Thinking about starting a business in the UAE? The very first thing on your checklist, before you even think about office space or hiring, is securing the right business license.

This isn't just a piece of paper. It's the official key that unlocks the door to the region's incredibly dynamic economy. With it, you can legally operate, open a corporate bank account, and access all the government services you'll need.

Your First Step in the UAE Business World

Embarking on your entrepreneurial journey here means getting to grips with the legal framework that makes the UAE so attractive to businesses. A business license is the foundation of your company—it defines what you can do, gives you legal standing, and acts as your passport to both local and international markets.

And the appeal is undeniable. The UAE has seen a massive surge in new companies, hitting a record high of over 1.5 million active commercial licenses. This boom is powered by forward-thinking legal reforms and a huge demand in hot sectors like e-commerce and logistics.

Just look at the numbers: Abu Dhabi recently saw a 16% jump in new mainland licenses, while Sharjah issued thousands of new licenses in just six months. The momentum is strong right across the Emirates.

Choosing Your Business Jurisdiction

Right at the start, you'll face a critical decision: choosing your jurisdiction. Think of this as selecting the "home base" for your business. This choice will directly impact your ownership structure, who you can sell to, and how you can operate.

It can feel a bit overwhelming, but it really boils down to three main paths for any entrepreneur setting up shop here:

- Mainland Company Formation: As specialists in Mainland company formation in Dubai, Sharjah & Abu Dhabi, we know this is your ticket to the entire UAE market. It gives you the freedom to trade directly with customers and other businesses anywhere in the Emirates.

- Free Zone Company Formation: A favourite among international entrepreneurs, we specialize in Freezone company formation across the UAE. Free zones are special economic hubs that offer incredible perks like 100% foreign ownership and significant tax advantages.

- Offshore Company: This is a bit different. An offshore company is mainly a tool for international trade, protecting assets, or holding shares in other companies. It gives you a legal entity based in the UAE, but without a physical office or presence here.

Getting your head around these three options is the first real step towards a successful launch. For a closer look at these initial stages, check out our complete guide on how to start a business in the UAE.

Our specialists are on hand to offer straightforward, cost-effective advice and 24/7 support to make sure you get this crucial first decision right.

Choosing Your Path: Mainland vs Free Zone

When you're looking to set up a business in the UAE, one of your first—and most important—decisions is whether to go for a Mainland or a Free Zone license. This isn't just a bit of paperwork; it's a choice that fundamentally shapes who you can do business with, what your ownership structure looks like, and how your company can grow in the long run.

Think of it this way: a Mainland license is your all-access pass to the entire UAE economy. It gives you the freedom to set up your office, shop, or clinic anywhere and trade directly with any customer or company across the seven emirates. As specialists in Mainland company formation in Dubai, Sharjah & Abu Dhabi, we can guide you through setting this up for maximum market access.

A Free Zone license, on the other hand, is like a special economic passport. It grants you entry into a designated business park with its own set of rules and some seriously attractive perks, all designed to make it easier for international businesses to operate.

The Allure of UAE Free Zones

For entrepreneurs coming from abroad, the benefits of a Free Zone are often too good to pass up. These zones are essentially self-contained business hubs, often built around specific industries like technology, media, or commodities trading.

The main draws are pretty compelling:

- Complete Foreign Ownership: You keep 100% of your company. There's no requirement for a local Emirati partner.

- Tax Exemptions: Enjoy UAE tax benefits for international entrepreneurs. Most free zones offer a complete exemption from corporate and personal income taxes.

- Full Profit Repatriation: You are free to send 100% of your profits and capital back to your home country, no questions asked.

Our team are specialists in Freezone company formation across the UAE and can walk you through the specifics of each zone, as they all have unique advantages. For a deeper dive, you can check out our detailed guide on Free Zone company setup in Dubai.

