So, you're thinking about setting up a business in Dubai. It's a fantastic move, but one of the first questions on everyone's mind is always: "How much is this going to cost me?"

When it comes to the price of a trading license, there isn't one simple number. Think of it more as a range. Realistically, you should budget somewhere between AED 15,000 and AED 50,000 for the initial setup, and this applies whether you're looking at a Mainland or a Free Zone company. This final figure is a mix of different fees, all depending on the specific choices you make for your business.

Your Guide to Dubai Trading License Costs

Getting your venture off the ground in Dubai is an exciting time, but figuring out the initial investment is step one. The cost of your trading license is the bedrock of your startup budget, and the final price isn't just a random figure—it's calculated based on key decisions you'll need to make early on.

Before we dive into Dubai's specifics, it helps to understand the basics of what a business license entails. Simply put, it's the government's official green light, allowing you to legally run your business and carry out your planned commercial activities.

Key Factors Influencing Your License Cost

That broad cost range exists for a simple reason: no two businesses are the same. A few critical factors will determine where your final investment lands on that spectrum. These are the main cost drivers, so you'll want to think them through carefully.

- Jurisdiction: This is the big one. Your choice between setting up on the Mainland or in a Free Zone will have the single biggest impact on your costs. Mainland companies can trade directly with the local UAE market, while Free Zones offer unique perks like 100% foreign ownership.

- Business Activities: What you plan to do matters. The nature of your business can affect the price. For instance, if you're trading in regulated goods, you might need extra approvals from various government ministries, and each of those comes with its own fee.

- Visa Requirements: How many people will you need? The number of employment or investor visas you apply for directly adds to the cost. Every visa has government fees attached for processing, medical tests, and issuing an Emirates ID.

A Breakdown of Common Fees

When you add everything up, the total cost for a Dubai trade license usually falls between AED 15,000 and AED 50,000 (that’s roughly USD 4,083 to USD 13,613). This depends heavily on your license type and business activities.

Beyond the main license fee, you'll need to account for other charges. These often include registration with the Department of Economic Development (DED), knowledge and innovation fees, and mandatory membership with the Dubai Chamber of Commerce.

To give you a clearer picture, here's a quick look at the main cost components you can expect.

Quick Overview of Dubai Trading License Cost Components

This table breaks down the primary expenses you'll encounter. It's a handy reference to see where your money will be going.

| Cost Component | Typical Mainland Range (AED) | Typical Free Zone Range (AED) | Notes |

|---|---|---|---|

| Initial Approval & Name Reservation | 600 – 1,000 | 500 – 2,500 | Securing your trade name and getting the initial go-ahead. |

| License Registration Fee | 8,000 – 15,000 | 10,000 – 50,000+ | The core fee for the license itself. Free Zone packages often bundle other services. |

| Office/Premises Rent | Varies widely | Often included in package | Mainland requires a physical address. Free Zones might offer flexi-desks. |

| Visa Costs (per visa) | 2,500 – 7,000 | 3,000 – 6,000 | Includes application, medical tests, and Emirates ID fees. |

| Sponsorship/Local Service Agent Fee | 5,000 – 15,000 (Annual) | N/A | Only applicable for certain Mainland company structures. |

| Additional Government Approvals | 500 – 5,000+ | 500 – 5,000+ | Required for specialised activities like healthcare or education. |

Keep in mind these are estimates. The final costs can shift based on your specific business needs and the jurisdiction you choose.

A successful business setup in Dubai isn't about finding the cheapest option, but the most cost-effective one. This means selecting a license package that aligns perfectly with your long-term goals, operational needs, and growth strategy, ensuring every dirham invested adds value to your venture.

Breaking Down Dubai Mainland License Costs

So, you're eyeing a Dubai Mainland license. This is the way to go if you want to trade directly within the UAE's bustling local market. It's a path loaded with opportunity, but it comes with a specific cost structure, mostly handled by the Dubai Department of Economy and Tourism (DET), which you might remember as the DED.

Getting a handle on these fees is the first step to budgeting properly and avoiding surprises down the road.

Think of it like building something from scratch. You have foundational costs, the main structure, and then the finishing touches. Each piece has a price tag, and you need them all to get the job done right. Let's unpack each of these so you know exactly what you’re paying for.

