So, you're planning to set up a business in Dubai. The first question on everyone's mind is always the same: what's it really going to cost?

The truth is, there's no single price tag. Your total investment can swing anywhere from AED 20,000 to over AED 50,000, and sometimes more. It all hinges on a few key decisions you'll make along the way. Let's break down exactly what goes into that final number so you can plan your launch with confidence.

Your Guide to Dubai Business Setup Costs

Kicking off a new venture in Dubai is a thrilling prospect, but you need a solid financial roadmap to get there. The biggest factor influencing your budget is the classic Dubai business dilemma: Mainland or Free Zone? Each path has its own rulebook, perks, and price points that will shape your startup expenses from day one.

But it doesn't stop there. The specific activities your business will undertake, how many visas you'll need for yourself and your team, and the kind of office you choose—these all play a significant role in your overall budget. Getting a handle on these variables is the first step to building a realistic financial plan.

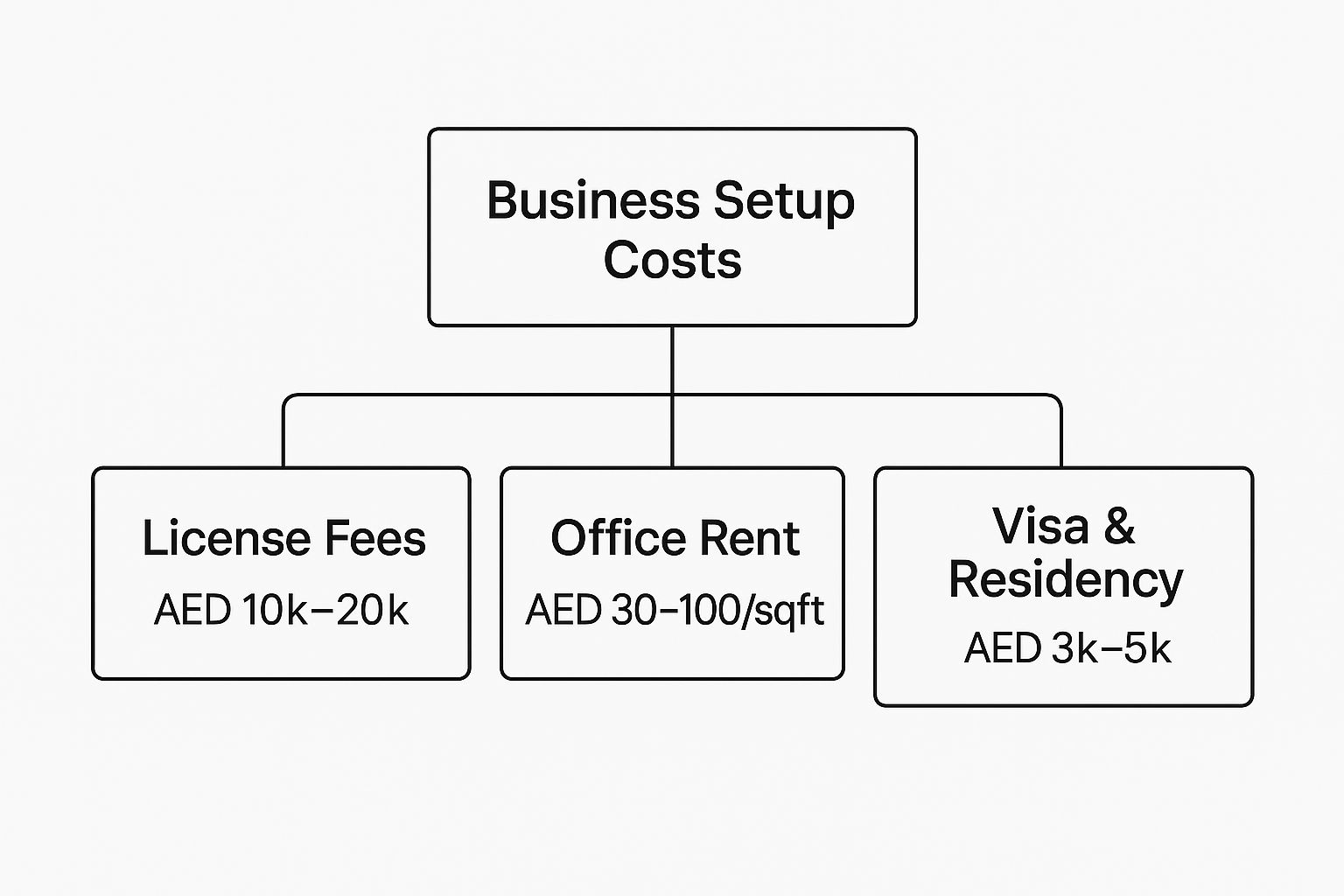

Key Cost Components at a Glance

To get a clearer picture of where your money will go, it helps to see the main expense categories laid out. This visual gives a great high-level overview, breaking down the costs into the three core areas you'll need to budget for: your license, your office, and your visas.

As you can see, the license and registration fees are usually the biggest chunk of your initial outlay. After that, you've got your office space and visa processing costs to consider.

To give you a clearer starting point, let's look at a quick comparison between Mainland and Free Zone setups.

Estimated Startup Costs in Dubai at a Glance

| Expense Category | Mainland (Estimated AED) | Free Zone (Estimated AED) | Key Considerations |

|---|---|---|---|

| Trade Licence & Fees | AED 12,000 – AED 25,000+ | AED 10,000 – AED 20,000+ | Mainland costs vary by business activity. Free Zone fees depend on the specific zone. |

| Office Space | AED 15,000 – AED 50,000+ (Annual Rent) | AED 5,000 – AED 25,000+ (Flexi-desk or office) | Mainland requires a physical office. Free Zones offer cost-effective flexi-desks. |

| Visa Fees (per visa) | AED 5,000 – AED 7,000 | AED 3,000 – AED 6,000 | Costs include Establishment Card, e-channel, medical tests, and Emirates ID. |

| Total Estimated Start | AED 32,000 – AED 82,000+ | AED 18,000 – AED 51,000+ | This is a baseline; complex activities or more visas will increase the total. |

This table provides a snapshot, but remember these are estimates. The final figure will depend on your unique business needs, the specific jurisdiction you choose, and the number of visas you require.

Initial Mainland Setup Expenses