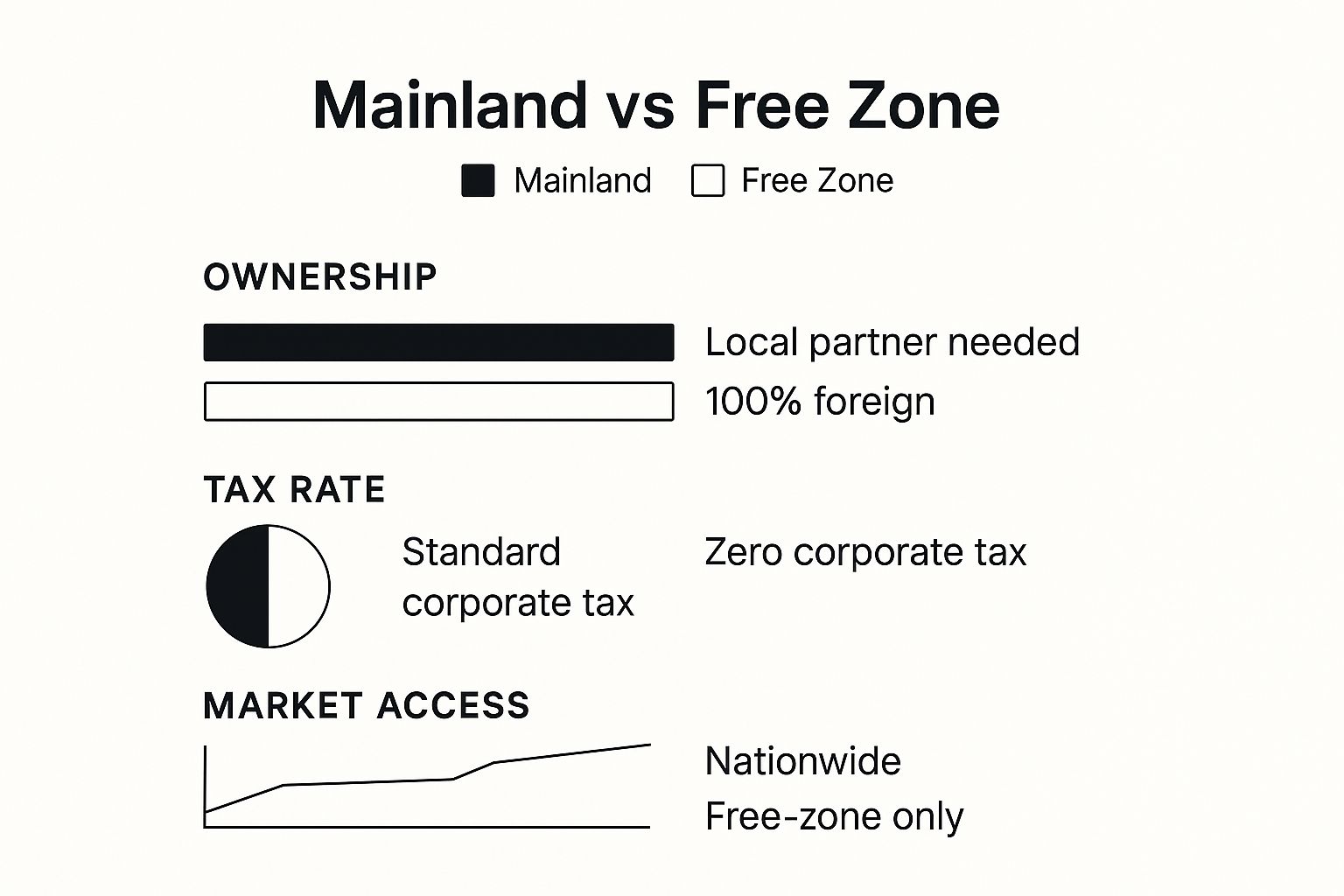

This infographic breaks down the core differences between the two jurisdictions at a glance.

As you can see, it’s a classic trade-off. Mainland gives you unrestricted access to the local market but comes with the standard corporate tax. Free Zones offer incredible tax benefits and full ownership but limit your ability to trade directly within the UAE mainland.

To make this even clearer, let's compare them side-by-side.

Mainland vs Free Zone At a Glance

| Feature | Mainland License | Free Zone License |

|---|---|---|

| Market Access | Unrestricted access to the entire UAE market. | Limited to the specific free zone and international markets. |

| Business Scope | Can operate anywhere in the UAE and internationally. | Operations are generally restricted to within the free zone. |

| Foreign Ownership | 100% foreign ownership is now available for most activities. | 100% foreign ownership is a standard feature. |

| Office Location | Can rent or own commercial space anywhere in the mainland. | Must operate from within the designated free zone. |

| Government Tenders | Eligible to bid on and win UAE government contracts. | Generally not eligible to bid for government projects. |

| Corporate Tax | Subject to the standard 9% UAE corporate tax. | Often offers 0% corporate tax for a specified period. |

| Profit Repatriation | 100% repatriation of profits and capital. | 100% repatriation of profits and capital. |

Ultimately, the right choice really boils down to your specific business model and who your customers are.