Foundational Setup Fees

Before you even get to the main license application, there are a couple of preliminary costs to take care of. These are the non-negotiable first steps that lay the groundwork for your business.

-

Initial Approval Certificate: This is your first green light from the DET. It’s their official nod, confirming they have no objection to your business idea. This certificate will set you back about AED 120.

-

Trade Name Reservation: Your business name has to be unique and follow UAE naming rules. The fee to reserve your chosen name is typically around AED 620.

Once you’ve paid these, your business concept and name are secured, clearing the way for the more significant parts of the process.

The Core License and Government Contributions

With the initial hurdles cleared, it's time to tackle the main costs tied to the trading license itself. This is where the bulk of your investment will go, as it covers several key government fees.

The biggest chunk is for the trading license issued by the DET. The final cost here is directly linked to the specific business activities you plan to undertake. A general trading license, for instance, will have a different fee than one for a specialised field like food trading, which might need extra approvals from other authorities.

On top of the license fee, you’ll have a few other mandatory payments:

-

Dubai Chamber of Commerce Membership: Every Mainland company has to register with the Chamber. This fee varies based on your company's legal structure and number of employees, but it’s a crucial step to becoming part of the local business community.

-

Knowledge and Innovation Fees: These are small government levies, often just AED 20, that you'll see on your payment voucher. They're added to transactions and contribute to Dubai's wider strategic goals.

If you want to get into the nitty-gritty of the mainland setup process, our complete guide to Mainland Company Formation in Dubai breaks it all down.

Understanding Market Fees

Now, here’s a unique cost component specific to a Mainland license: the "Market Fee." It’s an interesting concept that ties your license cost directly to your physical business location.

The Market Fee is a government charge calculated as 2.5% of your office or shop's annual rent. It's essentially your contribution to the commercial environment and infrastructure you’ll be using. This fee is paid to the DET when you issue and renew your license.

Let's say your annual office rent is AED 100,000. Your Market Fee would be AED 2,500. This makes your choice of office a direct factor in your yearly license cost—a critical detail to remember when you're planning your finances.

By understanding each component, from the initial approvals to the Market Fee, you can build a clear and realistic budget for your Dubai Mainland venture.

Navigating Dubai Free Zone License Costs

When you start looking into setting up a business in Dubai, you'll quickly see that the Free Zones offer a very different path compared to the Mainland. But one of the first things entrepreneurs realise is there's no single, universal "Free Zone price." Instead, you’re met with dozens of unique fee systems across big names like JAFZA, DMCC, and IFZA, each with its own way of packaging and pricing.

Getting your head around this variety is the secret to making a smart, cost-effective choice. It's a bit like booking a holiday: you can go for an all-inclusive resort where everything is bundled into one tidy price, or you can book an à la carte trip, paying for your flight, hotel, and activities one by one. Both ways work, but you need to know exactly what’s included to compare the true total cost.

Understanding the Tiers of Free Zone Costs

To make sense of all the options, it helps to group Dubai's Free Zones into three general tiers based on their price point, reputation, and the facilities they offer. This simple breakdown can help you quickly match a zone to your budget and what your business actually needs.

- Premium Zones (e.g., DMCC, JAFZA): These are the established, world-renowned players. They offer top-tier infrastructure, strategic locations, and incredible networking opportunities. Their license packages are the most expensive, but in return, you get unparalleled credibility and a foot in the door of specific industry ecosystems.

- Mid-Range Zones (e.g., Dubai South, DAFZ): Striking a great balance between cost and benefits, these zones provide excellent facilities and a strong business environment without that premium price tag. They're a really popular choice for businesses that need quality infrastructure and good connectivity.

- Budget-Friendly Zones (e.g., IFZA, Meydan): Designed with startups and SMEs in mind, these zones offer some of the most competitive and cost-effective setup packages available. They provide all the essential benefits of a Free Zone, making them a fantastic entry point for new entrepreneurs.

For those looking to set up a company in Dubai’s free zones, the startup cost can be much lower and varies quite a bit. For instance, popular zones like IFZA or Meydan have trade license fees that start from around AED 5,500 to AED 6,000. On the other hand, setting up in some of the premium free zones can easily cost AED 12,900 just for the license, and that doesn't even touch visa-related fees. If your business needs visas, you'll have to budget an extra AED 2,000 for each visa slot, which is separate from the actual cost of getting the visa issued.