If your goal is to trade directly within the local UAE market, a Mainland company is your ticket. Getting set up here involves several distinct fees. Just to secure the commercial licence, you’re looking at a minimum of around AED 12,000. All in, a standard Mainland setup often lands somewhere between AED 20,000 and AED 30,000.

To break it down further, you have initial approval fees paid to the Dubai Department of Economic Development (DED), which are about AED 116 plus another AED 151. Securing your trade name will cost around AED 651 plus an additional AED 116. It's these smaller, distinct fees that add up to the total.

For international entrepreneurs, the ability to leverage UAE tax benefits while gaining access to a global hub makes Dubai a premier destination. Our cost-effective business setup solutions are designed to maximise these advantages.

While this guide dives deep into Dubai, some principles of starting a business are universal. This general guide to starting a business offers some great foundational knowledge that can be useful for any new entrepreneur. Working with specialists who know the ins and outs of company formation in Dubai, Sharjah, and Abu Dhabi is the best way to ensure you navigate all these financial steps correctly from the very beginning.

Breaking Down Dubai Mainland Setup Costs

Choosing a Dubai Mainland setup is like planting your business directly in the heart of the local economy. It’s the path that gives you the freedom to trade anywhere in the UAE, a massive advantage for so many industries. But with that freedom comes a specific cost structure, and understanding it is key to budgeting properly from day one.

The whole process involves a series of government fees and approvals. Think of it like assembling a puzzle where each piece has its own price tag. As specialists in Mainland company formation in Dubai, Sharjah & Abu Dhabi, our job is to make sure you have all the right pieces from the very beginning, so there are no surprises down the road.

The Initial Government Fees

Your journey starts with several mandatory payments to the Department of Economic Development (DED). These are the foundational costs that secure your legal standing and business identity. While they might seem like small individual payments, they add up to form a significant part of your initial budget.

Here are the key preliminary fees you can expect:

- Initial Approval Fee: This is your first official green light from the authorities. It confirms that your proposed business activity is allowed.

- Trade Name Reservation: You need a unique name for your company, one that follows UAE naming rules. This fee secures that name for you.

- Memorandum of Association (MoA) Attestation: The MoA is the legal blueprint of your company, detailing its structure and who the shareholders are. It needs to be professionally drafted and then attested by a public notary, which has its own fee.

