Choosing to set up your business on the UAE mainland isn't just a formality; it's a strategic decision that plants you right in the heart of one of the world's most dynamic economies. This is the path for entrepreneurs who want to trade without borders within the Emirates and work directly with powerful government entities. It's about full market penetration, not just a foothold.

Why a Mainland Company Gives You a Strategic Edge

One of the first big questions you'll face when entering the UAE market is whether to go for a mainland or a free zone setup. Free zones are great for specific international trading activities, but a mainland company gives you the ultimate freedom to operate, grow, and connect with the entire UAE market. Think of it as the key that unlocks the full commercial potential of powerhouse cities like Dubai, Abu Dhabi, and Sharjah.

If your business model involves a physical, customer-facing presence—a retail shop, a bustling cafe, or a service centre—a mainland licence is the only way to go. It’s what allows you to lease a commercial space anywhere you want, hire staff without complex restrictions, and serve the local community directly.

Unrestricted Market Access

The real game-changer with a mainland setup is the complete operational freedom you get. A free zone company is often confined to its specific geographical zone or limited to international trade. A mainland company, on the other hand, can:

- Trade Directly: You can do business fluidly across all seven Emirates. There's no need to find a local agent or distributor to act as a middleman.

- Secure Government Contracts: This is a big one. A mainland licence makes you eligible to bid on lucrative government tenders, which are a massive part of the UAE's economy.

- Establish a Physical Presence: Want to open an office in Downtown Dubai, a showroom on Sheikh Zayed Road, or a warehouse in an Abu Dhabi industrial zone? You can.

This kind of flexibility is absolutely critical for any business that relies on direct engagement with local customers or other UAE-based companies.

Full Ownership and Control

The business environment here has gone through a massive transformation. The UAE mainland now allows for 100% foreign ownership for the vast majority of business activities. This is a huge leap from the old model that required a local Emirati partner to hold a 51% stake.

This change has made the mainland incredibly appealing for international investors who want full control over their business. When your company is licensed by the relevant Department of Economic Development (DED), you get all the benefits of direct market access and complete operational autonomy. It's truly the best of both worlds. You can learn more about the differences in UAE company structures and what they mean for ownership.

A mainland licence is more than just a piece of paper; it’s a passport to the entire UAE economy. It sends a clear signal to partners, clients, and government bodies that your business is a serious, fully integrated player in the local commercial landscape.

To help clarify the core differences, let's break down how a mainland setup compares to a free zone.

Mainland vs Free Zone At a Glance

This table offers a straightforward comparison of the key operational differences between setting up on the UAE Mainland versus in a Free Zone.

| Feature | Mainland Company | Free Zone Company |

|---|---|---|

| Market Access | Unrestricted access to trade directly across the entire UAE. | Primarily restricted to the specific free zone and international markets. |

| Government Contracts | Eligible to bid on and win lucrative government tenders and projects. | Generally not eligible to work directly with government bodies. |

| Office Location | Can rent or own commercial property anywhere in the respective Emirate. | Limited to leasing office or warehouse space within the free zone's borders. |

| Ownership | 100% foreign ownership is available for over 2,000 business activities. | 100% foreign ownership has always been a standard feature. |

| Visa Eligibility | Based on office size, with generally no upper cap on the number of visas. | The number of visas is typically tied to the size of the leased facility. |

| Regulatory Body | Governed by the Department of Economic Development (DED) in each Emirate. | Governed by the specific Free Zone Authority (e.g., DMCC, JAFZA). |

Ultimately, the right choice hinges on your business model. If your goal is to serve the local market and engage with the broader UAE economy, the mainland provides the access and flexibility you need.

Navigating the Emirates

Our expertise isn't just general; it's specific to the UAE's most powerful economic hubs. We offer hands-on guidance for mainland company formation in:

- Dubai: The global magnet for trade, tourism, and finance, offering an incredibly diverse and fast-paced market.

- Abu Dhabi: The nation's capital, with a heavy focus on industrial projects, energy, and major government-led initiatives.

- Sharjah: A rising economic power known for its strength in manufacturing, education, and culture, often providing more cost-effective setup options.