Dissecting a Typical Free Zone Package

When a Free Zone sends you a quote, it’s so important to look beyond that big headline number. Most packages are bundled for convenience, but what’s actually inside can differ wildly from one zone to the next.

A standard package will almost always cover these basics:

- Trade License Fee: The main cost for your business license.

- Registration Fee: A one-off charge to register your company name and legal entity.

- Memorandum of Association (MOA): The cost to prepare your company’s foundational legal documents.

But here’s the catch: several other crucial things might be optional add-ons or need to be paid for separately. This often includes employee visas, access to shared office spaces (like flexi-desks), and your company's Establishment Card. If you don't factor these in from the start, you could be in for some unexpected expenses down the line. A detailed guide on Free Zone business setup in Dubai can give you a much clearer picture of what to expect in these packages.

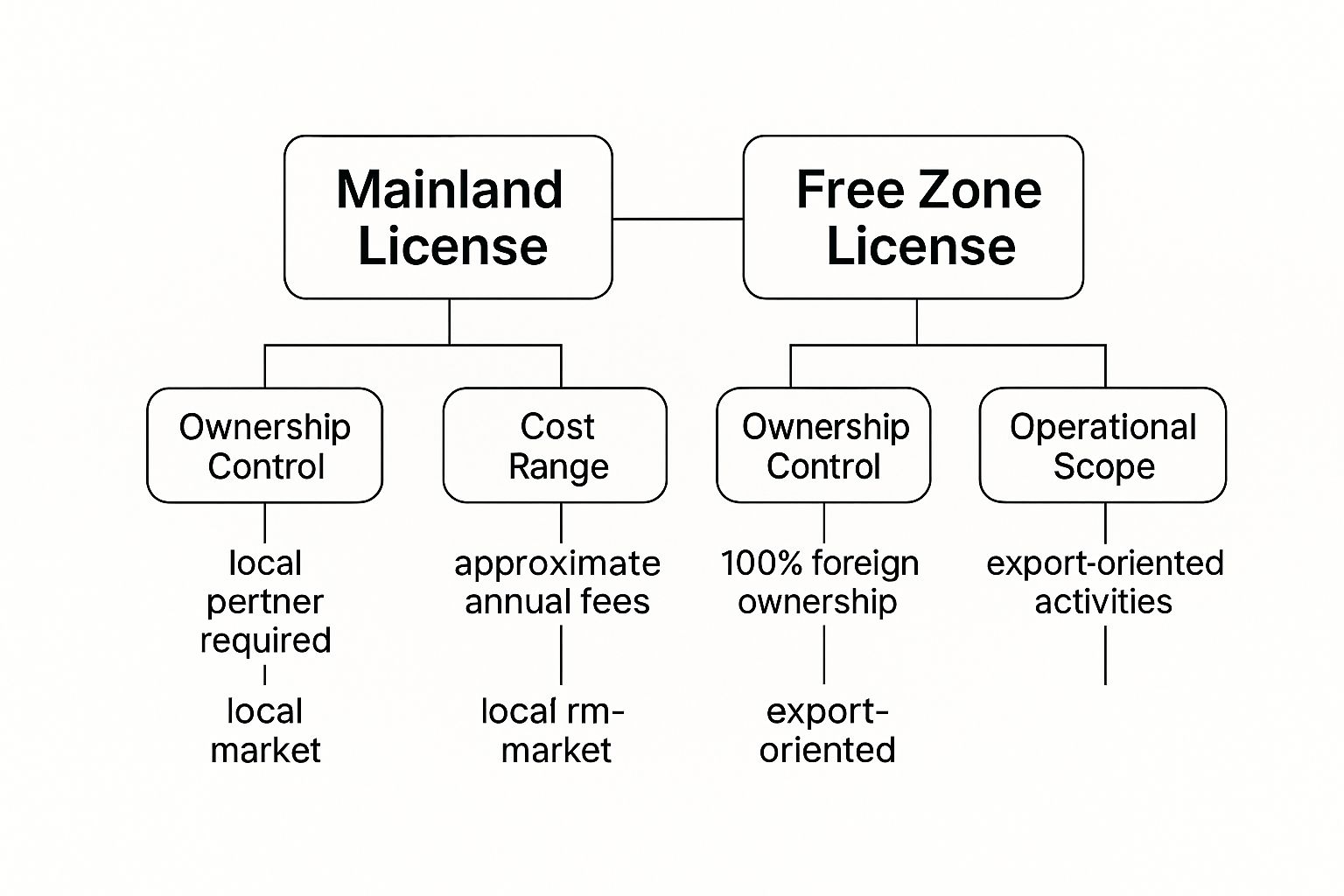

This infographic breaks down the fundamental differences between a Mainland and a Free Zone setup visually.