These first steps are non-negotiable and pave the way for getting your actual trade licence. For a more detailed walkthrough of the entire setup process, you might find our guide on https://prodesk.ae/how-to-start-business-in-uae/ really helpful.

Variable Costs: The Local Service Agent

If you're setting up a professional service business—like a consultancy or a technical services firm—the law requires you to appoint a Local Service Agent (LSA). An LSA is a UAE national who acts as your company’s representative for government paperwork but holds absolutely no shares or decision-making power in your business.

This is a massive shift from the old local sponsorship model. The LSA is simply a service provider, not a partner. It’s how you can maintain 100% ownership and control of your business while still meeting all the legal requirements.

The fee for an LSA is a major variable in your mainland setup budget. It’s an annual payment, and the cost can vary quite a bit depending on the agent’s experience and how complex your business is.

- LSA Annual Fee: You can expect this to range from AED 5,000 to AED 25,000.

This fee is often negotiable, which is why it’s so important to have a trusted partner who can connect you with reliable LSAs offering fair rates. It’s an investment that ensures all your administrative processes run smoothly and you stay compliant.

Office Lease and Related Market Fees

Having a physical office is mandatory for a Mainland company, and this brings its own set of costs that go beyond just the rent. The DED actually links certain fees directly to your tenancy contract (Ejari), meaning your choice of office space has a direct impact on your total setup and renewal expenses.

One of the most important costs here is the Market Fee, which is calculated as a percentage of your annual office rent. You’ll pay this to the DED every time you issue or renew your trade licence.

Here’s a quick example of how it works:

- Annual Office Rent: AED 60,000

- Market Fee Percentage: 2.5% (a common rate for many activities)

- Annual Market Fee: AED 1,500

This clearly shows how your decision on an office location and size directly influences your annual government fees. As specialists in creating cost-effective business setup solutions tailored to your needs, we help you break down these interconnected costs to build a financial plan that works for you.

A Look at Dubai Free Zone Costs

For a huge number of entrepreneurs coming to the UAE, a Free Zone is the most logical first step. These economic zones were literally built to attract foreign investment, and they often present a simpler and more budget-friendly route compared to setting up on the Mainland. The appeal is pretty straightforward and powerful for any global business owner.

The two biggest draws are 100% foreign ownership and some seriously attractive tax advantages. In a Free Zone, you have complete control over your company right from the start. When you combine that level of autonomy with the UAE's tax benefits for international entrepreneurs, you’ve got a business case that’s hard to ignore.

The All-in-One "Package" Model

One of the first things you'll notice about Free Zone pricing is that it works differently. Instead of getting a long, confusing list of individual government fees, most Free Zones bundle everything into a neat, all-in-one package. This approach makes it so much easier to figure out your startup budget.

You can almost think of it like a starter kit for your business. You pay one fee, and it covers the absolute essentials to get you up and running.

A typical Free Zone package will almost always include:

- Your Trade Licence: This is the core permit that legally allows you to operate.

- A Flexi-Desk: This gives you a legitimate physical address and satisfies legal requirements without the expense of a full-time office.

- Establishment Card: Think of this as your company's official registration with the immigration authorities, which you need before you can sponsor any visas.

- Visa Allocation: Most starter packages include the eligibility for at least one residence visa, and you can usually add more if you need to grow your team.

This bundled model is a real game-changer, especially for startups and small businesses, because it brings the initial investment way down. Some Free Zone packages can start as low as AED 12,900 (without visas), with the final price depending on your specific business activity and how many visas you need.

Why Costs Differ from One Free Zone to Another

Okay, so while the package model is standard, the prices are anything but. The UAE has over 40 Free Zones, and each one has its own pricing, industry focus, and general vibe. The final cost you pay is going to be shaped by the specific zone you choose.

The "best" Free Zone isn't always the cheapest one. It's about finding the right environment for your specific business—balancing the cost against the location, networking potential, and the quality of the infrastructure.

A zone's reputation and location make a massive difference. For instance, a well-established, premium Free Zone like the Dubai Multi Commodities Centre (DMCC) will naturally have higher setup costs than a newer zone like the International Free Zone Authority (IFZA). But for that higher price, DMCC gives you a prestigious address and an incredible ecosystem if you're in the commodities trade.