Each Emirate has its own unique flavour and opportunities, and a mainland licence gives you the agility to tap into all of them. Understanding these regional economic drivers is key to positioning your business for success, whether you’re targeting high-end consumers in Dubai or seeking industrial partners in Abu Dhabi. That’s the kind of deep, on-the-ground knowledge that makes for a smooth launch.

Making Your First Critical Decisions

The first few choices you make when setting up your business in the UAE are by far the most important. Getting these foundations right from day one will save you a world of headaches and money down the road. Think of it less as paperwork and more as creating the blueprint for your entire company's future success.

We're going to walk through the three things every entrepreneur must nail down before anything else: choosing the right legal structure, picking a compliant trade name, and defining your business activities with absolute precision.

Selecting Your Legal Structure

Your company's legal structure is its operational DNA. It dictates everything from your personal liability and how you can raise money to the rules of ownership. For a business setup in mainland Dubai, Abu Dhabi, or Sharjah, you have a few key options to consider.

The Limited Liability Company (LLC) is, without a doubt, the most popular route for foreign entrepreneurs, and for good reason. It builds a protective wall between your personal assets and any business debts. This structure is also incredibly flexible, allowing for multiple shareholders, which makes it perfect for almost any commercial or industrial venture.

On the other hand, if you're a single professional offering services, a Sole Proprietorship might fit the bill. In this setup, you are the business, but that also means your personal liability is unlimited. For partnerships in professional fields like consulting or law, a Civil Company allows multiple partners to team up, reflecting their professional collaboration.

A classic mistake I see is people picking a legal structure based on which one seems cheapest upfront. An LLC might have slightly higher initial costs, but the liability protection it provides is priceless for most businesses. It’s what protects your personal wealth from the very beginning.

Crafting a Compliant Trade Name

Your business name is your brand, but in the UAE, it also has to pass the strict guidelines of the Department of Economic Development (DED). Having your trade name rejected is a surprisingly common hurdle that can stop your progress in its tracks.

To keep things moving smoothly, stick to these practical rules:

- Be Unique: Your name can't already be taken. A quick search on the DED's online portal will tell you if you're in the clear.

- Be Clear: The name must not be offensive or go against public morals.

- Be Accurate: The name should give a clue about what you do. Calling your restaurant "Global Trading," for instance, just won't fly.

- Avoid Restricted Terms: Stay away from using names of God, government entities, or famous global brands unless you have explicit permission.

Here’s a pro tip: always have three name options ready to go. If your first choice gets rejected, you can just move on to the next one without losing momentum. This simple bit of prep makes the approval process so much faster.

Defining Your Business Activities

This is probably the most crucial step of them all. The DED has a list of over 2,000 approved business activities, and your trade licence will specify exactly which of these you are legally allowed to do. Picking the wrong ones, or missing one you need, can lead to serious fines or even being forced to stop operations.

For example, say you want to sell electronics online but also offer repair services. You need to make sure both "E-Commerce" and "Electronics Repair" are listed on your application. Just listing one isn't good enough and immediately puts your business out of compliance.

As you figure out these initial steps, getting familiar with the essential legal documents for startups will help ensure you're not missing anything critical. Defining your activities is a huge part of this legal foundation.

Think about where your business will be in one or two years, not just today. While you can add activities to your licence later, it means more fees and more paperwork. It's always cheaper and easier to get it right from the very start.

Getting Your Trade Licence and Official Approvals

With your foundational decisions locked in, it's time to make your business official. This is where you shift from planning to execution, gathering the crucial documents that legally permit you to operate. Securing your trade licence is the moment your idea becomes a real, tangible entity.

Let's walk through what that journey looks like.

