So, what does “company formation in Dubai” actually mean? It’s the official process of setting up your business within the city’s legal framework, which opens the door for you to operate both locally and on the global stage. It all starts with getting the right trade licence from an authority like the Department of Economy and Tourism (DET) and picking your business’s home base—a Mainland, Free Zone, or Offshore jurisdiction.

Think of it as your official entry ticket into one of the world's most exciting and business-friendly hubs.

Why Start Your Business Journey in Dubai

One of the biggest draws for any entrepreneur is Dubai's urban infrastructure, which gives you a world-class foundation to build and grow your operations.

Choosing Your Economic Launchpad

Your very first strategic decision is figuring out where to plant your business flag. Dubai’s economic terrain is split into three main jurisdictions, and each one is built for different types of businesses and goals. Getting this choice right from the start is absolutely critical for your company's future.

- Dubai Mainland: This is your go-to if you plan on trading directly with customers across the UAE or want to bid on valuable government projects.

- Dubai Free Zones: Think of these as specialised hubs, perfect for international trade. They offer huge perks like 100% foreign ownership and zero corporate taxes, often tailored to specific industries like tech or media.

- Offshore Companies: These are typically used as holding companies to manage international assets or oversee global business operations from a tax-neutral base.

Making sense of these options can be tough. As specialists in Mainland Company Formation in Dubai, Sharjah & Abu Dhabi, we help businesses establish themselves right in the heart of the local market. Our team also has deep expertise in Freezone Company Formation across the UAE, matching international businesses with the perfect zone for their needs.

Your choice of jurisdiction is more than a legal formality—it defines your market access, ownership structure, and operational capabilities. It is the single most important decision in your company formation journey.

To make things a little clearer, here’s a quick comparison to help you understand the fundamental differences.

Dubai Business Jurisdictions at a Glance

| Jurisdiction | Market Access | Ownership Structure | Ideal For |

|---|---|---|---|

| Mainland | Unrestricted access to the entire UAE market. | Typically requires a local UAE partner or agent. | Businesses targeting local customers, retail, and government contracts. |

| Free Zone | Limited to the specific Free Zone and international markets. | 100% foreign ownership, no local partner needed. | International trade, export/import, and industry-specific services. |

| Offshore | No direct access to the UAE market. | 100% foreign ownership. | Holding companies, asset management, and international invoicing. |

Choosing the right jurisdiction is the cornerstone of a successful setup, setting the stage for everything that follows.

Beyond the Licence: A Foundation for Growth

Getting your company set up in Dubai is about so much more than just filing paperwork. You're building a solid foundation for real, sustainable growth. The city’s government is incredibly pro-business and actively fosters a stable, secure environment for entrepreneurs. This includes major advantages like the UAE Tax Benefits for International Entrepreneurs, a huge pull for business leaders from around the world.

And the support doesn't stop once your licence is in hand. Business owners often need help navigating ongoing government tasks, from visa applications to document clearances. This is where Corporate PRO Services and Attestation Services become a lifesaver, handling all the administrative legwork for you.

Plus, with our 24/7 Support Service, you’re never left to figure things out on your own. This comprehensive ecosystem of support turns a potentially complex process into a smooth one, letting you focus on what really matters: growing your business.

Choosing Your Path: Mainland vs Free Zone Setup

When you're setting up a company in Dubai, the very first, and most critical, decision you'll face is whether to go for a Mainland or a Free Zone licence. This isn't just a small detail; it fundamentally shapes who you can do business with, your ownership structure, and what your company's growth path looks like for years to come. Getting this right from day one is everything.

Think of it like this: a Mainland company is like a flagship retail store right on Sheikh Zayed Road. It has complete, unrestricted access to the entire local market. You can sell directly to any customer or business across all seven emirates. Plus, and this is a big one, only Mainland companies can bid for those valuable government contracts, opening up a massive potential revenue stream.

A Free Zone company, on the other hand, is more like a high-tech workshop inside a specialised, gated industrial park. These zones are specifically designed to pull in international trade with some very attractive incentives. For any entrepreneur whose main focus is on global markets, this is often the perfect choice.