Making the Right Strategic Decision

An international marketing consultant whose clients are all based in Europe and the US would be perfectly suited for a Free Zone. They could take full advantage of the tax benefits without ever needing to directly access the local UAE market.

But for a logistics company planning to manage deliveries between Sharjah and Dubai, a Mainland license is non-negotiable. They need that freedom to operate across the country without any restrictions.

The UAE’s business-friendly approach continues to draw in entrepreneurs from around the globe. In fact, recent data shows that Dubai alone was responsible for 59% of all new business licenses issued in the UAE in just one quarter. With the government investing billions into the startup ecosystem and rolling out initiatives for nearly instant license approvals, there has never been a better time to get started.

Finding the Right License for Your Business

Once you've settled on setting up in either a Mainland or Free Zone jurisdiction, the next big decision is picking the specific type of license you'll need. This is a crucial step, as it legally defines everything your business can and cannot do.

Think of it like getting a driver’s license. A standard license lets you drive a car, but you’d need a completely different permit to operate a heavy truck or a bus. The same logic applies here; your business license must perfectly match your business activities.

In the UAE, the system is organised into clear categories to fit different business models. Choosing the right one from the start is about more than just paperwork—it’s about ensuring your company is compliant from day one and positioned for smooth, uninterrupted operations. Your license is the legal blueprint dictating every service you can offer and every product you can sell.

The Commercial License for Traders

The most common choice for many entrepreneurs is the Commercial License. This is designed for any business involved in trading—buying and selling goods, import and export, real estate, and pretty much any kind of retail.

If your business model revolves around physical products, whether you're selling electronics, clothing, or food items, this is almost certainly the license for you. It covers a massive range of activities, making it a flexible and popular option for anyone looking to tap into the UAE's bustling trade sector. Our specialists can help you pinpoint your exact business activities to make sure your license provides the perfect coverage.

The Professional License for Experts

For businesses built on skill, talent, and expertise, the Professional License is the way to go. This license is specifically for entrepreneurs whose value comes from their intellectual or artistic talent rather than trading goods.

It’s the ideal fit for consultants, designers, accountants, tech experts, and artisans. Essentially, if you're selling a service, this is your category.

A key advantage of the Professional License, particularly on the mainland, is that it allows for 100% foreign ownership. This was a major draw long before the recent widespread changes to ownership laws, and it continues to make it an attractive route for international experts wanting to establish a presence in the UAE.

This structure is a formal recognition that the business's primary asset is the owner's expertise. As specialists in Corporate PRO Services and Attestation Services, our team can help professionals navigate this process seamlessly.

The Industrial License for Manufacturers

Finally, there's the Industrial License. As the name suggests, this is required for any business engaged in manufacturing, production, or any form of industrial processing. This license is for companies that take raw materials and transform them into finished products—think textile factories, food processing plants, or metal fabrication workshops.

Getting this license involves a more rigorous approval process from various government bodies, like the Ministry of Economy and local municipalities, to ensure your operations meet all environmental and safety standards.

Beyond these three main categories, you'll also find specialised permits for specific sectors like tourism, education, and e-commerce. As your dedicated consultants, we provide tailored, cost-effective business setup solutions and 24/7 support to identify the precise business license in the UAE that aligns with your vision.

The UAE Business License Application Roadmap

Once you’ve picked your jurisdiction and the right licence for your business, it’s time to actually get it. The application process might look a little intimidating from the outside, but it’s really just a logical sequence of steps. Think of it as a clear roadmap—each milestone you hit gets you one step closer to launching your company.

The good news is that this journey has become a lot smoother in recent years. The UAE government has really leaned into making the country business-friendly, rolling out some major digital upgrades. We’re talking digital memorandums of association and e-signatures, which means a huge chunk of the setup can now be handled from anywhere.

For example, in free zones like RAKEZ and Dubai Silicon Oasis, you could have your licence in hand within 1 to 5 working days, provided all your paperwork is correct.

