Thinking about setting up a business in the UAE? You're looking at a gateway to a dynamic, tax-friendly economy that's genuinely built for global entrepreneurs. But turning that idea into a reality can feel complex. This guide is here to change that.

We'll break down the entire process into clear, practical steps, covering the critical decisions, licensing, and financial groundwork you need to launch successfully.

Your Entrepreneurial Journey in the UAE Starts Here

Making the move to set up a business in the UAE is more than just paperwork; it’s a strategic leap into one of the world's most vibrant economic hubs. The government here is actively fostering innovation and rolling out the red carpet for international talent, creating fertile ground for growth.

Think of this guide as your inside source. We've packed it with practical insights drawn from our direct experience helping founders just like you succeed. Our goal is simple: replace confusion with clarity, ensuring your journey is as smooth and cost-effective as possible, right from the start.

This isn't just a feeling; the numbers back it up. The UAE's new business density—a measure of registrations per 1,000 people—is among the most active globally. It signals a steady stream of new ventures that need expert support.

Confidence among small and medium-sized enterprises (SMEs) is also exceptionally high. Recent reports show that a staggering 91% of UAE SMEs are optimistic about their future, with many planning to seek external credit to fuel their expansion. This boom highlights a growing demand for essential setup services, from company formation to the often-tricky process of opening a corporate bank account.

What This Guide Covers

We've designed this resource to walk you through every critical phase of establishing your company. You won't find generic advice here—only actionable steps and real-world examples from our years on the ground.

Here’s a look at what we'll unpack:

- Jurisdiction Deep Dive: We'll compare Mainland, Free Zone, and Offshore setups, helping you decide which structure truly aligns with your business model and long-term ambitions.

- Licensing and Visas: Get a clear walkthrough of the necessary documentation, approvals, and visa processes. We’ll even touch on options like the prestigious Golden Visa on property.

- Corporate Banking: We’ll share practical tips for successfully opening a corporate bank account, a common hurdle for new entrepreneurs in the region.

- Ongoing Support: Learn about essential corporate PRO services and document attestation that keep your business compliant and running smoothly long after day one.

As you start your entrepreneurial journey, it’s also helpful to understand the broader expat experience. If you’re considering Dubai specifically, you might find valuable insights in A comprehensive guide to living in Dubai for expats.

Ultimately, partnering with the right specialists can make all the difference. Our experienced business setup consultants in Dubai have turned what can be a daunting process into a seamless launch for countless clients. We’re here to do the same for you.

Choosing Your Foundation: Mainland vs Free Zone

When you decide on a business setup in UAE, your first big decision is where to plant your flag. Will it be on the Mainland or inside a specialised Free Zone? This choice is the absolute bedrock of your company. It defines who you can do business with, where you can operate, and what your long-term growth will look like. It’s not just about an address; it's a strategic move that shapes your entire journey in the UAE.

Let's cut through the jargon. These two jurisdictions serve completely different purposes, and picking the right one from the get-go will save you a world of headaches, time, and money down the line. The "right" choice depends entirely on your business model and who your customers are.

Understanding the Mainland Advantage

A Mainland company, registered directly with the Department of Economic Development (DED) in an emirate like Dubai or Abu Dhabi, gives you one massive advantage: unrestricted market access.

If your business plan involves selling directly to customers anywhere in the UAE, providing services to other local companies, or bidding on lucrative government contracts, then a Mainland licence is your golden ticket. Simple as that.

This setup allows you to operate without any geographical chains within the country. You can open your office in a bustling downtown area, set up multiple branches across the emirates, and truly embed your brand in the local economy. For anyone in retail, local professional services, or construction, this is really the only way forward.

The numbers back this up, too. As of mid-2022, there were 557,000 SMEs on the UAE Mainland, contributing a staggering 63.5% of the non-oil GDP. It’s a powerful testament to why so many entrepreneurs choose this path. With government initiatives pushing to grow this number to one million by 2030, the Mainland is where the local action is.

Exploring the Freedom of Free Zones

On the other side of the coin, you have the Free Zones. These are designated economic areas that offer a completely different set of perks, aimed primarily at businesses with an international focus.

If your clients are outside the UAE, or your business is centred on international trade, import/export, or logistics, then a Free Zone company is almost always the smarter choice.

There are over 40 Free Zones scattered across the UAE, and many are tailored to specific industries—think tech hubs like Dubai Internet City or media hubs like twofour54 in Abu Dhabi. This creates these incredible, self-contained ecosystems where you're surrounded by peers, partners, and potential clients in your exact field.