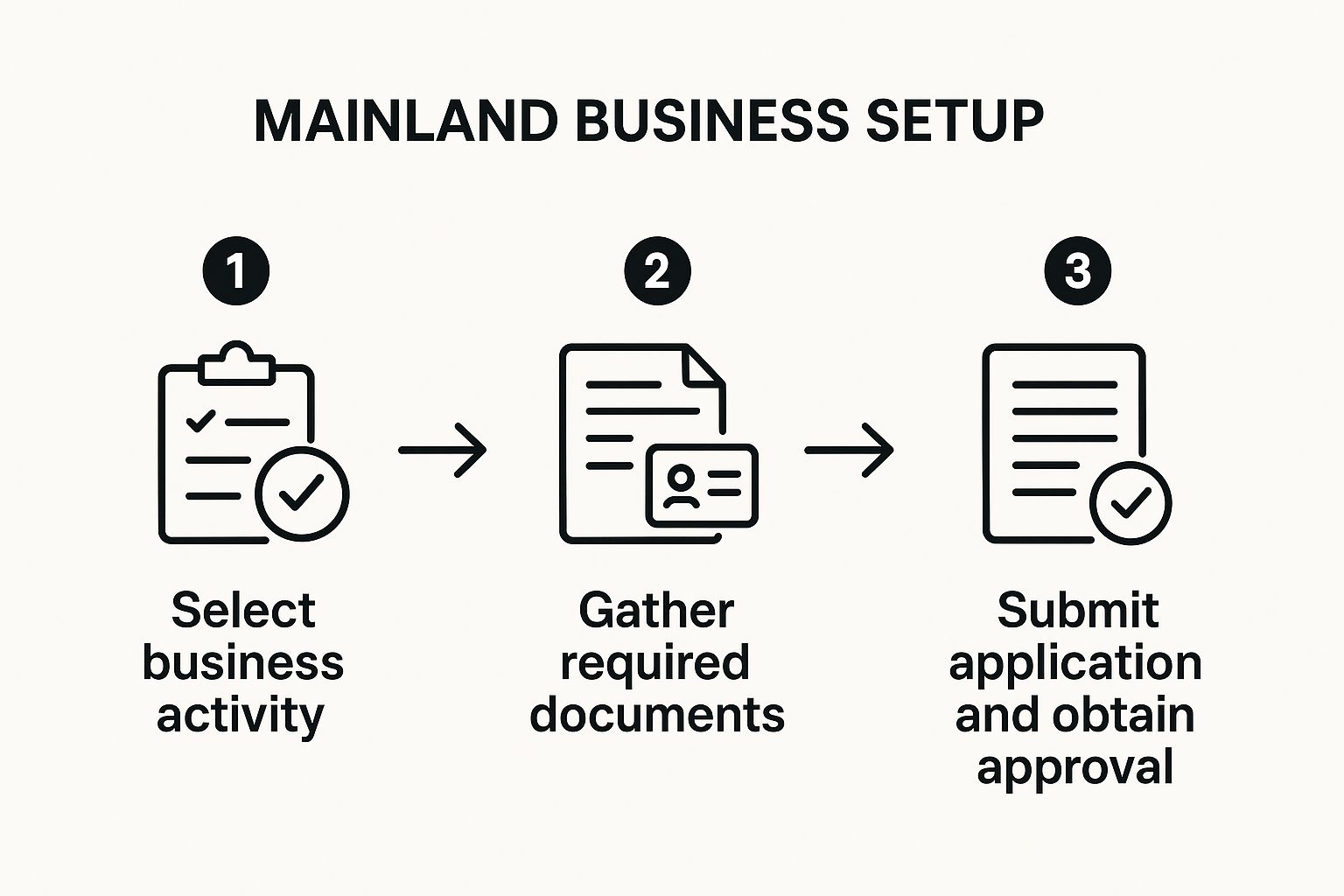

This process isn't as daunting as it might seem. When you break it down, it's a logical progression from one stage to the next, starting with getting the initial nod from the authorities.

The First Hurdle: Gathering Documents for Initial Approval

Before the Department of Economic Development (DED) can even consider your application, they need a clear picture of who you are and what you plan to do. Think of this first step, known as Initial Approval, as your formal introduction.

You'll need a file with some core documents ready to go:

- A completed application form: This lays out your business name, all proposed activities, and your chosen legal structure.

- Passport copies: Every shareholder and the appointed manager must provide a clear copy.

- A solid business plan: This isn't always required, but for many professional activities, a concise plan showing your objectives and financial forecasts is a must.

- Third-party approvals: If you're venturing into a regulated industry like healthcare, education, or engineering, you'll need a No Objection Certificate (NOC) from the relevant ministry first.

Having these organised from the outset shows you're serious and helps things move along much faster. One missing document can bring the whole process to a halt.