As you can see, the biggest draws for Free Zones are the 100% foreign ownership and their focus on international trade, whereas Mainland licenses are built for businesses that want direct access to the local UAE market.

Uncovering The Hidden Costs Of Business Setup

Getting your trade license in hand is a huge milestone, no doubt about it. But it's crucial to understand that this initial fee is really just the tip of the iceberg. Many entrepreneurs get so focused on that headline price that they're caught off guard by all the other expenses needed to actually get up and running. A solid, realistic budget looks at the whole picture.

Think of the license fee like buying a car. The "hidden costs" are the insurance, registration, and fuel you absolutely need before you can legally drive it off the lot. If you overlook those, your business journey can stall before it even gets started.

The Real Cost Of Visas And Staffing

One of the biggest expenses you'll face right away is getting visas for yourself and any employees you plan to hire. Each visa is a multi-step journey, and there are government fees at every single stop. Budgeting for your team accurately is absolutely key to managing your startup funds.

For every employee, you’re generally looking at this process:

- Entry Permit: This is the first document that allows someone to enter the UAE for work.

- Medical Fitness Test: A mandatory health check that all residents must pass.

- Emirates ID Application: The fee for getting the official national residency card processed.

- Visa Stamping: The final step, where the residency visa is physically placed in the employee's passport.

When you add it all up, these steps can easily run into several thousand dirhams for just one employee.

A critical first step for any new company is obtaining an Establishment Card. This is a digital card that registers your business with the immigration and labour departments, giving you the authority to sponsor employees. Without it, you can't hire anyone or issue visas.

Office Space And Physical Presence

Every business in Dubai needs a registered address, and the cost for this can vary wildly depending on what you need and where you set up. Your choice, whether it's a budget-friendly virtual office or a full physical space, will make a big difference to your bottom line.

- Virtual Offices & Flexi-Desks: These are very common in Free Zones. They give you a professional address and basic facilities without the major expense of a traditional lease.

- Physical Office Space: This is often a requirement for Mainland licenses or any business with a growing team. It involves annual rent, security deposits, and connecting utilities.

Getting a detailed breakdown will help you understand the total cost of setting up a business in Dubai and see exactly how your office choice fits into the bigger financial picture.

Essential Administrative And PRO Services

Lastly, don't forget about the smaller, but numerous, admin costs that can quickly add up. These are the operational nuts and bolts that keep your business compliant and running smoothly.

Key administrative costs often include:

- Document Attestation: If you're using documents from outside the UAE (like a university degree or company incorporation papers), they must be legally attested. This involves fees at multiple government bodies.

- Legal Translation: Any official document you submit to a UAE government authority has to be translated into Arabic by a certified legal translator.

- Corporate PRO Services: Hiring a professional to handle all the government paperwork and submissions saves a massive amount of time and helps you avoid expensive mistakes. Their fees cover submitting documents, getting clearances, and following up.

It’s also worth noting that beyond the usual Mainland and Free Zone setups, a guide to Offshore Company Setup in UAE can reveal a completely different cost structure. By carefully mapping out every single potential expense, you can build a financial plan that works and launch your Dubai venture with real confidence.

Choosing the Right Business Setup Partner

Getting a handle on the different fees is a great first step, but trying to navigate Dubai's business setup process by yourself can quickly become overwhelming. The regulations are very specific, the deadlines are non-negotiable, and one small mistake on your application can lead to expensive delays or even an outright rejection.

This is the point where professional guidance stops being a luxury and becomes a strategic necessity.

Bringing an expert consultancy on board isn't just about handing off paperwork; it's about giving yourself a serious competitive edge. A good partner does a lot more than just fill in forms. They lay out a clear roadmap, helping you steer clear of the common mistakes that can drive up your trading license cost in Dubai. Their job is to make your journey from a business idea to a fully operational company as smooth as possible.