Industry specialisation also plays a big part. Hubs like Dubai Media City or Dubai Internet City are built for those specific sectors, and their pricing reflects the specialised community and facilities they offer. When you're ready to explore these differences, our guide on Free Zone business setup is a great place to start comparing your options.

Here's a quick look at how a few popular Free Zones stack up with their entry-level packages.

Sample Free Zone Package Comparison

This table gives you a general idea of how costs and inclusions can vary. Remember, these are starting points, and packages can be customised.

| Free Zone Name | Starting Package Cost (AED) | Included Visas | Office Type | Best For |

|---|---|---|---|---|

| IFZA (International Free Zone Authority) | ~ AED 12,900 | 0 (can be added) | Flexi-Desk | Startups, consultants, and general trading |

| Meydan Free Zone | ~ AED 23,000 | 1 | Flexi-Desk | Professional services and consultancies |

| DMCC (Dubai Multi Commodities Centre) | ~ AED 55,000 | 1 | Flexi-Desk | Commodities trading and established businesses |

As you can see, the price range is wide, which is why it's so important to match the zone's benefits to your business goals.

As specialists in Freezone Company Formation across the UAE, we help you see past the initial price tag. Our goal is to find a cost-effective solution that actually fits your long-term vision, ensuring your business lands in a place that will help it grow.

Working Out Your Visa and Establishment Card Costs

Once you’ve sorted your trade licence and office space, the next major part of your budget will be visas. This isn't just a single line item; it's a whole category of costs. If you plan on bringing yourself, your partners, or any employees to the UAE, getting a handle on these expenses is non-negotiable.

Think of it as a series of essential, sequential steps. Each one has its own fee, and together they build up to securing legal residency for you and your team in Dubai. It all kicks off with one foundational document: the Establishment Card.

The All-Important Establishment Card

Before your company can even think about sponsoring someone for a visa, it needs an Establishment Card. This is the key that unlocks the entire immigration system for your business. It's an official document from the immigration authorities that registers your company as a legitimate sponsoring entity.

Without it, you simply cannot apply for any residence visas. The cost for this card usually falls somewhere between AED 500 and AED 2,500, depending on whether you're on the Mainland or in a Free Zone. It's a one-off fee when you set up, with a smaller renewal fee each year.

The True Cost of a Residence Visa

With your Establishment Card in hand, you can start the visa process for individuals. The total cost to get a single visa processed from start to finish will typically land between AED 3,000 and AED 7,000. This figure is a sum of several smaller, mandatory government fees.

Here’s a quick look at the journey each application takes:

- Entry Permit: First, you secure an e-visa that allows the person to enter the UAE specifically for residency purposes.

- Status Change: If they're already in the country on a tourist visa, this step lets them switch to a resident status without having to leave and re-enter.

- Medical Fitness Test: Every applicant has to pass a medical screening at a government-approved health centre. You can pay more for a faster, VIP service.

- Emirates ID Application: This covers the mandatory federal identity card, including the application and biometrics.

- Visa Stamping: The final step. A residence visa sticker is placed in the passport, officially making them a UAE resident for the next one to three years.

As you can see, there’s no single "visa fee." It’s an accumulation of several non-negotiable charges that add up to the final cost.

Investor Visas and the Golden Visa Advantage

As a business owner, your own residency is tied to the company you've just created. The standard Investor Visa is the most common path, following the same cost structure we just outlined. It's a critical part of the setup process. To get a clear picture of the criteria, check out our detailed guide on the UAE investor visa requirements.

As specialists in residency solutions, including the Investor Visa and the prestigious Golden Visa on Property, we offer pathways to long-term stability. A Golden Visa provides unparalleled security for investors, entrepreneurs, and specialised talents, decoupling your residency from your company's licence renewal.

The Golden Visa is a strategic move for anyone planning a long-term future in the UAE. While the initial investment is higher, it offers incredible peace of mind and simplifies many aspects of life here. Our team is on hand 24/7—always here when you need us—to walk you through all the options, from standard employee visas to the premium Golden Visa, making sure your residency plan is a perfect fit for your business ambitions.

Budgeting for Your Dubai Office Space

When you're setting up a company in Dubai, your office isn't just a place to put your desk. It's a non-negotiable legal requirement that's directly linked to your trade licence. This makes your choice of workspace one of the biggest line items in your startup budget, so it’s something you need to get right from the very beginning.