The main draws for a Free Zone are financial and structural:

- 100% Foreign Ownership: You own your business outright. No local partner or sponsor is needed.

- Tax Exemptions: You benefit from 0% corporate and personal income tax.

- Full Repatriation of Profits: You're free to send all your capital and profits back to your home country without any restrictions.

- Simplified Procedures: The setup process is generally quicker and involves less paperwork than a Mainland company.

This structure is perfect for international consultants, e-commerce stores that ship globally, or holding companies managing overseas assets. A Free Zone gives you a strategic base in the UAE with incredible operational and financial freedom.

A Head-to-Head Comparison

To make this crystal clear, let's look at a couple of real-world scenarios.

Imagine you want to open a boutique coffee shop in Downtown Dubai. Your customers will be local residents, office workers, and tourists. For this, a Mainland licence is non-negotiable. You need that freedom to set up shop in a prime commercial area and trade directly with the public.

Now, let's say you're a software developer with clients in Europe and Asia. You need a base for invoicing and operations, but you don't need a physical office in the UAE or to serve local clients. A Free Zone company would be perfect. It's a cost-effective solution that gives you 100% ownership and huge tax benefits, which aligns perfectly with an international business model.

To really get into the nitty-gritty, here’s a quick breakdown of the core differences.

Mainland vs Free Zone Company At a Glance

| Feature | Mainland Company | Free Zone Company |

|---|---|---|

| Ownership | 100% foreign ownership for most activities. Some strategic sectors may require a local partner. | 100% foreign ownership is standard. |

| Scope of Business | Can trade anywhere in the UAE and internationally. | Restricted to trading within the Free Zone or internationally. Local trade requires a distributor. |

| Office Space | Mandatory physical office space required, registered with Ejari. | Flexible options, including virtual offices, flexi-desks, and physical spaces. |

| Visas | Visa eligibility is generally tied to the size of the office space. | Visa packages are typically pre-approved (1-6 visas). More can be added with a physical office. |

| Government Approvals | Requires approvals from the DED and potentially other government bodies depending on the activity. | All approvals are handled by the specific Free Zone authority, making it a one-stop-shop process. |

| Capital Requirement | No minimum capital requirement for most business types. | Varies by Free Zone; some have no minimum capital, while others require it. |

Ultimately, the right choice boils down to your vision. For a deeper analysis of specific scenarios and costs, you can explore our detailed guide comparing Free Zone vs Mainland company setup in Dubai.

Answering one simple question is the first step: Are you building a business for the UAE market, or for the world from a UAE base? Once you know that, the path forward becomes much clearer.

From Paperwork to Trade License: A Practical Walkthrough

Once you’ve settled on your jurisdiction, it's time to shift from planning to action. This is the administrative core of your business set up in uae, a series of steps that will turn your business idea into a legal, operational entity. It can feel like a lot, but with a clear roadmap, it’s entirely manageable. This phase is less about big-picture strategy and more about precision—getting every single document right and every approval ticked off.

This is where a lot of entrepreneurs get bogged down. A minor error on a form or a misunderstanding of a specific requirement can lead to unexpected and frustrating delays. It's exactly at this point that professional Corporate PRO Services prove their worth. Having an expert who knows the ins and outs of the various government portals and submission rules doesn't just save you time; it ensures your application sails through the system without any costly rejections.