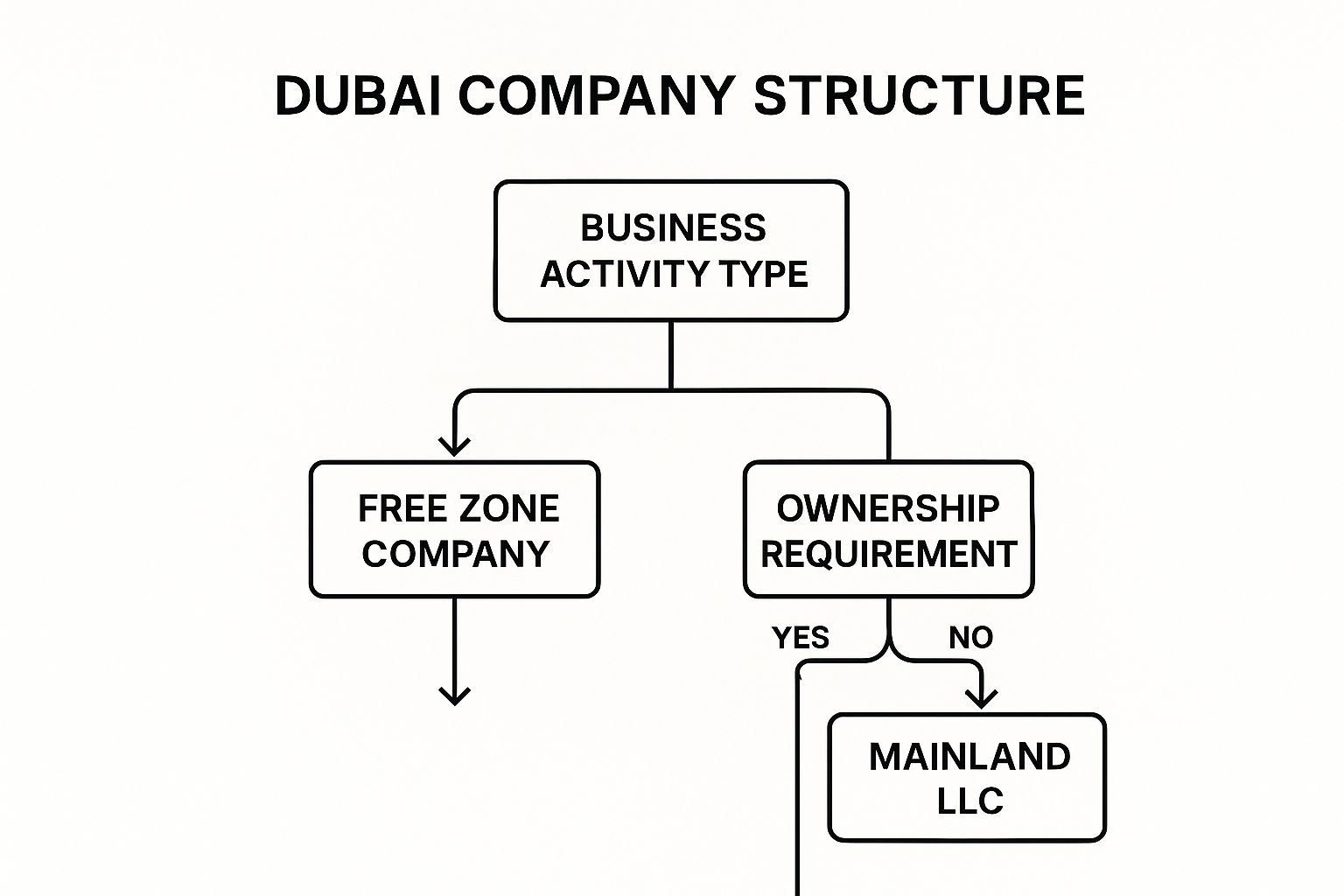

To help you figure out which path is the right one for you, this decision tree breaks down the key questions you need to ask yourself, from what your primary business is to what kind of ownership you prefer.

