Setting up shop in a UAE free zone is an incredible launchpad for international entrepreneurs. Why? The benefits are hard to ignore: 100% foreign ownership, zero corporate tax on qualifying income, and the freedom to repatriate all your profits. It's a structure deliberately designed to pull in global investment by keeping the setup process straightforward and the regulatory environment friendly.

Understanding the UAE Business Landscape

Before you dive into your company formation in a UAE free zone, it’s essential to get the lay of the land. The UAE has three main business jurisdictions: mainland, free zone, and offshore. Each serves a different purpose, and picking the right one from the start is the most critical decision you'll make for your new venture.

A mainland company, for example, is your best bet if you plan to trade directly within the local UAE market without any restrictions. For most foreign investors, however, a free zone company is the go-to choice because of the unmatched benefits it offers for international trade and services.

Mainland vs Free Zone At a Glance

To make things clearer, let’s quickly compare the two most popular options for entrepreneurs. Getting your head around these core differences will help you match your business model to the right legal framework from day one.

| Feature | Mainland Company | Free Zone Company |

|---|---|---|

| Ownership | Often requires a local Emirati partner, though 100% foreign ownership is now possible for many activities. | 100% foreign ownership is the standard, giving you complete control. |

| Scope of Business | Can trade directly anywhere in the UAE and internationally. | Mainly operates within its designated free zone and internationally. Doing business on the mainland often requires a local agent. |

| Taxation | Subject to a 9% corporate tax on taxable income over AED 375,000. | Can benefit from 0% corporate tax on qualifying income, offering huge financial advantages. |

| Office Requirement | A physical office registered with the Department of Economic Development is mandatory. | Requires a registered address in the zone, but flexible options like flexi-desks are common. |

| Customs Duty | Standard customs duties apply to imported goods. | Generally exempt from customs duties on goods brought into the free zone. |

This side-by-side comparison really shows why free zones are so appealing. They offer a secure, cost-effective, and independent environment built specifically to help international businesses grow.

A Strategic Look at Prominent Free Zones

Free zones have been a pillar of the UAE’s economic strategy ever since the Jebel Ali Free Zone (JAFZA) was established back in 1985. Fast forward to today, and the UAE has over 46 free zones spread across the emirates, each specialising in different industries like media, logistics, fintech, and biotech.

These zones are serious economic powerhouses, contributing to roughly 40% of the UAE’s total exports. This really highlights their crucial role in cementing the country's position as a global trade hub. If you want to dig deeper, you can explore detailed insights on the UAE's free zone strategy.

Think about it this way: a tech startup would naturally feel at home in an ecosystem like Dubai Internet City, which has the right infrastructure and networking opportunities for the IT sector. On the other hand, a logistics or trading company would find its perfect match in JAFZA, one of the world's biggest and best-connected free zones.

Choosing the right free zone isn’t just about the licence; it's about joining an ecosystem. The right zone provides industry-specific infrastructure, networking opportunities, and regulatory support that can significantly accelerate your business growth.

Ultimately, the choice between mainland, free zone, or even an offshore setup comes down to your business model. Are you targeting the local market in Dubai, Sharjah, or Abu Dhabi? Or is your focus purely on international trade? Answering that question is your first real step towards a successful company formation in a UAE free zone.

How to Choose the Right Free Zone

Picking the right free zone for your business is easily one of the most important decisions you'll make when setting up a company in the UAE. With over 40 different zones, each with its own quirks, costs, and industry focus, the sheer number of options can feel overwhelming.

A classic mistake I see all the time is entrepreneurs making a quick decision based on the cheapest setup fee they can find. This can seriously stunt your company's growth before it even gets off the ground. A smart choice means looking way beyond that first invoice. You need to find a free zone whose entire ecosystem aligns with your long-term goals, from the specific activities you'll be doing to your logistical needs and future expansion plans.

Think of it like choosing a neighbourhood for your business—the right environment truly makes all the difference.

Align Your Business Activities with the Zone's Specialisation

First things first: the most critical factor is making sure the free zone’s permitted business activities are a perfect match for what you actually do. Each zone is licensed to support specific industries. If you operate outside these approved activities, you could be looking at heavy fines or even losing your licence altogether.