Don't underestimate the Initial Approval. It’s more than just a piece of paper; it’s the government's signal that they’re on board with your concept. This gives you the confidence to move forward with bigger financial commitments, like signing an office lease.

Drafting Your Company's Constitution: The Memorandum of Association

Once you have that Initial Approval, the next critical task is drafting the Memorandum of Association (MOA). For a Limited Liability Company (LLC), this document is essentially your company's constitution. It lays down the ground rules for how the shareholders will work together, making it absolutely vital for a successful business setup in mainland UAE.

Your MOA needs to clearly define:

- The official business name and its objectives.

- The full names of all partners and their exact shareholdings.

- How profits and losses will be distributed.

- The management structure and the specific duties of the manager.

This document has to be drafted in both Arabic and English, then notarised by a UAE public notary. This official attestation is non-negotiable and makes the MOA legally binding. A vague or poorly written MOA is a recipe for future disputes, so investing the time to get it right is crucial.

Securing Your Physical Space and Ejari

A mainland company needs a real, physical address. This is a non-negotiable requirement that proves your business has a legitimate base of operations in the UAE—no virtual offices allowed here. You must lease a commercial space that's officially registered with the DED.

After you've found your office and signed the tenancy contract, the next step is registering it with Ejari. This is the government's online portal for all tenancy agreements in Dubai. The resulting Ejari certificate is mandatory; without it, your final trade licence application simply won't be accepted.

The Final Push: Submission and Licence Issuance

You're now on the home stretch. With your Initial Approval, attested MOA, and Ejari certificate all in hand, it's time for the final submission to the DED. This is where our Corporate PRO Services specialists often step in to ensure every form is filled out perfectly and all requirements are met. You can learn more about the finer points of getting your Dubai trade license in our dedicated guide.

Once your complete file is submitted, the DED will conduct a final review. Assuming everything is in order, they'll issue a payment voucher for the trade licence fees. The final amount will depend on your specific business activity, legal structure, and trade name.

As soon as that payment is made, your official trade licence is issued. This is the document that legally empowers you to begin operations. Holding it in your hands means you've successfully navigated the formation process and are officially ready for business in the UAE.

Post-Licence Steps and Essential PRO Services

Holding your brand-new trade licence feels like crossing the finish line, but in reality, it’s just the start of the next leg of the race. A few more administrative hurdles stand between you and opening your doors. This is where the paperwork really kicks in and where having an expert on your side makes all the difference.

Getting through these post-licence procedures is a non-negotiable part of any business setup in mainland UAE. You'll be dealing with several government departments, and each one plays by its own set of rules. For a new entrepreneur, it can feel like a maze.

This is exactly why Corporate PRO (Public Relations Officer) services aren't just a "nice-to-have"—they're a strategic part of your launch. A good PRO is your official liaison, the person who handles all the government paperwork and clearances. They’ve seen it all before and know the system inside and out, which saves you from the headaches and delays that can derail a new business.

Firing Up Your Operations

The very first thing on your to-do list after getting the licence is securing your Establishment Card. Think of it as your company's official ID card in the government's system. You can’t do much without it, especially when it comes to building your team.

This card actually comes from two separate, crucial authorities:

- The Ministry of Human Resources and Emiratisation (MOHRE): This version, often just called the Labour Card, is your key to hiring staff and processing their work permits.

- The Federal Authority for Identity and Citizenship (ICP): This one registers your business with the immigration department, giving you the green light to apply for investor and employee visas.

Bottom line: no cards, no visas, no employees. It's the critical step that officially turns your licensed company into an operational one.

Making Sense of the Visa Process

With your Establishment Card sorted, you can finally start the visa process for yourself (as the investor) and any employees. This isn't a single action but a sequence of steps that need to be followed perfectly.

Here’s what the typical journey looks like:

- Get the Entry Permit: First, an initial permit is issued. This lets the person enter the UAE or, if they're already here, change their visa status without leaving the country.

- Pass the Medical Fitness Test: Every new resident has to go through a standard medical screening at a government-approved clinic to check for certain communicable diseases.

- Apply for an Emirates ID: After the medical test is cleared, the applicant heads to a service centre for fingerprinting and a photo. This is for their mandatory Emirates ID card.