As you can see, it really boils down to your target market and what you need to operate effectively. These factors will naturally point you toward the jurisdiction that's the best fit for your business model.

Understanding the Mainland Advantage

Going the Mainland route gives you unmatched flexibility and access to the entire UAE market. Recent legal changes have been a real game-changer, now allowing for 100% foreign ownership for most of the 2,000+ business activities available. This did away with the long-standing rule of needing a local Emirati sponsor for many commercial and industrial licences.

Here are the key benefits you get with a Mainland setup:

- Unrestricted Market Access: You are free to trade directly with any customer, supplier, or partner located anywhere in Dubai and across the entire UAE. No restrictions.

- Government Contract Eligibility: Mainland companies are the only businesses allowed to tender for and win lucrative government projects.

- Operational Freedom: You can set up your office anywhere you like in the emirate, whether it’s a prestigious tower in Downtown or a warehouse in an industrial area.

- Unlimited Visa Potential: The number of employee visas you can get is tied directly to the size of your office space, which means you can scale up your team as your business grows.

This setup is ideal for any business focused on the local market, like retail shops, restaurants, consulting firms, and construction companies that need to operate freely across the country.

Exploring the Power of Free Zones

The UAE has over 40 distinct Free Zones, and each one acts as its own economic area with its own rules and regulations. They are magnets for foreign investment because of the incredibly attractive financial and operational perks they offer.

Free Zones are purpose-built ecosystems created to help specific industries thrive. When you choose the right one, you're not just getting a licence; you're joining a community of peers and gaining access to infrastructure built just for your business needs.

Think of Dubai Media City for creative agencies, Dubai International Financial Centre (DIFC) for financial services, or Jebel Ali Free Zone (JAFZA) for logistics and trading.

Here’s why so many entrepreneurs are drawn to a Free Zone:

- Guaranteed 100% Foreign Ownership: This has always been a core benefit, giving you complete control over your business from the start.

- Tax Exemptions: Free Zone companies enjoy 0% corporate and personal income tax, a huge incentive for international business owners.

- Full Repatriation of Profits: You can send 100% of your profits and capital back to your home country without any restrictions whatsoever.

- Simplified Setup Process: Free Zones are known for their streamlined and often faster incorporation procedures compared to the Mainland.

This option is perfect for businesses that are focused on international trade, import-export, or services delivered to a global client base. If your customers are primarily outside the UAE, a Free Zone gives you a cost-effective and highly efficient base to operate from. You can learn more about the specific advantages in our detailed guide on Free Zone business setup in Dubai. It truly is a powerful launchpad for global ambitions.

Your Step-by-Step Formation Roadmap

Starting a company in Dubai can seem like putting together a complex puzzle. But if you break it down into a clear, step-by-step roadmap, the whole thing becomes much more manageable. This guide turns the journey into a series of logical moves, making sure you hit every crucial milestone along the way.

Think of this as the blueprint for your business. Each step lays a vital part of the foundation, from locking in your legal identity to setting up your physical office. Following this sequence is the key to a smooth and efficient setup, helping you sidestep those costly delays and common headaches.

Stage One: Foundational Legal Steps

First things first, you have to establish your business's legal identity. These initial steps are non-negotiable and set the tone for your company's entire future. Getting them right is critical for a seamless journey.

-

Select Your Business Activity: Before you do anything else, you need to define exactly what your company will do. The Department of Economy and Tourism (DET) has a list of over 2,000 approved business activities. Your choice here determines the type of licence you'll need—commercial, professional, or industrial—and any special approvals that might be required.

-

Choose and Reserve Your Trade Name: Your company's name is its public face. You’ll need to register a unique trade name with the DET that not only reflects your business but also follows UAE naming rules. It can't be offensive, misleading, or already in use.

-

Secure Initial Approval: With your activity and name sorted, you'll apply for an Initial Approval Certificate from the DET. This is basically the government giving you the green light, confirming they have no objection to you starting your business. This certificate lets you move on to the next steps, like drafting legal documents and finding an office.

