If you're looking to tap into the entire UAE market, trade directly with local businesses, and bid on lucrative government contracts, then a mainland business setup in Dubai is the way to go.

It offers a level of operational flexibility that other structures just can't match. For any entrepreneur with an eye on long-term, scalable growth in one of the world's most dynamic economies, this is the gold standard.

Why Choose a Dubai Mainland Business Setup

Deciding where to base your company is one of the biggest calls you'll make. For so many international entrepreneurs, a mainland company in Dubai isn't just about getting a trade licence—it's a strategic move. It’s about deeply integrating your business into the local and national economy for sustained growth.

The biggest draw? Unrestricted market access. A mainland licence gives you the freedom to operate anywhere across all seven emirates, from Dubai and Abu Dhabi to Sharjah. This means you can open a retail shop, set up an office, or offer services directly to any customer in the UAE, without needing a local agent or distributor.

The Power of 100% Foreign Ownership

A few years ago, a game-changing reform completely reshaped the landscape for foreign investors. The UAE government introduced 100% foreign ownership for thousands of business activities on the mainland.

This change did away with the long-standing rule that required a local Emirati partner to hold a 51% majority share. Now, you can have full control. This shift makes the mainland incredibly attractive, as it also allows you to bid directly on UAE government tenders and enjoy 100% corporate tax exemption on profits below a certain threshold.

With no minimum capital investment required for many activities, the barriers to entry have never been lower. It’s created a much more secure and empowering environment for international entrepreneurs, giving them total command over their operations and profits.

The ability to retain full ownership while accessing the entire UAE market is the single most compelling reason entrepreneurs choose a mainland setup. It combines the freedom of a free zone with the market penetration of a local entity.

Strategic Advantages Over Other Structures

It helps to see how a mainland company stacks up against other popular options, like free zones. While free zones are fantastic for specific industries geared towards international trade, they usually confine your business activities to their designated geographical area.

To help you decide, let's look at a quick comparison.

Mainland vs Free Zone At a Glance

| Feature | Mainland Company | Free Zone Company |

|---|---|---|

| Market Access | Can trade anywhere in the UAE and internationally. | Restricted to trading within the free zone and internationally. |

| Ownership | 100% foreign ownership for most business activities. | 100% foreign ownership is standard. |

| Office Location | Can rent commercial space anywhere in the emirate. | Must lease an office or facility within the free zone. |

| Government Contracts | Eligible to bid for lucrative government tenders. | Generally not eligible to bid for government contracts. |

| Visa Quotas | Generally more flexible and scalable visa quotas. | Visa eligibility is often tied to office size. |

As you can see, a mainland licence offers some distinct benefits that are hard to ignore, especially if you have ambitious growth plans.

A mainland licence offers several unique benefits:

- Government Contracts: Only mainland companies are eligible to bid for and win profitable contracts with UAE government departments and agencies.

- Geographical Freedom: You can set up your office or retail space anywhere in Dubai or the other emirates, putting you right where your customers are.

- Visa Flexibility: Mainland companies usually have more flexibility with visa quotas, which is crucial for building a larger team as you expand.

- Business Scope: You can engage in a much wider range of business activities, often all under a single trade licence.

Ultimately, choosing a mainland setup is a strategic decision for those with big plans. Once your mainland business is established in Dubai, understanding effective small business growth strategies is crucial for scaling your operations and achieving sustained success. This foundation allows you to not only enter the market but to truly thrive within it.

Choosing Your Business Activities and Legal Structure

Getting your business activities and legal structure right is probably the single most important decision you'll make when launching a mainland business setup in Dubai. This choice doesn't just tick a box; it fundamentally shapes what your company can do, the kind of licence you'll get, and your personal financial risk.

Think of it as the foundation of your new venture. A solid foundation supports growth, while a shaky one can cause costly problems and headaches down the road.

The first thing to do is nail down exactly what your business will offer. In Dubai, every mainland company has to operate under a list of pre-approved activities set by the Department of Economy and Tourism (DET). This isn't just red tape—the activities you choose directly determine whether you need a commercial, professional, or industrial licence.