For instance, a fintech startup would naturally fit into a zone like Dubai International Financial Centre (DIFC) or Abu Dhabi Global Market (ADGM), as they are specifically regulated for financial services. Trying to set up that same fintech company in a place like Dubai Media City, which is geared towards media production, just wouldn't work.

The UAE is leaning heavily into these industry-specific hubs. In fact, over 60% of new business licences in the free zones are now sector-specific, showing a clear move away from general trading towards specialised clusters like health-tech, AI, and digital businesses. Thanks to the rise of digital services, you can now register your company online in as little as seven business days, making it easier than ever to join these ecosystems. You can read more about the latest trends in UAE free zone business setup rules to stay updated.

Evaluate Long-Term Costs and Infrastructure

While a low initial setup cost is always tempting, you have to look at the whole financial picture. The recurring annual fees, office lease costs, and visa charges can vary wildly from one zone to another. An option that seems cheap at first might have higher renewal fees that make it more expensive in the long run.

Let's look at a real-world scenario. An e-commerce startup is weighing up two free zones:

- Zone A (Budget-Friendly): It offers a really low initial licence fee. The catch? It’s in a remote area with basic facilities and next to no logistics support.

- Zone B (Specialised): This is Dubai CommerCity. The setup costs are higher, but it comes with integrated logistics, fulfilment centres, and direct access to major shipping partners.

For a business that lives and dies by efficient shipping, the higher cost of Zone B is a strategic investment. That integrated infrastructure will save a huge amount of time and money on logistics down the line, leading to better profits and happier customers. The "cheaper" Zone A would quickly turn into a logistical nightmare, wiping out any initial savings.

Your free zone is more than just a legal address; it's your operational base. The right infrastructure—be it advanced logistics, high-speed internet, or specialised lab facilities—is a critical component of your business's success.

Analyse Location and Logistical Advantages

Where your free zone is physically located has a direct impact on your day-to-day operations. Being close to airports, seaports, major highways, and your target clients can give you a serious competitive edge.

If you're running a trading company that imports and re-exports goods, a location like Jebel Ali Free Zone (JAFZA) is unbeatable. Its direct connection to one of the world's largest seaports and Al Maktoum International Airport makes the entire supply chain incredibly smooth.

On the other hand, a consultancy firm that needs to meet clients all over Dubai would be much better off in a central spot like Dubai Multi Commodities Centre (DMCC). Don't underestimate the practical benefit of convenience for both you and your clients.

Understanding the Free Zone Authority's Rules

Finally, every free zone is run by its own independent authority, each with its own rulebook. Before you commit, you absolutely must get your head around their specific requirements for things like:

- Share Capital: Some zones have a minimum share capital you need to deposit, while others have none at all.

- Auditing: Annual audit requirements can differ, which impacts your admin workload and costs.

- Visa Allocations: The number of visas you're eligible for is often linked to the size of your office space.

- Support Services: The quality of administrative support and how easy it is to deal with the authority can make or break your experience.

Choosing the right free zone is a foundational step. By carefully thinking through these factors—activity alignment, long-term costs, location, and the regulatory environment—you can pick an ecosystem that doesn’t just let your business launch, but actually empowers it to thrive for years to come.

The Company Formation Process From Start to Finish

Setting up a company in a UAE free zone might seem complex, but when you break it down, it's a pretty logical sequence. While every free zone has its own quirks and specific rules, the core journey from business idea to a legally operating company follows a well-trodden path.

It all kicks off with locking down your business identity and getting the green light for your planned activities. From there, you dive into the paperwork—this is where paying attention to detail really matters. Finally, you'll sort out your physical office space (don't worry, it's flexible) and get that all-important trade licence that officially opens your doors for business.

The whole system is designed to be efficient, cutting out a lot of the usual red tape to attract entrepreneurs from around the globe.