Let’s walk through the exact steps you’ll need to take.

Step 1: Reserve Your Trade Name

First things first: your company needs a name. This is your business’s first impression, and in the UAE, it has to be unique and follow certain rules. You’ll need to brainstorm a few options and submit them to the relevant Department of Economic Development (DED) or free zone authority for approval.

The name can't be offensive, use religious references, or sound too much like another company that's already out there. Once your chosen name gets the green light, it's officially reserved for you. This is the first real, concrete step to making your business a legal reality.

Step 2: Secure Initial Approval

Next up is getting what’s known as Initial Approval. This is basically a preliminary thumbs-up from the authorities, confirming they have no objections to your business idea. You can’t move on to the more serious legal paperwork without it.

To get this, you’ll submit your application form, copies of the shareholders' passports, and a simple business plan. Getting this approval means you're clear to proceed with drafting the formal documents for your company.

Step 3: Prepare Legal Documents

This is where things get official. It’s time to draft and sign the core legal documents that will define your company. The main document is the Memorandum of Association (MoA) for mainland companies, or a similar set of articles for free zone businesses.

The MoA is critical—it lays out your company’s structure, who the shareholders are, their ownership stakes, and what the business will do. It has to be drafted in both English and Arabic, then notarised by a public notary and attested by the right government bodies. As specialists in Corporate PRO Services and Attestation Services, we can save you a lot of headaches, ensuring every detail is spot on.

Step 4: Arrange Your Business Address

Every single business licence in the UAE has to be tied to a physical address. For mainland businesses, this usually means leasing an office space and registering it with Ejari (in Dubai) to get an official tenancy contract.

But there are other options. Many free zones and professional licences offer more flexible and budget-friendly solutions, like flexi-desks or even virtual offices. These give you an official business address and access to facilities without the commitment and cost of a full-time office.

Step 5: Submit Final Application and Payment

You've got your initial approval, your attested MoA, and your tenancy contract. Now you're on the home stretch. The final step is to bundle all your documents and submit them to the DED or free zone authority. At this point, you'll also pay the required licence fees.

Once the authorities verify that everything is in order, they'll issue your trade licence. This is the document that makes it all official. With it, you can finally open a corporate bank account, apply for visas for yourself and your employees, and legally start doing business in the UAE.

Understanding the Costs of Your Business License

Before you can even think about launching your business, you need a crystal-clear budget. When it comes to getting your business license in the UAE, it's so important to look past the final issuance fee and get a real handle on every single cost involved, both upfront and down the road.

Getting this forecast right from the start means you can put your capital where it needs to be and avoid any nasty financial surprises. The costs can swing wildly, too; a mainland license in Dubai has a completely different price tag compared to a free zone setup in Sharjah.

Let's break down the key financial pieces you need to plan for.

One-Time Setup Fees

Think of these as the initial investment to build the legal foundation of your company. They're the one-off charges you'll pay to get registered and officially open for business. While the exact numbers will vary, you'll generally encounter the same types of fees.

- Trade Name Reservation: This is the fee you pay the economic department to lock in your unique company name.

- Initial Approval Certificate: A charge for the preliminary green light that lets you move forward with all the legal paperwork.

- License Issuance Fee: The main government fee for the trade license itself. This can change quite a bit depending on your business activities and where you set up.

- Document Attestation: These are the costs for getting legal documents, like your Memorandum of Association (MoA), notarised and officially stamped.

Nailing down these initial expenses is your first major step. For a really detailed look, you can dig into our analysis of the trade license cost in Dubai, which gets into the specifics for mainland companies.

Ongoing Annual and Recurring Costs

Once you're up and running, your business will have yearly expenses to stay legally compliant and operational. It's just as crucial to budget for these as it is for the initial setup.

The biggest one is the annual license renewal fee, which is non-negotiable if you want to keep your license active. You also have to factor in office rent. This could be a significant expense for a physical office on the mainland, or a much more manageable cost for a virtual office or flexi-desk in a free zone.

And don't forget the visas. As specialists in Golden Visa on Property and Investor Visa, we know these are crucial. Every visa tied to your company—including your own investor visa and those for your employees—comes with government fees for issuance and renewal. These visa-related costs are a major part of your annual operational budget.