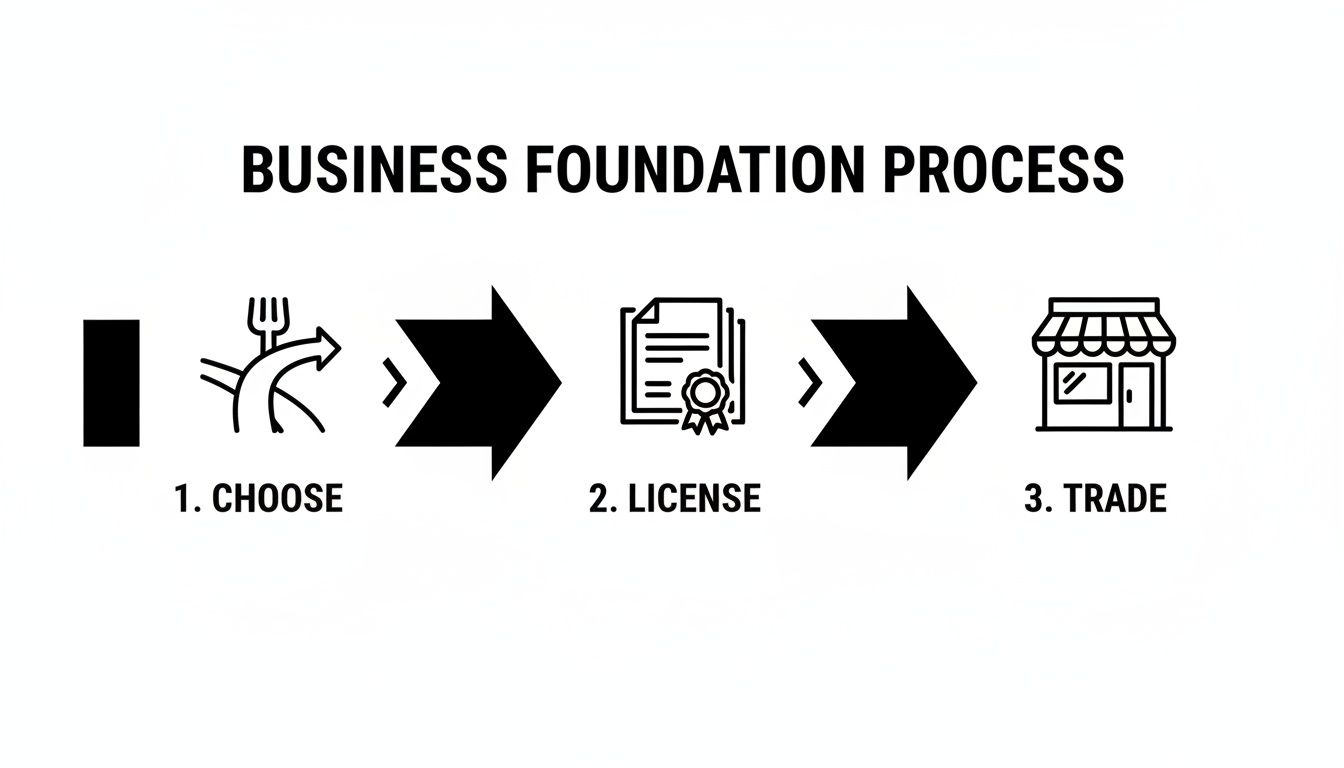

This infographic breaks down the essential flow of getting your business off the ground, from that first crucial choice to being ready to trade.

As you can see, the licensing stage is the critical bridge connecting your foundational decisions with your actual ability to operate and make money.

Securing Your Trade Name and Business Activities

Your first official move is picking and registering your company’s trade name. This isn't just a branding decision; your name has to follow strict UAE regulations. It can't violate public morals, include any religious language, or be linked to any political organisations. Critically, it must also be unique and not already taken.

At the same time, you'll need to lock in your business activities. The UAE offers a massive list of over 2,000 approved activities, and what you choose determines the kind of license you'll get—be it Commercial, Professional, or Industrial. It is absolutely vital to select activities that precisely match what your business will do. Operating outside your licensed scope can result in some serious penalties.

For example, a digital marketing agency would operate under a Professional license, whereas a business importing and selling electronics would need a Commercial one. Getting this right from day one is fundamental, as it influences everything that follows, from your office needs to how many visas you might be eligible for.

Crafting Your Memorandum of Association

For most company structures, especially a Limited Liability Company (LLC) on the Mainland, a Memorandum of Association (MOA) is a non-negotiable legal document. You can think of it as your company's constitution. It clearly lays out the business objectives, how the shares are divided, the distribution of profits and losses, and the specific responsibilities of each partner.

The MOA has to be drafted in both Arabic and English and then officially notarised by a public notary here in the UAE. This document is legally binding and governs the entire relationship between the shareholders. Any vagueness or mistake in the MOA can easily spiral into future disputes, so it's crucial to have it drafted by a professional.

Think of the MOA as the blueprint for your business partnership. A well-drafted MOA protects all parties and provides a clear framework for governance, which is especially important if you are entering into a partnership.

Documents like the MOA often need attestation to validate them, particularly if any of the partners or supporting documents originate from outside the UAE. Our team can handle the entire process, from drafting to notarisation and attestation, ensuring you're fully compliant without having to get lost in complex legal jargon.

Obtaining Your Initial Approval and Office Space

With your trade name and activities approved, the next big milestone is getting an 'Initial Approval Certificate'. This comes from the relevant authority, like the Department of Economic Development (DED) for a mainland company or the specific free zone authority you've chosen. This certificate basically means the government has no objection to your business being set up.