Stage Two: Corporate and Physical Setup

Once you have the initial legal approvals, it’s time to formalise your company’s structure and secure a physical address. This is where your business starts to feel real, moving from just an idea to a concrete entity.

A key document at this point is the Memorandum of Association (MOA). This legal paperwork outlines the shareholding structure, the responsibilities of each partner, and how the company will operate. It needs to be drafted with care and notarised to be legally binding.

"The MOA is the constitution of your company. It defines the rules of engagement between shareholders and establishes the legal groundwork for all future business operations. A well-drafted MOA prevents disputes and ensures clear governance from day one."

After the MOA is finalised, your next job is to find a physical home for your business.

Finding Your Business Home

In Dubai, having a registered physical address is a mandatory requirement to get your trade licence. This address is verified through an official tenancy contract, known as an Ejari.

- Lease an Office Space: You must find and rent an office, warehouse, or retail space that fits your business needs and activity.

- Register Your Ejari: Your tenancy contract has to be registered with the Real Estate Regulatory Agency (RERA) to get your official Ejari certificate. This document is the proof of your physical address needed for the final licence application.

This step officially connects your legal entity to a real-world location, ticking a major regulatory box.

Stage Three: Final Licensing and Operations

The home stretch is all about pulling everything together to get your trade licence and make your business fully operational. This is where all your preparation pays off, resulting in the legal permit to start trading in the UAE.

After you submit all your documents—including the Initial Approval, notarised MOA, and Ejari—the DET will do a final review. Once everything checks out and you've paid the fees, they will issue your official Trade Licence. This licence is the final key, legally authorising you to conduct business in Dubai.

But the journey doesn't stop there. After getting your licence, you still have to complete several crucial administrative tasks. This is where professional support can be a lifesaver. Many entrepreneurs use specialists in Corporate PRO Services and Attestation Services to handle these complex steps efficiently. This support takes care of the administrative load, freeing you up to focus on launching and growing your new venture.

Finally, opening a corporate bank account is an absolute must to manage your finances, process payments, and stay compliant. With your licence in hand and a bank account active, your Dubai company is officially open for business.

Decoding the Costs and Timelines

Before you jump into any new business venture, you need two things: a solid financial plan and a realistic schedule. Getting a handle on the investment needed for your company formation in Dubai isn’t about some single, magic number. It’s about understanding exactly where your money is going and how long each step will take.

This kind of clarity is what separates a smooth launch from one full of stressful, last-minute surprises.

Your financial journey really splits into two parts. First, you’ve got the one-time setup costs—everything required to get your business legally registered and ready to open its doors. After that, you'll have recurring annual costs, which are the ongoing expenses to keep your company in good standing year after year.

Breaking Down the Initial Setup Investment

Your initial outlay is the money that brings your company to life. This covers all the foundational legal and administrative fees you’ll pay to get that all-important trade license in your hands. Think of it as the cost of building the house before you move in; it’s a one-off expense that creates the entire structure for your business.

These one-time costs generally cover:

- Trade Name Reservation Fee: This is what you pay to the Department of Economy and Tourism (DET) or the relevant Free Zone authority to lock in your unique business name.

- Initial Approval Certificate Fee: The cost for the government's preliminary nod, confirming they have no objection to your proposed business.

- License Registration and Issuance Fees: This is the main government fee for your trade license, and it can vary quite a bit depending on your business activity.

- Legal and Notarisation Fees: These are the costs for drafting and legally witnessing your Memorandum of Association (MOA) and other required documents.

Figuring out these payments can feel complicated since the fees are different for Mainland and Free Zone setups. The goal is to find Cost-Effective Business Setup Solutions tailored to your needs, making sure you get the right structure without paying for extras you don't need. A detailed breakdown can save you from a financial headache before you even start trading.

Understanding Recurring Annual Expenses

Once your business is officially up and running, your focus shifts to maintenance. These are the recurring annual costs that keep your company compliant and operational. Budgeting for these is every bit as crucial as funding the initial setup.

The true cost of a business isn't just the setup fee; it's the total cost of ownership over time. A low initial price can be misleading if annual renewals are prohibitively expensive.

