurnished office space that you lease and fit out yourself. It gives you the most freedom and the highest visa eligibility, but it's also the biggest financial commitment.

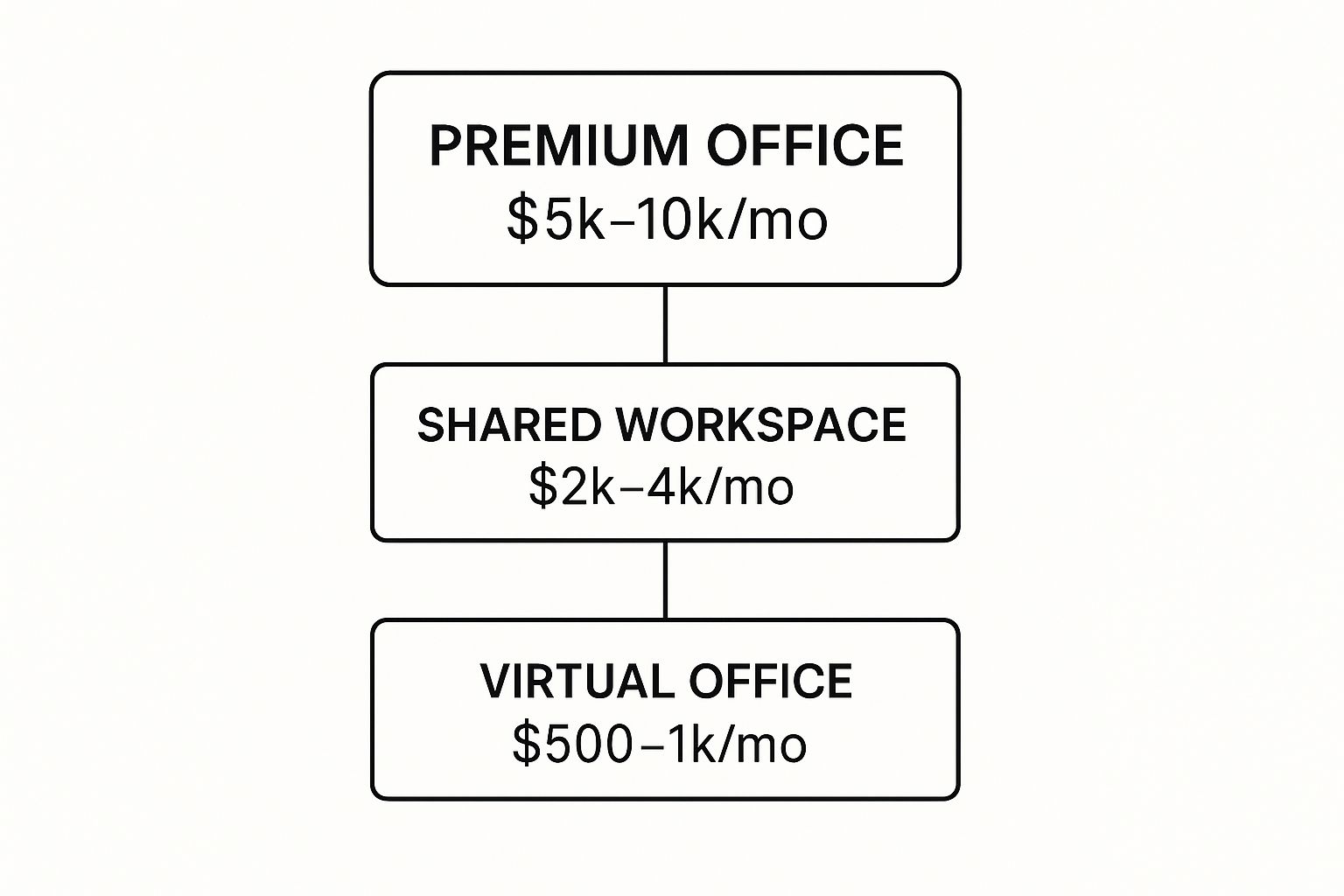

The image below gives you a clear idea of the typical monthly cost differences for various office solutions in Dubai.

As you can see, you can pick an office solution that grows with your budget, starting with an affordable virtual office and scaling up to a premium physical space when the time is right.