This approval is also the green light you need to finalise other essential contracts. For a mainland company, one of the most important is your office lease agreement, known locally as an Ejari. A physical office is a mandatory requirement for the majority of mainland licenses. The Ejari officially registers this tenancy contract, and you can't submit your final trade license application without it.

Free zones tend to be more flexible, offering everything from virtual offices and flexi-desks to dedicated warehouses and full office suites. But no matter which option you go for, you will always need to provide proof of a registered business address before your license can be issued.

This entire administrative journey builds towards one thing: getting your trade license. For more details on the different license types available, our comprehensive guide covers everything you need to know about getting a trade license in Dubai.

Securing Your Residency and Corporate Bank Account

You've got the trade license – congratulations, your business is now a legal entity in the UAE. The next phase is all about cementing your personal and financial foundation here. This involves two of the most critical parts of any successful business set up in uae: getting your residency visa and opening a corporate bank account.

While they might seem like two separate checklists, they're actually deeply linked. This is also where many new entrepreneurs stumble. The processes are complex, involving multiple government departments and very strict bank compliance checks. Honestly, having an expert who navigates this daily can be the difference between a smooth setup and months of frustrating delays. We specialise in these exact procedures, making sure every detail is handled correctly the first time.

Navigating the UAE Visa Process

Your path to residency starts with something called an Establishment Card. Think of it as your company's official immigration file. You can't apply for any visas under your company's name until this card is issued. Once that’s sorted, we can move on to your own investor or partner visa.

The whole visa journey follows a clear sequence:

- Entry Permit: First, we apply for your entry permit. This is the document that lets you start the residency process from within the UAE.

- Status Change: If you're already here on a tourist visa, we'll do a "status change." It’s a simple procedure that means you don't have to leave the country and fly back in.

- Medical Fitness Test: You’ll have to complete a mandatory medical screening at a government-approved health centre. It’s pretty straightforward – just a blood test and a chest X-ray.

- Emirates ID & Biometrics: Next, you'll provide your fingerprints and have your photo taken for the Emirates ID application. This card is essential for daily life in the UAE.

- Visa Stamping: The final step is getting the residency visa sticker placed in your passport. This officially confirms your legal right to live and work here.

A quick but important note: if any of your personal documents, like birth or marriage certificates, aren't in Arabic, you will need professional immigration document translation services to ensure they meet the strict government standards.

Expanding Your Visa Options

Once your own visa is sorted, your company gives you the power to sponsor others. This includes bringing on key employees or sponsoring your family members, like your spouse and children. Sponsoring dependents is a relatively simple process after your own residency is finalised.

For those planning a more substantial investment, the UAE also offers the prestigious Golden Visa. This is a long-term residency visa, usually valid for 10 years, that offers far greater stability and extra benefits. Eligibility is often tied to things like a significant property investment or a large capital deposit. As specialists in the Golden Visa on Property and Investor Visa routes, we can quickly assess your eligibility and walk you through this exclusive application.

Key Takeaway: The visa process isn't just paperwork; it’s the foundation of your new life in the UAE. When it's managed flawlessly by experienced PROs, it frees you, your family, and your team to focus on what matters—settling in and growing the business without bureaucratic headaches.

The Challenge of Corporate Bank Account Opening

Ask anyone who has set up a business here, and they'll likely tell you that opening a corporate bank account is one of the toughest parts of the entire journey. It's not an exaggeration. Because of strict international anti-money laundering (AML) and know-your-customer (KYC) rules, UAE banks are incredibly thorough.

Just showing up with a trade license won't cut it.

The banks need to see a full, compelling story of your business. They want to understand your business model, who your customers are, your projected transaction volumes, and where your initial funds are coming from. A vague or incomplete application is almost guaranteed to be rejected. This is where our strong relationships with major UAE banks become a huge advantage for our clients.

What UAE Banks Look For

To give yourself the best shot at a quick and successful account opening, you need to walk in with a perfectly prepared file.

Here’s a snapshot of what you'll need:

- Complete Company Documents: Your trade license, Memorandum of Association (MOA), and shareholder registry are non-negotiable.

- Founder's Personal Documents: Passport copies, visa copies, and the Emirates IDs of all shareholders are required.

- Proof of Business Substance: This is key. A solid business plan, a detailed company profile, and even draft contracts with potential clients can make a huge difference.