Your journey starts on the official DET portal. You can search for activities using keywords that fit your business, like "digital marketing," "general trading," or "IT consultancy." The portal will then show you the official terminology and descriptions you need to use.

Strategically Selecting Your Business Activities

A common pitfall I see is entrepreneurs picking just one narrow activity when their business model is much wider. For example, a digital marketing agency isn't just doing "marketing." It's likely handling social media management, SEO services, and creating advertising content, too. Bundling these related activities under a single licence is key to staying compliant and keeping costs down.

Here's an insider tip: Always try to choose activities from the same official group or category. If you start mixing activities from completely different fields (say, event management and food trading), you might face higher fees or be forced to get separate licences.

This is where working with a specialist in mainland company formation can really pay off. They know the DET framework inside and out and can help ensure your licence covers everything you plan to do, without any expensive surprises.

Demystifying Common Legal Structures

With your activities locked in, the next big decision is the legal structure. This impacts everything from your personal liability to your tax obligations and capital requirements. For most foreign investors setting up on the mainland, the choice boils down to two popular options: the Limited Liability Company (LLC) and the Sole Establishment.

Let's look at them through some real-world examples:

-

Limited Liability Company (LLC): This is, by far, the most common structure for expats and foreign investors. An LLC is its own legal entity, which is a fancy way of saying your personal assets are shielded from business debts. It's incredibly versatile and works for almost any commercial or industrial business, whether you're launching an e-commerce store or a trading company. You can also have multiple shareholders, making it perfect for partnerships.

-

Sole Establishment: This one is tailored for individuals offering professional services—think consultants, designers, or legal advisors. It's owned by a single person and isn't legally separate from them. The upside is you have total control; the downside is you are personally on the hook for any business debts.

Matching Your Business Model to the Right Structure

So, how do you choose? It all comes down to your business model and your tolerance for risk.

Imagine you're launching an e-commerce brand that sells physical products. An LLC is the way to go, no question. It creates a protective wall between the business's finances and your own. If the company ever ran into debt or faced a lawsuit, your personal savings and property would be safe.

Now, picture a freelance management consultant. For them, a Sole Establishment makes perfect sense. Their main asset is their expertise. This structure is simpler and more affordable to set up. While professionals need a Local Service Agent (LSA), this person holds no shares and has zero say in the business—they are simply paid an annual fee for their role.

As you navigate these choices, it’s a good idea to dig deeper by understanding different business structure types and their implications. Making the right call now saves you from the hassle and expense of restructuring later, ensuring your company is built to last.

Navigating the Documentation and Approval Maze

Once you've locked in your business activities and legal structure, it’s time to tackle the paperwork and official approvals for your mainland business setup in Dubai. This stage can feel a bit overwhelming, but if you treat it like a checklist, it's really just a methodical process of ticking the right boxes. The main goal here is simple: get all the correct documents together and submit them properly the first time to sidestep any frustrating delays.

Think of this part as gathering all the essential ingredients that will form your company's official identity. Every single document serves a purpose, whether it's proving who you are, what your business will do, or where it will be based. Nailing this from the get-go is absolutely critical for a smooth ride to getting your trade licence in hand.

Your Essential Documentation Checklist

The Department of Economy and Tourism (DET) has a fairly standard list of required documents, but let me be clear: precision is everything. A tiny mistake—a missed signature or an improperly attested paper—can set you back and cost you precious time.

Here's a quick rundown of the non-negotiables:

- Passport Copies: You'll need clear, valid passport copies for every shareholder and the company's General Manager. Make sure they're high-resolution scans and that the expiry date is a good way off.

- Memorandum of Association (MOA): This is basically your company's rulebook. It lays out the business activities, who owns what percentage, and how the company will operate. It needs to be professionally drafted and then notarised by a public notary right here in Dubai.

- Tenancy Contract (Ejari): Every mainland company must have a physical office address. This means you need a valid commercial tenancy contract that's been registered through the Ejari system, Dubai's official online portal for leases.

- Initial Approval Certificate: This is one of the first green lights you'll get from the DET. It confirms the government has no issue with your proposed business name and activities. You can't even draft your MOA without it.