- Stamp the Visa: Once all the approvals are in, the final residence visa is stamped into the passport. Congratulations, you’re officially a UAE resident!

An experienced PRO can orchestrate this entire process for you. They know which typing centres are fastest, how to schedule medical tests to skip the long lines, and how to keep the application moving smoothly. What could take you weeks of confusion, they can handle efficiently.

The Real Value of a Professional PRO

Let's be honest—trying to tackle all this government paperwork yourself will eat up your most precious asset: your time. Regulations can shift, online portals get updated, and one tiny error on an application can send you right back to square one.

Working with a firm that provides expert Corporate PRO services and attestation services means you've got a dedicated pro handling these critical tasks. From visas and renewals to licence updates and document clearing, they’ve got it covered. This frees you up to focus on what actually matters—building your business. To get a better sense of what's involved, you can learn more about the full scope of professional PRO services in Dubai and see how they can support your new venture.

Ultimately, these post-licence steps are what bring your company to life. Getting them right from the start puts you on solid, compliant footing, setting you up for success in the UAE's vibrant market.

Tapping into the UAE’s Tax Advantages for Growth

One of the biggest draws for setting up a business in the UAE mainland is, without a doubt, its incredibly friendly tax environment. This isn’t just a small benefit; it’s a core part of the UAE’s economic strategy, deliberately designed to pull in global investment and spark entrepreneurship. Whether you're setting up in Dubai, Sharjah, or Abu Dhabi, getting a firm grip on this system is your ticket to boosting your bottom line.

The financial upside is felt almost immediately. It means more of your revenue can be channelled right back into the business—funding your marketing, expanding your operations, or hiring that game-changing senior manager. It creates a powerful growth loop from the get-go.

The New Corporate Tax Landscape

To truly make the most of the UAE's tax climate, it helps to have a solid grasp of understanding taxation principles. While the UAE was once famous for having no corporate tax, it introduced a federal system in June 2023. This was a smart move to align with global financial standards, but it was done in a way that keeps the UAE extremely competitive.

The new structure is especially good news for small and medium-sized enterprises (SMEs), which are the real engine of the local economy.

Here’s how it works:

- You pay 0% tax on any taxable profits up to AED 375,000 (that’s about USD 102,000).

- For profits above that threshold, the rate is a flat, competitive 9%.

This tiered approach means startups and smaller businesses get a real chance to build momentum without being weighed down by heavy taxes. Meanwhile, larger, established companies contribute at a rate that remains one of the lowest you'll find anywhere in the world. To get the specifics sorted for your business, take a look at our guide on https://prodesk.ae/how-to-register-for-corporate-tax-in-uae/.

This tax structure is a strategic invitation for entrepreneurs. The 0% bracket for the first AED 375,000 of profit provides a crucial buffer, allowing new businesses to find their footing and scale sustainably.

A Powerful Magnet for Global Talent

Even with the new corporate tax, the UAE’s most famous financial perk is still in place: 0% personal income tax. This is a massive advantage, acting as a powerful magnet for international entrepreneurs and world-class professionals you might want to bring onto your mainland team.

Think about it. When you’re building your team, you can offer salary packages that are incredibly compelling because your employees take home 100% of what they earn. This isn't just for C-suite executives; it applies to every single person on your payroll, making it much easier to recruit and keep the skilled people you need to thrive.

This directly fuels your business in a few key ways:

- Competitive Hiring: You can attract top-tier candidates from all over the world who are drawn by the tax-free earning potential.

- Happier Team: With no deductions from their paycheques, employee morale and financial well-being get a natural boost.

- Simpler Payroll: Your admin load is significantly lighter without the headache of managing and deducting payroll income taxes.

It’s a true win-win. Your employees have more disposable income, and your business gets access to a deeper, more motivated talent pool. All this happens while you operate in one of the most dynamic and business-friendly hubs on the planet.

Keeping Your Business Compliant for the Long Run

Getting your trade licence is a huge milestone, but the journey doesn't end there. Think of it as the starting line, not the finish. Now, the focus shifts to keeping your business healthy and compliant. This isn't just about ticking boxes to avoid fines; it's about building a solid foundation for your company's future in the UAE's ever-evolving legal landscape.