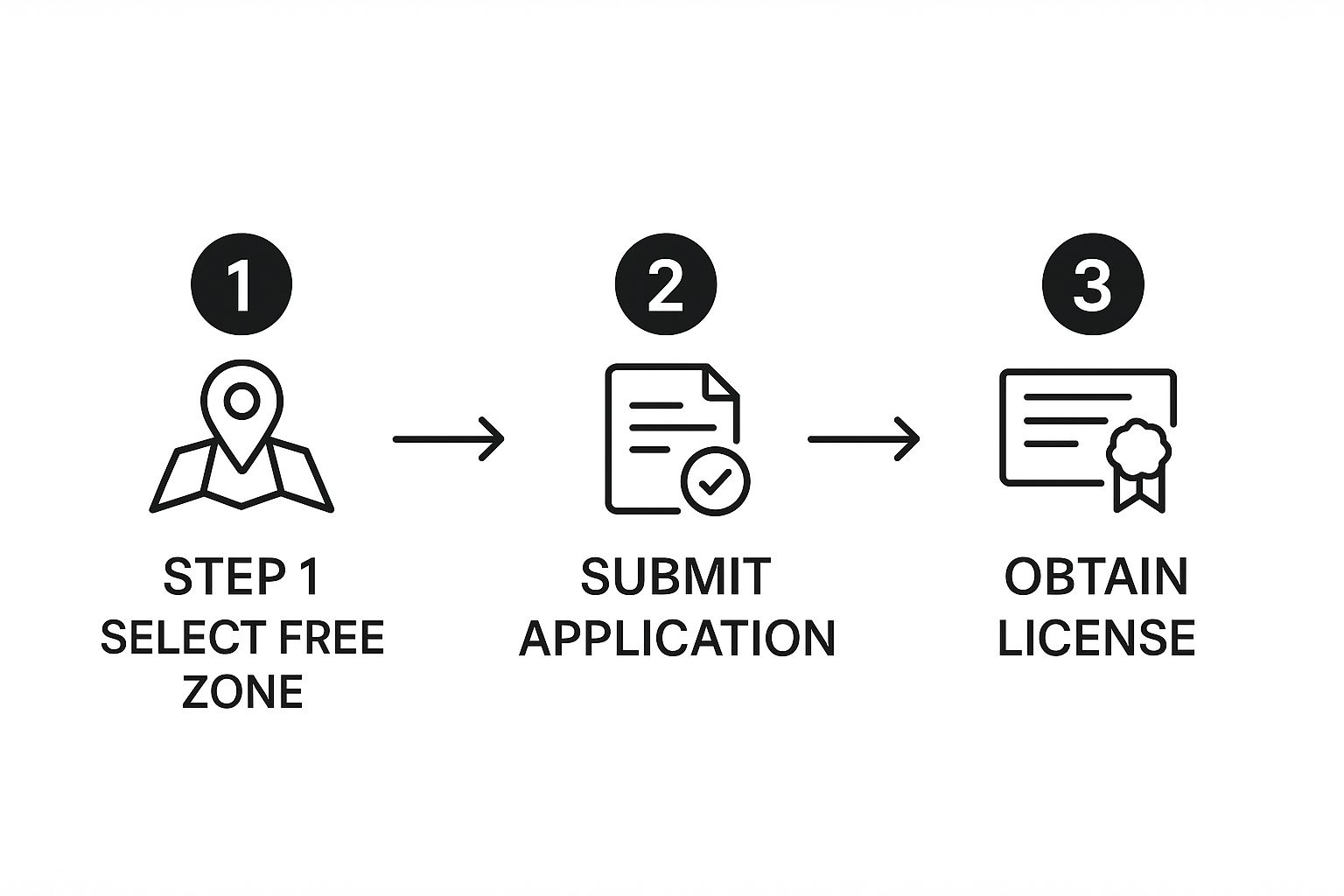

This infographic neatly lays out the three main stages: kicking things off with selection and application, moving through registration, and finally, getting your licence. That licence is the end goal.

Securing Your Trade Name and Initial Approvals

Your first real step on the ground is to choose and reserve your company's trade name. This isn't just a branding exercise; your name has to follow strict UAE naming rules. For example, it can't be offensive, already taken, or include any religious references.

Once your name gets the nod, you'll apply for 'initial approval' from the free zone authority. Think of this as a preliminary thumbs-up, confirming the government has no objections to you setting up shop. It's the document that allows you to move on to the more detailed parts of the process.

Without this initial approval, you can't go any further. It's the foundation for everything else, from drafting legal documents to leasing an office.