- Source of Funds Declaration: A clear, documented explanation of where your investment capital originated.

Of course, one of the main reasons entrepreneurs come here is the incredible financial environment. You can Enjoy UAE Tax Benefits for International Entrepreneurs, as the country has 0% personal income tax and a highly competitive corporate tax rate, making it an extremely efficient base for global business.

When you work with us, you're tapping into years of experience. We know exactly what each bank is looking for and help you build a robust application that ticks every box, presenting your new company in the strongest possible light and clearing the path to getting your account up and running.

Understanding Your Investment Costs and Timelines

A successful launch comes down to two things: a realistic budget and a clear schedule. When you're planning your business setup in the UAE, it’s critical to move past the big-picture ideas and get down to the brass tacks of the actual investment required. This is where we need to get transparent about the costs involved, so you can plan with confidence and sidestep any nasty financial surprises.

Having a solid grasp of the financial layout from day one prevents delays and helps you put your money where it matters most. Your total investment won’t be a single figure, but rather a sum of several key parts, each one changing based on your specific choices—like your jurisdiction, company size, and day-to-day operational needs.

Breaking Down the Core Costs

Let's dissect the main expenses you should expect to see. This isn't just about the licence fee; it’s about the whole financial ecosystem needed to get your company up and running properly.

Here are the main cost categories you need to budget for:

- Government and Licensing Fees: This is your foundational cost. It covers things like your trade name registration, initial approval, and the final trade licence issuance fee, which varies quite a bit between mainland authorities and the different free zones.

- Visa Expenses: Every visa you process comes with its own set of costs, whether it's for you as an investor or for your employees. These fees include the establishment card, entry permit, medical test, Emirates ID application, and the final visa stamping in your passport.

- Office Rental Costs: For mainland companies, a physical office space with a registered Ejari (your tenancy contract) is non-negotiable. In the free zones, you get more flexibility. Options range from affordable flexi-desks to larger, dedicated offices, each with a different price point.

- Professional Service Charges: This fee covers the expertise of a business setup specialist. It’s for managing all the paperwork, dealing with government departments on your behalf, and giving you the strategic guidance needed for a smooth, error-free process from start to finish.

The goal is to completely avoid surprises. A detailed, itemised quote from your setup consultant should clearly outline every single government fee and professional charge. That way, you get a complete picture of your initial outlay before you commit.

Cost-Effective Packages and Tailored Solutions

Every business is different, so a one-size-fits-all price tag just doesn't work. For example, a solo consultant who doesn't need staff right away has a completely different budget than a trading company that plans on hiring five employees and leasing a warehouse.

This is why we focus on Cost-Effective Business Setup Solutions built around your specific needs. We always start by understanding what you want to achieve—your business activity, preferred location, and how many visas you'll need—to put together a package that makes complete financial sense for you.

For entrepreneurs looking for the most economical way to get started, our packages can begin from as low as AED 5,999. This usually covers a zero-visa free zone licence, which is perfect for digital nomads, international consultants, or businesses just testing the waters in the UAE market. From there, we can scale up the solutions to match your ambition.

Mapping Out Realistic Timelines

Money isn't the only resource you need to manage carefully; time is just as crucial. Knowing what to expect at each stage helps you plan your launch, line up suppliers, and even manage your own relocation.

Here’s a general timeline for what a typical business setup looks like:

- Initial Approvals & Licensing (1-3 weeks): This phase is all about getting your trade name reserved, your activities approved, and your trade licence issued. Free zone setups are often much quicker, sometimes taking just a few days. Mainland processes can take a bit longer because they involve coordinating with multiple government departments.

- Visa Processing (2-4 weeks): Once the company licence and establishment card are ready, the visa process kicks off. This timeline covers everything from applying for the entry permit to getting the final visa stamped in your passport.

- Bank Account Opening (2-4 weeks): This process usually runs alongside your visa application. How long it takes really depends on the bank's internal compliance checks and whether you’ve provided all your documents correctly.

All in all, a realistic end-to-end timeline to have your licence, visa, and bank account fully operational is generally between 4 to 8 weeks.

Post-Setup Compliance You Cannot Ignore

Your job isn't done once you have your trade licence in hand. To operate legally and build a successful business long-term, you have to stay on top of your ongoing compliance duties.

Here are the key things you'll need to manage after setup:

- Annual Licence Renewal: Your trade licence has to be renewed every single year. This involves paying the renewal fees and making sure your office lease is still valid.