Comparing Costs Across Major Free Zones

While the UAE has over 40 free zones, a handful stand out due to their popularity and well-defined fee structures. Looking at their entry-level packages can give you a solid idea of the initial investment you'll need to make.

For instance, the Jebel Ali Free Zone (JAFZA) is one of the world's largest and oldest, with a strong focus on trade, logistics, and manufacturing. Its costs tend to reflect its top-tier infrastructure and global connections. On the other hand, newer or more specialised free zones might offer more competitive prices to attract businesses in specific sectors, like tech or media.

When you're comparing your options, be sure to look at:

- Licence Fees: The annual cost for your trade licence.

- Registration Fees: The one-time payment to register your company.

- Office Costs: The yearly fee for your chosen office type (flexi-desk, serviced, etc.).

- Visa Costs: The fee for each visa and the total number of visas your package allows.

In the end, choosing the right free zone is all about balancing your budget with your business goals. If you carefully analyse the packages and understand the trade-offs between cost and features, you can find a solution that sets your new venture up for success without breaking the bank.

Budgeting for Visas and Employee Sponsorship

So you've secured your trade licence. That's a huge milestone, but the journey to being fully operational isn't quite over. The next major piece of your budget puzzle is sorting out the costs to legally live and work in Dubai.

For any entrepreneur, visa expenses—for yourself, your partners, and eventually, your team—are a significant and recurring part of the total cost of starting a business in Dubai. These aren't just one-off fees; they're a series of payments for different mandatory services.

Think of it like this: from the initial card that lets your company sponsor people, right down to the final visa stamp in your passport, every single stage has its own price tag. Getting this budget wrong can cause a real financial headache just when you need to be focusing on growing your business.

Let’s walk through what’s involved so you can build a realistic financial plan.

The Foundation: The Establishment Card

Before you can even think about applying for a single visa, your company needs an Establishment Card. You can think of this as your company’s official immigration file. It’s the essential first step that registers your business with the immigration authorities and unlocks your ability to sponsor anyone.

The cost for this card usually falls somewhere between AED 2,000 and AED 2,500. It's a non-negotiable, one-time fee during your initial setup, though it does need to be renewed each year. Without it, you simply can't process any residence permits. It’s one of the very first expenses you’ll face after getting your licence.

Securing Your Own Residency: The Investor Visa

As the business owner, getting your own legal residency sorted is priority number one. This is usually done with an Investor Visa (or Partner Visa), which is valid for two years. The process itself is a sequence of steps, and each one has a fee attached.

All in, you can expect the investor visa to cost between AED 4,000 and AED 5,500. This total figure covers a chain of required procedures:

- Entry Permit Application: This is the initial green light for you to enter the UAE for residency purposes.

- Status Change: If you’re already in the UAE on a tourist visa, you'll need to pay to have your status officially changed.

- Medical Fitness Test: A mandatory health screening for all residency applicants.

- Emirates ID Application: The fee for processing your national identity card.

- Visa Stamping: The final step, where the residence visa is physically placed inside your passport.

Getting through this multi-step process requires careful attention to detail. We also offer detailed guidance on the specific requirements for an investor visa in the UAE to help you prepare.

Budgeting for visas isn't just about covering the fees for one person. It's about planning for your entire team's legal residency. A common mistake is underestimating how quickly these per-person costs can add up as your business grows and you start hiring.

Sponsoring Your Team: Employee Visas and Office Space

Once your own visa is in place, you can start bringing on employees. The cost breakdown for an employee visa looks very similar to an investor visa—it covers the same core things like medical tests and the Emirates ID. But there’s a critical catch you need to be aware of: the link between your visa quota and your office space.

The number of employee visas your company can get is often directly tied to the size of your physical office. The general rule of thumb is that authorities allocate around 80-100 square feet of office space per visa.

This rule creates an interesting financial dynamic. If you want to hire more people, you'll need a bigger—and therefore more expensive—office. It’s a smart system that prevents companies from getting a tiny office just to sponsor a large workforce. It forces you to make sure your operational setup grows in step with your team, making it vital to factor in both immigration fees and rising rental costs as you scale.