Preparing and Submitting Essential Paperwork

With the initial approval in hand, it's time to gather your documents. Getting this part right is crucial. Even a small mistake can set you back, wasting precious time and money.

Here’s a look at the typical documents you’ll need to pull together:

- Completed Application Form: The standard form from your chosen free zone.

- Business Plan: A straightforward summary of what your business will do, who your customers are, and your basic financial goals.

- Passport Copies: Clear, colour copies for every shareholder and the manager.

- Memorandum of Association (MOA) and Articles of Association (AOA): These are the legal nuts and bolts of your company, defining its structure, purpose, and how it will be run. They need to be drafted perfectly and notarised.

The MOA is especially important. It outlines the relationship between the shareholders and clearly states the company's purpose. Nailing this document from day one can prevent a world of headaches and potential disputes later on. As Specialists in Freezone Company Formation across the UAE, our team is on hand 24/7 to help draft and attest these vital documents, ensuring everything is fully compliant from the start.

A common mistake entrepreneurs make is submitting incomplete or incorrectly attested documents. Double-checking every detail, from passport validity to notarisation stamps, can save you weeks of frustrating back-and-forth with the authorities.

Leasing an Office and Obtaining Your Trade Licence

You absolutely need a registered physical address in your free zone to get a trade licence. But that doesn't mean you have to sign a lease on a massive office right away. Most free zones are built for modern businesses and offer some really smart, affordable options.

You can often choose from:

- Flexi-desks: This gives you a legal address and a desk you can use whenever you need it. Perfect for solo entrepreneurs.

- Co-working Spaces: A more social, collaborative setup with shared amenities.

- Serviced Offices: Private, fully-furnished offices on flexible rental terms.

Once you’ve signed your lease agreement, you'll submit it with the rest of your approved paperwork. After a final review and payment of the registration and licence fees, the free zone authority will issue your trade licence. This is the official document that permits you to legally operate your business. If you need a hand with this, it's worth exploring what a proper free zone company setup in Dubai looks like with expert guidance.

When that trade licence is in your hands, you’ve done it. Your company formation in the UAE free zone is complete. Now you can open your corporate bank account, start the visa process for yourself and any staff, and get down to business.

Breaking Down the Costs and Tax Benefits

Getting a handle on the financials is probably the most critical part of setting up your company in a UAE free zone. A realistic budget from the get-go saves you from nasty surprises down the line and really paves the way for sustainable growth. This means looking at both the one-time fees to get your doors open and the yearly costs you'll need to factor into your operational budget.

Just as important is getting your head around the UAE's fantastic tax landscape, especially that famous 0% corporate tax rate for free zone companies. But here's the thing: it isn't automatic. You've got to meet specific conditions. By understanding both the costs involved and the tax perks available, you can turn what seems like a complicated financial puzzle into a real competitive advantage.

Unpacking the Initial and Annual Costs

When you first set up, you'll run into a series of one-time fees. Think of this as your initial investment to get the company legally registered and operational. After that, you'll have recurring annual costs to keep your company in good standing with the authorities.

Here’s a practical breakdown of what to expect:

- One-Time Setup Fees: This is your main upfront cost. It covers things like your trade licence registration, reserving the company name, and getting those initial approvals. It also includes the legal legwork, like drafting and attesting your Memorandum of Association (MOA) and issuing your establishment card.

- Annual Recurring Costs: The biggest one here is your trade licence renewal, which is due every year. You'll also have annual fees for your office space or flexi-desk lease, plus any visa renewals for yourself and your team.

Budgeting for both from day one is just smart cash flow management. If you want to dive deeper, we've put together a comprehensive guide on the business setup cost in Dubai that offers more detailed insights.

A Look at Estimated Setup Costs

To give you a clearer picture, let's walk through the potential costs for a new company in a fairly standard, mid-range UAE free zone. Keep in mind, these are just estimates. The final numbers can shift based on the specific free zone you choose, your licence type, and how many visas you need.