- UBO Declarations: All companies are required to maintain a register of their Ultimate Beneficial Owners (UBO) and submit this information to the authorities.

- Audit and Tax Filings: Depending on your jurisdiction and revenue, you might need to prepare audited financial statements and file corporate tax returns.

Planning for these recurring tasks from day one is the best way to ensure your business stays in good standing. It frees you up to focus on growth without worrying about fines or penalties down the line.

Your Questions Answered: UAE Business Setup

Setting up a business in the UAE is an exciting prospect, but it’s completely normal to have a lot of questions. We get calls about this every single day.

To make things clearer, we’ve put together answers to the most common queries we hear from entrepreneurs looking to launch in Dubai, Sharjah, Abu Dhabi, and beyond. This is practical advice, straight from our daily experience on the ground.

What Is the Minimum Cost to Start a Business in the UAE?

This is usually the first thing people ask, but there’s no single price tag. The real cost depends entirely on your choices: will you be on the Mainland or in a Free Zone? What exactly will your business do? How many visas do you need?

For someone just starting out, like a freelancer or an international consultant, a Free Zone package can be incredibly affordable, with some starting as low as AED 5,999 for a company that doesn’t need any visas. It’s a fantastic entry point.

A Mainland business, on the other hand, will almost always require a bigger initial investment. This is mainly because you’ll likely need a physical office space, and the government approvals are a bit more involved.

The most important thing is to get a quote that lists out every single fee. It should cover everything from reserving your trade name and getting initial approvals right through to the final stamp on your visa. We make sure our quotes are completely transparent so you won’t face any nasty surprises later on.

Can I Get a UAE Residency Visa by Opening a Company?

Yes, absolutely. For many people, forming a company is the most reliable way to get a UAE residency visa.

As the owner of the business, you’re eligible to apply for an investor visa. This is typically valid for two years and is renewable.

What’s more, your new company can then act as a sponsor for your employees. The number of staff visas you can get is usually tied to things like the size of your office and your specific business activity.

If you’re planning a more significant investment, setting up a company can also be a stepping stone towards the sought-after Golden Visa. We specialise in both investor visas and the Golden Visa on Property, so we can help you figure out the best path to long-term residency.

Do I Need a Local Sponsor for My Business in Dubai?

This is a very common question, and thankfully, the answer has changed for the better. The old rule requiring a local Emirati sponsor to own 51% of a Mainland company is no longer in effect for the vast majority of businesses.

Major legal changes now allow for 100% foreign ownership for most commercial and professional licences on the Mainland. It’s only a handful of very specific, strategic sectors where a local partner is still needed.

And in the Free Zones? 100% foreign ownership has always been one of their biggest selling points, so a local sponsor has never been part of the equation there. We keep on top of all the latest ownership laws, so we can give you clear, up-to-date advice for your specific business.

The big takeaway here is that the UAE has thrown its doors wide open to foreign investors. This move towards full ownership gives you complete control over your Mainland business and its profits, without having to split it with a local partner.

How Long Does It Take to Set Up a Company in the UAE?

The timeline can be anything from a few days to several weeks. It really hinges on where you set up and how complex your business is.

Free Zones are famous for their speed. Some authorities can issue a trade licence in as little as 24-48 hours.

A Mainland setup takes a bit more time, usually somewhere between one and three weeks. That’s because it involves getting approvals from different government bodies, like the Department of Economic Development (DED) and the Ministry of Human Resources and Emiratisation (MOHRE).

The full end-to-end process—from getting your trade licence to having your residency visa stamped and your corporate bank account open—generally takes about four to eight weeks. Working with an experienced team is the best way to speed this up, as we know how to get every application right the first time and avoid common delays. Our 24/7 support also means we’re always pushing your setup forward.

Ready to turn your business idea into a reality? At PRO Deskk, we specialise in seamless company formation across the UAE, offering tailored solutions that fit your budget and goals.

✅ Specialists in Mainland Company Formation in Dubai, Sharjah & Abu Dhabi

✅ Specialists in Freezone Company Formation across the UAE

✅ Specialists in Golden Visa on Property and Investor Visa

✅ Specialists in Corporate PRO Services and Attestation Services

✅ 24/7 Support Service – Always here when you need us

✅ Cost-Effective Business Setup Solutions tailored to your needs

✅ Enjoy UAE Tax Benefits for International Entrepreneurs

📞 Call Us Now: +971-54-4710034

💬 WhatsApp Us Today for a Free Consultation