Here are some common recurring costs you can expect:

- Annual Trade License Renewal: A mandatory government fee you'll pay every year to keep your license active.

- Office Rent and Ejari Renewal: Whether you have a physical office, a flexi-desk, or a virtual space, your tenancy contract (Ejari) must be renewed annually.

- Establishment Card Renewal: This card is vital for processing employee visas and needs to be renewed regularly.

- Visa Renewal Fees: Any investor or employee visas have renewal costs that must be part of your yearly budget.

These figures can fluctuate based on how many employees you have and which jurisdiction your business is in. For a more granular view, check out our in-depth analysis of the complete business setup cost in Dubai to help you build an accurate financial forecast.

Realistic Timelines for Company Formation

In business, time is just as valuable as money. Knowing how long each phase of the company formation process will take helps you plan your launch, manage client expectations, and coordinate your own move to the UAE if you're coming from abroad.

The entire process, from submitting your application to getting your investor visa stamped in your passport, can typically take anywhere from 2 to 4 weeks. But this timeline really depends on getting quick approvals and having all your paperwork perfectly in order.

For example, securing the initial approval can take as little as 24-72 hours, while the final license issuance might take a few more days once everything is submitted. Delays almost always happen because of incorrect paperwork or the need for extra approvals from other ministries for certain specialised activities. A clear, organised approach is your best bet for a fast setup.

Securing Your Future with Investor and Golden Visas

For most entrepreneurs coming to Dubai, setting up a company is about much more than just business. It’s a strategic move to build a new life in one of the world's most exciting cities. Your trade licence isn’t just a permit to operate—it’s the very key that unlocks residency, security, and a future for you and your family in the UAE.

This critical link between your business ambitions and personal life is forged through investor visas. These are the residency permits tied directly to your new company, changing your status from a foreign business owner to a UAE resident. It's the foundation for living and working long-term in Dubai.

Your Direct Path to Residency: The Investor Visa

The most straightforward route to residency right after your company is formed is the Investor Visa, which you might also hear called a Partner Visa. This visa is granted to the owners or partners of a company, whether it's on the Mainland or in a Free Zone. It's the government's official recognition of your contribution to the UAE's economy.

Getting this visa is a standard part of the process after your trade licence is issued. As soon as your company’s establishment card is ready, you're eligible to apply. The steps involve a medical fitness test and providing biometrics for your Emirates ID, all leading up to that residency stamp in your passport.

An Investor Visa does more than just let you live in the UAE. It gives you the power to open personal bank accounts, rent a home in your own name, and, crucially, sponsor your family members to join you. This is what truly turns Dubai into your home.

The Golden Visa: A Long-Term Vision

For those with a bigger investment and a longer-term vision, the prestigious Golden Visa offers a more permanent footing. This is a long-term residency programme, typically for 10 years, providing a level of stability that a standard investor visa can't match. It’s designed for serious investors, entrepreneurs, and specialised talents making a significant impact.

While a regular Investor Visa is linked to your company, the Golden Visa usually requires a higher investment threshold. This can include:

- Real Estate Investment: A property purchase of at least AED 2 million can make you eligible for a Golden Visa.

- Business Investment: A significant capital injection into your new or existing company can also open this door.

As specialists in Golden Visa on Property and Investor Visas, we help clients navigate the specific criteria for each path. Our expertise ensures you can perfectly align your business goals with your personal residency ambitions for the long haul. The benefits are massive, including being able to stay outside the UAE for long periods without your visa becoming invalid.

Deciding between an Investor Visa and a Golden Visa really comes down to your long-term goals and investment level. You can explore our guide to get a clearer picture of the Investor Visa UAE requirements and figure out which option is the best fit for your journey.

Your Dubai Business Setup Questions Answered

Setting up a company in Dubai can feel like you're learning a whole new language, with its own set of rules and jargon. To cut through the noise, we've pulled together the most common questions we get from entrepreneurs just like you. Think of this as your straightforward guide to getting started, designed to give you the confidence to take the next step.

Can I Really Own 100% of My Company on the Dubai Mainland?