Estimated Costs for a Typical Free Zone Setup

Here’s a table that breaks down some of the common one-time and annual expenses you might encounter.

| Cost Item | Estimated One-Time Fee (AED) | Estimated Annual Fee (AED) |

|---|---|---|

| Trade Licence & Registration | 12,000 – 18,000 | 10,000 – 15,000 |

| Establishment Card Fee | 1,500 – 2,500 | 1,500 – 2,500 (Renewal) |

| Office/Flexi-Desk Lease | N/A | 5,000 – 15,000 |

| Investor Visa (per person) | 4,000 – 6,000 | 4,000 – 6,000 (Renewal) |

| Document Attestation | 1,000 – 2,000 | N/A |

As specialists in providing Cost-Effective Business Setup Solutions tailored to your needs, we can help you navigate these figures and find a package that fits your exact needs, ensuring you get the best value without cutting corners.

Maximising the UAE's Tax Benefits

For many entrepreneurs, the UAE's tax system is the main draw. While the country did introduce a standard 9% corporate tax, free zone companies can still get a 0% tax rate on their 'qualifying income'. This isn't some loophole; it's a deliberate strategy by the UAE to attract global businesses.

So, how do you qualify? Your business needs to be a "Qualifying Free Zone Person" and generate income from specific, approved activities. For example, income you make from dealing with other free zone companies or from exporting goods and services outside the UAE generally qualifies for that coveted 0% rate. You can fully Enjoy UAE Tax Benefits for International Entrepreneurs by structuring your company correctly.

The key takeaway here is that the 0% corporate tax isn't a blanket exemption. It's a targeted incentive. You absolutely have to structure your operations correctly and maintain proper accounting records to stay compliant and actually reap the financial rewards.

Recently, the UAE Ministry of Finance released new decisions that brought more clarity to the corporate tax rules for free zone businesses. These updates widened the eligibility for the zero percent rate and gave clearer definitions of what counts as qualifying and excluded activities. It's another move that reinforces the UAE's commitment to being a transparent, business-friendly hub. Staying on top of these changes is crucial.

Getting Your Business Operational After Setup

Receiving your trade licence is a huge milestone in your company formation UAE free zone journey, but it’s really the starting line, not the finish line. This document makes your business legally real; now, the work begins to make it operational.

The steps that follow are all about transforming your registered entity into a fully functioning business that can hire staff, manage its finances, and operate compliantly within the UAE. Getting these next steps right builds a solid foundation, ensuring you can move forward with confidence and focus on what truly matters—growing your business.

Activating Your Company with an Establishment Card

The very first thing you need after getting that shiny new trade licence is an Establishment Card. Think of this as your company’s official ID card with the immigration and labour departments.

It’s a small but absolutely critical document. It officially registers your business with the authorities, which then gives you the power to apply for visas. Without this card, your company simply can’t hire anyone, including yourself. It’s the key that unlocks your ability to sponsor residence visas for owners, investors, and employees.

The application is typically straightforward and submitted to the relevant free zone authority or immigration office. It’s a quick but non-negotiable step to becoming an active employer in the UAE.

Securing Your Residency with an Investor Visa

Once your establishment card is issued, you can finally apply for your own residence visa under the new company. This is usually processed as an investor visa or partner visa, which legally allows you to live and work in the UAE as the owner of the business. This is a crucial part of the company formation UAE free zone experience, cementing your personal commitment to your venture.

The process involves a few distinct stages:

- Entry Permit: This is the initial document that allows you to start the in-country visa process.

- Medical Fitness Test: A mandatory health screening is required for all new residents.

- Emirates ID Application: You'll complete the biometrics for your official UAE identity card.

- Visa Stamping: The final step where the residence visa is physically stamped into your passport.

Navigating the specific requirements can sometimes feel complex. For a detailed breakdown, you can explore our guide on the https://prodesk.ae/investor-visa-uae-requirements/. As Specialists in Golden Visa on Property and Investor Visa, we ensure this entire process is handled efficiently. Our team also manages all related Corporate PRO Services and Attestation Services, removing any administrative burdens so you can focus on your business from day one.

Opening Your Corporate Bank Account

This is often one of the most challenging hurdles for new entrepreneurs. UAE banks have stringent Know Your Customer (KYC) and anti-money laundering regulations. This means opening a corporate bank account requires thorough documentation and a clear, convincing business plan.

To give yourself the best chance of a smooth approval, be prepared with:

- All your company formation documents (licence, MOA, etc.).

- Passport and visa copies for all shareholders.

- A detailed business plan outlining your activities, target market, and financial projections.