Why Partner with PRO Desk?

At PRO Desk, we simplify the complex. Our mission is to provide you with a seamless, transparent, and affordable path to launching your business in the UAE. We offer:

✅ Specialists in Mainland Company Formation in Dubai, Sharjah & Abu Dhabi

✅ Specialists in Freezone Company Formation across the UAE

✅ Specialists in Golden Visa on Property and Investor Visa

✅ Specialists in Corporate PRO Services and Attestation Services

✅ 24/7 Support Service – Always here when you need us

✅ Cost-Effective Business Setup Solutions tailored to your needs

✅ Expert guidance to help you enjoy UAE Tax Benefits for International Entrepreneurs

Choosing the right partner means they act as your strategic advisors, not just service providers. Their deep knowledge of local regulations and relationships with government bodies can save you thousands of dirhams and weeks of valuable time.

Complete Support That Goes Beyond Just the Licence

A successful launch is about more than just getting your trade licence. It’s about making sure all the different pieces—from securing your residency to staying on top of compliance—come together perfectly.

Our expertise covers the full range of essential services, ensuring every part of your setup is handled with care. This includes handling investor visas, the sought-after Golden Visa on property, and all corporate PRO services like attestations and renewals, so you don't have to deal with the administrative headaches. With our dedicated 24/7 support, you'll always have the answers you need, exactly when you need them.

Don't let the complexity of the process get in the way of your ambitions. Partner with an expert who can simplify everything and position you for long-term success.

📞 Call Us Now: +971-54-4710034

💬 WhatsApp Us Today for a Free Consultation

Frequently Asked Questions

As you get closer to launching your business, a few final questions always seem to pop up. Here are some straightforward answers to the queries we hear most often from entrepreneurs about the trading license cost in Dubai, helping you lock in your budget and move forward.

Can I Get a Trading License in Dubai Without Renting an Office?

Yes, for many businesses, you absolutely can. Most Free Zones have adapted to modern work styles and offer flexi-desk or virtual office packages. These are brilliant because they give you a legitimate, registered business address without the hefty cost of leasing a physical office.

If you’re setting up on the Mainland, you also have options like the DED Trader licence or using an approved co-working space to meet the legal address requirement. But—and this is a big but—it really depends on your specific business activity and how many visas you need. Certain activities or a higher number of employee visas will trigger the requirement for a dedicated physical office.

The smartest move? Have a quick chat with a setup specialist. They can tell you the exact office requirements for your specific business. It’s a simple step that can save you from making expensive mistakes and ensures you’re compliant right from the start.

What Is the Cheapest Trading License Available in Dubai?

When people ask for the 'cheapest' license, they're usually looking at the initial setup fee. You’ll find some of the most competitive packages in dynamic Free Zones like IFZA or Meydan. Here, you can find zero-visa packages starting from around AED 12,000 to AED 15,000.

While that low entry price is tempting, it’s vital to make sure the license actually fits what you want to do. The cheapest option might restrict the kind of business you can conduct or stop you from hiring staff down the road. Real value isn’t just about the lowest upfront price; it’s about getting a license that will support your business as it grows.

How Long Does It Take to Get a Trading License in Dubai?

The timeline really depends on where you’re setting up and how complex your business is. A simple Free Zone license, particularly one that doesn’t need any outside approvals from other government bodies, can be issued incredibly fast—often in just a few working days.

A Dubai Mainland license usually takes a bit longer, typically somewhere between one and three weeks. This accounts for all the necessary steps like reserving your trade name and getting initial approvals. If your business needs special permits—say, from the Dubai Municipality or the Roads and Transport Authority (RTA)—the process can stretch out to several weeks. This is where an experienced PRO service can be a game-changer, speeding things up by ensuring all your documents are perfect the first time.

At PRO Deskk, our specialty is creating affordable business setup solutions that are built around your goals. As experts in Mainland and Free Zone company formation, Golden Visas, and Corporate PRO services, we’re here to help you 24/7. Let us guide you in launching your business successfully and making the most of the UAE's tax benefits.

📞 Call Us Now: +971-54-4710034 or 💬 WhatsApp Us Today for a free consultation at https://prodesk.ae.