One of your very first moves after getting licensed should be opening a corporate bank account. This is absolutely essential for managing your company’s finances, handling payments, and building a credible financial track record. A quick tip from experience: walk into the bank prepared. Have a well-thought-out business plan and all your shareholder documents properly attested and organised. Banks need to see you're serious and understand your business model, and being prepared makes the whole process faster and smoother.

Your Ongoing Obligations

With your banking sorted, your attention needs to turn to the recurring tasks that keep your company in good standing with the authorities. These aren't just one-off jobs; they're part of the rhythm of running a business in the UAE.

Here’s what needs to stay on your radar:

- Annual Trade Licence Renewal: Every trade licence comes with an expiry date. Mark it in your calendar and set multiple reminders. Missing this deadline can lead to hefty fines and, in some cases, a complete stop to your business operations.

- VAT and Corporate Tax Filing: You'll need to register for VAT if your annual turnover hits the mandatory threshold, and then file your returns on time. Likewise, getting up to speed with the UAE's corporate tax regulations, including registration and filing, is a critical part of operating legally.

Mainland companies are the backbone of the UAE's economic vision. With the economy expected to grow by 4.8% in 2025, much of that momentum is coming from the non-oil sectors where mainland businesses thrive. You’re not just starting a company; you’re becoming part of a major growth story. You can get more insights into the UAE's economic boom on horizonbizco.com.

Got Questions? We've Got Answers

Setting up a business on the UAE mainland can feel like a maze, and it's natural to have questions. I've worked with countless entrepreneurs just like you, and certain queries pop up time and time again. Let's tackle some of the most common ones head-on.

Do I Still Need a Local Emirati Partner for a Mainland Company?

For most businesses, the short answer is no. A few years ago, the UAE government made a game-changing move by allowing 100% foreign ownership for the vast majority of commercial and industrial activities on the mainland. This was a huge shift from the old 51% local sponsorship rule.

That said, there are still a handful of strategic sectors—think oil and gas or certain public utility services—where specific ownership rules apply. It's always a good idea to double-check the exact requirements for your specific business activity with an expert before you get started.

What's the Real Difference Between an Initial Approval and a Trade Licence?

This is a classic point of confusion, but it's actually quite simple. The Initial Approval is essentially the government's first nod of acceptance. It's the Department of Economic Development (DED) saying, "We have no objection to your business idea." Getting this approval is what unlocks the next steps, like drafting your legal documents and leasing an office.

The Trade Licence, on the other hand, is the final prize. It's the official, legally binding document that gives you the authority to actually run your business. You can't start trading, send an invoice, or hire your first employee until you have that licence in hand.

Here's an analogy I often use: The Initial Approval is like getting the green light to build your house. The Trade Licence is the certificate of occupancy that lets you finally move in and start living there. One gives you permission to proceed, the other gives you permission to operate.

How Much Does a Mainland Business Setup Cost in the UAE?

This is the big question, and the honest answer is: it depends. The total cost can swing quite a bit based on a few key things: the type of business you're running, the legal structure you choose (an LLC has different costs than a Sole Proprietorship), and even which Emirate you're in.

To give you a better idea, here are the main costs you'll need to account for:

- Trade name and initial approval fees

- Trade licence issuance fees

- Office rent and Ejari (the tenancy contract registration)

- Visa processing and other essential PRO services

Because every business is so different, there's no magic number. For a precise and cost-effective quote that fits your exact plan, your best bet is to get a free consultation. A setup expert can walk you through a detailed breakdown so there are no surprises.

Ready to bring your business to the UAE mainland? Let the experts at PRO Deskk take the stress out of the process. With our end-to-end solutions, you get a smooth, compliant, and cost-effective path to launch.

✅ Specialists in Mainland Company Formation in Dubai, Sharjah & Abu Dhabi

✅ Specialists in Freezone Company Formation across the UAE

✅ Specialists in Golden Visa on Property and Investor Visa

✅ Specialists in Corporate PRO Services and Attestation Services

✅ 24/7 Support Service – Always here when you need us

✅ Cost-Effective Business Setup Solutions tailored to your needs

✅ Enjoy UAE Tax Benefits for International Entrepreneurs

📞 Call Us Now: +971-54-4710034 or WhatsApp Us Today for a Free Consultation.