- Proof of your business address within the free zone.

Many new business owners underestimate the time it takes to open a corporate bank account. Start the process immediately after receiving your trade licence and be prepared for multiple conversations with the bank. Having a professional consultant assist you can make a significant difference.

Staying Compliant for Long-Term Growth

Finally, staying operational means staying compliant. The UAE has introduced regulations to align with international standards, and your free zone company must adhere to them.

Two of the most important are the Economic Substance Regulations (ESR) and the Ultimate Beneficial Ownership (UBO) declarations. ESR requires companies in specific sectors to prove they have a genuine economic presence in the UAE. UBO, on the other hand, requires you to maintain a register of your company's ultimate beneficial owners and submit this information to the authorities. Failing to comply with either can result in substantial penalties.

Many businesses established in UAE Free Zones have their eyes on an international market. To effectively reach these global customers, developing a robust and targeted international SEO strategy is a key part of your growth plan after ensuring full compliance. These foundational steps pave the way for sustainable expansion.

Your Top Questions Answered on UAE Free Zone Setup

Setting up a company in a UAE free zone is a popular route for entrepreneurs, but it naturally comes with a lot of questions. Getting the right answers upfront is key to making smart decisions and avoiding any surprises down the line. Here’s a look at some of the most common queries we get from clients.

Can My Free Zone Company Do Business on the Mainland?

This is one of the first and most critical questions people ask. In short, a free zone company is primarily licensed to operate within its designated free zone and internationally.

If you want to trade directly with customers on the UAE mainland, you can't just set up shop anywhere. You’ll typically need to work with a local distributor or go through the process of setting up a mainland branch of your company. Some professional service licences might offer a bit more wiggle room, but you absolutely have to check the specific rules of your chosen free zone authority to know for sure. As Specialists in Mainland Company Formation in Dubai, Sharjah & Abu Dhabi, we can guide you on the best structure if local trade is part of your plan.

Do I Really Need a Physical Office?

Yes, a registered physical address inside the free zone is non-negotiable for getting your trade licence. But this doesn't mean you're forced to rent a big, expensive office right away.

The free zones are well aware of what modern businesses and startups need. They offer some very Cost-Effective Business Setup Solutions that tick all the legal boxes:

- Flexi-desks: Essentially a shared desk that gives you a legal address.

- Co-working spaces: Great for networking in a shared, collaborative environment.

- Serviced offices: Private, furnished offices you can rent on flexible terms.

These options make it completely manageable for new businesses and solo entrepreneurs to get started without a huge upfront investment in real estate.

How Long Will It Take to Get My Company Set Up?

The timeline for a company formation in a UAE free zone can differ. It really depends on which free zone you choose, how complex your business activity is, and whether your paperwork is spot-on. If everything is submitted perfectly, the process can be incredibly fast—sometimes just 7 to 10 business days.

It's a good idea to plan for a 2-to-4-week window to be safe. This covers everything from getting initial approvals to having the final licence in your hand. Working with a setup specialist can often speed this up, as they know exactly what's needed and can prevent common delays. Our 24/7 Support Service means we're always here when you need us, keeping your application moving forward.

What’s the Minimum Share Capital I Need?

This varies hugely from one free zone to another. Many zones, especially those designed to attract startups, have no mandatory share capital requirement at all. This is a massive advantage as it lowers the financial barrier to entry.

Other zones might ask for a certain amount. Sometimes you’ll need to deposit this into a corporate bank account, while other times you just need to state it in your company’s founding documents (the Memorandum of Association). It’s crucial to confirm the specific capital rules for the free zone you’re interested in before you start anything.

Getting through these details is much easier when you have an expert on your side. We are specialists in:

✅ Mainland Company Formation in Dubai, Sharjah & Abu Dhabi

✅ Freezone Company Formation across the UAE

✅ Golden Visa on Property and Investor Visa

✅ Corporate PRO Services and Attestation Services

We provide 24/7 Support Service because we are always here when you need us, offering Cost-Effective Business Setup Solutions tailored to your needs so you can Enjoy UAE Tax Benefits for International Entrepreneurs.

📞 Call Us Now: +971-54-4710034

💬 WhatsApp Us Today for a Free Consultation at https://prodesk.ae