Yes, absolutely. For a huge list of business activities, 100% foreign ownership is now the norm on the Dubai Mainland. This is a game-changer, thanks to some major legal reforms that have really opened up the market.

It wasn't always this way. You used to need an Emirati sponsor who would hold 51% of your company's shares. For most commercial and industrial businesses, that requirement is a thing of the past.

But there's a small catch. Certain strategic sectors or professional services might still need a Local Service Agent (LSA). The key thing to remember is that an LSA has zero equity or voting rights in your business. They simply act as your official go-between for government paperwork. It's crucial to check exactly where your business activity falls to know which ownership structure applies to you.

Is a Physical Office Mandatory for a Dubai Company?

Yes, having a registered physical address is a non-negotiable legal requirement for setting up in both Mainland Dubai and most Free Zones. Your trade licence is tied directly to this address, which has to be proven with an official tenancy contract called an Ejari.

Now, this doesn't mean you have to immediately sink a fortune into a fancy office. There are plenty of smart, flexible options that tick this legal box perfectly.

- Co-working Spaces: Perfect for startups and freelancers. You get a professional address plus great networking opportunities.

- Flexi-Desks: Your own dedicated desk in a shared space. It’s a legitimate address with all the basic facilities you need.

- Business Centre Solutions: These give you a prestigious address and back-office support without the massive overheads of a private office lease.

These are fantastic ways for a new business to get off the ground affordably while still being fully compliant. As specialists in cost-effective business setup solutions, we can point you to the best fit for your budget and how you plan to operate.

How Do I Open a Corporate Bank Account in the UAE?

Opening a corporate bank account is the critical step you take right after your trade licence is issued. It’s the financial engine for your entire UAE operation.

First, you'll need to gather all your company's legal documents and submit them to the bank you've chosen. This will include your trade licence, Memorandum of Association (MOA), and passport copies for every shareholder and signatory.

UAE banks operate under strict international compliance rules, which means they perform thorough Know Your Customer (KYC) checks. Be ready to provide more information, like:

- A solid business plan explaining what your company does.

- Details on your expected transaction volumes and who your typical clients will be.

- Profiles of the company's ultimate beneficial owners (UBOs).

The banks are meticulous, and the process can take a few weeks. Our best advice? Start early and get all your paperwork in perfect order to ensure everything goes smoothly.

What Is the Difference Between a Trade License and Commercial Registration?

It’s easy to get these two mixed up, but they are completely different stages of the setup process. Let's use a simple analogy to clear it up.

Commercial Registration is like your company's official birth certificate. It’s the moment your business is formally entered into the UAE's Commercial Register, giving it legal life as a real entity.

The Trade License, on the other hand, is the permit that allows your newborn company to actually start doing business. It spells out and authorises the specific activities you're allowed to carry out.

You always have to complete the commercial registration first. Once that's done, the relevant authority—like the Department of Economy and Tourism (DET) or a Free Zone—can issue your trade license, which is the official green light to open your doors. Our 24/7 support service is always here to clear up questions like these.

At PRO Deskk, we're more than just consultants; we're your partners in building something great. We specialise in making the entire process of company formation in Dubai straightforward, efficient, and perfectly matched to your vision. From figuring out Mainland vs. Free Zone to securing your Golden Visa and handling all your PRO needs, we take care of the red tape so you can focus on what you do best: growing your business.

Ready to start your Dubai business journey?

✅ Specialists in Mainland Company Formation in Dubai, Sharjah & Abu Dhabi

✅ Specialists in Freezone Company Formation across the UAE

✅ Specialists in Golden Visa on Property and Investor Visa

✅ Specialists in Corporate PRO Services and Attestation Services

✅ 24/7 Support Service – Always here when you need us

✅ Cost-Effective Business Setup Solutions tailored to your needs

✅ Enjoy UAE Tax Benefits for International Entrepreneurs

📞 Call Us Now: +971-54-4710034

💬 WhatsApp Us Today for a Free Consultation

Start your journey with confidence by visiting us at https://prodesk.ae and let's build your Dubai business together.