A very common slip-up I see is with the attestation of documents that come from outside the UAE. Any corporate paperwork has to be attested by the UAE embassy in its country of origin and by the Ministry of Foreign Affairs here in the UAE. And if it's in another language, it must be legally translated into Arabic.

This is exactly why working with specialists who handle Corporate PRO Services and Attestation Services is such a smart move—they navigate these bureaucratic hurdles every single day.

The Approval Process Demystified

Getting approved is a sequence of official checkpoints. It always starts with the DET, but depending on your business, you may need to get the thumbs-up from other government bodies as well.

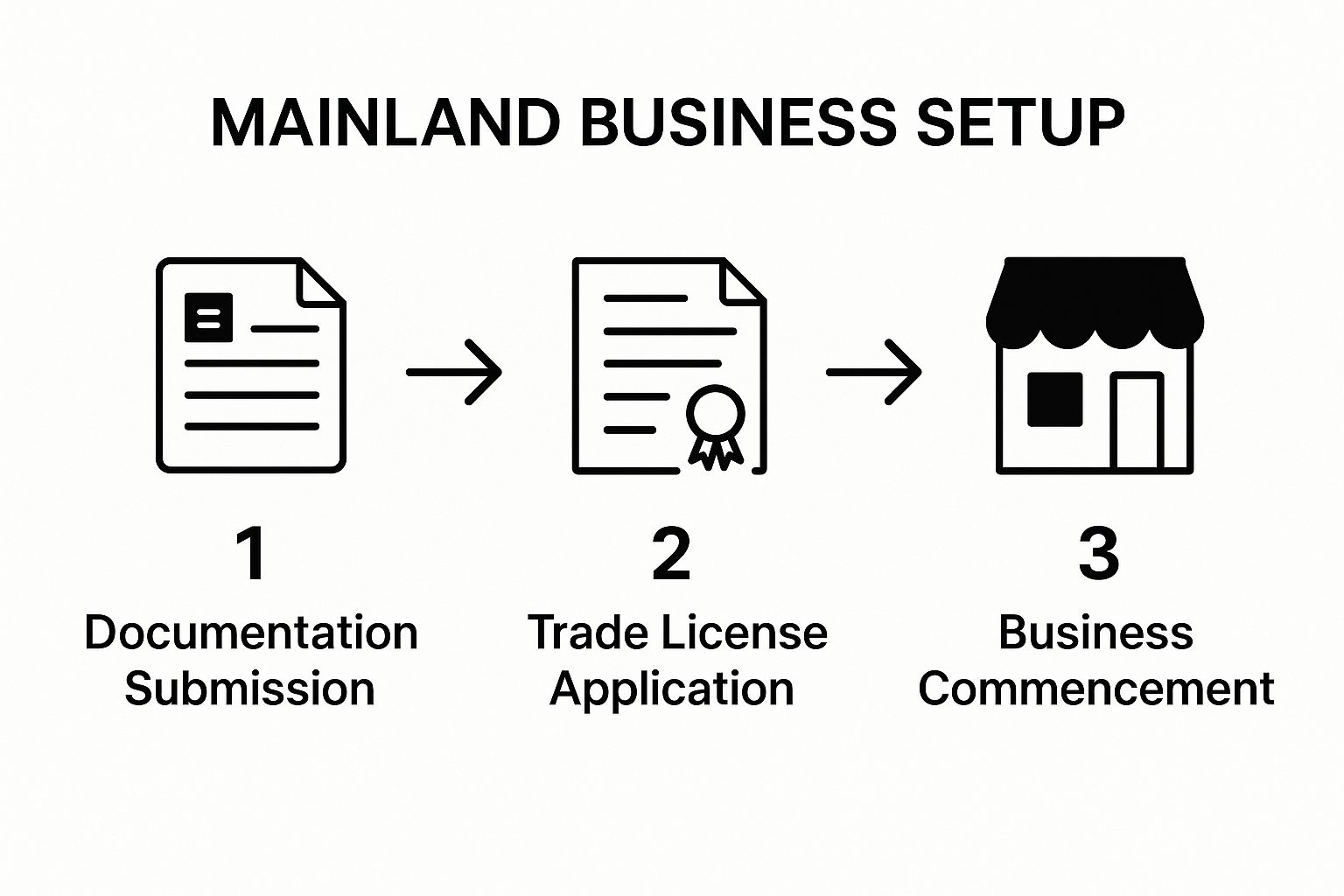

The infographic below gives you a bird's-eye view of the registration journey, from getting your documents in order to finally launching your business.