To give you a clearer picture, we've put together a general overview of the potential costs you're likely to come across.

Estimated Cost Components for a UAE Business License

This table provides a snapshot of the potential costs, both one-time and recurring, that you should factor into your business setup budget.

| Cost Component | Type | Typical Cost Range (AED) |

|---|---|---|

| Trade Name Reservation | One-Time | 600 – 1,000 |

| Initial Approval | One-Time | 150 – 250 |

| License Issuance | One-Time / Annual | 8,000 – 15,000+ |

| Office Rent (Virtual) | Annual | 3,000 – 10,000 |

| Establishment Card | One-Time / Annual | 600 – 2,000 |

| Investor Visa | Recurring | 3,500 – 7,000 (per visa) |

Properly planning for both the initial setup and the yearly recurring costs is absolutely essential. We are here to provide cost-effective business setup solutions tailored to your needs, making sure you have a transparent and predictable financial plan right from day one.

Need Help Setting Up Your Company in the UAE?

Why try to figure out the maze of UAE business licenses on your own? When you work with a specialist, what seems like a complicated process becomes straightforward. It saves you time and helps you avoid mistakes that can cost you later. We take care of all the paperwork so you can get back to what you do best—growing your business.

Our team are:

✅ Specialists in Mainland Company Formation in Dubai, Sharjah & Abu Dhabi

✅ Specialists in Freezone Company Formation across the UAE

✅ Specialists in Golden Visa on Property and Investor Visa

✅ Specialists in Corporate PRO Services and Attestation Services

Our goal is simple: to offer cost-effective business setup solutions tailored to your needs, making sure you can fully enjoy UAE tax benefits for international entrepreneurs. With our 24/7 support service, we're always here when you need us.

Beyond just the licence, our services cover every aspect of your setup. We can help you with your Investor Visa or even a Golden Visa on Property. Our support doesn't stop there; we also provide corporate PRO services and document attestation to make sure every single requirement is ticked off.

Let us handle the admin work while you focus on your next big move. Ready to get started?

📞 Call Us Now: +971-54-4710034

💬 WhatsApp Us Today for a Free Consultation

Frequently Asked Questions

When you're looking into getting a business licence in the UAE, a lot of specific questions tend to pop up. Let's tackle some of the most common ones entrepreneurs ask, so you can move forward with a clearer picture.

Can a Foreigner Own 100% of a Company on the UAE Mainland?

Yes, for the most part. Thanks to recent legal changes, foreigners can now have 100% ownership for over a thousand different commercial and industrial activities right on the mainland. This was a big shift, getting rid of the old rule that required a local Emirati sponsor for many businesses.

Keep in mind, though, that a few strategic sectors might still have their own specific ownership rules. The smartest move is always to chat with a specialist in Mainland company formation in Dubai, Sharjah & Abu Dhabi who can give you the exact requirements for your industry.

How Long Does It Take to Get a Business Licence in the UAE?

The timeline really depends on where you set up and the type of licence you're after. If you go with one of the UAE's modern free zones, you could have your licence in just a few working days. A mainland licence, on the other hand, usually takes a bit longer, somewhere between one to four weeks.

Why the wait for mainland? It's simply because there are more government departments involved in giving approvals. The real secret to speeding things up is making sure every single one of your documents is perfectly prepared and correctly attested right from the very beginning.

Is a Physical Office Required for a UAE Business Licence?

Not always. Whether you need a physical office comes down to your jurisdiction and what your business actually does. Many free zones, and even some professional licences on the mainland, offer really affordable options like virtual offices or flexi-desk agreements. These are perfect when you're just starting out.

But for certain activities, especially on the mainland, a physical office with a registered tenancy contract (like an Ejari in Dubai) is non-negotiable. For more insights, news, and answers to common questions about setting up a business in the UAE, you can find a lot of helpful articles on Edgevista's UAE business setup blog.

Feeling overwhelmed by the details of your UAE company setup? Let PRO Deskk handle the tricky parts for you. We offer cost-effective business setup solutions tailored to your needs, including Mainland and Freezone company formation, investor visas, and all the corporate PRO services you'll need. Plus, with our 24/7 support service, we're always here when you need us.

📞 Call Us Now: +971-54-4710034

💬 WhatsApp Us Today for a Free Consultation