Getting a handle on the property market is critical to controlling your overall setup costs. Whether you need a simple, affordable solution or a dedicated physical office, understanding your options and what they really cost will save you from nasty surprises down the road.

The Flexible and Cost-Effective Route

For a lot of new entrepreneurs, particularly those setting up in a Free Zone, a flexi-desk is the perfect launchpad. Think of it as a smart, nimble way to get a legitimate business address and access to professional facilities without being locked into an expensive, long-term lease.

This approach is brilliant for startups, solo consultants, and international businesses that don’t need a big physical team on the ground from day one.

- What it is: A shared desk or office space you can use for a set number of hours each month.

- Best for: Free Zone companies, freelancers, and digital nomads needing a legal base.

- Typical Cost: Many Free Zone packages include this, with standalone annual costs ranging from AED 5,000 to AED 15,000.

This model keeps your overheads low and your options open, freeing up cash to pour back into growing the business. We often find that bundling a flexi-desk into an initial Free Zone package is the most efficient way to get started.

Serviced Offices for a Plug-and-Play Solution

If a flexi-desk feels a bit too casual, the next step up is a serviced office. These are fully furnished, private offices within a business centre that are ready to go from the minute you get the key. Everything from reception services and meeting rooms to IT support is usually wrapped into a single monthly fee.

A serviced office strikes a great balance. You get the privacy and professional image of your own space without the headaches and upfront costs of a traditional lease. You'll find these options in both Mainland and Free Zone areas.

Traditional Leases: The Mainland Requirement

For most companies setting up on the Dubai Mainland, a physical office is mandatory. This means signing a tenancy contract and getting it registered with Ejari. It’s the most traditional route and often the most expensive, but it gives you total control over your environment.

When you're budgeting for a physical lease, the annual rent is just the beginning of the story. There are several other upfront costs you absolutely have to account for.

- Ejari Registration Fee: The official government registration of your lease, which is a must-have for your trade licence application.

- DEWA Deposit: A refundable security deposit you’ll pay to the Dubai Electricity and Water Authority to get your lights and water on.

- Dubai Municipality Fee: This is an annual tax calculated as 5% of your yearly rent. It's paid in monthly chunks along with your DEWA bill.

- Security Deposit: Expect to pay the landlord 5-10% of the annual rent upfront. You'll get this back when your lease ends, provided you've met the terms.

These extra costs can easily add thousands of Dirhams to your initial setup bill. It's crucial to factor them into your financial planning to get a realistic picture of what it takes to get your doors open.

How PRO Services and Digitalisation Affect Your Bottom Line

When you're trying to figure out the real cost of setting up a business in Dubai, looking at just the licence and office fees is only half the story. The real-world cost is all about efficiency—how fast and how accurately you can get through all the red tape. This is where two things make a huge difference: the government's big push for digital services and the value of a good PRO.

Dubai has done a fantastic job of moving its company formation process online. The Dubai Department of Economy and Tourism (DET) now has digital systems that let you handle almost everything from your laptop, sometimes without even setting foot in the UAE. For international investors, this is a game-changer.

This digital-first approach really helps trim the fat from your budget. While the direct government and licence fees will still land somewhere between AED 20,000 and AED 30,000, going digital saves you a fortune in other ways. Think about it: no travel costs, no courier fees for documents, and no time wasted shuffling paper. Learn more about how this lean process cuts costs over at Sethub.

What Exactly Are Corporate PRO Services?

Even with great online platforms, you still need to know what to do and how to do it. The local regulations can be tricky, and that’s where a Public Relations Officer, or PRO, comes in. Corporate PRO services are basically a professional team that handles all your government-related paperwork and legwork for you.

Think of a PRO as your company's dedicated agent for all things administrative. Instead of you spending days trying to decipher complex forms and procedures, your PRO takes care of it.

As specialists in Corporate PRO Services and Attestation Services, we're built to handle every critical task you'll face:

- Document Clearing: Making sure every application is perfect before it's submitted.

- Government Liaison: Acting as your representative with the DET, Ministry of Labour, Immigration, and others.

- Attestation Services: Getting your key documents legally verified, stamped, and ready to go.