As you can see, it’s a logical progression. Each completed stage unlocks the next one, bringing you closer to your goal.

Navigating External Approvals

After you get that Initial Approval from the DET, you might need to get clearances from other authorities. This is a point where many entrepreneurs hit unexpected speed bumps because they didn't plan ahead. These external approvals are only for specific, regulated business activities.

For instance:

- A healthcare clinic will absolutely need approval from the Dubai Health Authority (DHA).

- An engineering consultancy has to get clearance from the Dubai Municipality.

- A restaurant or café requires permits covering food safety and public health.

Figuring out these requirements early in the process is crucial. In some situations, especially if you're a foreign national already working in the UAE, you may need a No Objection Certificate (NOC) from your current employer to launch a new venture. If you need more clarity on this, our guide on the No Objection Certificate in Dubai breaks it down. Managing these steps correctly ensures your application keeps moving forward smoothly, clearing the path for the final payment and issuance of your mainland trade licence.

Decoding the Costs of a Dubai Mainland Licence

When you're mapping out your mainland business setup in Dubai, getting the budget right is probably one of the most important first steps. The reality is that the true cost goes well beyond just the trade licence fee. There's a mix of one-time payments and recurring expenses that can trip you up if you haven't planned for them.

Having a clear financial roadmap from the get-go isn't just about avoiding nasty surprises; it's about giving yourself the confidence to invest properly and build your launch on a solid foundation.

It’s easy to focus only on that big licence number, but a cluster of smaller government fees always come into play. These are the mandatory charges you’ll face during the initial registration, forming the legal bedrock of your company.

Fixed Government Fees

These are the non-negotiable costs that create the baseline for your setup budget. While the exact dirhams might shift slightly, they’re fairly standard across most business activities.

Here’s what you should expect to pay for at the start:

- Trade Name Reservation: A one-off fee to lock in your unique business name.

- Initial Approval Fee: This goes to the Department of Economy and Tourism (DET) to get their official nod for your business activity and structure.

- MOA Notarization: Your Memorandum of Association needs to be legally notarised, which comes with a fee at the notary public office.

- Market Fees: A small percentage of your office's annual rent, which is collected by the DET.

Knowing these charges upfront is key to building an accurate budget from day one. They are simply the cost of entry into the Dubai mainland market.

Variable and Recurring Expenses

Once you’re past the initial government payments, you need to think about the costs that will change depending on your specific operation. These expenses pop up every year, so they absolutely must be part of your long-term financial planning.

The biggest one? Your commercial office space.

A physical office is a mandatory requirement for any mainland licence, and you’ll need to register your tenancy contract through the Ejari system. This rent will almost certainly be your largest recurring cost. On top of that, you have to budget for the Establishment Card—this is what allows your company to apply for visas—and then the costs for each investor visa or employee visa you need.

Planning for both one-time setup fees and annual renewals is the key to financial stability. I’ve seen many new businesses focus on the launch cost but get caught off guard by the recurring expenses a year later.

This is where getting some expert guidance can make a huge difference. A good consultant can point you towards cost-effective solutions that fit your specific needs, helping you trim expenses without cutting corners on compliance or your business goals.