Uncovering PRO Services and Other Hidden Costs

Beyond the big-ticket items like your trade licence and office space, there’s a whole other layer of administrative costs that often catch new entrepreneurs by surprise. Trying to navigate the paperwork and government approvals on your own can feel like putting together a complicated puzzle without the picture on the box. This is where a Public Relations Officer, or PRO, becomes one of the most valuable parts of your setup budget.

Think of a PRO as your company’s official guide and representative, someone who knows the ins and outs of the UAE's regulatory system. They’re the ones submitting documents for your licence and visas, managing renewals, and handling amendments. Going it alone can easily lead to delays, wrong submissions, and expensive mistakes, which is why professional PRO services are a smart investment, not just an optional extra.

Understanding PRO Service Fees

When you’re mapping out the cost of starting a business in Dubai, you'll see PRO service fees are usually offered in two ways. The right one for you really depends on your company’s needs and how much help you think you’ll need down the line.

- One-Time Setup Fee: A lot of new businesses go for a single, project-based fee. This covers the entire company formation process from A to Z, giving you a clear, upfront cost that makes initial budgeting much easier.

- Annual Retainer: If you want continuous support, an annual retainer is the way to go. This model ensures all your company's visa renewals, licence updates, and other compliance tasks are managed throughout the year, so you never have to worry about missing a critical deadline.

With our dedicated specialists in Corporate PRO Services and Attestation Services, we take care of all the administrative headaches, saving you time and preventing those costly errors. You can explore our professional PRO solutions to learn how we can make your setup process much smoother.

Beyond PRO Fees: Other Ancillary Expenses

The maze of requirements doesn't end with government liaison. Several other "hidden" costs can pop up during the setup phase. If you haven't accounted for them, they can put a real strain on your starting capital. A good financial plan has to include these smaller, but still critical, expenses.

A realistic budget is one that anticipates the small costs as well as the large ones. Overlooking expenses like document attestation or translation can lead to unexpected budget shortfalls and disrupt the momentum of your business launch.

Let’s break down some of the most common costs that entrepreneurs often forget to factor into their initial financial plans.

Common Overlooked Costs in Dubai Business Setup

It’s crucial to set aside funds for these procedural steps. It’s the key to making sure your company formation is smooth and fully compliant from day one.

-

Foreign Document Attestation: Before any of your personal or corporate documents are officially recognised in the UAE, they need to be legally attested. This is a multi-step journey that begins in your home country (at various government ministries and the UAE Embassy) and concludes here in the UAE (at the Ministry of Foreign Affairs). Each official stamp along this chain has its own fee.

-

Legal Translation: Any document that isn’t already in Arabic has to be legally translated by a government-approved translator. This applies to foundational documents like your Memorandum of Association (MoA) and any Power of Attorney (POA), adding another cost to the list.

-

Corporate Bank Account Opening: While most banks won’t charge you an explicit "opening fee," they almost always require you to maintain a significant minimum balance. If your account drops below this amount, you could face monthly penalties. Some banks also have initial deposit rules that can tie up a chunk of your capital right at the start.

-

Mandatory Health Insurance: In Dubai, basic health insurance is mandatory for every single resident. This is a non-negotiable cost for you as the investor and for every employee you sponsor. It's an annual expense that must be built into your operational budget.

Your Partner for a Cost-Effective Business Setup

Trying to navigate the maze of Dubai's business setup rules on your own can feel overwhelming. It’s a path often filled with confusing paperwork and expensive missteps that can quickly inflate the cost of starting a business in Dubai. Think of partnering with a professional consultancy not just as a convenience, but as a strategic move to save both money and time.

The right expert acts as your co-pilot. They guide you toward the most financially sensible decisions right from the start, turning a complex process into a smooth and financially sound journey.

Tailored and Cost-Effective Solutions

No two businesses are alike, and a one-size-fits-all approach to company formation rarely works. That’s why we provide cost-effective business setup solutions built specifically around your goals. Whether you’re targeting the local market or international clients, our guidance is designed to match your exact needs.

Our expertise covers the full spectrum of UAE company structures:

- ✅ Specialists in Mainland Company Formation in Dubai, Sharjah & Abu Dhabi

- ✅ Specialists in Freezone Company Formation across the UAE

This tailored approach means you won't pay for services you don’t need or end up in a jurisdiction that doesn't align with your budget. We focus on creating a streamlined plan that gets you operational without the unnecessary overheads.