- Visa Processing: Managing the entire residency visa process for you and your staff, from start to finish.

An Investment, Not an Expense

It’s tempting to look at PRO services as just another line item on your invoice. But honestly, it's smarter to see it as an investment that pays for itself. A simple mistake on an application can lead to fines, rejections, and delays that can stop your business in its tracks. A seasoned PRO makes sure those expensive errors never happen.

A professional PRO service doesn't just tick boxes. It offers real strategic value by keeping you compliant with regulations that are always changing, saving you from headaches and penalties down the road.

More importantly, offloading all this admin work frees you up to do what you do best: build your business. With our 24/7 support service, you can focus on your launch, knowing the bureaucracy is in expert hands. In the same way, to keep your finances in order and your budget optimised, looking into outsourcing accounting and bookkeeping services in Dubai is another smart move. By bringing in the right experts, you build a foundation that's not just affordable, but built for success.

Common Questions About Dubai Business Setup Costs

When you're crunching the numbers for a new venture in Dubai, a few key questions always pop up. Let's tackle the most common ones we hear from entrepreneurs, so you can budget with a clearer picture of the real cost of setting up a business in Dubai.

Do I Absolutely Need a Physical Office to Start a Business in Dubai?

Yes and no—it really depends on where you decide to set up.

Many Free Zones are built for flexibility, offering cost-effective flexi-desk or virtual office packages. These are perfect for satisfying the legal requirement of having a registered address without locking yourself into a pricey traditional lease.

On the other hand, if you're setting up on the Mainland, most licenses and certain regulated activities legally require a physical office. You'll need to prove this with a registered Ejari (lease contract), which is a non-negotiable part of your application.

What are the Sneaky "Hidden" Costs I Should Watch Out For?

It’s easy to focus on the big-ticket items, but a few smaller expenses can catch you by surprise. Your annual license renewal is the big one; it's often just as much as your initial setup fee, and it’s a recurring cost many new business owners forget to factor in.

Beyond that, keep an eye out for these other common costs:

- Mandatory Document Attestation: Getting corporate documents and educational certificates legally stamped and verified isn't free.

- Translation Services: All official paperwork needs to be translated into Arabic by a certified translator, which adds to the bill.

- Utility Deposits: If you rent a physical office, expect to pay security deposits for electricity (DEWA) and water.

- Government Inspection Fees: Depending on your business, you might face mandatory inspections from various authorities, each with its own fee.

Working with a setup specialist who offers cost-effective business setup solutions tailored to your needs is the best way to get a full breakdown of these costs right from the start.

How Much Should I Budget for My Annual Trade Licence Renewal?

Think of your trade licence renewal as a major operational expense, not just a minor admin task. It’s critical to plan for it in your annual budget.

For a Mainland company, the renewal fee is a combination of the base license cost, market fees (calculated as a percentage of your office rent), and your Local Service Agent (LSA) fee, if applicable. In a Free Zone, it’s usually a straightforward package fee, much like your initial setup. Staying on top of this payment is crucial to keep your business in good legal standing.

Is a Local Sponsor Still a Must-Have for a Mainland Company?

Good news—for most businesses, the answer is no. Major legal changes now allow for 100% foreign ownership across more than a thousand commercial and industrial activities on the Dubai Mainland. This has been a game-changer for international entrepreneurs.

The exception is for professional service licenses, like consultancies, law firms, or medical clinics. These still require a UAE national to act as a Local Service Agent (LSA). An LSA doesn't own any part of your company or have any say in how it's run. They simply act as your official link to the government for a fixed annual fee—a role we manage seamlessly through our specialised Corporate PRO Services.

Ready to turn your Dubai business ambitions into reality? The expert team at PRO Deskk is here to guide you through every step.

- ✅ Specialists in Mainland Company Formation in Dubai, Sharjah & Abu Dhabi

- ✅ Specialists in Freezone Company Formation across the UAE

- ✅ Specialists in Golden Visa on Property and Investor Visa

- ✅ Specialists in Corporate PRO Services and Attestation Services

- ✅ 24/7 Support Service – Always here when you need us

- ✅ Cost-Effective Business Setup Solutions tailored to your needs

- ✅ Enjoy UAE Tax Benefits for International Entrepreneurs

📞 Call Us Now: +971-54-4710034

💬 WhatsApp Us Today for a Free Consultation