Sample Cost Breakdown for a Mainland LLC Licence

To paint a clearer picture, let's look at some typical numbers. Keep in mind that every business is unique, but this sample table gives you a realistic idea of the investment needed for a standard Limited Liability Company (LLC) on the Dubai mainland.

| Expense Item | Estimated One-Time Cost (AED) | Estimated Annual Cost (AED) |

|---|---|---|

| Trade Licence & Registration Fees | 15,000 – 20,000 | 15,000 – 20,000 |

| Office Rent (Ejari) | Varies Greatly | Varies Greatly |

| Establishment Card | 2,000 | 2,000 |

| Investor Visa (per person) | 4,500 – 6,000 | Renewal fees apply |

| MOA Notarization | 1,500 – 2,500 | N/A |

By breaking it down like this, you can build a much more comprehensive and realistic budget. For a deeper dive into the numbers, check out our complete guide on the mainland company setup Dubai cost. This kind of forward-thinking approach ensures you're well-capitalised not just for your launch, but for sustained success in the years ahead.

Getting Your Visas and Corporate Bank Account Sorted

Landing your trade licence is a massive win, but you're not quite at the finish line. Now comes the part where you make your mainland business setup in Dubai truly operational. This means getting yourself and any key staff into the country legally and setting up the financial backbone to actually do business.

Think of this as the shift from paperwork to reality. Securing your residency visas and opening a corporate bank account are the two most crucial steps that come right after licensing. They're what turn your registered company into a living, breathing business that's ready to hit the ground running.

Unpacking the Residency Visa Process

As soon as your trade licence is issued, the very first document you'll need is an Establishment Card. It's a small, credit-card-sized card from the immigration authorities that officially puts your company on their radar. You simply cannot apply for any visas without it.

Once you have the Establishment Card, the visa journey for an investor or employee usually looks something like this:

-

Entry Permit Application: This is your initial, temporary visa. It lets the individual enter the UAE (or stay if they're already here) while everything else gets sorted. It's typically valid for 60 days.

-

Medical Fitness Test: Every resident has to go through a mandatory medical check. This involves a blood test and a chest X-ray to screen for certain communicable diseases.

-

Emirates ID Application: Next, you'll head to a designated centre to give your biometrics—that's your fingerprints and a photo. This is for your Emirates ID, the official identification card for everyone living in the UAE.

-

Visa Stamping: After you've passed the medical and done your biometrics, your passport is handed over to immigration for the final step: stamping the residency visa inside.

This whole sequence can take a couple of weeks, so it’s smart to get started the moment your licence is in hand.

For high-net-worth individuals, other long-term residency options are also on the table. We are specialists in the Golden Visa on Property and Investor Visa, offering alternative paths to secure your future in the UAE. You can find out more about these specialised visa options and mainland setups on startanybusiness.ae.

Opening Your Corporate Bank Account

This is where many people get stuck. Opening a corporate bank account in the UAE can be a surprisingly detailed process. Banks here take compliance and "Know Your Customer" (KYC) rules very seriously to combat financial crime. A weak or incomplete application is the number one reason for outright rejection or frustratingly long delays.

To get approved, you need to present your business as a professional and credible operation.

Banks want to see a clear business plan, evidence of your professional background, and a genuine reason for operating in the UAE. Simply having a trade licence is often not enough to get an account opened quickly.

Your application package has to be flawless. This means having every single document organised and ready before you even walk in. Banks will typically request your complete set of corporate documents—think trade licence, Memorandum of Association (MOA), and Establishment Card. On top of that, they’ll want passport and visa copies for all shareholders, personal CVs, and a well-thought-out business plan.

Choosing the right bank is just as important as having the right documents. Some banks are much more comfortable with startups and international entrepreneurs than others. Picking a bank that actually understands your business model can make the entire experience so much smoother.

For a deeper dive, our article on how to open a business bank account in Dubai offers practical tips and insights. Getting this step right is the final piece of the puzzle. It gives you the financial tools to start sending invoices, getting paid, and growing your new mainland company.

Your Top Questions About Mainland Business Setup Answered

Setting up a mainland business in Dubai is a big step, and it's natural to have a lot of questions. Getting clear, reliable answers is the best way to move forward with confidence and avoid any surprises down the road.

Let's dive into some of the most common queries we hear from entrepreneurs who are right where you are now.

Do I Still Need a Local Emirati Partner?

This is easily the most frequent question we get—and for good reason. The answer has completely changed the game for foreign investors.