Comprehensive Support Beyond Licensing

A successful launch is about more than just getting a trade licence. It requires expert handling of visas, legal paperwork, and ongoing compliance—all areas where costly delays and errors can happen. You can get a better sense of the complexities by exploring our guide on securing a Dubai trade license.

Our specialist teams are here to assist with:

- ✅ Specialists in Golden Visa on Property and Investor Visa

- ✅ Specialists in Corporate PRO Services and Attestation Services

By leveraging established government relationships and deep regulatory knowledge, a professional partner ensures compliance and streamlines paperwork, turning potential financial pitfalls into a smooth, predictable process.

We make sure you are perfectly positioned to enjoy UAE tax benefits for international entrepreneurs, maximising your financial advantage. And with our 24/7 support service, you are never alone. We are always here when you need us.

Ready for a precise, personalised quote for your venture?

📞 Call Us Now: +971-54-4710034

💬 WhatsApp Us Today for a Free Consultation

Frequently Asked Questions

When you're figuring out the budget for your new business, a lot of questions pop up. It's completely normal. To give you some clarity, we’ve put together answers to the most common queries we hear about the cost of starting a business in Dubai. Hopefully, this helps you plan with a bit more confidence.

What Is the Absolute Minimum Cost to Start a Small Business in Dubai?

Let's be realistic. While the exact figure can shift, the lowest you can expect to spend for a simple service business in a budget-friendly free zone is somewhere between AED 15,000 to AED 20,000.

This initial amount generally gets you the trade licence, covers the registration fees, and secures a flexi-desk setup, making you eligible for one residence visa. But remember, this doesn't include the actual visa processing fees, the costs to get your corporate bank account open, or other day-to-day operational expenses. A mainland professional licence might start in a similar ballpark, but costs can climb quickly once you factor in mandatory physical office rent and local service agent fees.

Are There Any Hidden Fees I Should Be Aware Of?

Yes, and this is where many new entrepreneurs get caught out. Several costs often get overlooked in the initial excitement, so it's smart to plan for them to avoid any nasty surprises down the line.

Some of the most common "hidden" costs include:

- Document Attestation: You'll need to pay to get your personal and corporate documents legally verified, both in your home country and again here in the UAE.

- Legal Translation: Any official documents that aren't in Arabic must be translated by a certified legal translator, and this is a mandatory expense.

- Bank Account Requirements: This isn't a fee, but it's a cost. Many UAE banks require you to maintain a substantial minimum balance to avoid hefty monthly penalties.

- Mandatory Health Insurance: Every person you sponsor, including yourself, must have valid UAE health insurance. This is an annual, recurring cost.

- PRO Service Fees: These are the fees you pay a professional firm for managing all your paperwork and government applications. They are separate from the actual government charges.

How Much Does a Trade Licence Cost in Dubai per Year?

The annual renewal fee for your trade licence really depends on where your business is set up. For a mainland company, you'll be paying renewal fees to the Department of Economic Development (DED). This can range from AED 8,000 to AED 15,000 or even more, on top of your office rent, which is compulsory.

In the free zones, things are a bit different. The licence renewal is usually bundled into an annual package that includes your office facility. These packages can start from around AED 12,000 and go up to over AED 40,000 each year. The final price depends on the free zone's prestige, the type of office you have, and how many visas are allocated to your company.

Can I Reduce My Business Setup Costs in Dubai?

Absolutely. The best way to keep costs in check is by making smart decisions right at the start. The most critical step is choosing the right jurisdiction and licence type that genuinely fits your business activities and, just as importantly, your budget.

A great tip for startups and consultants is to opt for a free zone package with a flexi-desk instead of a permanent office. This move alone can save you thousands of Dirhams every single year, especially if you don't need a large physical space to begin with.

Partnering with a reputable business setup consultancy is another fantastic way to control your expenses. Their experience helps you sidestep costly mistakes on applications, and they can put together cost-effective packages that give you everything you need without any unnecessary extras.

Ready to get a clear, personalised quote for your Dubai business? At PRO Deskk, we specialise in creating tailored, cost-effective business setup solutions that align with your budget and ambitions. Contact us today for a free consultation and let's build your success story together.