For the vast majority of business activities, the old requirement of having a local Emirati partner hold 51% of your company’s shares is a thing of the past. Thanks to major updates in the UAE's Commercial Companies Law, 100% foreign ownership is now standard for thousands of commercial and industrial businesses. This puts international entrepreneurs in full control of their operations and profits.

However, there are still a couple of key situations to be aware of:

- Strategic Sectors: A very small number of business activities considered strategically important to the UAE might still require some level of local partnership.

- Professional Licences: If you're establishing a consultancy, a law firm, or another professional services company, you will need what’s called a Local Service Agent (LSA). This is not a shareholder. An LSA is an Emirati national who acts as your company’s representative for government paperwork in exchange for an annual fee, but they have no ownership stake or management control.

It’s always best to confirm the exact rules for your specific business activity with the Department of Economy and Tourism (DET) or work with a specialist who knows the ins and outs of mainland formation.

What’s the Minimum Office Space Requirement?

One thing is certain: a physical commercial address is non-negotiable for a Dubai mainland licence. To finalise your application, you must have a valid tenancy contract registered in the Ejari system.

There's no strict, one-size-fits-all rule on square footage. The requirement is simply that the space must be suitable for your business activity and the number of employees you plan to hire. A trading company with a large staff will obviously need more space than a one-person consultancy.

The most important thing to remember is that the property must be a commercially registered space. A residential address simply won't work for a mainland licence. Your tenancy contract has to be officially logged with Ejari.

For startups and small businesses looking to keep costs down, there are plenty of flexible options. Using a flexi-desk or a shared office space in an approved business centre is a perfectly legal and cost-effective way to meet the physical address requirement without committing to a large, expensive lease.

How Long Does It Take to Set Up a Mainland Company?

The timeline for getting your mainland business up and running can vary quite a bit. It really hinges on the complexity of your business.

If all your documents are in order and your business activity doesn’t need any special external approvals, the trade licence itself can sometimes be issued in as little as one week.

But things can take longer if your business is in a regulated field. For instance, a restaurant needs a green light from the Food Control Department, and a medical clinic requires approval from the Dubai Health Authority (DHA). These external checks can add several weeks to the process.

Once you have your licence in hand, you should realistically plan for another 2-4 weeks to become fully operational. This buffer accounts for the time needed to get your residency visa sorted—including the medical test and Emirates ID biometrics—and to get your corporate bank account opened.

What Are the Ongoing Compliance Requirements?

Getting your trade licence is a huge milestone, but it’s not the final step. To keep your mainland company in good standing and avoid fines, you need to stay on top of a few key annual tasks.

Compliance is straightforward as long as you have these on your yearly to-do list:

- Trade Licence Renewal: This is non-negotiable and must be done annually with the DET before the expiry date.

- Tenancy Contract (Ejari) Renewal: You must always have a valid office lease.

- UBO and ESR Filings: Annual declarations for Ultimate Beneficial Ownership (UBO) and compliance with Economic Substance Regulations (ESR) are mandatory.

- Proper Accounting: You are required by law to maintain accurate and up-to-date financial records.

- Corporate Tax: Depending on your revenue, you'll need to register with the Federal Tax Authority (FTA) and file an annual Corporate Tax return. While the UAE’s tax advantages are incredible, staying compliant is crucial.

Managing these renewals and filings can be a hassle, which is why many business owners use professional Corporate PRO Services. They handle all the government liaison work, making sure everything is filed correctly and on time so you can focus on running your business.

Ready to turn your business vision into a reality in Dubai? The process can be complex, but you don't have to do it alone. At PRO Deskk, we're here to make your journey smooth and successful.

✅ Specialists in Mainland Company Formation in Dubai, Sharjah & Abu Dhabi

✅ Specialists in Freezone Company Formation across the UAE

✅ Specialists in Golden Visa on Property and Investor Visa

✅ Specialists in Corporate PRO Services and Attestation Services

✅ 24/7 Support Service – Always here when you need us

✅ Cost-Effective Business Setup Solutions tailored to your needs

✅ Enjoy UAE Tax Benefits for International Entrepreneurs

📞 Call Us Now: +971-54-4710034

💬 WhatsApp Us Today for a Free Consultation